- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Stratum Benefits Corporate Elite Plus

Overall, Stratum Benefits Corporate Elite Plus is a trustworthy short-term insurance product designed to provide extra protection for those with medical aid. The Stratum Benefits Corporate Elite Plus Plan price is set per quote. Stratum Benefits has a trust score of 4.5.

| 🔎 Provider | 🥇 Stratum Benefits Corporate Elite Plus |

| 🟥 Years in Operation | 24 years |

| 🟧 Underwriters | Guardrisk Insurance Company Limited (FSP 75) |

| 🟨 Market Share in South Africa | >5% |

| 🟩 Gap Cover Waiting Period | 3 Months |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | N/A |

| 🟥 Oncology Benefit | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

Stratum Benefits Corporate Elite Plus – 6 Key Point Quick Overview

- ✅ Stratum Benefits Corporate Elite Plus Overview

- ✅ Stratum Benefits Corporate Elite Plus Benefits and Cover Breakdown

- ✅ Stratum Benefits Corporate Elite Plus Exclusions and Waiting Periods

- ✅ Stratum Benefits Corporate Elite Plus vs Other Gap Cover Plans

- ✅ Our Verdict on Stratum Benefits Corporate Elite Plus

- ✅ Stratum Benefits Corporate Elite Plus Frequently Asked Questions

Stratum Benefits Corporate Elite Plus Overview

The Stratum Benefits Corporate Elite Plus is one of eleven plans with customized premiums per employer group. Stratum Benefits’ Base has benefits for Scopes and scans, breast reconstruction after mastectomy, physical rehabilitation, illness, accidents, and more.

Stratum Benefits Gap Cover has eleven plans to choose from:

-

- Stratum Benefits Elite

- Stratum Benefits Corporate Elite Plus

- Stratum Benefits Corporate Elite

- Stratum Benefits Corporate Compact 300

- Stratum Benefits Corporate Access Plus 500

- Stratum Benefits Corporate Access

- Stratum Benefits Corporate Access Co Pay Plus 500

- Stratum Benefits Compact 300

- Stratum Benefits Access Optimiser

- Stratum Benefits Access Co pay Plus 300

- Stratum Benefits Base

Stratum Benefits Corporate Elite Plus Benefits and Cover Breakdown

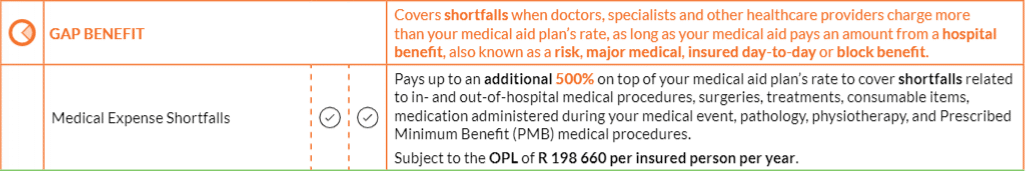

| 🟥 Gap Benefit | Covers in and out-of-hospital expenses up to 500% with an annual limit of R185,873 per insured person. |

| 🟧 Co-Payment Benefit | Includes cover for admission and procedure co-payments, penalty co-payments (up to R13,000 per year), and robotic surgery co-payments (up to R10,000 per year). |

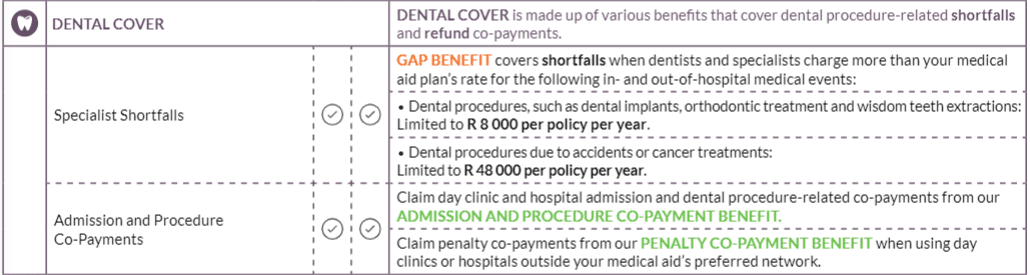

| 🟨 Dental Cover | Provides gap benefit cover up to 500% with varying limits (R8,000 to R24,000 per year) depending on the procedure. Also covers co-payments for admissions and procedures up to R185,837 per insured person per year. |

| 🟩 Maternity Cover | Includes cover for pre-natal consultations, childbirth shortfalls, post-natal consultation shortfalls, preventative procedures, childhood immunizations, birth control, and private room shortfalls. |

| 🟦 Sub-Limit Benefit | Covers specific medical procedures such as colonoscopies, enterostomies, gastroscopies (up to R5,000 per event), internal prosthetic devices (up to R30,000 per event), and renal dialysis treatments (up to R30,000 per event). |

| 🟪 Radiology Cover | Provides gap benefit cover up to R185,837 per insured person per year and co-payment cover for admissions and procedures. Also covers sub-limit benefits for MRI, CT, and PET scans (up to R5,000 per event) and a top-up benefit for the same scans (up to R5,000 per year). |

