- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Cape Medical Plan Late Joiner Fee

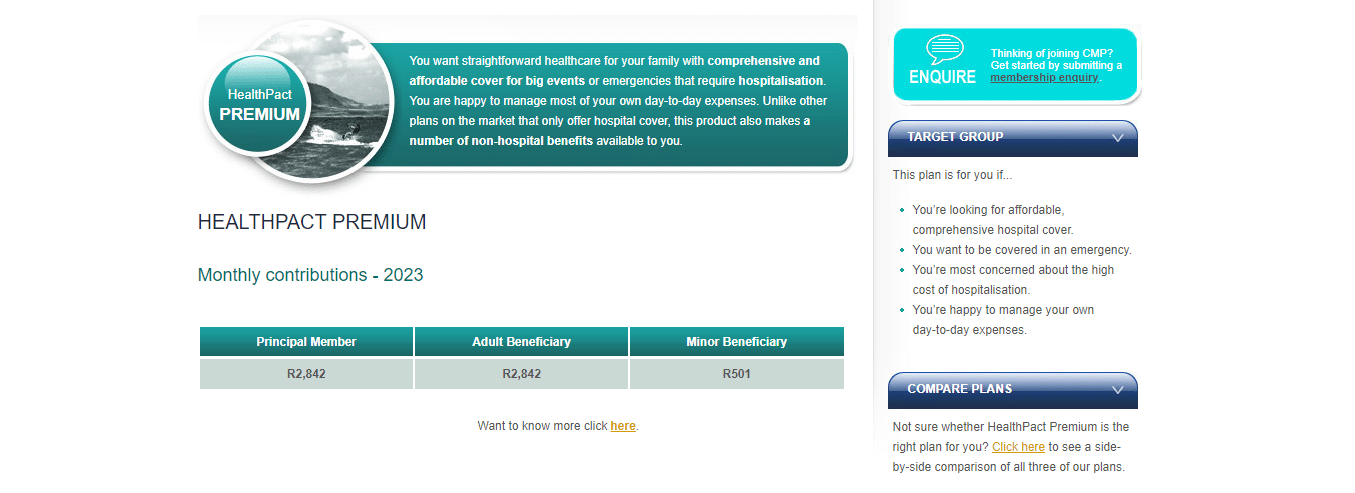

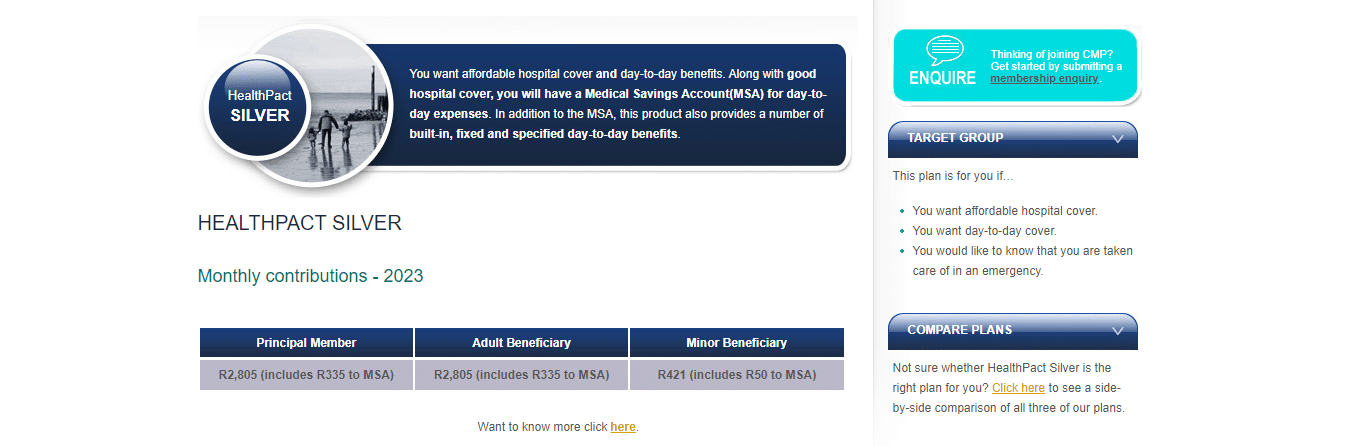

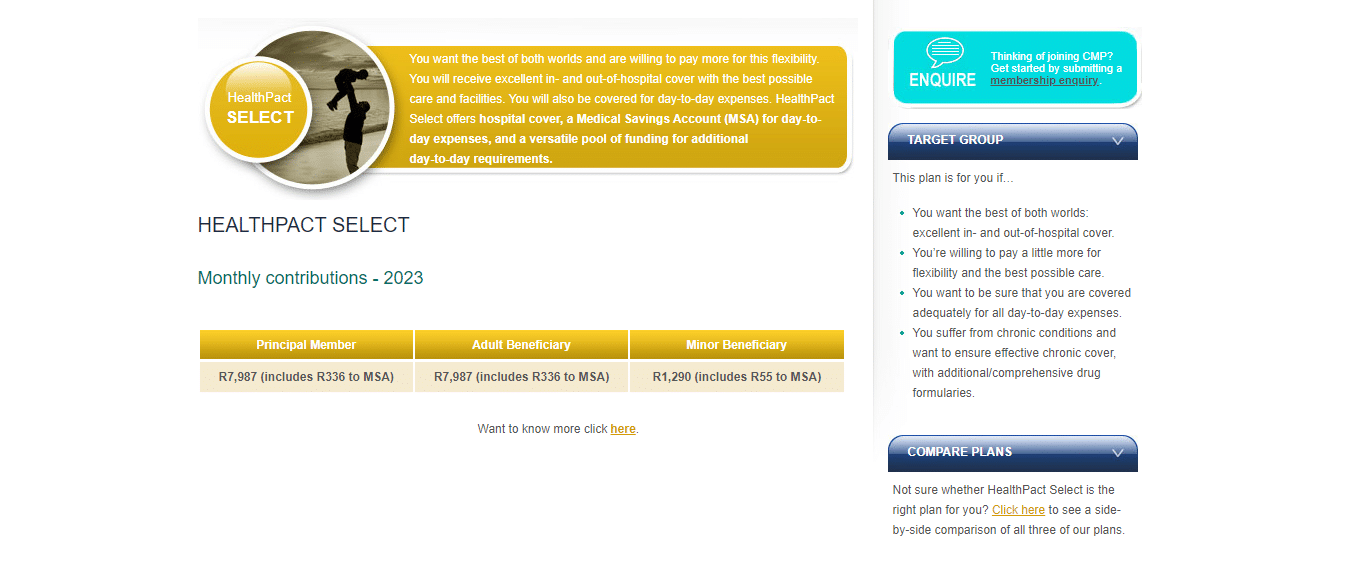

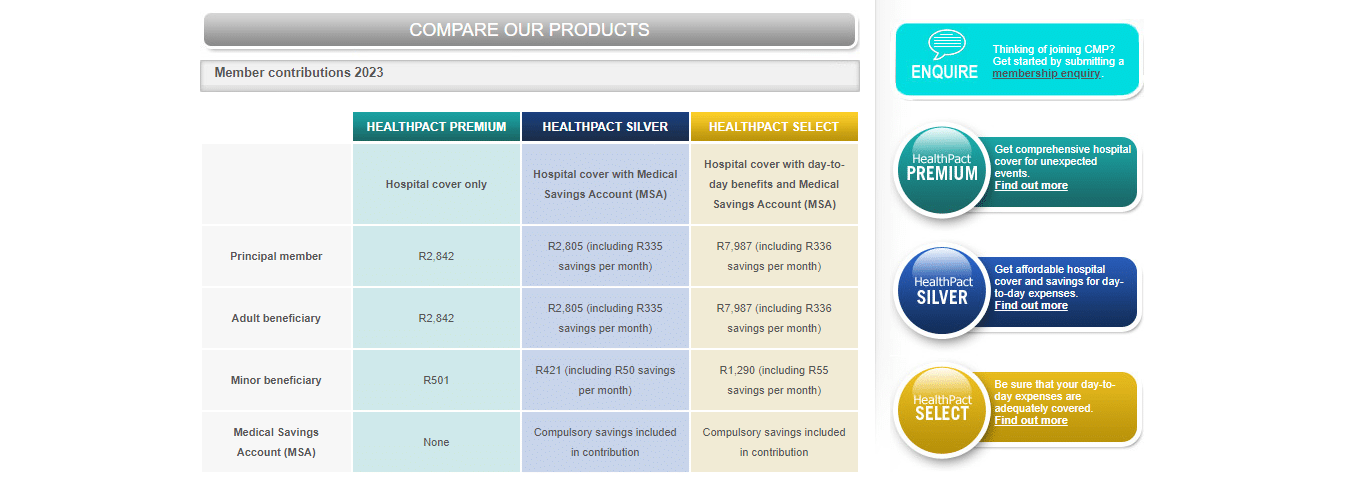

Overall, the Cape Medical Plan is a trustworthy and comprehensive medical aid provider. New Members 35 years or older may be subject to late-joiner penalties on Cape Medical Plan Medical Aid Plans. The Cape Medical Plan Medical Aid Plans start from R2805 ZAR per month. Bestmed Medical Scheme has a trust rating of 3.9.

| 💶 Medical Aid Contribution Range | R2,805 – R7,987 per month |

| ⬇️ Average Waiting Period | 12 months |

| ⬆️ Late-joiner penalties charged | ☑️ Yes |

| ➡️ Late Joiner Penalty Age | 35 years or Older |

Cape Medical Plan Late Joiner Fees – 9 Key Point Quick Overview

- ✅ Cape Medical Plan Late Joiner Fees – What to know before Joining

- ✅ Cape Medical Plan Waiting Periods

- ✅ Cape Medical Plan Exclusions

- ✅ Cape Medical Plan and Pre-existing Conditions

- ✅ Late Joiner Fees vs. Waiting Periods: What is the Difference?

- ✅ What Happens if You Do Not Pay Late Joiner Fees?

- ✅ National Health Insurance (NHI) Bill South Africa

- ✅ Our Verdict on Cape Medical Plan Late Joiner Fees

- ✅ Cape Medical Plan Late Joiner Fees Frequently Asked Questions

Cape Medical Plan Late Joiner Fees – What to know before Joining

New members who join Cape Medical Plan after the age of 35 and who have a history of membership in another South African medical scheme are subject to a late-joiner penalty.

This surcharge is added to the member’s monthly premiums for the duration of their membership. It is based on the years the member went without medical scheme cover.

This restriction applies solely to their insured portion of benefits. Late Joiner Fees will apply on the following Cape Medical Plans:

- ✅ Cape Medical HealthPact Premium Plan

- ✅ Cape Medical HealthPact Select Plan

- ✅ Cape Medical HealthPact Silver Plan

Cape Medical Plan Waiting Periods

New members can be subjected to two types of waiting periods: a general three-month waiting period for all new members and a condition-specific waiting period of up to 12 months.

Cape Medical Plan Exclusions

As with other medical aid schemes, Cape Medical Plan has exclusions for some treatments, appliances, and services. PMB regulations exclude these from all products and cannot be paid for with insured benefits. The following are some of the exceptions that apply:

- ✅ Procedures to correct eye refraction errors, including blepharoplasties and excimer laser/Lasik

- ✅ Treatment for sexual dysfunction in males and females

- ✅ Infertility treatment, except if authorized within PMB level of care criteria

- ✅ Breast reductions, including scar revision, Botox, breast augmentation, and gynecomastia

- ✅ MammaPrint genetic testing and any other type of genetic testing

- ✅ Non-diseased breast reconstruction, nipple reconstruction, etc.

- ✅ Cosmetic surgery

- ✅ Long-term nursing care, such as frail care nursing

- ✅ Non-PMB treatment for alcohol or substance abuse, willful self-injury, or attempted suicide

- ✅ Non-PMB psychological and psychiatric treatment, including sleep studies

- ✅ Treatment or surgery for obesity

- ✅ Educational and group therapy

- ✅ Protective gear

Medical examinations for insurance, school, association, emigration, visa, employment, or other applications may be excluded.

Cape Medical Plan and Pre-existing Conditions

When joining a medical aid scheme, it is important to note that there is usually a waiting period of 12 months before any pre-existing conditions are covered. Therefore, joining a medical aid scheme earlier in life is advisable, rather than waiting until old age when the risk of developing chronic health conditions is higher.

Additionally, it is important to note that some medical aid schemes, such as Cape Medical Plan, have specific policies regarding pre-existing conditions.

Therefore, it is important to research and understands the policies of a medical aid scheme before joining to ensure that you are fully aware of any waiting periods or limitations regarding pre-existing conditions.

Late Joiner Fees vs. Waiting Periods: What is the Difference?

Late Joiner Fees are a one-time penalty fee charged by medical aid if you join after a certain age or have never been a member of a medical aid program. Waiting periods, on the other hand, are periods during which you are not covered for certain medical aid benefits.

These waiting periods apply to all new members, regardless of whether they are charged Late Joiner Fees. Depending on the benefit, waiting periods can range from three to twelve months.

Read More: Late Joiner Penalties Explained.

What Happens if You Do Not Pay Late Joiner Fees?

Your medical aid membership may be suspended or terminated if you fail to pay the Late Joiner Fees. The scheme may also pursue legal action to collect overdue fees. If your membership is suspended, you cannot access medical aid benefits until you have paid any outstanding fees.

If your membership is terminated, you must reapply for membership and may be subject to even higher Late Joiner Fees. Therefore, paying your Late Joiner Fees on time is crucial to prevent interruptions in your medical aid coverage.

National Health Insurance (NHI) Bill South Africa

In South Africa, the NHI is a proposed universal health coverage system. It is still in the planning stages, but it could affect Late Joiner Fees and other facets of medical aid.

Our Verdict on Cape Medical Plan Late Joiner Fees

Cape Medical Plan (CMP) imposes a late-joiner penalty on new members who join after 35 and have a proven history of previous medical scheme membership in South Africa. This penalty is calculated based on the member’s years without medical scheme cover. It is added to their monthly premiums for the entire membership duration.

However, it is worth noting that the penalty is only applied to the insured portion of a member’s benefit.

Regarding the transparency of CMP, the company is proud to state that 100% of the contributions made by members go towards medical benefits, with none of the money used for administration costs.

Cape Medical Plan also acknowledges that it may feel like members are paying more than they are getting out in the short term. However, they are confident that just one short hospital stay will demonstrate the value of being covered.

Cape Medical Plan Late Joiner Fees Frequently Asked Questions

What are late joiner fees with Cape Medical Aid?

Cape Medical Aid imposes late joiner fees, a form of penalty fee, on members who do not enroll in the program as soon as they are first eligible to do so.

How do I know if I have to pay late joiner fees with Cape Medical Aid?

Cape Medical Aid assesses late joiner fees if you are over 35 and have not belonged to a registered medical scheme within the past two years.

Can I avoid paying late joiner fees with Cape Medical Aid?

If you were prevented from enrolling in a medical plan due to extenuating circumstances, you might be eligible to have Cape Medical Aid waive your late joiner fees.

How much are late joiner fees with Cape Medical Aid?

Cape Medical Aid’s late joiner fees are proportional to the number of years you could enroll in the program but did not. As a result, fees can be as high as 75% of your regular payment.

Are late joiner fees with Cape Medical Aid refundable?

Cape Medical Aid’s late-joiner fees are not refundable, unfortunately.

What is the deadline for paying late joiner fees with Cape Medical Aid?

Cape Medical Aid requires late joiner fees to be paid by the last day of the month following the month in which membership was established.

Can I negotiate late joiner fees with Cape Medical Aid?

Cape Medical Aid’s late-joiner fees are non-negotiable, unfortunately.

What happens if I do not pay my late joiner fees with Cape Medical Aid?

Your membership with Cape Medical Aid could be terminated, and you could be held responsible for any unpaid fees if you fail to pay your late joiner fees.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans