- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Stratum Benefits Essential Primary Plus Emergency/Accident Plan

Overall, the Stratum Benefits Essential Primary Plus Emergency/Accident Plan is a trustworthy and comprehensive medical health plan that offers 24/7 medical emergency assistance and accidental death benefits to up to 3 Family Members. The Stratum Benefits Essential Primary Plus Emergency/Accident Plan starts from R192 ZAR. Stratum Benefits has a trust score of 4.1.

| 🔎 Medical Health Plan | 🥇 Stratum Benefits Essential Primary Plus Emergency & Accident |

| 🌎 International Cover | None |

| 👤 Main Member Contribution | R192 – R246 |

| 👥 Adult Dependent Contribution | R107 – R161 |

| 😊 Child Dependent Contribution | R44 |

| 🔁 Gap Cover | ✅ Yes |

| 😷 Screening and Prevention | None |

| 💶 Medical Savings Account | None |

| 🍼 Maternity Benefits | None |

| ❤️ Pre and Postnatal Care | None |

Stratum Benefits Essential Primary Plus Emergency/Accident Plan – 7 Key Point Quick Overview

- ✅ Stratum Benefits Essential Primary Plus Emergency/Accident Plan Overview

- ✅ Stratum Benefits Essential Primary Plus Emergency/Accident Plan Premiums

- ✅ Stratum Benefits Essential Primary Plus Emergency/Accident Plan Benefits and Cover Comprehensive Breakdown

- ✅ Stratum Benefits Essential Primary Plus Emergency/Accident Plan Exclusions and Waiting Periods

- ✅ Stratum Benefits Essential Primary Plus Emergency/Accident Plan vs Other Providers

- ✅ Our Verdict on the Stratum Benefits Essential Primary Plus Emergency/Accident Plan

- ✅ Stratum Benefits Essential Primary Plus Emergency/Accident Plan Frequently Asked Questions

Stratum Benefits Essential Primary Plus Emergency/Accident Plan Overview

The Stratum Benefits Essential Primary Plus Emergency/Accident Plan is one of 4, starting from R192. It includes emergency coverage, benefits for MRIs and scans, medical emergency services, accidental death benefits, and more.

Gap Cover is available on the Stratum Benefits Essential Primary Plus Emergency/Accident Plan, along with 24/7 medical emergency assistance. According to the Trust Index, Stratum Benefits has a trust rating of 9.

Stratum Benefits Health Insurance has the following four plans to choose from:

✅ Stratum Benefits Corporate Essential Day-to-Day Plan

✅ Stratum Benefits Corporate Essential Emergency/Accident Plan

✅ Stratum Benefits Essential Primary Plus Day-to-Day Plan

✅ Stratum Benefits Essential Primary Plus Emergency/Accident Plan

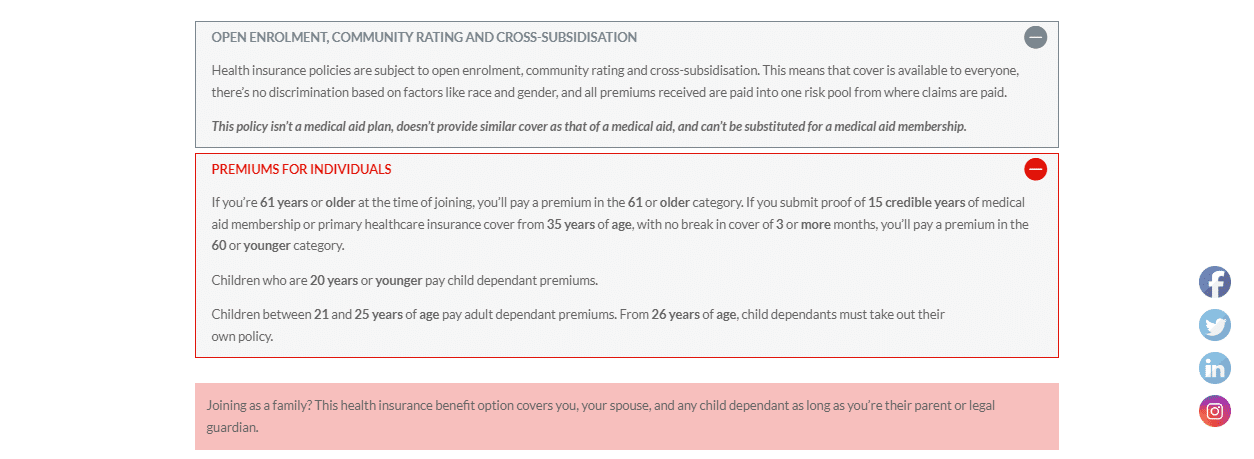

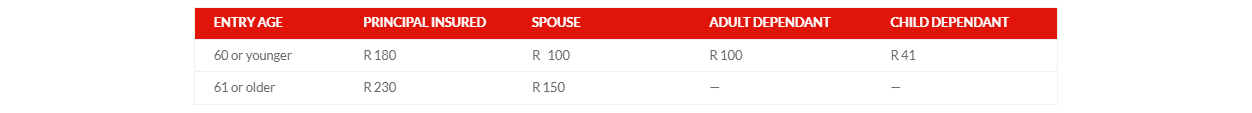

Stratum Benefits Essential Primary Plus Emergency/Accident Plan Premiums

| 🟥 Eligible Age | 🟧 Principle Member | 🟨 Spouse | 🟩 Adult Dependent | 🟦 Child Dependent |

| <60 Years | R192 | R107 | R107 | R44 |

| 61 Years> | R246 | R161 | n/a | n/a |

Consider GAP Cover? Read more about Gap Cover Options

Stratum Benefits Essential Primary Plus Emergency/Accident Plan Benefits and Cover Comprehensive Breakdown

Emergency and Accident Benefits

Emergency Cover

- In case of a medical emergency, transportation to the nearest private hospital and admission for stabilization will be covered.

- The cover is limited to R30,000 per person per event.

- Pre-authorization is required for smooth admission into the hospital.

Accident Cover

- Cover for immediate medical treatment for physical injuries sustained due to an accident.

- The cost of transportation and admission to the nearest private hospital will be covered.

- The cover is limited to R 1,500,000 per person per event.

- Pre-authorization is required for smooth admission into the hospital.

| 🔴 Casualty Accident Cover | Cover for less severe accidents requiring immediate medical treatment is provided for treatment at the nearest private hospital’s emergency unit. The cover is limited to R7,600 per person per event. Pre-authorization is required. |

| 🟠 MRI and Scans | If admitted to the hospital for physical injuries sustained due to an accident, the cost of an MRI or CT scan will be covered. The cover is limited to R20,000 per person per year. Pre-authorization is required. |

| 🟡 Physiotherapy and Occupational Therapy | Physiotherapist and occupational therapist’s fees will be covered if hospitalized due to an accident and need physical therapy after discharge. Cover is limited to R3,800 per person per year. Pre-authorization is required. Covers therapy is required after discharge within 3 months. |

| 🟢 24-Hour Medical Emergency Services | ER24’s all-day, every-day national emergency contact center helps with the following: Ambulance transfers between hospitals. Emergency transport services by air or road. Repatriation of loved ones’ mortal remains within the borders of South Africa. Telephonic medical advice. |

| 🔵 Pay-Out Benefit | Limited to R25,000 per person for the principal insured and spouse if passes away due to an accident. Benefit amounts payable to nominated beneficiaries or respective estates. Each child dependent is covered for R5,000 if death is due to a motor vehicle accident. The benefit amount payable to the principal insured or the principal insured’s estate if there’s no surviving principal insured. |

Testing and Screening

Essential Assistance Program (EAP): Reality Wellness Group provides unlimited 24/7 telephonic advice and counseling services for financial advice, legal advice, HIV/AIDS counseling, and trauma counseling.

READ more about Health Insurance for Kids

Stratum Benefits Essential Primary Plus Emergency/Accident Plan Exclusions and Waiting Periods

Stratum Benefits Essential Primary Plus Emergency/Accident Plan Exclusions

The insurance policy does not cover the following events:

- ✅ Uninsured events.

- ✅ Events during a waiting period, except for medical emergencies or accidents.

- ✅ Policy benefits limit events.

- ✅ Inappropriate policy benefits.

- ✅ Missed pre-authorization or healthcare provider referral.

- ✅ Events where non-network healthcare or service providers are used unless the policy covers it.

- ✅ Non-emergency hospital or casualty admissions.

- ✅ In-patient stabilization procedures unless they are emergency stabilization costs.

- ✅ MRI/CT scans unless accidental.

- ✅ Non-emergency medical transport.

- ✅ Non-accidental physical therapy or occupational therapy after 3 months of hospital discharge.

- ✅ Costs of voluntary private hospitalization after medical stabilization.

- ✅ Unnecessary, inappropriate, or inconsistent treatment costs.

- ✅ Non-authorized cosmetic or maxillo-facial reconstructive surgery after an accident.

- ✅ Obesity, cosmetic surgery, or surgery directly or indirectly related to cosmetic surgery unless the policy covers it.

- ✅ Artificial limbs and wheelchairs.

and many more. A full list of Exclusions will be provided by Stratum Benefits.

POLL: 5 Best Medical Aid Schemes for Employees

Stratum Benefits Essential Primary Plus Emergency/Accident Plan Waiting Periods

The following waiting periods apply to the Essential Primary Plus Emergency & Accident Plan:

- ✅ 2-month general waiting period where there is no cover for Day-to-Day Wellness Assessment and Preventative Care Benefits.

- ✅ 9-month waiting period for pre-birth consultation.

- ✅ 12-month waiting period for chronic medication.

Finally, a 12-month waiting period will apply for eye care.

Stratum Benefits Essential Primary Plus Emergency/Accident Plan vs Other Providers

| 🔎 Medical Health Plan | 🥇 Stratum Benefits Essential Primary Plus Emergency & Accident | 🥈 Medihelp MedVital | 🥉 EssentialMED Hospital |

| 🌎 International Cover | None | Scheme Tariff | None |

| 👤 Main Member Contribution | R192 – R246 | R2,598 | R699 |

| 👥 Adult Dependent Contribution | R107 – R161 | R1,998 | R699 |

| 😊 Child Dependent Contribution | R44 | R894 | R272.50 |

| 🔁 Gap Cover | ✅ Yes | None | None |

| 😷 Screening and Prevention | None | ✅ Yes | ✅ Yes |

| 💶 Medical Savings Account | None | None | None |

| 🍼 Maternity Benefits | None | ✅ Yes | ✅ Yes |

| ❤️ Pre and Postnatal Care | None | ✅ Yes | None |

You might like to read our study about the Changing Climate Health Environment

Our Verdict on the Stratum Benefits Essential Primary Plus Emergency/Accident Plan

According to our research and evaluation, the Essential Emergency and Accident Plan covers medical emergencies and accidents, offering immediate medical treatment, transportation, and hospitalization benefits. The plan covers less severe accidents requiring emergency treatment. In addition, it provides cover for MRI or CT scans, physiotherapy or occupational therapy, and ambulance transfers between hospitals.

Furthermore, we found that the plan also offers cover for accidental death, repatriation of mortal remains, and telephonic medical advice through ER24’s emergency contact center.

One significant advantage of this plan is its comprehensive cover for accidents and medical emergencies, which can be a lifeline in critical situations. The plan’s benefits are extensive, covering various medical procedures and treatments that could be financially draining without insurance.

Furthermore, we discovered that including emergency transportation and telephonic medical advice services is especially useful, as they can provide quick and convenient access to medical care.

You might also like: Stratum Benefits Health Insurance

You might also like: Stratum Benefits Corporate Essential Day-to-Day Plan

You might also like: Stratum Benefits Corporate Essential Emergency/Accident Plan

You might also like: Stratum Benefits Essential Primary Plus Day-to-Day Plan

Stratum Benefits Essential Primary Plus Emergency/Accident Plan Frequently Asked Questions

What is the Stratum Benefits Essential Primary Plus Emergency/Accident Plan?

The Essential Primary Plus Emergency & Accident Plan is an insurance policy that provides cover for medical emergencies and accidents.

What does the Stratum Benefits Essential Primary Plus plan cover?

The plan covers immediate medical treatment, transportation, hospitalization, MRI or CT scans, physiotherapy or occupational therapy, ambulance transfers, and telephonic medical advice through ER24’s emergency contact center.

Is pre-authorization required for medical events?

Yes, pre-authorization on the Stratum Benefits Essential Primary Plus is required for medical events to ensure smooth admission into the hospital.

Does the Stratum Benefits Essential Primary Plus plan cover events that occurred before obtaining cover?

No, the plan does not cover events that occurred before obtaining cover.

Are there benefit limits for the Stratum Benefits Essential Primary Plus plan?

Yes, there are benefit limits for the plan, which vary depending on the event and cover.

What is the cover limit for Stratum Benefits Essential Primary Plus hospitalization?

The cover limit for hospitalization is up to R30,000 per person per event.

Does the Stratum Benefits Essential Primary Plus plan cover rehabilitation therapy?

The plan covers the physiotherapist and occupational therapist’s fees if hospitalized due to an accident and needs physical therapy after discharge. The cover limit is up to R3,800 per person per year.

Does the Stratum Benefits Essential Primary Plus plan cover repatriation of mortal remains?

Yes, the plan covers the repatriation of a loved one’s mortal remains within the borders of South Africa, limited to R7,600 per policy per year.

Are there any exclusions for the Stratum Benefits Essential Primary Plus plan?

Yes, there are exclusions for the plan, such as events where the policy’s benefit limits have been reached, events not deemed medically necessary or clinically appropriate, and participation in active military, aviation, or competitive or professional sports or activities.

Table of Contents

Free Health Insurance Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans