- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Stratum Benefits Corporate Compact 300

Overall, Stratum Benefits Corporate Compact 300 is a trustworthy short-term insurance product designed to provide extra protection for those with medical aid. The Stratum Benefits Corporate Compact 300 Plan price is set per quote. Stratum Benefits has a trust score of 4.5.

| 🔎 Provider | 🥇 Stratum Benefits Corporate Compact 300 |

| 🟥 Years in Operation | 24 years |

| 🟧 Underwriters | Guardrisk Insurance Company Limited (FSP 75) |

| 🟨 Market Share in South Africa | >5% |

| 🟩 Gap Cover Waiting Period | 3 Months |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | N/A |

| 🟥 Oncology Benefit | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

Stratum Benefits Corporate Compact 300 – 6 Key Point Quick Overview

- ✅ Stratum Benefits Corporate Compact 300 Overview

- ✅ Stratum Benefits Corporate Compact 300 Benefits and Cover Breakdown

- ✅ Stratum Benefits Corporate Compact 300 Exclusions and Waiting Periods

- ✅ Stratum Benefits Corporate Compact 300 vs Other Gap Cover Plans

- ✅ Our Verdict on Stratum Benefits Corporate Compact 300

- ✅ Stratum Benefits Corporate Compact 300 Frequently Asked Questions

Stratum Benefits Corporate Compact 300 Overview

The Stratum Benefits Corporate Compact 300 is one of eleven plans with customized premiums per employer group. Stratum Benefits’ Base has benefits for radiology, dentistry, admissions and procedures in the hospital, and more.

Stratum Benefits Gap Cover has eleven plans to choose from:

-

- Stratum Benefits Elite

- Stratum Benefits Corporate Elite Plus

- Stratum Benefits Corporate Elite

- Stratum Benefits Corporate Compact 300

- Stratum Benefits Corporate Access Plus 500

- Stratum Benefits Corporate Access

- Stratum Benefits Corporate Access Co Pay Plus 500

- Stratum Benefits Compact 300

- Stratum Benefits Access Optimiser

- Stratum Benefits Access Co pay Plus 300

- Stratum Benefits Base

Stratum Benefits Corporate Compact 300 Benefits and Cover Breakdown

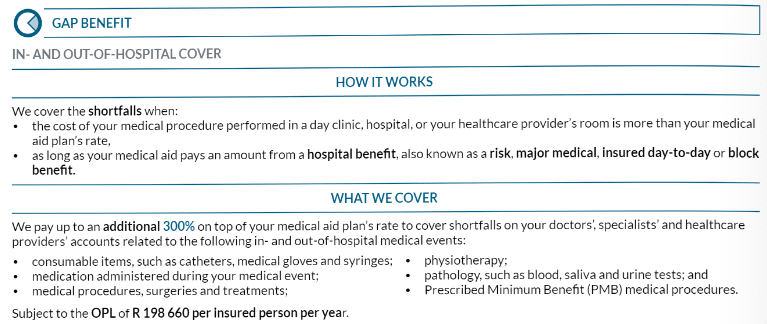

| 🟥 Gap Benefit | Covers in and out-of-hospital expenses up to 300% of the medical aid tariff, with an overall limit of R185,873 per insured person annually. |

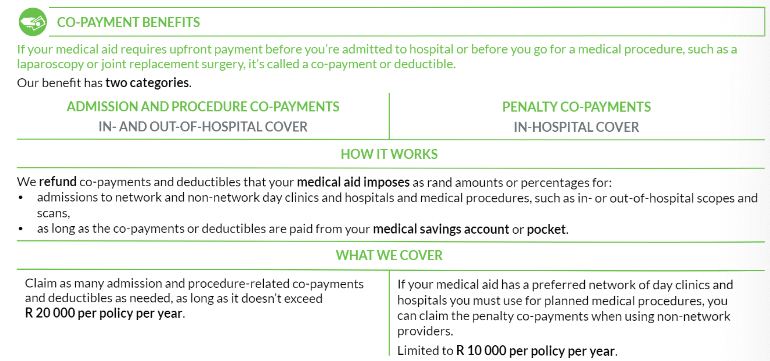

| 🟧 Co-Payment Benefit | Covers claims on admission and procedure-related co-payments and deductibles up to R15,000. Penalty co-payments on non-DSP providers can be claimed up to R6,500 per policy annually. |

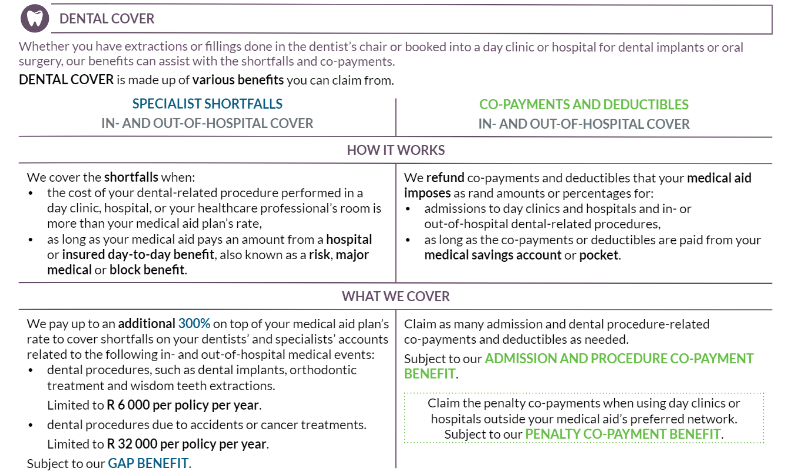

| 🟨 Dental Cover | Provides cover up to 300%, with limits ranging from R6,000 to R16,000 per policy per year, depending on the procedure. |

| 🟩 Maternity Cover | Covers shortfalls when healthcare professionals charge more than the medical aid rate for delivering a baby. Also covers specific amounts paid by the medical aid from the hospital benefit. |

| 🟦 Sub-Limit Benefit | Covers internal prosthetic devices up to R20,000 per insured person per event after the medical aid’s portion is paid. |

| 🟪 Radiology Cover | Includes Gap Cover for shortfalls, Co-Payment Benefits for admission and procedure co-payments, and Sub-limit Benefits for MRI, CT, and PET scans. |

| 🟥 Cancer Benefit | Covers cancer treatment shortfalls up to R185,837, with options for top-ups up to R60,000 per insured person annually. |

| 🟧 Casualty Benefit – Accidents and Illness | Reimburses shortfalls or total costs for accidental and illness-related events treated outside the hospital if paid from the medical savings account or out-of-pocket. |

| 🟨 Trauma Counselling | Provides cover up to R5,000 per policy per year. |

| 🟩 Accidental Death and Disability | Covers the policyholder, spouse, and dependents, with limits ranging from R5,000 to R15,000 per insured person. |

| 🟦 First-Time Cancer Diagnosis | Covers up to R15,000 per insured person in their lifetime. |

| 🟪 Lifestyle Benefits | Offers access to e-learning options through Boston Online Home Education for high school students in grades 8 to 12. |

Stratum Benefits Corporate Compact 300 Exclusions and Waiting Periods

Corporate Compact 300 Exclusions

Suppose you claim within the first 10 months of cover for certain medical events/procedures (arthroscopic surgery, bunion surgery, reconstructive dental procedures, etc.). In that case, Stratum Benefits will only cover 20% of the claim amount.

Corporate Compact 300 Waiting Periods

Waiting periods apply from the policy start date, policy option upgrades, and for new members added after the initial policy start date. There is a three-month general waiting period for all claims except accidental events.

Additionally, there is a 12-month waiting period for pre-existing conditions, including investigations, procedures, surgeries, and treatments related to illnesses or medical conditions diagnosed within 12 months of starting the policy with Stratum Benefits.

Stratum Benefits Corporate Compact 300 vs Other Gap Cover Plans

| 🔎 Provider | 🥇 Stratum Benefits Corporate Compact 300 | 🥈 Cura Administrators Gap Standard | 🥉 Liberty Optimal Gap Cover |

| 🟥 Years in Operation | 24 years | 26 years | 66 years |

| 🟧 Underwriters | Guardrisk Insurance Company Limited (FSP 75) | GENRIC Insurance Company Limited | Guardrisk Life Limited (FSP 76) |

| 🟨 Market Share in South Africa | >5% | <5% | >25% |

| 🟩 Gap Cover Waiting Period | 3 Months | 3 – 12 months | 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | N/A | R281 | R225 |

| 🟥 Oncology Benefit | ✅ Yes | None | None |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | None | ✅ Yes |

| 🟩 Maternity Benefit | ✅ Yes | None | None |

| 🟦 Scopes and Scans | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Co-payment Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | None |

| 🟧 Accidental Cover | ✅ Yes | None | ✅ Yes |

| 🟨 Trauma Counseling | ✅ Yes | None | ✅ Yes |

| 🟩 Premium Waiver | None | None | ✅ Yes |

| 🟦 Non-DSP Co-Payment | None | None | ✅ Yes |

| 🟪 Prostheses | ✅ Yes | None | ✅ Yes |

| 🟥 Travel Cover Extender | ✅ Yes | None | None |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | None | ✅ Yes |

Our Verdict on Stratum Benefits Corporate Compact 300

Stratum Benefits’ Corporate Compact 300 is an all-inclusive gap cover plan designed to cover a variety of medical expense gaps. This plan provides extensive coverage in and out of the hospital, up to 300% of the medical aid tariff, focusing on common healthcare costs.

In addition, it includes co-payments for penalties, dental cover, maternity cover, radiology, and cover for shortfalls in cancer treatment, among others. Although Stratum Benefits Compact 300 provides valuable cover, it is essential to consider the plan’s exclusions and waiting periods.

Furthermore, exclusions limit coverage for specific medical events or procedures during the first 10 months of coverage, and general claims and pre-existing conditions are subject to waiting periods.

Stratum Benefits Corporate Compact 300 Frequently Asked Questions

What is Corporate Compact 300?

Corporate Compact 300 is a gap cover option offered by Stratum Benefits. It is designed to cover the most often experienced medical expense shortfalls and is available to employer groups.

Who is eligible for Corporate Compact 300?

Corporate Compact 300 is available to employer groups. It covers five or more employees as an employer group if you join through your employer. If your employer allows, your spouse and dependents can also join.

How are the premiums for Corporate Compact 300 determined?

Premiums and waiting periods for Corporate Compact 300 are determined by factors such as the group’s size, average age, and whether coverage is compulsory or voluntary.

What are the key benefits of Corporate Compact 300?

Corporate Compact 300 offers a range of benefits subject to an Overall Policy Limit (OPL) of R185,837 per insured person annually. These include gap benefits for in- and out-of-hospital cover, co-payment benefits for admission and procedure co-payments, and penalty co-payments for in-hospital cover.

What is the Overall Policy Limit (OPL) for Corporate Compact 300?

The Overall Policy Limit (OPL) for Corporate Compact 300 is R185,837 per insured person annually. All approved claim amounts will be deducted from the available OPL.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans