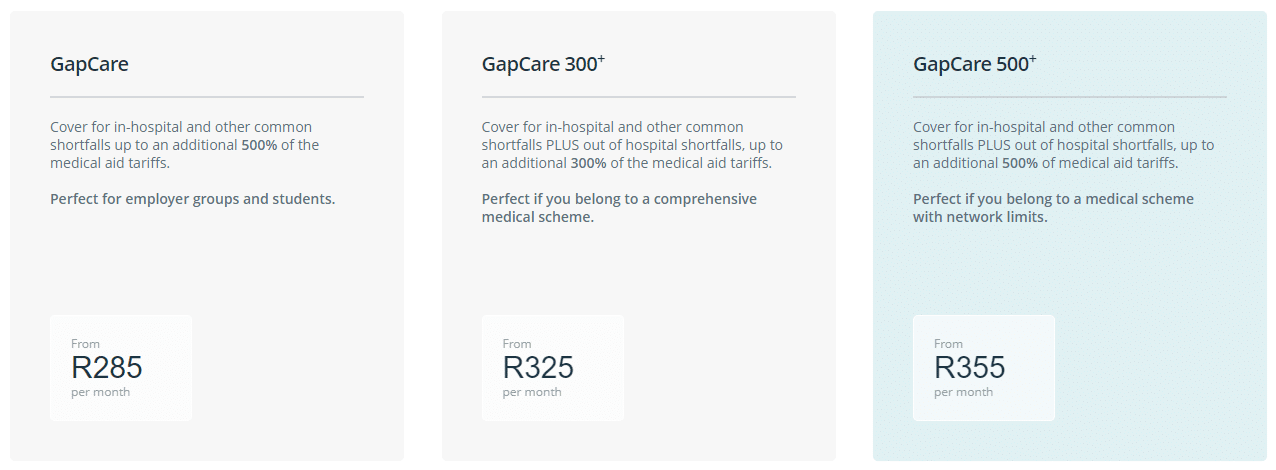

Monthly Premium

From R390

Waiting Period

3 - 12 months

500+

The 500+ plan offers a range of benefits, including coverage for sub-limits, hospital birth, day-to-day expenses, prenatal testing, premium waiver, and various other additional advantages.

★★★★★ 4.5/5

Oncology Benefits:

Scopes and Scans:

Accidental Cover:

Trauma Counseling:

Co-Payment Cover:

Maternity Benefits:

The 500+ plan offers a range of benefits, including coverage for sub-limits, hospital birth, day-to-day expenses, prenatal testing, premium waiver, and various other additional advantages.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses:

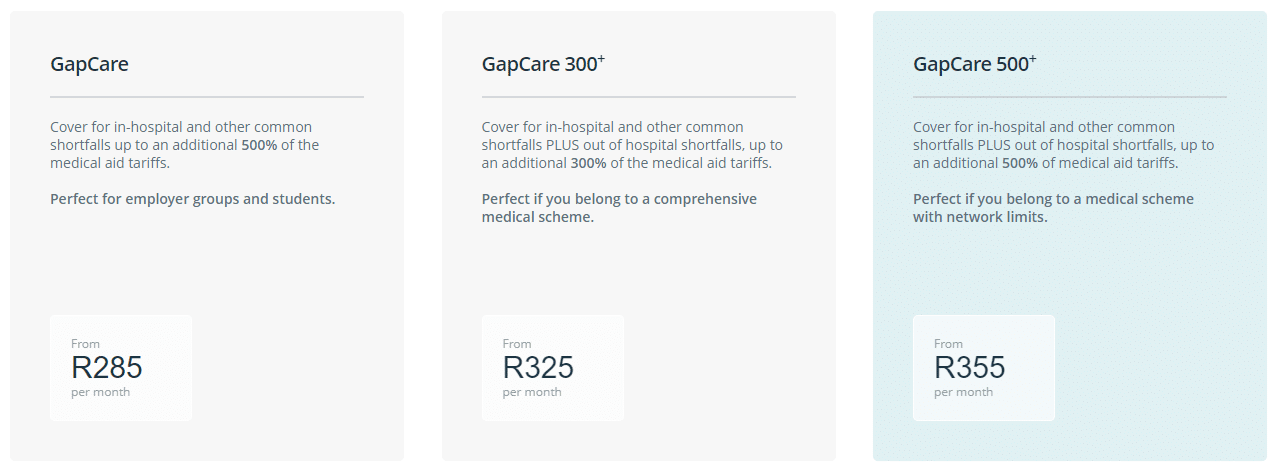

500+

The 500+ plan offers a range of benefits, including coverage for sub-limits, hospital birth, day-to-day expenses, prenatal testing, premium waiver, and various other additional advantages.

★★★★★ 4/5

Monthly Premium

From R390

Waiting Period

3 - 12 months

The 500+ plan offers a range of benefits, including coverage for sub-limits, hospital birth, day-to-day expenses, prenatal testing, premium waiver, and various other additional advantages.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses: