Principle Member

From R610

Dependant Member

From R610

Child Dependant

From R359

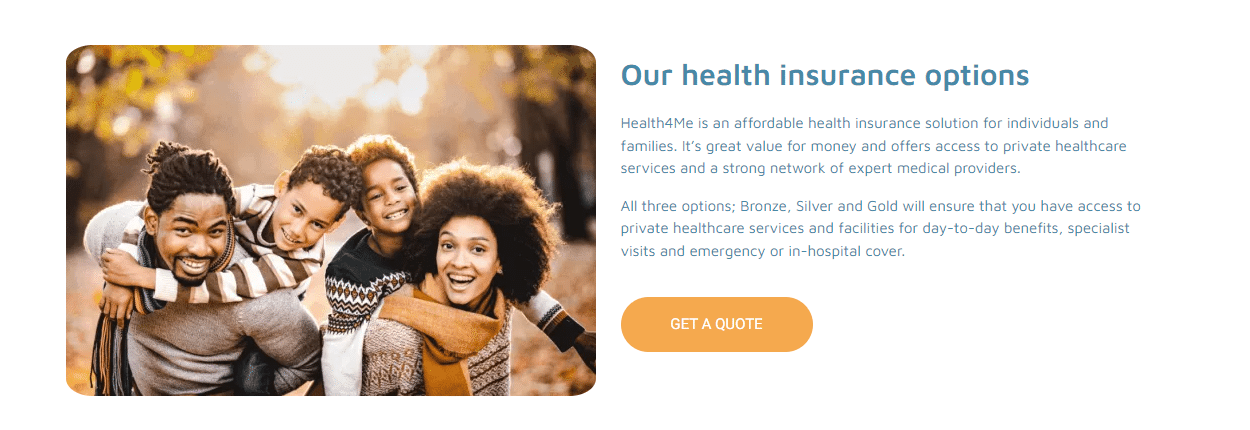

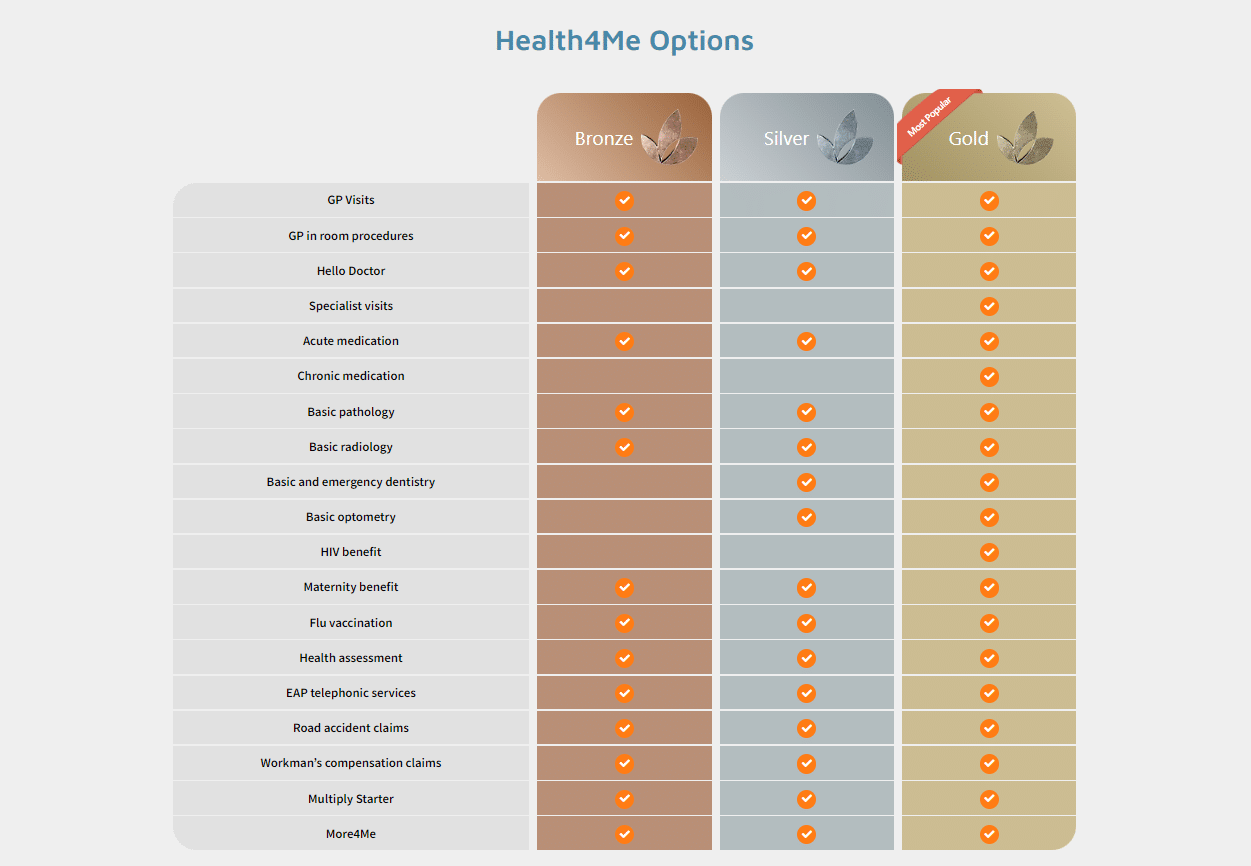

Health4Me Silver

The Health4Me Silver plan provides coverage for essential health services such as Basic and Emergency Dentistry, Basic Optometry, Vaccinations, Health Assessments, Hello Doctor, and other related services.

★★★★★ 4.5/5

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Health4Me Silver plan provides coverage for essential health services such as Basic and Emergency Dentistry, Basic Optometry, Vaccinations, Health Assessments, Hello Doctor, and other related services.

Tax Deductible:

Travel Cover:

Health4Me Silver

The Health4Me Silver plan provides coverage for essential health services such as Basic and Emergency Dentistry, Basic Optometry, Vaccinations, Health Assessments, Hello Doctor, and other related services.

★★★★★ 4/5

Principle Member

From R610

Dependant Member

From R610

Child Dependant

From R359

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Health4Me Silver plan provides coverage for essential health services such as Basic and Emergency Dentistry, Basic Optometry, Vaccinations, Health Assessments, Hello Doctor, and other related services.

Tax Deductible:

Travel Cover: