- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Cape Medical MyHealth 100 Saver Plan

Overall, the Cape Medical MyHealth 100 Saver Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance, and maternity plus pediatric benefits to up to 3 Family Members. The Cape Medical MyHealth 100 Saver Medical Aid Plan starts from R3,113 ZAR.

| 👤 Main Member Contribution | R3,113 |

| 👥 Adult Dependent Contribution | R3,113 |

| 🍼 Child Dependent Contribution | R467 |

| 🔁 Gap Cover | None |

| 📉 Annual Limit | Unlimited Hospital Cover |

| 🏥 Hospital Cover | Unlimited |

| ➡️ Oncology Cover | 100% CMP tariff |

| 🟦 Medical Savings Account | ☑️ Yes |

| 💙 Maternity Benefits | ☑️ Yes |

| 🔵 Home Care | None |

Cape Medical MyHealth 100 Saver Plan – 7 Key Point Quick Overview

- ✅ Cape Medical MyHealth 100 Saver Plan Overview

- ✅ Cape Medical MyHealth 100 Saver Contributions and Medical Savings Account

- ✅ MyHealth 100 Saver Plan Benefits and Cover Comprehensive Breakdown

- ✅ MyHealth 100 Saver Plan Exclusions and Waiting Periods

- ✅ Cape Medical MyHealth 100 Saver Plan vs. Similar Plans from Other Medical Schemes

- ✅ Our Verdict on The MyHealth 100 Saver Plan

- ✅ MyHealth 100 Saver Plan Frequently Asked Questions

Cape Medical MyHealth 100 Saver Plan Overview

The Cape Medical MyHealth 100 Saver Medical Aid Plan is one of three, starting from R3,113, and includes cover for consultations with GPs and Specialists, maternity and pediatric benefits, prostheses, dialysis, and more.

Gap Cover is not available on the Cape Medical Plan MyHealth 100 Saver. However, Cape Medical Plan offers 24/7 medical emergency assistance. According to the Trust Index, Cape Medical Plan has a trust rating of 3.9.

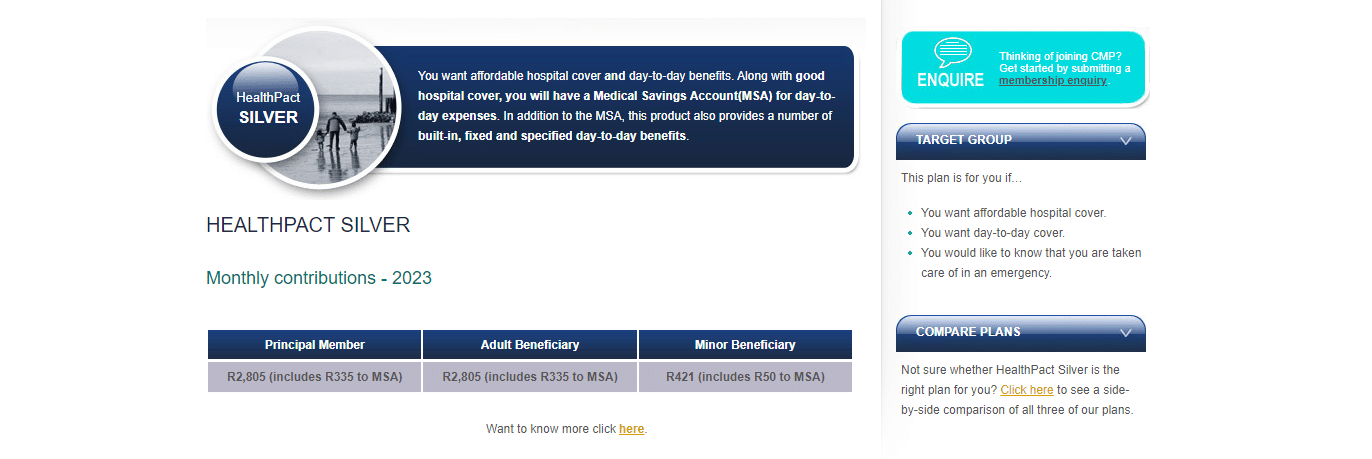

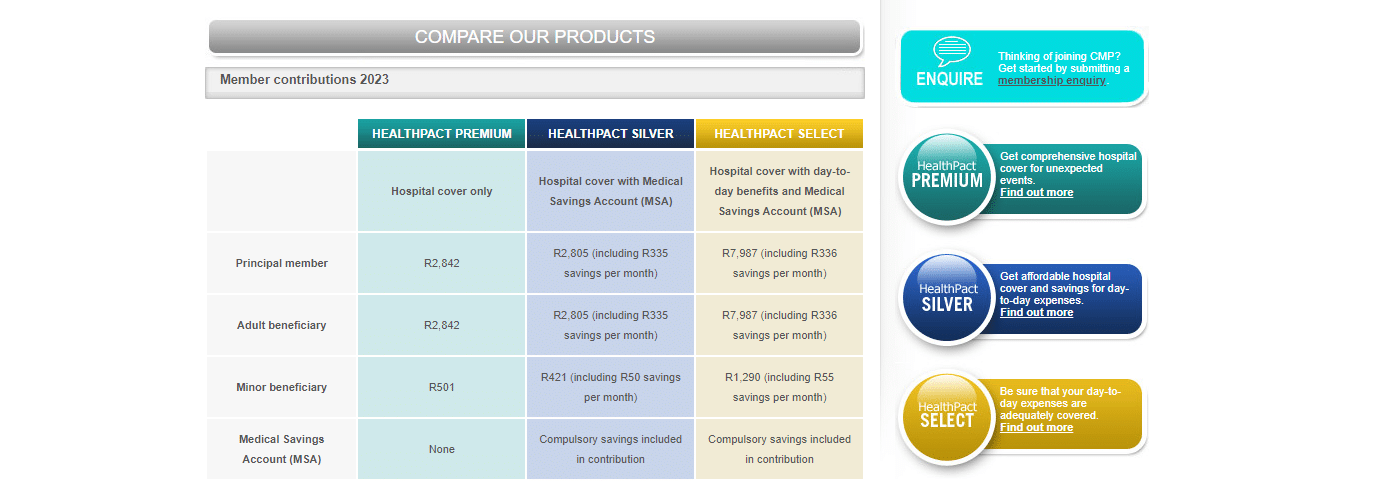

Cape Medical MyHealth 100 Saver Plan Contributions and Medical Savings Account

MyHealth 100 Saver Plan Contributions

| 👤 Main Member | 👥 +1 Adult Dependent | 🍼 +1 Child Dependent |

| R3,113 | R3,113 | R567 |

MyHealth 100 Saver Plan Medical Savings Account

| 👤 Main Member | 👥 +1 Adult Dependent | 🍼 +1 Child Dependent |

| R335 per month R4,020 per month | R335 per month R4,020 per year | R50 monthly R600 per year |

Discover the 5 Best Hospital Plans with Savings Accounts

MyHealth 100 Saver Plan Benefits and Cover Comprehensive Breakdown

MyHealth 100 Saver Plan In-Hospital Benefits

| 🟥 Overall Annual Limit | Unlimited cover in-hospital for authorized admissions. |

| 🟧 Hospital Accommodation Ward Fees Operating Theatre Costs Unattached Theatres Day Hospitals | Covered up to 100% of the CMP tariff or the agreed tariff. Subject to pre-approval. |

| 🟨 Emergency Room treatment (Only) | Paid from the MSA unless it is a PMB. |

| 🟩 Hospitalization for treatment: Mental Illness Alcoholism Drug Addiction | Paid from the MSA unless it is a PMB. Subject to pre-authorization. |

| 🟦 Hospitalisation Alternatives Registered step-down facilities Hospices Registered Nurses Rehabilitation Centres | Covered up to 100% of the CMP tariff for hospices and registered nurses. Limited to 15 days per beneficiary. Subject to pre-approval. |

| 🟪 Emergency Services | Covered up to 100% of the CMP Tariff unless it is a PMB. Subject to pre-authorization. |

| 🟥 Blood Transfusions | Covered up to 100% of the CMP Tariff unless it is a PMB. Subject to pre-authorization. |

| 🟧 Materials and Devices | Covered up to 100% of the cost to a Single Exit Price, Agreed Tariff, or Pre-Authorised Tariff. Subject to pre-approval. |

| 🟨 Medicine | Covered up to 100% of the cost to a Single Exit Price for approved medicines. Subject to pre-authorization. |

| 🟩 Supplementary Services Physiotherapists Occupational Speech Therapists Dieticians | Covered up to 100% of the CMP Tariff. Subject to pre-authorization. |

| 🟦 Consultations, Procedures, and Operations by General Practitioners | Covered up to 100% of the CMP Tariff. Subject to pre-authorization. |

| 🟪 Consultations, Procedures, and Operations by Registered Medical Specialists | Covered up to 100% of the CMP Tariff. Subject to pre-authorization. |

| 🟥 Laparoscopic and Endoscopic Procedures In-Hospital | Covered up to 100% of the CMP Tariff. Subject to pre-authorization. Endoscopic surgeon-guided laparoscopic procedures with a co-payment per scope, per procedure. |

MyHealth 100 Saver Plan Out-of-Hospital Benefits

| 👩⚕️ General Practitioner Consultations and Procedures | Limited to 2 GP visits per beneficiary per year. Covered up to 100% of the CMP tariff. Once the benefit is depleted, consultations are payable from the MSA unless it is a PMB. Pre-authorization is required. |

| 👨⚕️ Registered Medical Specialist Consultations and Procedures | Payable from the MSA unless it is a PMB. Subject to pre-approval. A written referral is required. |

| 🩺 Laparoscopic and Endoscopic Procedures | Covered up to 100% of the CMP Tariff. Subject to pre-authorization. Endoscopic surgeon-guided laparoscopic procedures with a co-payment per scope, per procedure. A written referral is required. |

| 🧬 Supplementary Services Physiotherapists Occupational Speech Therapists Dieticians | Payable from the MSA unless it is a PMB. Subject to pre-approval. |

| 🪥 General Dental Practitioner Consultations | Covered up to 100% of the CMP Tariff. Limited to R650 per beneficiary; after that, consults are paid from the MSA unless it is a PMB. Subject to pre-approval. |

| 🦷 General Dental Practitioner Procedures In-Hospital Procedures | Covered up to 100% of the cost and 100% of the CMP tariff. Covers procedures and operations that require hospitalization unless it is a PMB. Subject to Dental Protocols. |

| ➡️ Orthodontic Treatment | Paid from the MSA. |

| 🙂 Maxillo-Facial Surgeons In-Hospital Procedures | Covered up to 100% of the CMP tariff unless it is a PMB. Subject to pre-authorization. |

| 😊 Maxillo-Facial Surgeons and Orthodontists Dental Implants General Dental Treatment Orthodontic Treatment Orthognathic Procedures Periodontic Treatment and Prosthodontic Treatment | Paid from the MSA. |

| 🤰 Maternity Confinement Birth or Delivery | Covered up to 100% of the CMP tariff. Only medically necessary caesareans will be covered unless it is a PMB. Subject to pre-approval. |

| 👶 Antenatal Consultations and Fetal Scans In and Out-of-Hospital Provided by a Registered Gynaecologist or Radiologist | Covered up to 100% of the CMP tariff. Limited to R2,818 per family annually. Once the limit is reached, claims are paid from the MSA unless it is a PMB. |

| 💙 Paediatrician Consultations | Covered up to 100% of the CMP tariff. Limited to R1,125 per child yearly. Once the benefit reaches the limit, consultations are covered by available funds in the MSA unless it is a PMB. |

| 🥰 Paediatrician Procedures and Operations | Covered up to 100% of the CMP tariff. Subject to pre-authorization. |

| 📈 Radiologist Procedures Angiograms CT scans Duplex Doppler Scans International Radiology MRI scans Nuclear Medical Investigations | Covered up to 100% of CMP tariff. Limited to R14,732 per beneficiary per year, with a co-payment of R1,500 per event on all procedures. Once the benefit reaches the limit, it is payable from MSA after that – except for PMBs. Pre-approval is required. Written referral required. |

| 🖤 Black and White X-Rays (in-hospital) | Covered up to 100% of the CMP tariff. Subject to pre-authorization. |

| 🤍 Black and White X-Rays (out-of-hospital) | Paid from the MSA unless it is a PMB. |

| ↪️ Mammogram Benefit | Covered up to 100% of CMP tariff Requires a co-payment of R300 per female beneficiary 49 years>. Available once every 2 years. Limited to R1,898. Once the benefit limit is reached, claims are paid from the MSA unless it is a PMB. Subject to pre-approval. A registered radiologist must perform it. |

| 🦴 Bone Density Benefit | Covered up to 100% of the CMP tariff per beneficiary once every 5 years for beneficiaries 50 years>. Once the limit is reached, claims are paid from the MSA unless it is a PMB. |

| 📊 Pathology Services In and Out-of-Hospital with Pathcare or Lancet Laboratories | In-and-out pathology is fully covered if you use SANAS-accredited Pathcare or Lancet Laboratories. In-hospital pathology services provided by a provider other than Pathcare or Lancet Laboratories will be covered only during the first 24 hours. If you do not use a Preferred Provider, any out-of-hospital pathology will be paid from available funds in the MSA. |

| 🦾 Prostheses and Implants, excluding: Hearing Devices Dental Implants | Covered up to 100% of the cost if introduced internally as a crucial component in surgery. Subject to CMP prosthetic price list. Limited to R54,000 per beneficiary yearly. Subject to pre-approval. |

| 🦿 External Prostheses and Surgical Appliances Wheelchairs Crutches, etc. | Covered up to 100% of the cost and paid from the MSA unless it is a PMB. Subject to pre-authorization. |

| ☑️ Chronic Renal Dialysis | Covered at 100% of the CMP if: PMB level of care criteria is met. Treatment is offered by a Preferred Provider. Subject to pre-approval. |

| 💖 Organ Transplants | Covered at 100% of the CMP if: PMB level of care criteria is met. Treatment is offered by a Preferred Provider. Subject to pre-approval. |

| 🧪 Oncology | Covered at 100% of the CMP according to SA Oncology Consortium Primary Level of Care treatment guidelines if: Formularies and Treatment Protocols of CMP and SA Oncology Consortium tier guidelines are applied according to an agreed treatment plan. Subject to pre-approval. |

| ⚕️ Oncology Treatment Anti-emetics Vitamins Cosmetic and Prosthetic Appliances | Paid from the MSA unless it is a PMB. |

| 💊 Chronic Medication | Covered up to 100% of the cost to a Single Exit Price and the Preferred Provider dispensing fee. Subject to the chronic program protocols. |

| 🤧 Acute Medication | Covered up to 100% of the cost to a Single Exit Price and the Preferred Provider dispensing fee. Limited to R800 per family. Once the limit is reached, claims are paid from the MSA unless it relates to a PMB. Subject to the chronic program protocols. |

| 🤕 Take-home Medication after discharge | Covered from the MSA unless it is a PMB. |

| 😎 Spectacles and Contact Lenses | Covered up to 100% of the cost. Paid from the MSA unless it is a PMB. |

| ↪️ Supplementary Services | Covered up to 100% of the cost. Paid from the MSA unless it is a PMB. |

| 🅰️ Mammograms for female beneficiaries | Limited to one per female beneficiary every 2 years. |

| 🦴 Bone Mineral Density Tests | Limited to one per beneficiary every 5 years. |

| 🅱️ Pap Smears for female beneficiaries | Female beneficiaries 21 to 65 years, once every 3 years. |

| ↪️ Prostate Test (PSA level) for male beneficiaries | Once yearly for males between 40 and 75 years. |

| ➡️ Antenatal Visits for pregnant beneficiaries | According to CMP guidelines. |

| 🎗️ Voluntary HIV testing and counseling | Once yearly per beneficiary. |

| 💉 Flu Vaccines | Once yearly per beneficiary. |

MyHealth 100 Saver Plan Chronic Conditions and Medication

Access to the chronic medicine benefit is contingent upon CMP’s formularies and protocols. Individuals diagnosed with a chronic condition will likely be required by their physician to adhere to a regimen of regular medication.

While all CMP members are provided coverage for chronic conditions, this coverage is not automatic. Rather, individuals must obtain pre-authorization by enrolling in our Chronic Disease Management program.

Upon registration, re-registration will only be necessary if medication changes occur or administrative purposes necessitate it. The Chronic Disease List (CDL) includes the following covered conditions.

- ☑️ Addison’s Disease

- ☑️ Anti-coagulating therapy

- ☑️ Asthma

- ☑️ Bipolar Mood Disorder

- ☑️ Bronchiectasis

- ☑️ Cardiac failure

- ☑️ Dementia

- ☑️ Cardiomyopathy

- ☑️ Chronic Obstructive Pulmonary Disease

- ☑️ Chronic Renal Disease

- ☑️ Coronary Artery Disease

and many more.

Read more about Medical Insurance for Young Children

MyHealth 100 Saver Plan Exclusions and Waiting Periods

MyHealth 100 Saver Exclusions

Similar to other medical schemes, there are certain procedures, products, and services that CMP will not cover. As per PMB rules, these exclusions are listed across all products and cannot be paid for from insured benefits. However, they can be paid for using the MSA if funds are available. The following exclusions are applicable:

- ✅ Procedures to correct eye refraction errors, including blepharoplasties and excimer laser/Lasik

- ✅ Treatment for sexual dysfunction in males and females

- ✅ Infertility treatment, except if authorized within PMB level of care criteria

- ✅ Breast reductions, including scar revision, Botox, breast augmentation, and gynecomastia

- ✅ MammaPrint genetic testing and any other type of genetic testing

- ✅ Non-diseased breast reconstruction, nipple reconstruction, and symmetry, unless authorized within PMB level of care criteria

- ✅ Cosmetic surgery

- ✅ Long-term nursing care, such as frail care nursing

- ✅ Non-PMB treatment for alcohol or substance abuse, willful self-injury, or attempted suicide

- ✅ Non-PMB psychological and psychiatric treatment, including sleep studies

and many more.

You might consider: Health Insurance for Pregnancy

MyHealth 100 Saver Waiting Periods

New members can be subjected to two types of waiting periods: a general three-month waiting period for all new members and a condition-specific waiting period of up to 12 months.

Cape Medical MyHealth 100 Saver Plan vs. Similar Plans from other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 Cape Medical Plan MyHealth 100 Saver | 🥈 Medihelp MedSaver | 🥉 Momentum Incentive Plan |

| 👤 Main Member Contribution | R3,113 | R3,516 | R2,794 |

| 👥 Adult Dependent Contribution | R3,113 | R2,892 | R2,206 |

| 🍼 Child Dependent Contribution | R467 | R1,080 | R1,072 |

| 📉 Annual Limit | Unlimited Hospital Cover | Unlimited Hospital Cover | None |

| ➡️ Hospital Cover | Unlimited | Unlimited | Unlimited |

| ↪️ Oncology Cover | 100% CMP tariff | R262,000 | R200,000 per year, 20% co-payment thereafter |

POLL: 5 Best Medical Aids under R200

Our Verdict on The MyHealth 100 Saver Plan

MyHealth 100 Saver plan is a comprehensive medical scheme offered by CMP that provides members access to quality healthcare services. The plan covers a broad range of medical expenses, including in-hospital treatments, chronic medication, and day-to-day medical costs.

The plan includes a Medical Savings Account (MSA) for members to pay for day-to-day medical expenses. This feature allows members to manage their healthcare costs more effectively by providing a predictable source of funds for non-hospital-related expenses.

You might also consider reading the following options Cape Medical has to offer:

- Cape Medical Plan Review

- Cape Medical Plan MyHealth 200 (HealthPact Premium)

- Cape Medical Plan MyHealth 200 Plus (HealthPact Select)

- Cape Medical Plan Late Joiner Fee

MyHealth 100 Saver Plan Frequently Asked Questions

What is MyHealth 100 Saver Plan?

MyHealth 100 Saver plan, previously known as HealthPact Silver is a medical scheme offered by Cape Medical Plan (CMP) that provides affordable healthcare coverage to members.

What does MyHealth 100 Saver cover?

MyHealth 100 Saver plan provides comprehensive medical cover that includes in-hospital treatments, chronic medication, day-to-day medical costs, and dental coverage.

How does MyHealth 100 Saver differ from other medical scheme plans?

MyHealth 100 Saver is an affordable medical scheme product that provides members with a medical savings account (MSA) to manage their day-to-day medical expenses.

What is a medical savings account (MSA)?

An MSA is a savings account that members can use to pay for day-to-day medical expenses such as doctor consultations, prescriptions, and laboratory tests.

Does MyHealth 100 Saver plan cover chronic medication?

Yes, MyHealth 100 Saver covers chronic medication up to a certain limit per person per month.

Can members choose their own healthcare providers?

Yes, members can receive treatment from healthcare providers outside of the network but will have to pay additional costs.

What are the exclusions and limitations of MyHealth 100 Saver plan?

MyHealth 100 Saver Plan lists exclusions and limitations, including procedures, products, and services that are not covered. Members may also be required to pay co-payments or use their MSA for certain medical treatments.

What is pre-authorization?

Pre-authorization is a process whereby members must obtain approval from the medical scheme before undergoing certain medical treatments or procedures.

Is chronic disease management covered under MyHealth 100 Saver Plan?

Yes, chronic disease management is covered under MyHealth 100 Saver through CMP’s Chronic Disease Management Program.

Does MyHealth 100 Saver cover prescribed minimum benefits (PMB)?

Yes, MyHealth 100 Saver covers PMB as required by law.

How do members enroll in MyHealth 100 Saver?

Members can enroll in MyHealth 100 Saver by completing an application form and meeting the eligibility criteria.

Are co-payments required for all medical treatments?

No, co-payments are only required for certain medical treatments as specified in the plan.

How often can members claim from their medical savings account (MSA)?

Members can claim from their MSA as often as needed, up to the limit of their available funds.

Can members claim for non-medical expenses from their MSA?

No, members can only claim eligible medical expenses from their MSA.

Is dental cover included in MyHealth 100 Saver?

Yes, the dental cover is included in MyHealth 100 Saver.

Are there waiting periods for certain medical treatments?

Yes, there may be waiting periods for certain medical treatments as specified in the plan.

Can members change their medical scheme products?

Yes, members can change their medical scheme product subject to certain conditions.

Does MyHealth 100 Saver cover emergency medical treatments?

Yes, emergency medical treatments are covered under MyHealth 100 Saver.

Can members access healthcare services outside of South Africa?

Yes, members can access healthcare services outside of South Africa but must pay additional costs.

What happens if a member’s medical savings account (MSA) runs out of funds?

If a member’s MSA runs out of funds, they must pay for day-to-day medical expenses out of their own pocket.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans