- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

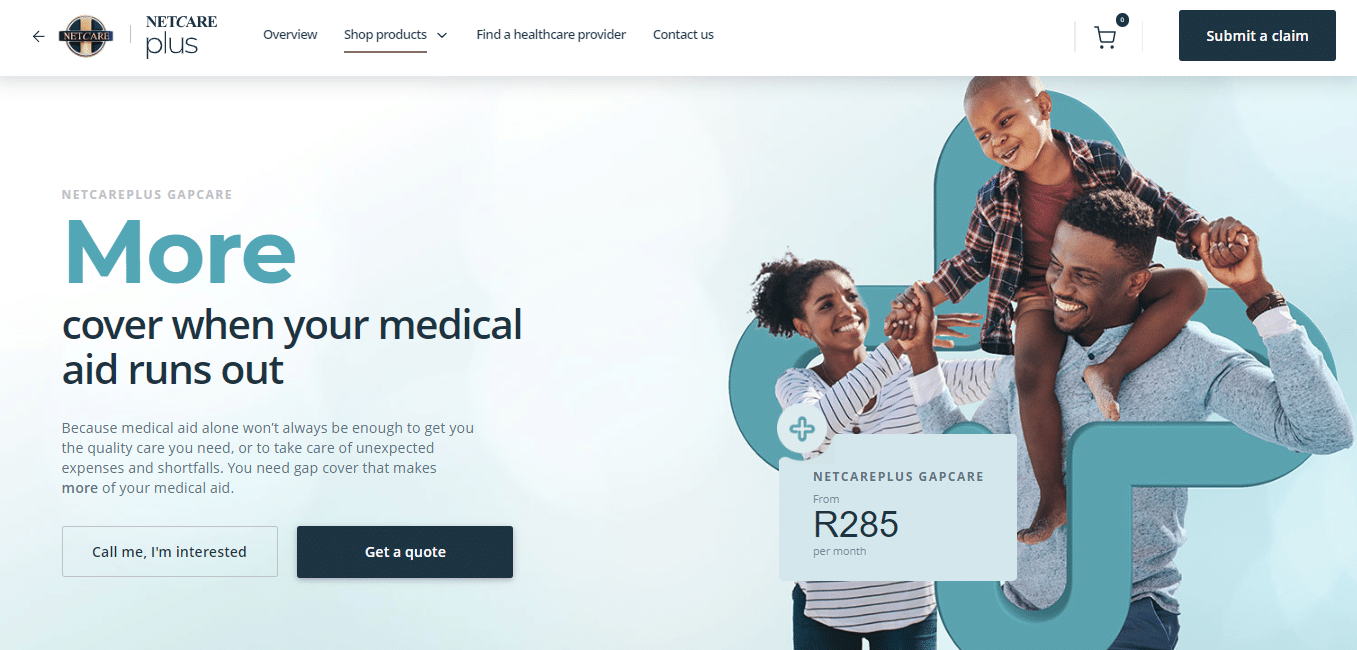

NetcarePlus GapCare 300+

Overall, NetcarePlus GapCare 300+ is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The NetcarePlus GapCare 300+ Plan starts from R325 ZAR. NetcarePlus GapCare has a trust score of 4.1.

| 🔎 Provider | 🥇 NetcarePlus GapCare 300+ |

| 🟥 Years in Operation | 27 years |

| 🟧 Underwriters | The Hollard Insurance Company Limited |

| 🟨 Market Share in South Africa | <5% |

| 🟩 Gap Cover Waiting Period | 3 – 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | R325 |

| 🟥 Oncology Benefit | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

NetcarePlus GapCare 300+ – 7 Key Point Quick Overview

- ✅ NetcarePlus GapCare 300+ Overview

- ✅ NetcarePlus GapCare 300+ Premiums

- ✅ NetcarePlus GapCare 300+ Benefits and Cover Breakdown

- ✅ NetcarePlus GapCare 300+ Exclusions and Waiting Periods

- ✅ NetcarePlus GapCare 300+ vs Other Gap Cover Plans

- ✅ Our Verdict on NetcarePlus GapCare 300+

- ✅ NetcarePlus GapCare 300+ Frequently Asked Questions

NetcarePlus GapCare 300+ Overview

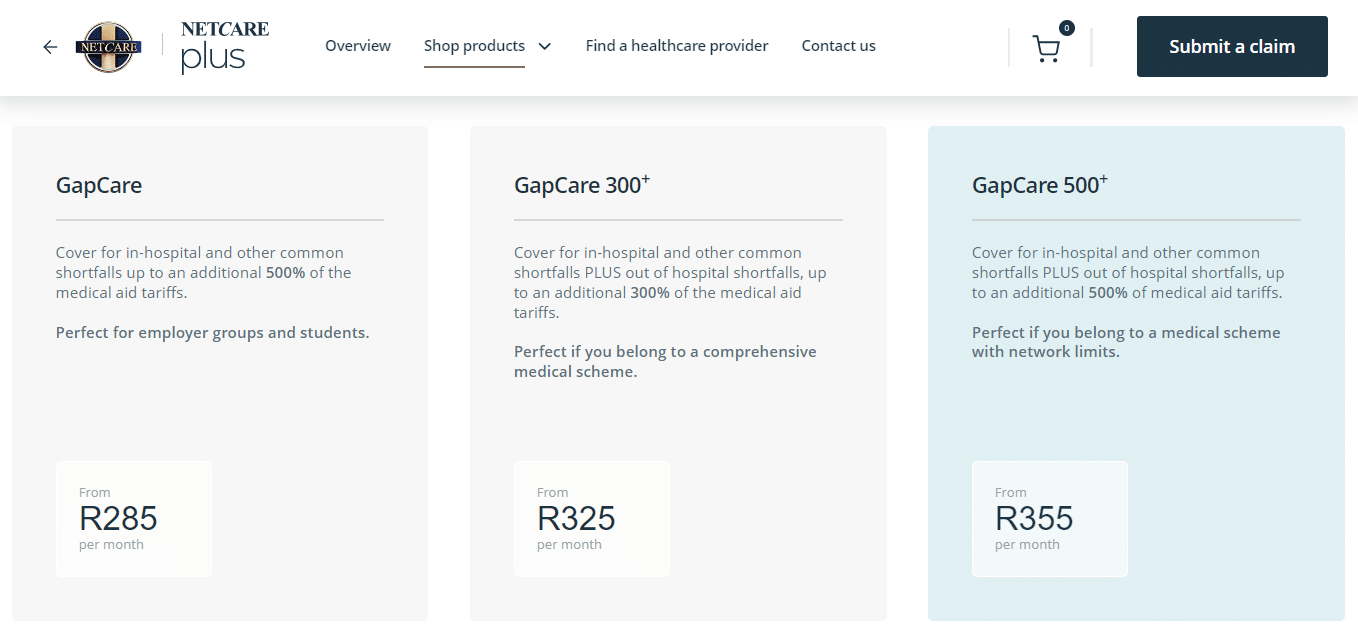

The NetcarePlus GapCare 300+ is one of three plans that starts from R325 per month. The NetcarePlus GapCare 300+ plan has benefits for charges that exceed medical aid sub-limits, casualties, private ward cover for maternity admissions, and more.

NetcarePlus GapCare Gap Cover has two plans to choose from:

NetcarePlus GapCare 300+ Premiums

| 🅰️ NetcarePlus GapCare 300+ Plan | 🅱️ Monthly Premium |

| GapCare 300+ | From 325 per month |

NetcarePlus GapCare 300+ Benefits and Cover Breakdown

NetcarePlus GapCare In-Hospital Benefits

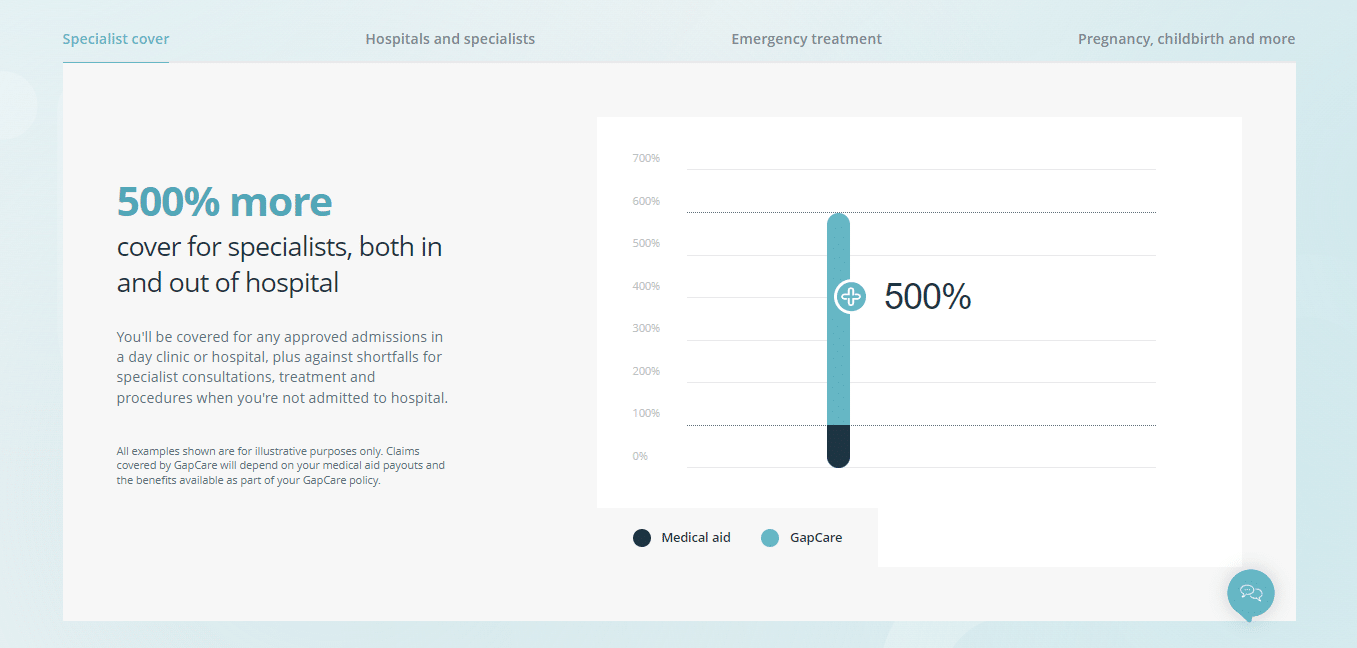

| 🟥 In-Hospital Specialist Shortfall | Covers up to 300% of the medical aid scheme tariff. Includes approved medical procedures in specialist rooms, hospitals, and day hospitals. All consultations are covered when the insured person is hospitalized. |

| 🟧 Co-Payments and Deductibles | Covers upfront payments that medical schemes require for certain procedures, including scopes and scans (MRI, CT, etc.) performed in-hospital or when the insured person goes to a day clinic. The cover amount is either a fixed cost or a percentage of the overall cost. |

| 🟨 Cancer Treatment Benefits | NetcarePlus covers oncology shortfalls on related treatments when insured persons use a non-DSP. Co-payments are applied for certain cancer-related treatments. Co-payments will apply when the insured person reaches the oncology limit of their medical scheme. |

| 🟩 Out-of-Network/Non-DSP Hospital Co-pays | When the insured person uses a healthcare provider outside the medical scheme network voluntarily, NetcarePlus will cover the co-payment, and the following will apply: Unlimited hospital admissions within the NetcarePlus network. Limited to one hospital admission annually, up to R10,000 for healthcare facilities outside the NetcarePlus network. |

| 🟦 Charges Exceeding Sub-Limits | Sub-limits may be applied by the insured person’s medical aid regarding certain in-hospital medical procedures, prosthetics, the allowed stay in mental health institutions, rehabilitation, step-down or sub-acute facilities. Therefore, NetcarePlus will pay up to R35,000 for each insured person per year. |

| 🟪 Emergency Treatment in an Emergency Department | This covers insured persons when they require medical emergency treatment, including the following: Shortfalls on doctors’ claims up to 300% of the medical scheme tariff. Out-of-pocket expenses paid when the insured’s medical savings have run out, or they reach their day-to-day sub-limit, are covered up to R20,000 per policy per year, subject to the overall annual limit. The following are covered under this benefit: Consultation fees for the doctor Facility fees Basic radiology, specialized radiology, pathology Medical appliances Medication |

Read more about the 5 Top Medical Aids for Pregnant Women

NetcarePlus GapCare Maternity In-and Out-of-Hospital Benefits

| 🟥 Private Ward Cover | NetcarePlus covers the difference between the general ward fee that the insured’s medical aid covers and the private ward fee for a maternity admission, subject to availability. |

| 🟧 Hospital Birth | NetcarePlus covers the following if the insured chooses a hospital in the network: Maternity fees charged, including: “Back to Basics” book. One 4D Ultrasound. Netcare Baby Gift Bag. Mandatory Hearing Screening for newborns. First Baby Immunisations (BCG and Polio) One check-up visits two weeks after birth. 24-hour crisis line. Antenatal classes at a NetcarePlus network hospital. |

| 🟨 Day-to-Day Maternity Benefits | NetcarePlus covers the difference between what the gynecologist/Obstetrician charges and the amount covered by the member’s medical aid for prenatal visits. When the member’s medical saving is depleted or they have reached the day-to-day benefits of their scheme, NetcarePlus offers the following: Prenatal testing for high-risk pregnancies is limited to R25,000 for every pregnancy. Baby immunization per the latest government schedule. |

NetcarePlus GapCare Out-of-Hospital and Day-to-Day Benefits

| 🟦 Out-of-Hospital Specialist Shortfalls | When the member’s medical aid has only paid a portion of out-of-hospital specialist consults, NetcarePlus will cover shortfalls for the following: Out-of-hospital consultations. Medical treatment is provided out-of-hospital. |

| 🟪 Day-to-Day Expenses Exceeding Medical Aid Limits | Once the insured member depletes their Medical Savings Account or they reach day-to-day benefit sub-limits, NetcarePlus will cover the following: Medical specialist consultations are required, deemed necessary by a GP. Basic Dentistry. Specialized Dentistry, including root canals, pulp removal, specialized x-rays, and reconstructive dentistry because of an accident and a trauma event. Specialized radiology and pathology deemed necessary by a GP or medical specialist for treatment or diagnosis. |

Discover more about Health Insurance for oversea holidaymakers

NetcarePlus GapCare 300+ Exclusions and Waiting Periods

NetcarePlus GapCare Exclusions

NetcarePlus GapCare 300+ has the following exclusions:

- ✅ Claims not processed by your medical scheme or excluded.

- ✅ Claims exceeding benefit-specific or overall annual limits.

- ✅ Events occurring when you were not insured.

- ✅ Events during waiting periods, unless for accidents or traumatic events.

- ✅ Failure to obtain pre-authorization or comply with medical aid rules.

- ✅ Non-recognized tariff codes (excluding procedure and consultation codes).

- ✅ Claims for healthcare services outside South Africa.

- ✅ Neglecting to use the NetcarePlus network when required.

- ✅ Services or benefits not included in the Policy.

- ✅ Suicide, attempted suicide, or intentional self-injury.

- ✅ Willful exposure to danger, except when attempting to save a human life.

Use of any drug or narcotic, legal or illegal, without a Medical Practitioner’s prescription and instructions, will be excluded.

NetcarePlus GapCare Waiting Periods

NetcarePlus GapCare 300+ has the following typical waiting periods that apply:

- ✅ A General waiting period of 3 months applies to all claims except those arising from accidents or traumatic events.

A Waiting period of 12 months for claims related to illnesses or medical conditions diagnosed, advised, or treated within the 12 months before your policy start date.

NetcarePlus GapCare 300+ vs Other Gap Cover Plans

| 🔎 Provider | 🥇 NetcarePlus GapCare 300+ | 🥈 Sirago Exact Cover with Gap and Co-Pay | 🥉 Stratum Benefits Access Co-Pay Plus300 |

| 🟥 Years in Operation | 27 years | 30 years | 24 years |

| 🟧 Underwriters | The Hollard Insurance Company Limited | GENRIC Insurance Company Limited (FSP: 43638) | Guardrisk Insurance Company Limited (FSP 75) |

| 🟨 Market Share in South Africa | <5% | >10% | >5% |

| 🟩 Gap Cover Waiting Period | 3 – 12 months | From 3 months (up to 12) | 3 Months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | R325 | R349 | R344 |

| 🟥 Oncology Benefit | ✅ Yes | None | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | None | ✅ Yes |

| 🟩 Maternity Benefit | ✅ Yes | None | ✅ Yes |

| 🟦 Scopes and Scans | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Co-payment Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Accidental Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Trauma Counseling | ✅ Yes | None | None |

| 🟩 Premium Waiver | ✅ Yes | ✅ Yes | None |

| 🟦 Non-DSP Co-Payment | ✅ Yes | None | None |

| 🟪 Prostheses | None | ✅ Yes | ✅ Yes |

| 🟥 Travel Cover Extender | None | None | None |

| 🟧 Accidental Death/ Permanent Disability | None | ✅ Yes | ✅ Yes |

Our Verdict on NetcarePlus GapCare 300+

Our research shows that NetcarePlus GapCare 300+ stands out as a comprehensive gap cover plan in South Africa. It offers a wide range of benefits, including cover for charges that surpass medical aid sub-limits, oncology treatments, both in-hospital and out-of-hospital expenses, maternity care, and emergency treatments.

The plan’s affordability is another appealing aspect, with monthly premiums starting at just R325.

NetcarePlus GapCare 300+ Frequently Asked Questions

What does GapCare 300+ cover?

GapCare 300+ covers charges that exceed medical aid sub-limits, oncology treatments, in-hospital and out-of-hospital expenses, maternity care, emergency treatments, and more.

How long has Netcare been operating?

Netcare has been operating for 27 years, providing a track record of experience and reliability.

Who underwrites GapCare 300+?

NetcarePlus is underwritten by The Hollard Insurance Company Limited, a reputable insurance provider.

What is the cost of GapCare 300+?

The monthly premiums for GapCare 300+ start from R325, making it an affordable option for additional cover.

Are there waiting periods for GapCare 300+?

Yes, there are waiting periods. A general waiting period of 3 months applies to all claims except those arising from accidents or traumatic events. There is also a waiting period of 12 months for claims related to pre-existing conditions.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans