- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Oneplan Health Blue Plan

Overall, the Oneplan Health Blue Plan is a trustworthy and comprehensive health insurance plan that offers 24/7 medical emergency assistance and Prescribed Minimum Benefits to up to 3 Family Members. The Oneplan Health Blue Plan starts from R955 ZAR.

| 🔎 Health Insurance Plan | 🥇 Oneplan Health Blue |

| 👤 Main Member Contribution | R955 |

| 👥 Adult Dependent Contribution | R1,835 for a couple |

| 🥰 Child Dependent Contribution | R1,505 (Single adult + 1 Child) – R2,380 (Couple + 1 child) |

| 🔁 Gap Cover | None |

| 📈 Annual Limit | R8,650 – R460,000 |

| 💶 Prescribed Minimum Benefits | ✅ Yes |

| 😷 Screening and Prevention | None |

| 💵 Medical Savings Account | None |

| 🍼 Maternity Benefits | ✅ Yes |

Oneplan Health Blue Plan – 7 Key Point Quick Overview

- ✅ Oneplan Health Blue Plan Overview

- ✅ Oneplan Health Blue Plan Premiums

- ✅ Oneplan Health Blue Plan Benefits and Cover Comprehensive Breakdown

- ✅ Oneplan Health Blue Plan Exclusions and Waiting Periods

- ✅ Oneplan Health Blue Plan vs Other Providers or Medical Aid Schemes

- ✅ Our Verdict on the Oneplan Health Blue Plan

- ✅ Oneplan Health Blue Plan Frequently Asked Questions

Oneplan Health Blue Plan Overview

The Oneplan Health Blue Plan is one of 4, starting from R955 and includes cover for dentistry, dread diseases, natural births and emergency caesareans, trauma counseling, and more. Gap Cover is not available on the Oneplan Health Blue Plan, along with 24/7 medical emergency assistance. According to the Trust Index, Oneplan Health has a trust rating of 9.9.

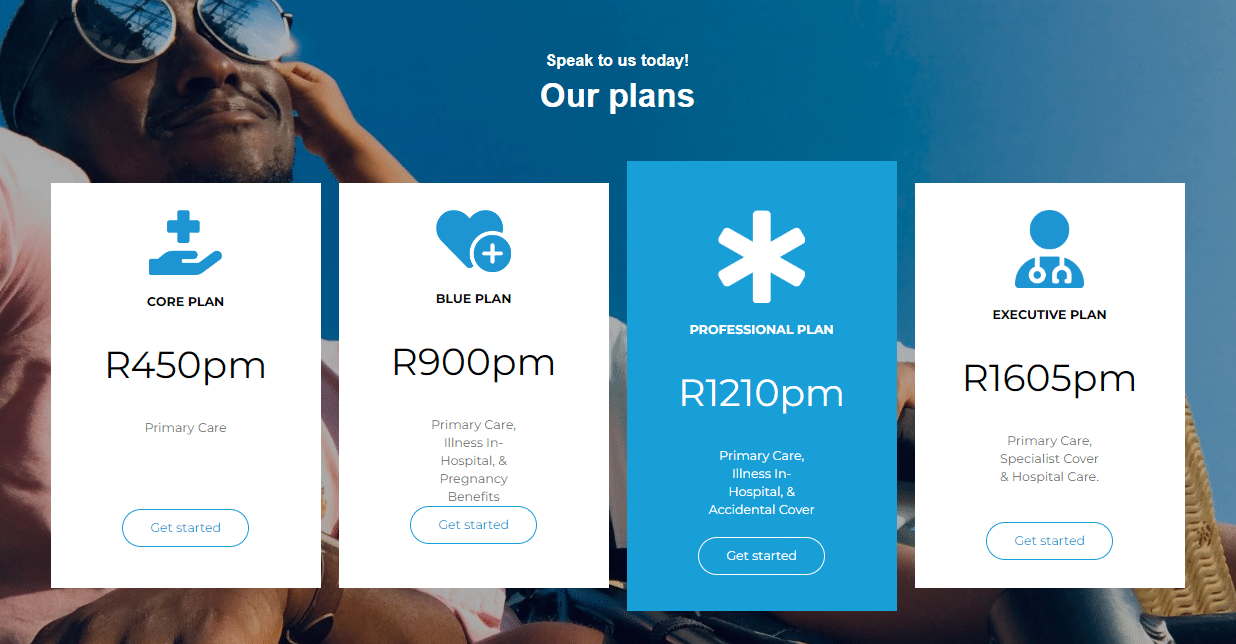

Oneplan Health Insurance has the following four plans to choose from:

✅ Oneplan Health Blue Plan

✅ Oneplan Health Core Plan

✅ Oneplan Health Executive Plan

✅ Oneplan Health Professional Plan

Oneplan Health Blue Plan Premiums

| 🟥 Family Dynamic | 💵 Monthly Premium |

| 🟧 Single Member | R955 |

| 🟨 Single Insured +1 Child | R1,505 |

| 🟩 Single Insured +2 Children | R2,055 |

| 🟦 Single Insured +3 Children | R2,590 |

| 🟪 Single Insured +4 Children | R3,110 |

| 🟥 Couple | R1,835 |

| 🟧 Couple Insured +1 Child | R2,380 |

| 🟨 Couple Insured +2 Children | R2,810 |

| 🟩 Couple Insured +3 Children | R3,215 |

| 🟦 Couple Insured +4 Children | R3,595 |

POLL: 3 Best Hospital Plans Under R1000

Oneplan Health Blue Plan Benefits and Cover Comprehensive Breakdown

Blue Plan Health Cover

| 👨⚕️ Doctor’s Visits | Limited to R420 per visit. Limited to R2,135 annually per single policyholder. Limited to R3,835 annually per family (2 – 3 dependents). Limited to R5,110 annually per family (4> dependents). Subject to a 30-day waiting period. |

| 💉 Scripted Medication | Limited to R190 per script. Limited to R755 annually per single policyholder. Limited to R1,100 annually per family (2 – 3 dependents). Limited to R1,465 annually per family (4> dependents). Subject to a 30-day waiting period. |

| 💊 Over-the-Counter Medication | Limited to R190 per year. Limited to R190 annually per single policyholder. Limited to R570 annually per family (2 – 3 dependents). Limited to R755 annually per family (4> dependents). Subject to a 30-day waiting period. |

| 🧪 Pathology | Limited to R505 per event Limited to R1,675 annually per single policyholder. Limited to R3,360 annually per family (2 – 3 dependents). Limited to R4,620 annually per family (4> dependents). Subject to a 30-day waiting period. Requires a doctor’s referral. |

| 🧬 Basic Radiology | Limited to R505 per event Limited to R1,675 annually per single policyholder. Limited to R3,360 annually per family (2 – 3 dependents). Limited to R4,620 annually per family (4> dependents). Subject to a 30-day waiting period. Requires a doctor’s referral. |

| 🦷 Basic Dentistry | Limited to R685 per visit, up to 3 visits per year. Limited to R1,695 annually per single policyholder. Limited to R3,160 annually per family (2 – 3 dependents). Limited to R4,235 annually per family (4> dependents). Subject to a 90-day waiting period. |

| 🍼 Maternity Pre-birth Benefit | Limited to R660 per visit, up to 3 visits per pregnancy. Overall annual limit of R1,985 All new policies have a 7-month waiting period followed by a 4-month waiting period from conception. |

| 😎 Optometry | Limited to R1,215 with benefits available after two years from the service date. Subject to a 12-month waiting period. |

Blue Plan Hospital Risk Cover

| ⚠️ Casualty Illness | Limited to R5,600 for all life-threatening illnesses in an emergency or casualty room. There is a 3-month waiting period that applies. There is an excess payable. |

| 🤕 Casualty Accident | Limited to R5,600 for accidents and covers treatment in casualty units that will not result in admission. Immediately available. There is an excess payable. |

| 🩹 Accident Cover | Limited to R230,000 per insured event. Limited to R460,000 per family per year. The cover is immediate. However, contact sport has a 12-month waiting period. There is an excess payable. |

| 🏥 Illness in Hospital | Limited to R60,000 per insured event per person. Limited to R150,000 per insured annually. A 90-day waiting period applies. Certain conditions will be subject to a 12-month waiting period. |

| 🤧 Dread Disease | Limited to R315,000 per defined disease annually. A 6-month waiting period will apply. |

| 👶 Natural Birth and Emergency Caesareans | Limited to R55,000 per insured event per person. The cover is subject to illness and operations’ annual limits. A 12-month waiting period will apply. |

| 🤰 Neonatal Benefits | Limited to R55,000 per insured event per person. The cover is subject to the illness and operations’ overall limit. There is a 12-month waiting period that applies. The benefit includes coverage within the first 4 weeks from birth. |

| 📌 Repatriation | Limited to R15,000 per insured person and includes repatriation of mortal remains to the funeral home. The cover is available immediately. |

| 🚑 Ambulance and Emergency Services | The cover is available immediately and includes 24-hour Medical Assistance. The insured will be transported by ambulance to the closest appropriate medical facility if a life-threatening medical emergency occurs. |

Blue Plan Additional Benefits

| ❤️ Accidental Disability | Limited to R220,000 for the duration of the policy. Limited to the principal insured policyholder. |

| 🖤 Family Death Cover | Limited to R15,000 for the principal insured member. Limited to R15,000 for the Spouse/Partner. Limited to R15,000 for every child between 14 and 21 years. Limited to R10,000 per child between 6 to 13 years. Limited to R7,500 per child between 1 to 5 years. |

| 🤍 Trauma, Assault, and Accidental HIV | Includes trauma and assault counseling, accidental HIV protection services, and Accidental HIV infection treatment. |

Discover more about the 5 Best Medical Aid for Unemployed in South Africa

Oneplan Health Blue Plan Exclusions and Waiting Periods

Oneplan Health Blue Plan Exclusions

Oneplan Health Blue Plan exclusions include, but are not limited to, the following:

- ✅ Nuclear weapons, nuclear material, ionizing radiation, or contamination by radioactivity from nuclear fuel or waste from nuclear fuel combustion.

- ✅ War, invasion, an act of a foreign enemy, hostilities, warlike operations, civil war, mutiny, military rising, martial law, state of siege, insurrection, rebellion, or revolution.

- ✅ Cost of operations, treatments, and procedures that are not medically justifiable, i.e. all other lines of conservative treatment, must first be considered.

- ✅ Cosmetic procedures such as breast augmentation, gastroplasty, gender reversal operations, etc.

- ✅ Costs incurred for tests and examinations requested for immigration, emigration, visas, insurance policies, employment, admission to schools and universities, court medical reports, muscle-function tests, fitness examinations, and tests for adopting children and retirement because of ill health.

- ✅ Costs incurred for the treatment of obesity and health holidays.

- ✅ Purchase of certain items such as bandages, cotton wool, and plasters on prescription not used in practitioners’ rooms, food substitutes, food supplements and patent food, incontinence supplies, diabetic strips, and other diabetic consumables, stoma care products, home pregnancy test kits, slimming products and appetite suppressants, prescribed toothpaste, mouthwashes, and ointments for oral hygiene, toiletries and beauty preparations, contraceptives, and medical appliances.

- ✅ Participation in civil commotion, labor disturbances, riots, strikes, or the activities of locked-out workers.

Participation in any race or speed test other than on foot or non-mechanically propelled watercraft, and more.

Oneplan Health Blue Plan Waiting Periods

Oneplan Health has the following waiting periods:

| 🔴 Doctor’s Visits | 30-day waiting period |

| 🟠 Scripted Medication | 30-day waiting period |

| 🟡 Over-the-Counter Medication | 30-day waiting period |

| 🟢 Pathology | 30-day waiting period |

| 🔵 Radiology | 30-day waiting period |

| 🟣 Dentistry | 30-day waiting period |

| 🔴 Specialist Cover (not available on Blue) | 30-day waiting period |

| 🟠 Maternity Pre-Birth | 11 months (7 months for new policies, 4 months from date of conception) |

| 🟡 Optometry | 12-month waiting period |

| 🟢 Casualty Illness | 90-day waiting period |

| 🔵 Casualty Accident | No waiting period |

| 🟣 Accident Cover | No waiting period |

| 🔴 Illness in Hospital | 90-day waiting period |

| 🟠 Dread Disease | 6-month waiting period |

| 🟡 Natural Birth and Emergency Caesareans | 12-month waiting period |

| 🟢 Neonatal | 12-month waiting period |

| 🔵 Repatriation | No waiting period |

| 🟣 Ambulance and Emergency Services | No waiting period |

| 🔴 Accidental Disability | No waiting period |

| 🟠 Family Death Cover | No waiting period |

| 🟡 Trauma, Assault, and Accidental HIV | No waiting period |

| 🟢 Excess Buster | No waiting period |

READ more about Hospital Plans

Oneplan Health Blue Plan vs Other Providers or Medical Aid Schemes

| 🔎 Health Insurance Plan | 🥇 Oneplan Health Blue | 🥈 Clientèle Health Ultimate H.E.L.P | 🥉 Momentum Ingwe Plan |

| 👤 Main Member Contribution | R955 | R546 | R541 |

| 👥 Adult Dependent Contribution | R1,835 for a couple | R546 | R541 |

| 🥰 Child Dependent Contribution | R1,505 (Single adult + 1 Child) – R2,380 (Couple + 1 child) | R546 | R541 |

| 🔁 Gap Cover | None | None | ✅ Yes |

| 📈 Annual Limit | R8,650 – R460,000 | R250,000 | None |

| 💶 Prescribed Minimum Benefits | ✅ Yes | ✅ Yes | ✅ Yes |

| 😷 Screening and Prevention | None | ✅ Yes | ✅ Yes |

| 💵 Medical Savings Account | None | None | None |

| 🍼 Maternity Benefits | ✅ Yes | ✅ Yes | ✅ Yes |

Our Verdict on the Oneplan Health Blue Plan

Oneplan Health Blue Plan is a comprehensive medical insurance policy offering a range of benefits to cover medical expenses that policyholders incur. The policy offers a combination of hospital cover, outpatient cover, and day-to-day benefits, including unlimited GP consultations and basic dentistry.

The policy covers medical expenses such as hospitalization, emergency medical treatment, specialist consultations, and prescribed medication. Furthermore, the policy also covers dread diseases such as cancer and heart disease. It provides a cash lump sum payout upon diagnosis of these conditions.

However, the policy has certain limitations and exclusions that may affect the scope of coverage. For example, pre-existing conditions have a waiting period, and certain conditions are not covered under the policy, such as cosmetic surgery and infertility treatment.

The policy also limits some benefits, such as casualty cover, which is limited to R5,600 per event. Furthermore, the policy document specifies that the policy will not cover expenses incurred outside of South Africa, and there are limitations on the coverage of chronic medication. The policy also has certain age restrictions for benefits such as maternity and wellness programs.

- You might also like: Oneplan Health Core Plan

- You might also like: Oneplan Health Executive Plan

- You might also like: Oneplan Health Professional Plan

- You might also like: Oneplan Health Insurance Review

Oneplan Health Blue Plan Frequently Asked Questions

What is the Oneplan Health Blue plan?

The Oneplan Health Blue plan is a more comprehensive health insurance plan that covers a range of healthcare services, including GP visits, hospital cover, and prescribed medication benefits. Furthermore, Oneplan Health Blue is designed as an affordable option for people who want access to quality healthcare without breaking the bank.

What does the Oneplan Health Blue plan cover?

The Oneplan Health Blue plan covers a range of healthcare services, including dentistry, pathology, radiology, casualty illness, dread diseases, accidents, and more.

How much does the Oneplan Health Blue plan cost?

The cost of the Oneplan Health Blue plan depends on several factors. However, it starts from R955 per single policyholder/insured person. The cost of this plan is determined by your family dynamic and how many dependents you add.

Can I choose my doctor with the Oneplan Health Blue plan?

Yes, with the Oneplan Health Blue plan, you can choose your own GP. There are no restrictions on which doctors you can see. However, you might require a doctor’s referral for benefits such as radiology and pathology.

Is dental and optical cover included in the Oneplan Health Blue plan?

Yes, the Oneplan Health Blue plan includes dental and optical benefits. This includes cover for routine check-ups, fillings, extractions, and other dental procedures, as well as eye tests, frames, and lenses.

Does the Oneplan Health Blue plan cover pre-existing conditions?

The Oneplan Health Blue plan does not cover pre-existing conditions for the first 12 months of membership. After this waiting period, cover for pre-existing conditions is provided, subject to certain terms and conditions.

Table of Contents

Free Health Insurance Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans