- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

NetcarePlus GapCare 500+

Overall, NetcarePlus GapCare 500+ is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The NetcarePlus GapCare 500+ plan starts from R355 ZAR. NetcarePlus GapCare has a trust score of 4.1.

| 🔎 Provider | 🥇 NetcarePlus GapCare 500+ |

| 🟥 Years in Operation | 27 years |

| 🟧 Underwriters | The Hollard Insurance Company Limited |

| 🟨 Market Share in South Africa | <5% |

| 🟩 Gap Cover Waiting Period | 3 – 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | R355 |

| 🟥 Oncology Benefit | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

NetcarePlus GapCare 500+ – 7 Key Point Quick Overview

- ✅ NetcarePlus GapCare 500+ Overview

- ✅ NetcarePlus GapCare 500+ Premiums

- ✅ NetcarePlus GapCare 500+ Benefits and Cover Breakdown

- ✅ NetcarePlus GapCare 500+ Exclusions and Waiting Periods

- ✅ NetcarePlus GapCare 500+ vs Other Gap Cover Plans

- ✅ Our Verdict on NetcarePlus GapCare 500+

- ✅ NetcarePlus GapCare 500+ Frequently Asked Questions

NetcarePlus GapCare 500+ Overview

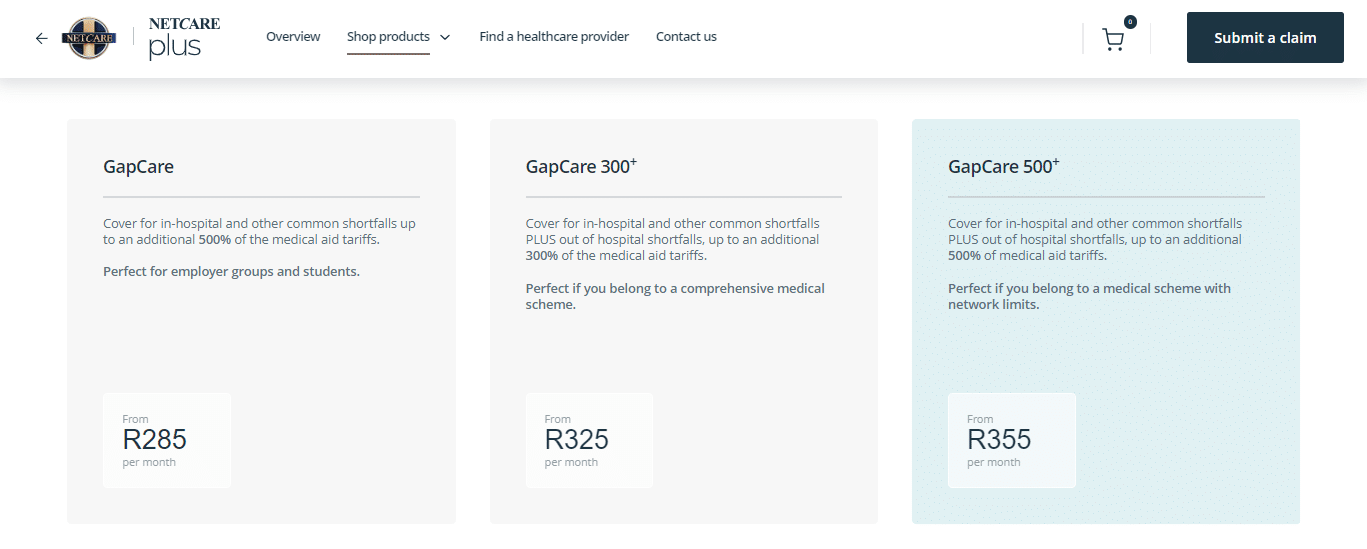

The NetcarePlus GapCare 500+ is one of three plans that starts from R355 per month. The NetcarePlus GapCare 500+ plan has benefits for sub-limits, hospital birth, day-to-day expenses, prenatal testing, premium waiver, and more.

NetcarePlus GapCare Gap Cover has two plans to choose from:

NetcarePlus GapCare 500+ Premiums

| 🅰️ NetcarePlus GapCare 500+ Plan | 🅱️ Monthly Premium |

| GapCare 500+ | From 355 per month |

NetcarePlus GapCare 500+ Benefits and Cover Breakdown

NetcarePlus GapCare 500+ In-Hospital Benefits

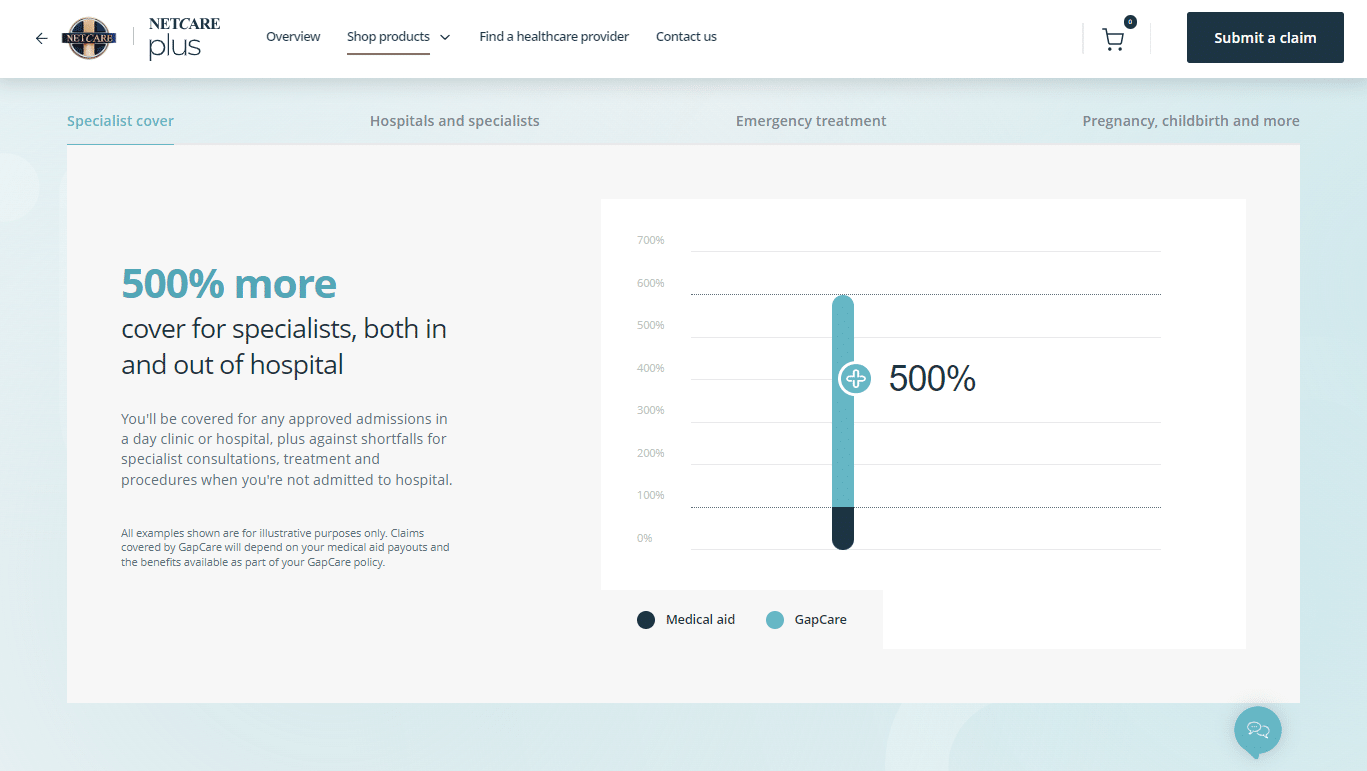

| 🟥 In-Hospital Specialist Shortfall | Covers up to 500% of the medical aid scheme tariff. Includes approved medical procedures in specialist rooms, hospitals, and day hospitals. All consultations are covered when the insured person is hospitalized. |

| 🟧 Co-Payments and Deductibles | Covers upfront payments that medical schemes require for certain procedures, including scopes and scans (MRI, CT, etc.) performed in-hospital or when the insured person goes to a day clinic. The cover amount is either a fixed cost or a percentage of the overall cost. |

| 🟨 Cancer Treatment Benefits | NetcarePlus covers oncology shortfalls on related treatments when insured persons use a non-DSP. Co-payments are applied for certain cancer-related treatments. Co-payments will apply when the insured person reaches the oncology limit of their medical scheme. |

| 🟩 Out-of-Network/Non-DSP Hospital Co-pays | When the insured person uses a healthcare provider outside the medical scheme network voluntarily, NetcarePlus will cover the co-payment, and the following will apply: Unlimited hospital admissions within the NetcarePlus network. Limited to one hospital admission annually, up to R10,000 for healthcare facilities outside the NetcarePlus network. |

| 🟦 Charges Exceeding Sub-Limits | Sub-limits may be applied by the insured person’s medical aid regarding certain in-hospital medical procedures, prosthetics, the allowed stay in mental health institutions, rehabilitation, step-down or sub-acute facilities. Therefore, NetcarePlus will pay up to R35,000 for each insured person per year. |

| 🟪 Emergency Treatment in an Emergency Department | This covers insured persons when they require medical emergency treatment, including the following: Shortfalls on doctors’ claims up to 500% of the medical scheme tariff. Out-of-pocket expenses paid when the insured’s medical savings have run out or they reach their day-to-day sub-limit, are covered up to R20,000 per policy per year, subject to the overall annual limit. The following are covered under this benefit: Consultation fees for the doctor Facility fees Basic radiology, specialized radiology, pathology Medical appliances Medication |

NetcarePlus GapCare 500+ Maternity In-and Out-of-Hospital Benefits

| 🟥 Private Ward Cover | NetcarePlus covers the difference between the general ward fee that the insured’s medical aid covers and the private ward fee for a maternity admission, subject to availability. |

| 🟧 Hospital Birth | NetcarePlus covers the following if the insured chooses a hospital in the network: Maternity fees charged, including: “Back to Basics” book. One 4D Ultrasound. Netcare Baby Gift Bag. Mandatory Hearing Screening for newborns. First Baby Immunisations (BCG and Polio) One check-up visits two weeks after birth. 24-hour crisis line. Antenatal classes at a NetcarePlus network hospital. |

| 🟨 Day-to-Day Maternity Benefits | NetcarePlus covers the difference between what the gynecologist/Obstetrician charges and the amount covered by the member’s medical aid for prenatal visits. When the member’s medical saving is depleted or they have reached the day-to-day benefits of their scheme, NetcarePlus offers the following: Prenatal testing for high-risk pregnancies is limited to R25,000 for every pregnancy. Baby immunization per the latest government schedule. |

Discover the 5 Best Medical Aids with No Late Signing up penalties

NetcarePlus GapCare 500+ Out-of-Hospital and Day-to-Day Benefits

| 🟥 Out-of-Hospital Specialist Shortfalls | When the member’s medical aid has only paid a portion of out-of-hospital specialist consults, NetcarePlus will cover shortfalls for the following: Out-of-hospital consultations. Medical treatment is provided out-of-hospital. |

| 🟧 Day-to-Day Expenses Exceeding Medical Aid Limits | Once the insured member depletes their Medical Savings Account or they reach day-to-day benefit sub-limits, NetcarePlus will cover the following: Medical specialist consultations deemed necessary by a GP. Basic Dentistry. Specialized dentistry includes root canals, pulp removal, specialized X-rays, and reconstructive dentistry because of an accident and a trauma event. Specialized radiology and pathology deemed necessary by a GP or medical specialist for treatment or diagnosis. |

| 🟨 Trauma Counselling | NetcarePlus will cover the following costs if a traumatic event occurs, up to R10,000 per insured per year, subject to the OAL: The difference between what the counselor/psychologist charges for counseling sessions and the amount the medical aid covers. The cost of counseling sessions with a counselor/psychologist once the insured person depletes their medical savings or they have reached their benefit limit. |

| 🟩 Premium Waiver | If the policyholder passes away or becomes permanently disabled following an accident, NetcarePlus will pay the GapCare Premium and Medical Aid Contribution for 6 months up to R5,000 a month. |

| 🟦 GapCare Emergency Booster | When medical emergency treatment is required, NetcarePlus will further cover the following: Doctor Consultation Fees Facility Fees Basic and Specialised Radiology and pathology Medical Appliances Medication |

NetcarePlus GapCare 500+ Cover Limits

| 🟥 Overall Annual Limit (OAL) | Limited to R185,000 per insured on the policy per year. |

| 🟧 Out-of-Network Hospital Co-Payments | Limited to one stay per insured person per year up to R10,000. Subject to the R185,000 OAL. |

| 🟨 Charged that Exceed Sub-Limits | Limited to R35,000 per insured person per year. Subject to the OAL. Limited to 5 days for stays in a mental health institution, rehabilitation, step-down or sub-acute facility. |

| 🟩 Emergency Treatment in an Emergency Department | Limited to R20,000 per policy per year. Subject to the OAL. |

| 🟦 Prenatal Testing for High-Risk Pregnancy | Limited to R25,000 per pregnancy. |

| 🟪 Day-to-Day Costs Exceeding Medical Scheme Limits | Limited to R20,000 per insured person per year. Subject to the R185,000 OAL. |

| 🟥 Trauma Counselling | Limited to R10,000 per insured person per year. Subject to the OAL. |

| 🟧 Premium Waiver | Limited to R5,000 per month up to 6 months for GapCover premiums and medical aid contributions |

| 🟨 GapCare Emergency Booster | Limited to R10,000 per policy per year. |

NetcarePlus GapCare 500+ Exclusions and Waiting Periods

NetcarePlus GapCare 500+ Exclusions

NetcarePlus GapCare 500+ has the following exclusions:

- ✅ Claims not processed by your medical scheme or excluded.

- ✅ Claims exceeding benefit-specific or overall annual limits.

- ✅ Events occurring when you were not insured.

- ✅ Events during waiting periods, unless for accidents or traumatic events.

- ✅ Failure to obtain pre-authorization or comply with medical aid rules.

- ✅ Non-recognized tariff codes (excluding procedure and consultation codes).

- ✅ Claims for healthcare services outside South Africa.

- ✅ Neglecting to use the NetcarePlus network when required.

- ✅ Weight-loss or cosmetic surgery (except for breast reconstruction due to cancer treatment).

- ✅ Claims for Prescribed Minimum Benefits, ward fees, medications, and other hospital expenses.

- ✅ Services or benefits not included in the Policy.

- ✅ Suicide, attempted suicide, or intentional self-injury.

- ✅ Willful exposure to danger, except when attempting to save a human life.

- ✅ Failure to follow the medical advice given by a Medical Practitioner.

Use of any drug or narcotic, legal or illegal, without a Medical Practitioner’s prescription and instructions, will be excluded.

NetcarePlus GapCare 500+ Waiting Periods

NetcarePlus GapCare 500+ has the following typical waiting periods that apply:

- ✅ A General waiting period of 3 months applies to all claims except those arising from accidents or traumatic events.

A Waiting period of 12 months for claims related to illnesses or medical conditions diagnosed, advised, or treated within the 12 months before your policy start date.

You might consider advancing your healthcare knowledge about Bargain Health Insurance in South Africa

NetcarePlus GapCare 500+ vs Other Gap Cover Plans

| 🔎 Provider | 🥇 NetcarePlus GapCare 500+ | 🥈 Sirago Exact Cover with Gap and Co-Pay | 🥉 Stratum Benefits Access Co-Pay Plus300 |

| 🟥 Years in Operation | 27 years | 30 years | 24 years |

| 🟧 Underwriters | The Hollard Insurance Company Limited | GENRIC Insurance Company Limited (FSP: 43638) | Guardrisk Insurance Company Limited (FSP 75) |

| 🟨 Market Share in South Africa | <5% | >10% | >5% |

| 🟩 Gap Cover Waiting Period | 3 – 12 months | From 3 months (up to 12) | 3 Months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | R355 | R349 | R344 |

| 🟥 Oncology Benefit | ✅ Yes | None | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | None | ✅ Yes |

| 🟩 Maternity Benefit | ✅ Yes | None | ✅ Yes |

| 🟦 Scopes and Scans | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Co-payment Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Accidental Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Trauma Counseling | ✅ Yes | None | None |

| 🟩 Premium Waiver | ✅ Yes | ✅ Yes | None |

| 🟦 Non-DSP Co-Payment | ✅ Yes | None | None |

| 🟪 Prostheses | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Travel Cover Extender | None | None | None |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | ✅ Yes | ✅ Yes |

Our Verdict on NetcarePlus GapCare 500+

According to our research, the NetcarePlus GapCare 500+ plan offers comprehensive benefits and coverage for individuals seeking to bridge the gaps in their medical expenses.

It covers in-hospital treatments, oncology, out-of-hospital consultations, maternity benefits, scopes and scans, co-payment cover, emergency room treatment, trauma counseling, and more.

The plan is suitable for individuals with a medical aid scheme who want additional financial protection against potential shortfalls and co-payments.

You might consider reading more about the Best Medical Aids in South Africa Cover ICSI (intracytoplasmic sperm injection) an assisted reproductive treatment

NetcarePlus GapCare 500+ Frequently Asked Questions

What does NetcarePlus GapCare 500+ cover?

NetcarePlus GapCare 500+ covers in-hospital treatments, oncology, out-of-hospital consultations, maternity benefits, scopes and scans, co-payment cover, emergency room treatment, trauma counseling, and more.

What are the premiums for NetcarePlus GapCare 500+?

The monthly premiums for NetcarePlus GapCare 500+ start from R355 per month, providing additional financial protection against potential shortfalls and co-payments.

How do I qualify for NetcarePlus GapCare 500+?

To qualify for NetcarePlus GapCare 500+, you must have an existing medical aid scheme. This plan is designed to supplement your medical aid coverage and fill the gaps in your medical expenses.

Can I use any healthcare provider with NetcarePlus GapCare 500+?

NetcarePlus GapCare 500+ allows you to choose your healthcare providers, specialists, and hospitals, whether in-network or out-of-network. However, it is important to note that there may be additional benefits and cover limitations depending on the provider network used.

How do I claim with NetcarePlus GapCare 500+?

To claim with NetcarePlus GapCare 500+, you must first ensure that your medical aid scheme has processed the claim. Once your medical aid has paid its portion, you can submit the remaining shortfall claim to NetcarePlus for reimbursement.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans