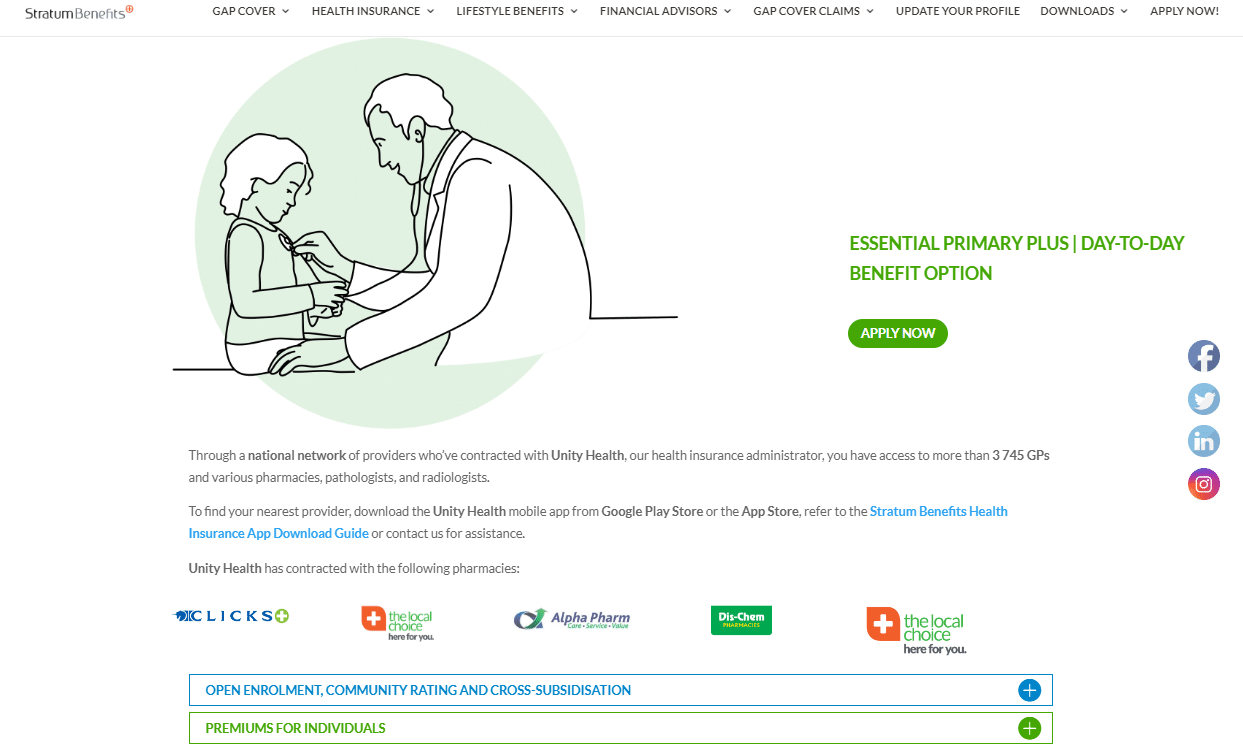

Principle Member

From R192

Dependant Member

From R107

Child Dependant

From R44

Essential Primary Plus Emergency/Accident

The Essential Primary Plus Emergency/Accident Plan encompasses emergency coverage, benefits for MRIs and scans, medical emergency services, accidental death benefits, and additional features.

★★★★★ 4.5/5

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Essential Primary Plus Emergency/Accident Plan encompasses emergency coverage, benefits for MRIs and scans, medical emergency services, accidental death benefits, and additional features.

Tax Deductible:

Travel Cover:

Essential Primary Plus Emergency/Accident

The Essential Primary Plus Emergency/Accident Plan encompasses emergency coverage, benefits for MRIs and scans, medical emergency services, accidental death benefits, and additional features.

★★★★★ 4/5

Principle Member

From R192

Dependant Member

From R107

Child Dependant

From R44

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Essential Primary Plus Emergency/Accident Plan encompasses emergency coverage, benefits for MRIs and scans, medical emergency services, accidental death benefits, and additional features.

Tax Deductible:

Travel Cover: