Best Gap Cover with No Waiting Period

The Best Gap Cover with No Waiting Period in South Africa revealed.

We tested them side by side and verified their gap cover options.

This is a complete guide to the best gap cover with no waiting period in South Africa.

In this in-depth guide you’ll learn:

- What is a Gap Cover?

- How do you benefit from gap cover if you have medical aid?

- Does gap cover have a waiting period for pregnancy?

- Which medical aids offer no waiting period on their gap cover?

- Which hospital plans have no waiting period?

- Which gap cover is immediately active?

So if you’re ready to go “all in” with the best gap cover with no waiting period in South Africa, this guide is for you.

Let’s dive right in…

Best Gap Cover With No Waiting Period Summary

Understanding gap cover

👉 Gap cover is a short-term insurance plan designed to supplement those who already have medical aid. It pays the difference between the tariff (MST) of your medical insurance and the actual rates paid by private healthcare experts.

👉 South African medical aid plans presently reimburse doctors and specialists at 100%, 200%, or 300% of the scheme rate. Professional medical practitioners, on the other hand, may charge up to five times the base price.

👉 By purchasing gap cover, you can protect yourself and your family from this financial discrepancy, potentially avoiding major out-of-pocket medical costs.

Benefits of gap cover

👉 Top-tier gap coverage policies provide in-hospital and defined out-of-hospital benefits of up to 500% of the MST. They may also cover co-payments for hospital admissions, some surgical procedures, and medical scans.

👉 Many South African medical aid programmes compel members to pay co-payments if they use hospitals outside of the scheme’s network. This statutory co-payment is covered by gap insurance up to a specified amount per household per year.

👉 With adequate gap coverage, you’ll also be eligible for lump sum benefits to cover medical expenditures for certain malignancies, internal prosthesis, accidental dentistry, and treatment and care in a casualty ward.

👉 READ more about the Top 5 Best Medical Aid Co-Payment Cover in South Africa

Waiting periods with regard to gap cover

👉 Gap cover, like traditional medical aid, has waiting periods and exclusions.

👉 There is often a three-month general waiting period for all benefits, as well as a 12-month waiting period for pre-existing conditions. You and your family are not eligible for coverage during these waiting periods.

👉 Exclusions are procedures and treatments that are not covered by gap insurance benefits. These differ depending on the source. Obesity treatment, cosmetic surgery, and specialty dentistry are examples of common exclusions.

👉 It should be noted that a gap cover provider may refuse to cover the costs of co-payments expressed as percentages rather than rand amounts; claims older than six months; and any limit, co-payment, or penalty imposed by your medical aid scheme for noncompliance with scheme rules or authorisation procedures.

👉 However, there is one gap cover provider which offers gap cover with no waiting period – a unique product in South Africa today. This product is offered by ZestLife, which we will explore in greater detail below.

You might consider Health / Medical Insurance

Who is Zestlife?

👉 Zestlife is a certified financial service provider that offers unique needs-based life and health insurance coverage to you and your family.

👉 Zestlife policies will cover you and your family financially in the event of death, incapacity, injury, or disease. If you are affected by one of these disasters, these insurance plans will cover the following expenses:

➡️ Medical and Daily Living Expenses

➡️ The settlement of outstanding Debt e.g. home loan, car finance, credit cards

👉 Swiss Re and Gen Re reinsure Zestlife’s insurance coverage. These are two of the world’s largest insurance firms, so you can be confident that if you submit a genuine claim, Zestlife will not only be willing but also able to satisfy it in accordance with any undertaking set out in their insurance policies.

Zestlife Gap Cover

👉 Zestlife Gap Cover covers the medical expense shortages that occur when medical aids do not cover the fees charged by doctors and specialists for in-hospital and some out-of-hospital procedures.

👉 The gap between what medical aids cover and what private practitioners charge frequently amounts to tens of thousands of Rands in deficits, for which the patient becomes accountable.

👉 Hospital patients should concentrate on getting healthy rather than worrying about how to manage unanticipated medical price deficits not covered by medical aids. Zestlife Gap Cover covers these unexpected medical bills, allowing patients to focus on getting back on their feet.

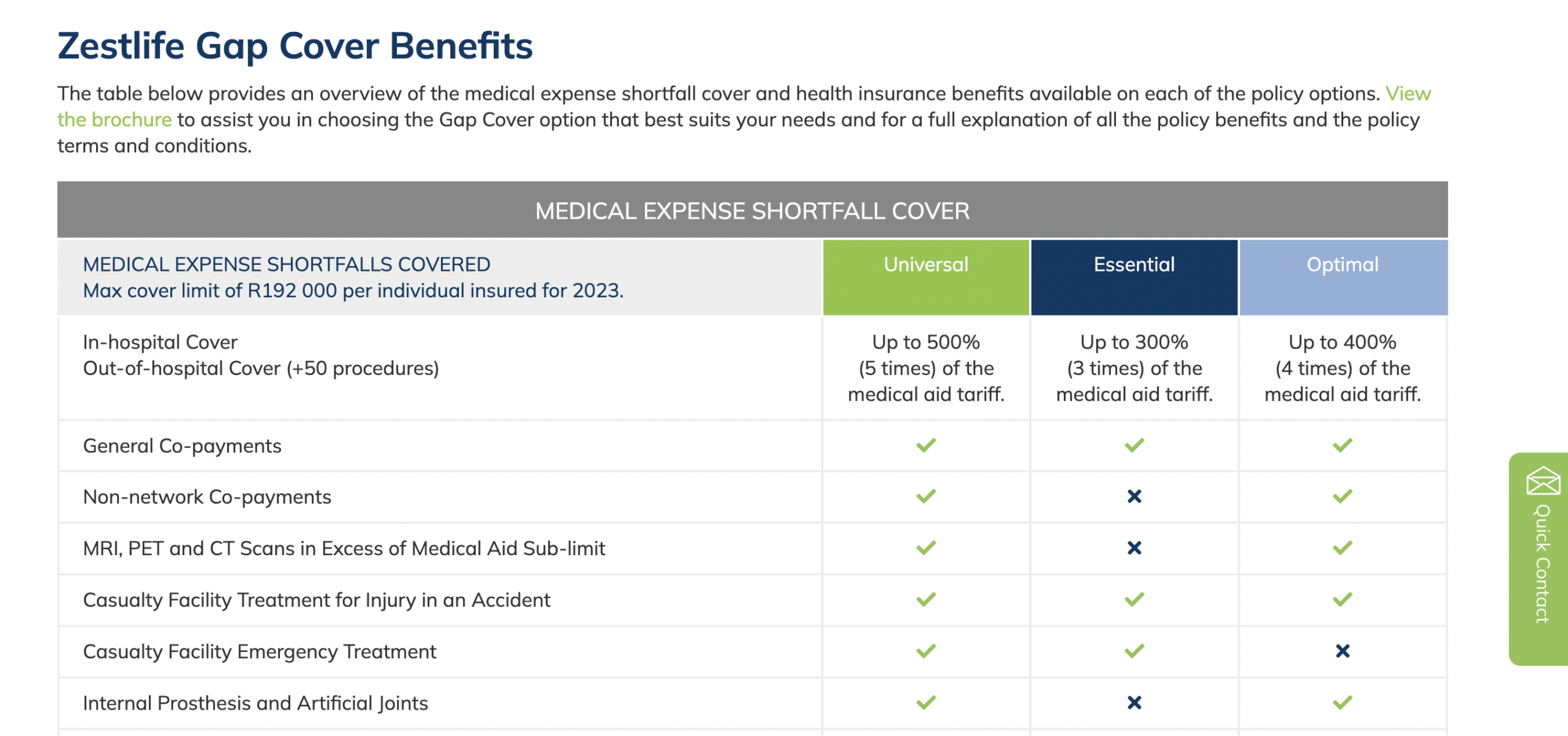

Zestlife Gap Cover Options

➡️ Zestlife Universal Gap Cover provides the most complete medical bill shortfall coverage, as well as significant financial protection against a variety of health risks. This option is available as single or family coverage.

➡️ Zestlife Essential Gap Cover provides low-cost coverage for the most common medical expense shortfalls, as well as supplementary financial protection for specific health risks. This option is available as single or family coverage.

➡️ Zestlife Optimal Gap Cover provides excellent levels of coverage at an affordable price to meet the demands of people under the age of 35.

👉 Zestlife Gap Cover options are available to primary members and dependents of all registered medical aids in South Africa. There is no maximum entrance age, and coverage continues indefinitely.

👉 You can supplement your Zestlife Gap Cover insurance with their Extended Cancer Cover. If you or any of your policy dependents are diagnosed with cancer for the first time, Zestlife will pay you the Extended Cancer Cover benefit of R100 000 or R200 000 to cover any unforeseen costs that may emerge as a result of the diagnosis.

Benefits of Zestlife Gap Cover

➡️ There is no maximum entrance age or expiry date.

➡️ Adult dependant coverage is provided automatically.

➡️ There is no blanket waiting time when coverage begins.

➡️ Coverage for in-hospital and over 50 out-of-hospital procedures is extensive.

➡️ Co-payment cover for hospital submissions and scans.

➡️ Coverage for travel outside of South Africa.

➡️ Exclusions are limited

➡️ Quick and efficient claim resolution.

Frequently Asked Questions

What is Gap cover with no waiting period?

Gap cover with no waiting period is a type of insurance policy that provides cover for medical expenses not fully covered by a medical aid scheme. It does not require a waiting period before the benefits can be used.

How does Gap cover with no waiting period work?

With Gap cover with no waiting period, you pay a monthly premium to the insurance provider. If you incur medical expenses that are not fully covered by your medical aid, you can claim from your Gap cover without having to wait for a waiting period to elapse.

What are the benefits of using Gap cover with no waiting period?

Using Gap cover with no waiting period can help you avoid unexpected medical expenses, as well as provide peace of mind knowing that you are covered for additional expenses not covered by your medical aid. Additionally, you can immediately use the benefits without having to wait for a waiting period to elapse.

What types of medical expenses does Gap cover with no waiting period typically cover?

Gap cover with no waiting period typically covers medical expenses such as co-payments, deductibles, and other out-of-pocket expenses that are not covered by your medical aid. It can also cover certain procedures that your medical aid may not cover in full.

How can I sign up for Gap cover with no waiting period?

To sign up for Gap cover with no waiting period, you can contact an insurance provider that offers this type of cover. They will provide you with the necessary information and assist you with the application process. It is important to compare different providers and policies to find one that suits your needs and budget.

Alternatively you can complete the Request a Medical Aid quote online and one of our dedicated Medical Aid Specialists brokers will be in touch.