| 🟥 Cancer Benefit | Covers breast reconstruction (up to R30,000 per lifetime), cancer treatment shortfalls (up to R185,837), and cancer treatment top-ups (up to R185,837 per year). |

| 🟧 Physical Rehab | Provides cover up to R10,000 per insured person per year. |

| 🟨 Out-Patient Specialist Consultation Benefit | Covers up to R1,300 per consultation, limited to 3 consultations per policy per year. |

| 🟩 Casualty Benefit – Accidents and Illness | Reimburses shortfalls or total costs for casualty events up to R12,000 per policy per year. |

| 🟦 Trauma Counselling | Provides cover up to R10,000 per policy per year. |

| 🟪 Preventative Care | Covers various tests and immunizations up to R1,300 per policy per year. |

| 🟥 Private Room Benefits | Covers up to R3,000 per policy per year. |

| 🟧 Accidental Death and Disability | Provides cover for the policyholder, spouse (up to R25,000 per insured person), and dependents (up to R5,000 per insured person) with a limit of 1 event per insured person per year. |

| 🟨 First-Time Cancer Diagnosis | Covers up to R30,000 per insured person in their lifetime. |

| 🟩 Medical Aid Contribution Waiver | Covers up to R4,500 per month for six months. |

| 🟦 Stratum Benefits Premium Waiver | Pays the premiums if the policyholder or the premium payer dies or becomes totally and permanently disabled. Employer-paid premiums must be included in the total salary package. |

| 🟪 Lifestyle Benefits | Offers access to e-learning options through Boston Online Home Education for high school students in grades 8 to 12. |

| 🟥 International Travel Insurance | Covers the entire family for acute illness and injury during pleasure trips outside South African borders, with a maximum of 31 days per trip and one per policy per year. |

Stratum Benefits Corporate Elite Plus Exclusions and Waiting Periods

Corporate Elite Plus Exclusions

Suppose you claim within the first 10 months of cover for certain medical events/procedures (such as adenoidectomy, cardiovascular procedures, cataract removal, dentistry, etc.). In that case, Stratum Benefits will only cover 20% of the claim amount.

Corporate Elite Plus Waiting Periods

Waiting periods apply from the policy start date, policy option upgrades, and for new members added after the initial policy start date. There is a three-month general waiting period for all claims except accidental events.

Additionally, there is a 12-month waiting period for pre-existing conditions, including investigations, procedures, surgeries, and treatments related to illnesses or medical conditions diagnosed within 12 months of starting the policy with Stratum Benefits.

Stratum Benefits Corporate Elite Plus vs Other Gap Cover Plans

| 🔎 Provider | 🥇 Stratum Benefits Corporate Elite Plus | 🥈 Auto & General Absolute Gap Cover | 🥉 Sirago Gov-Gap Cover |

| 🟥 Years in Operation | 24 years | 38 years | 30 years |

| 🟧 Underwriters | Guardrisk Insurance Company Limited (FSP 75) | 1Life Insurance Limited | GENRIC Insurance Company Limited (FSP: 43638) |

| 🟨 Market Share in South Africa | >5% | <5% | >10% |

| 🟩 Gap Cover Waiting Period | 3 Months | 10 months | From 3 months (up to 12) |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | N/A | R450 | R350 |

| 🟥 Oncology Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟩 Maternity Benefit | ✅ Yes | None | ✅ Yes |

| 🟦 Scopes and Scans | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Co-payment Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Accidental Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Trauma Counseling | ✅ Yes | None | None |

| 🟩 Premium Waiver | None | ✅ Yes | ✅ Yes |

| 🟦 Non-DSP Co-Payment | None | ✅ Yes | None |

| 🟪 Prostheses | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Travel Cover Extender | ✅ Yes | None | None |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | None | ✅ Yes |

Our Verdict on Stratum Benefits Corporate Elite Plus

According to our findings, the Corporate Elite Plus Plan offers extensive benefits, making it a comprehensive choice for employer groups seeking robust gap cover. In addition, it offers competitive, customized premiums and has a good reputation in the market.

Furthermore, we found that including lifestyle benefits, waivers, and a longer policy premium waiver period adds significant value to the plan. In addition, extended cancer coverage, maternity benefits, and outpatient consults can be an advantage for individuals.

However, we urge employer groups to consider the waiting periods, exclusions, and the absence of certain features when deciding if this plan fits their needs.

Stratum Benefits Corporate Elite Plus Frequently Asked Questions

What is the monthly premium for Stratum Benefits Corporate Elite Plus?

Premiums are calculated per employer group.

Does the plan cover oncology treatment?

Yes, Corporate Elite Plus provides cover for oncology treatment.

Are there waiting periods for claims?

Yes, there is a three-month general waiting period for all claims except accidental events and a 12-month waiting period for pre-existing conditions.

What are the exclusions of the plan?

Within the first 10 months of coverage, certain medical events/procedures have a reduced cover of 20% of the claim amount.

Is there cover for maternity benefits?

Yes, Corporate Elite Plus covers various maternity-related expenses such as pre-natal consultations, childbirth shortfalls, and post-natal consultation shortfalls.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans