- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Bloom Health4Me Bronze Plan

Overall, the Bloom Health4Me Bronze Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and GP consultations to up to 3 Family Members. The Bloom Health4Me Bronze Plan starts from R517 ZAR. Health4Me has a trust rating of 10.

| 🔎 Medical Health Plan | 🥇 Bloom Health4Me Bronze |

| 🌎 International Cover | None |

| 👤 Main Member Contribution | R517 – R847 |

| 👥 Adult Dependent Contribution | R517 – R847 |

| 👶 Child Dependent Contribution | R306 – R470 |

| 🔁 Gap Cover | None |

| 💵 Medical Savings Account | None |

| 🍼 Maternity Benefits | ✅ Yes |

| 💙 Pre and Postnatal Care | None |

| ☑️ Chronic Conditions | None |

Bloom Health4Me Bronze Plan – 7 Key Point Quick Overview

- ✅ Bloom Health4Me Bronze Plan Overview

- ✅ Bloom Health4Me Bronze Plan Premiums

- ✅ Bloom Health4Me Bronze Plan Benefits and Cover Comprehensive Breakdown

- ✅ Bloom Health4Me Bronze Plan Exclusions and Waiting Periods

- ✅ Bloom Health4Me Bronze Plan vs Other Providers or Medical Aid Schemes

- ✅ Our Verdict on the Bloom Health4Me Bronze Plan

- ✅ Bloom Health4Me Bronze Plan Frequently Asked Questions

Bloom Health4Me Bronze Plan Overview

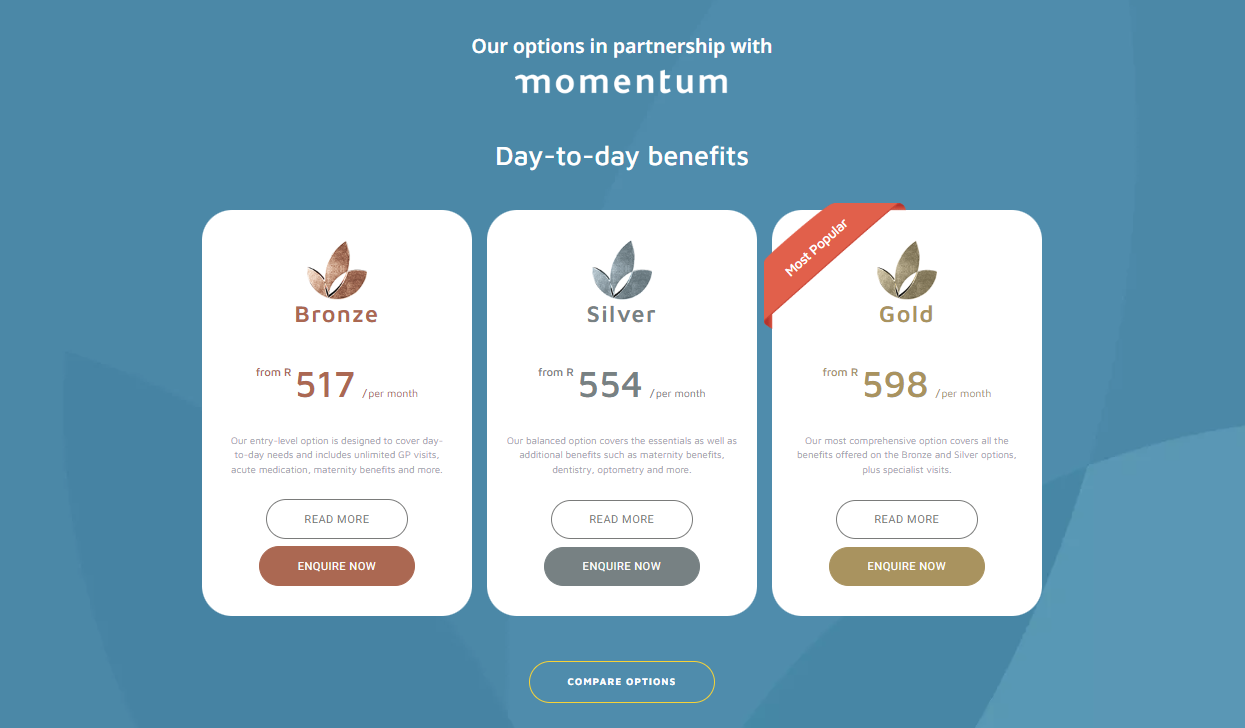

The Bloom Health4Me Bronze Plan is one of 3, starting from R517, and includes basic cover for day-to-day medical expenses such as GP consultations and in-room procedures, acute medication, maternity benefits, basic pathology, radiology, and more. The Health4Me Bronze option from Bloom Insurance is a solid choice for those seeking basic medical coverage at an affordable price.

Gap Cover is unavailable on the Bloom Health4Me Silver Plan. However, Bloom offers 24/7 medical emergency assistance. According to the Trust Index, Bloom Health4Me has a trust rating of 10.

Bloom Health Insurance has the following options:

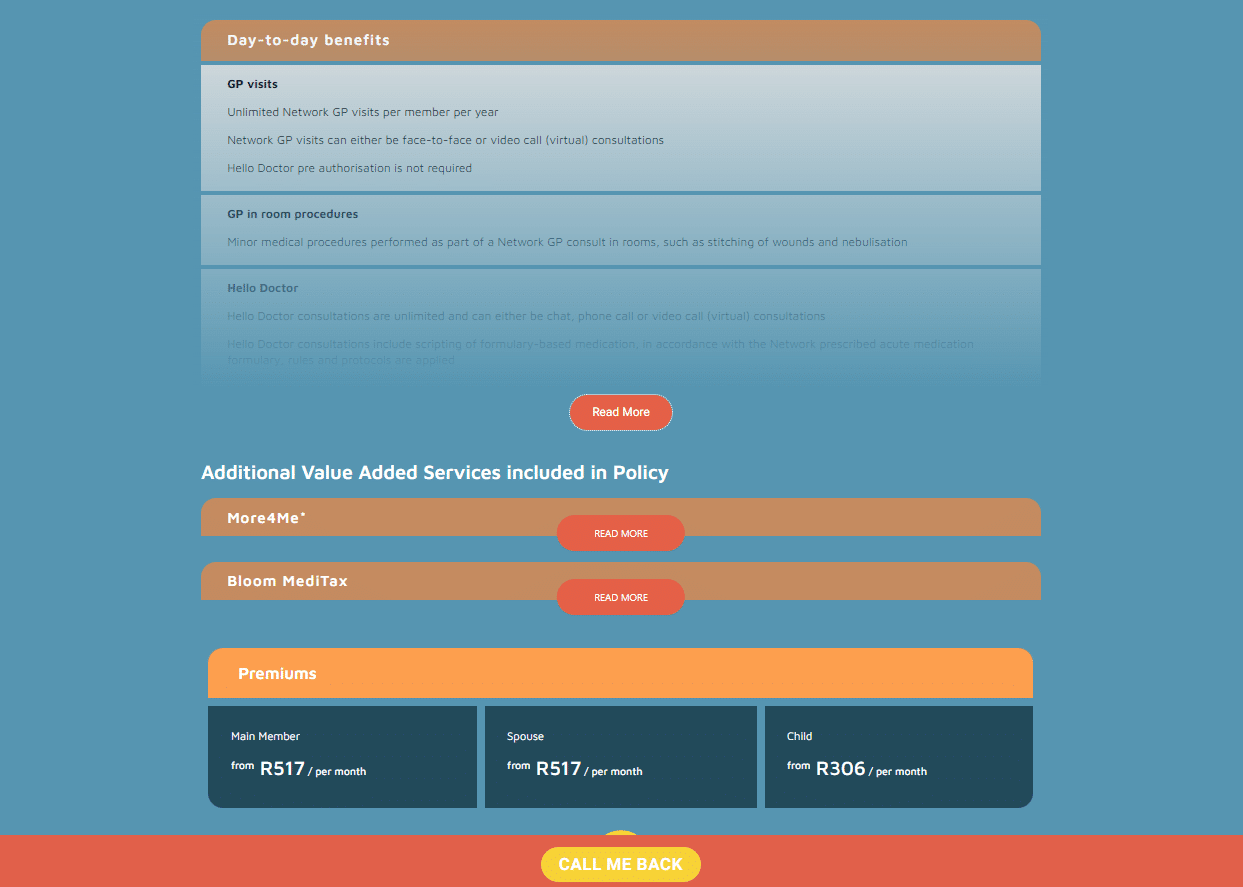

Bloom Health4Me Bronze Plan Premiums

| 🟥 Benefit Group | 1️⃣ Major Medical Event Benefit | 2️⃣ Principal Member | 3️⃣ Spouse (per Spouse) | 4️⃣ Child (per child) |

| 🟧 Day-to-Day | None | R517 | R517 | R306 |

| 🟨 Day-to-Day plus the following: Accident and Emergency Hospital Cash and Maternity Lump Sum Funeral Benefit | Base | R759 | R759 | R425 |

| 🟩 Day-to-Day plus the following: Accident and Emergency Hospital Cash and Maternity Lump Sum Funeral Benefit | Standard | R847 | R847 | R470 |

Bloom Health4Me Bronze Plan Benefits and Cover Comprehensive Breakdown

Acquiring healthcare is a crucial aspect of a person’s overall health and well-being. Nevertheless, private healthcare options, such as medical schemes, remain financially inaccessible to a significant portion of South Africa.

Momentum Health4Me aims to provide an affordable healthcare coverage solution for individuals with a monthly income of less than R30,000 through Bloom. Momentum Health4Me, aligning with Momentum’s commitment to innovation and adaptability, employs a modular approach. This enables you to select a blend of benefits that best aligns with your requirements and financial capacity.

Momentum Health4Me delivers exceptional value by leveraging vast expertise and proficiency in the industry and a robust network of provider partnerships. This allows Bloom to offer many South Africans an economical healthcare insurance solution.

Health4Me Bronze Day-to-Day Benefits

| 🔴 GP Benefit | Unlimited visits per member per year to a Network GP |

| 🟠 Procedures in the GP Room | Minor medical procedures, such as suturing and nebulization, are performed in-room as part of a Network GP consultation. |

| 🟡 Hello Doctor | Hello Doctor GP consultations are unlimited. Hello Doctor consultations are available via chat, telephone, or video call. During Hello Doctor consultations, formulary-based medications are prescribed per Network acute medication formulary rules and protocols. Hello Doctor consultations include pathology referrals per the Health4Me pathology list. Hello Doctor consultations include radiology referrals according to the Health4Me radiology list. |

| 🟢 Acute Medicine | Formulary of acute medications prescribed by the Network Standards and procedures are followed. |

| 🔵 Maternity Benefit | Limited to 1 Embryonic growth 2D scan per member per pregnancy Antenatal pathology tests linked to a Network GP visit and referred by a Network GP are performed per the Network prescribed acute medication formulary, rules, and protocols. Pre-approval is required. |

| 🟣 Basic Pathology | Unlimited pathology cover when linked to a Hello Doctor or Network GP visit and referred by a Hello Doctor or Network GP, per the Health4Me pathology list. |

| 🔴 Basic Radiology | Unrestricted cover for black-and-white x-rays when linked to a Hello Doctor or Network GP visit and referred by a Hello Doctor or Network GP, per the applicable Health4Me radiology list. |

| 🟠 Flu Vaccination | Limited to 1 Flu vaccination per member per year, preferably at a Dis-Chem, Clicks, MediRite, or Pick n Pay pharmacy clinic. |

| 🟡 COVID-19 Screening | Limited to 1 COVID-19 screening test per member per year is covered, pending a Hello Doctor, Network GP, or specialist referral. The COVID-19 screening test can also be administered as part of a consultation with a Network GP or a specialist in private rooms. |

| 🟢 Health Assessment | Limited to 1 Health assessment per member per year is provided at a pharmacy clinic, preferably a Dis-Chem, Clicks, MediRite, or Pick n Pay pharmacy clinic. Employer groups with more than 20 employees per location can host an on-site wellness day, during which members can undergo an annual health assessment. |

| 🔵 Employee Assistance Program | Provides counseling and support for adults, adolescents, and children. Provides services for trauma and critical incident counseling. Includes legal aid, credit counseling, and debt management. Provides managerial support services. Offers trauma and critical incident support services via telephone and on-site. |

| 🟣 Road Accident Claims | Offers assistance with vehicle accident claims (via EAP services). |

| 🔴 Workman’s Compensation Claims | Offers advice for occupational injury claims (through EAP services). |

| 🟠 Momentum Multiply Engage | Multiply Engage is free to use and provides rewards from various partners. Members receive substantial discounts on popular brands such as Makro, Nando’s, Intercape, and FlySafair, in addition to the Multiply online store. |

| 🟡 More4Me | More4Me rewards members based on their Healthy Heart Score with monthly airtime, data, Shoprite and Checkers vouchers, or Takealot vouchers. |

You might like to read more about the 5 Best Gap Cover Options for Under R500

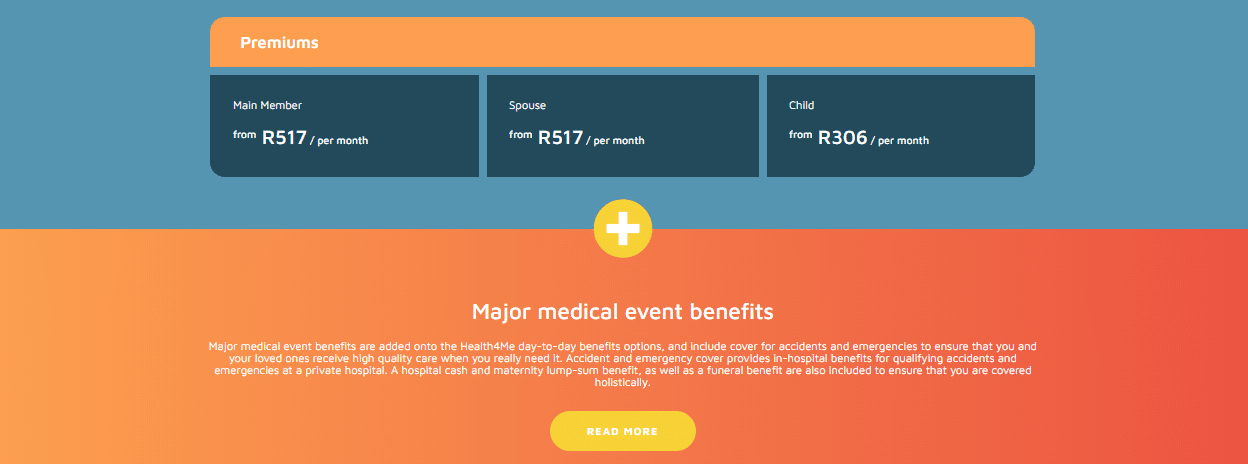

Health4Me Bronze Major Medical Event Benefits

✅ Accident and emergency cover

| 🅰️ Base | 🅱️ Standard |

| Accident Cover | Accident Cover |

| Casualty Benefits limited to R30,000 per event | Casualty Benefits limited to R30,000 per event |

| In-Hospital Benefits limited to R500,000 per event | In-Hospital Benefits limited to R1,500,000 per event |

| Emergency (Heart Attack or Stroke) Cover | Emergency (Heart Attack or Stroke) Cover |

- Accidents that meet the qualifying criteria are covered at a private hospital.

- An accident is a medical emergency caused by an external, unexpected event that is not directly or indirectly related to a member’s mental or physical health before the event.

✅ Emergency Transportation: Base + Standard

- If an accident or emergency (heart attack or stroke) requires immediate medical treatment, emergency transportation, stabilization, and treatment are paid for.

- If the benefit limit is exceeded, the member will be taken to a state facility for treatment.

- Accident and emergency cover include emergency transportation, stabilization, and treatment costs, as well as diagnostic scans (like MRI and CT scans), take-home medication, internal and external prosthetics, orthotics, assistive devices, rehabilitation services (like step-down services, wound care, physiotherapy, and occupational therapy), subject to clinical approval and per event limits.

- Members can receive R5,000,000 per year.

Discover what is Travel Cover

✅ Accident and Emergency Cover – Base Plan

- Limited to R500 per day in the hospital, payable from day one, if hospitalization lasts more than 48 hours.

- Limited to R20,000 per member per year.

- Limited to a maximum of 40 days per year.

- A maternity lump sum benefit of R10,000 is payable to a member if hospitalization is due to childbirth.

✅ Accident and Emergency Cover – Standard Plan

- Limited to R1,000 per day in the hospital, payable from day one, if hospitalization lasts more than 48 hours.

- Limited to R20,000 per member per year.

- Limited to a maximum of 20 days per year.

- A maternity lump sum benefit of R20,000 is payable to a member if hospitalization is due to childbirth, regardless of the number of days the member has been hospitalized.

✅ Funeral Benefits (Including Repatriation)

| 🟥 Base | 🟧 Base | 🟨 Base | 🟩 Standard | 🟦 Standard | 🟪 Standard |

| 🟧 Cause of Death | Natural | Unnatural | 🟦 Cause of Death | Natural | Unnatural |

| 🟨 Principal Spouse Child >14 | R10,000 | R20,000 | 🟪 Principal Spouse Child >14 | R15,000 | R30,000 |

| 🟩 Children 6 – 13 years | R5,000 | R10,000 | 🟥 Children 6 – 13 years | R7,500 | R15,000 |

| 🟦 Children 1 – 5 years | R2,500 | R5,000 | 🟨 Children 1 – 5 years | R3,750 | R7,500 |

| 🟪 Children <1 year | R1,250 | R2,500 | 🟩 Children <1 year | R1,875 | R3,750 |

| 🟥 Stillborn Babies (>28 weeks) | R750 | R1,500 | 🟦 Stillborn Babies (>28 weeks) | R1,125 | R2,250 |

✅ Repatriation – Base + Standard Plans

This benefit includes the following:

- ✅ Road or air repatriation of mortal remains to the nearest funeral home at the usual residence.

- ✅ Repatriation for distances over 100km within South Africa and neighboring countries (Botswana, Lesotho, Mozambique, Namibia, Swaziland, Zimbabwe).

- ✅ Consideration of customs and beliefs.

- ✅ Assistance with documentation and coordination with transportation authorities.

- ✅ Transfer of ashes after cremation to the usual residence.

- ✅ 24-hour bereavement counseling line for next of kin.

- ✅ One-night accommodation (up to R1,000) for family members identifying the deceased or accompanying them to the funeral home.

Finally, Europ Assistance provides repatriation services 24/7, every day of the year.

✅ Health4Me Bronze Hello Doctor

Members receive complimentary access to Hello Doctor, a mobile phone-based service offering 24/7 access to doctors within minutes. Furthermore, members can also enjoy unlimited access to online/mobile health information through Hello Doctor. Hello, Doctor consultations are unlimited and can be conducted via chat, phone, or video call (virtual) without any cost to the member.

If necessary, Hello Doctor consultations include the prescription of formulary-based medications. The prescription is sent directly to the member’s nearest Dis-Chem, Clicks, MediRite, or Pick n Pay pharmacy of their choice for medication collection.

Additionally, Hello Doctor consultations encompass referrals for pathology and radiology, as per the applicable Health4Me pathology list or Health4Me radiology list.

You might consider the 5 Best Hospital Plans for Domestic Workers

Bloom Health4Me Bronze Plan Exclusions and Waiting Periods

Bloom Health4Me Bronze Plan Exclusions

An exclusion is anything your insurance does not cover, such as a specific type of medication or surgery. Exclusions will differ between plans.

However, Bloom does not publish the specific exclusions and advises prospective members to speak with a consultant to ensure they understand the exclusions in their health insurance plan.

Bloom Health4Me Bronze Plan Waiting Periods

Bloom Health4Me Bronze has the following waiting periods:

- ✅ Hospital Cash and Maternity Lump Sum:

- ✅ A 3-month general waiting period

- ✅ A condition-specific 12-month waiting period for the base and standard options.

Finally, the 3-month waiting period for the base and standard options.

Bloom Health4Me Bronze Plan vs Other Providers or Medical Aid Schemes

| 🔎 Medical Health Plan | 🥇 Bloom Health4Me Bronze | 🥈 Oneplan Health Core | 🥉 CompCare NETWORX |

| 🌎 International Cover | None | None | Subject to benefits per individual benefit category. |

| 👤 Main Member Contribution | R517 – R847 | R450 – R1,555 | R472 – R3,123 |

| 👥 Adult Dependent Contribution | R517 – R847 | R870 for a couple | R472 – R2,807 |

| 👶 Child Dependent Contribution | R306 – R470 | R765 (Single adult + 1 Child) – R1,175 (Couple + 1 child) | R472 – R1,092 |

| 🔁 Gap Cover | None | None | None |

| 💵 Medical Savings Account | None | None | None |

| 🍼 Maternity Benefits | ✅ Yes | ✅ Yes | ✅ Yes |

| 💙 Pre and Postnatal Care | None | None | None |

| ☑️ Chronic Conditions | None | ✅ Yes | ✅ Yes |

Read more about Discovery Health Medical Aid Scheme

Our Verdict on the Bloom Health4Me Bronze Plan

The Health4Me Bronze option offered by Bloom Insurance is an affordable, entry-level health insurance plan that offers basic coverage for various medical services. Some of the key benefits of this plan include cover for GP visits, in-room procedures, and acute medicine. Additionally, policyholders have access to Hello Doctor, which provides virtual consultations with healthcare professionals.

While the Health4Me Bronze plan is a good option for those seeking basic medical cover, it is important to note that it may not provide adequate cover for those with more extensive medical needs. For example, it does not cover major medical expenses such as hospitalization or surgery, and coverage limits are relatively low.

Despite these limitations, the Health4Me Bronze option can be a good choice for individuals who are relatively healthy and do not anticipate needing extensive medical care at some point.

It is also an affordable option for those who may not have access to more comprehensive health insurance plans due to financial constraints.

- You might also like: Bloom Health4Me Gold Plan

- You might also like: Bloom Health4Me Silver Plan

- You might also like: Bloom Health Insurance Review

Bloom Health4Me Bronze Plan Frequently Asked Questions

What is Bloom Health4Me Bronze?

Bloom Health4Me Bronze is an affordable, entry-level health insurance plan offering basic medical coverage for various services.

What services are covered under the Bloom Health4Me Bronze plan?

The Health4Me Bronze plan covers GP visits, in-room procedures, and acute medicine. It also includes virtual consultations with healthcare professionals through Hello Doctor.

What are the cover limits for the Bloom Health4Me Bronze plan?

The coverage limits for the Health4Me Bronze plan are relatively low, and it does not cover major medical expenses such as hospitalization or surgery.

Is the Bloom Health4Me Bronze plan a good choice for me?

The Health4Me Bronze plan can be a good choice for individuals who are relatively healthy and do not anticipate needing extensive medical care in the near future. Furthermore, it could be an affordable option for those who may not have access to more comprehensive health insurance plans due to financial constraints.

How much does the Bloom Health4Me Bronze plan cost?

The cost of the Health4Me Bronze plan starts from R517 and will depend on the level of coverage you choose and the number of beneficiaries you add.

Can I use the Bloom Health4Me Bronze plan outside of my home province?

Yes, the Health4Me Bronze plan covers medical services received anywhere in South Africa.

How do I enroll in the Bloom Health4Me Bronze plan?

You can enroll in the Bloom Health4Me Bronze plan by visiting the Bloom Insurance website and applying. You can also contact Bloom Insurance directly for assistance with the enrollment process.

Table of Contents

Free Health Insurance Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans