- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Stratum Benefits Access Optimiser

Overall, Stratum Benefits Access Optimiser is a trustworthy short-term insurance product designed to provide extra protection for those with medical aid. The Stratum Benefits Access Optimiser Plan starts from R167 ZAR. Stratum Benefits has a trust score of 4.5.

| 🔎 Provider | 🥇 Stratum Benefits Access Optimiser |

| 🟥 Years in Operation | 24 years |

| 🟧 Underwriters | Guardrisk Insurance Company Limited (FSP 75) |

| 🟨 Market Share in South Africa | >5% |

| 🟩 Gap Cover Waiting Period | 3 Months |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | R167 |

| 🟥 Oncology Benefit | None |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | None |

Stratum Benefits Access Optimiser – 7 Key Point Quick Overview

- ✅ Stratum Benefits Access Optimiser Overview

- ✅ Stratum Benefits Access Optimiser Premiums

- ✅ Stratum Benefits Access Optimiser Benefits and Cover Breakdown

- ✅ Stratum Benefits Access Optimiser Exclusions and Waiting Periods

- ✅ Stratum Benefits Access Optimiser vs Other Gap Cover Plans

- ✅ Our Verdict on Stratum Benefits Access Optimiser

- ✅ Stratum Benefits Access Optimiser Frequently Asked Questions

Stratum Benefits Access Optimiser Overview

The Stratum Benefits Access Optimiser is one of eleven plans that starts from R167 per month. Stratum Benefits’ Base has benefits for casualties, illness, accidental death and disability, lifestyle, and in-hospital treatment, services, and procedures.

Stratum Benefits Gap Cover has eleven plans to choose from:

-

- Stratum Benefits Elite

- Stratum Benefits Corporate Elite Plus

- Stratum Benefits Corporate Elite

- Stratum Benefits Corporate Compact 300

- Stratum Benefits Corporate Access Plus 500

- Stratum Benefits Corporate Access

- Stratum Benefits Corporate Access Co Pay Plus 500

- Stratum Benefits Compact 300

- Stratum Benefits Access Optimiser

- Stratum Benefits Access Co pay Plus 300

- Stratum Benefits Base

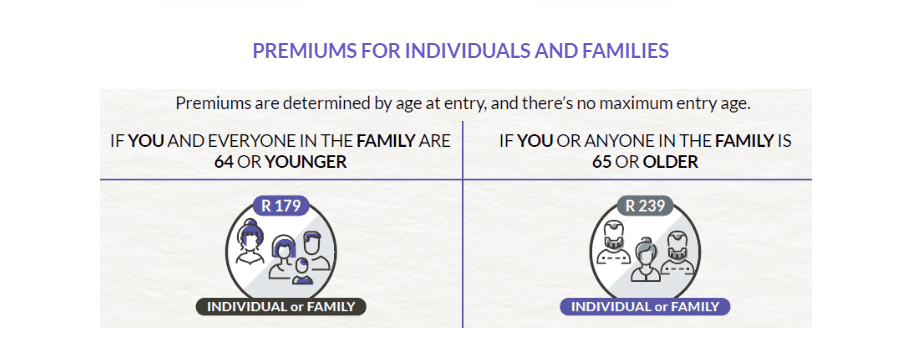

Stratum Benefits Access Optimiser Premiums

| 🟥 Membership Type | 🟩 Monthly Contribution |

| 🟧 Individuals or Families <64 years | 🟦 R167 |

| 🟨 Individuals or Families>65 years | 🟪 R207 |

Stratum Benefits Access Optimiser Benefits and Cover Breakdown

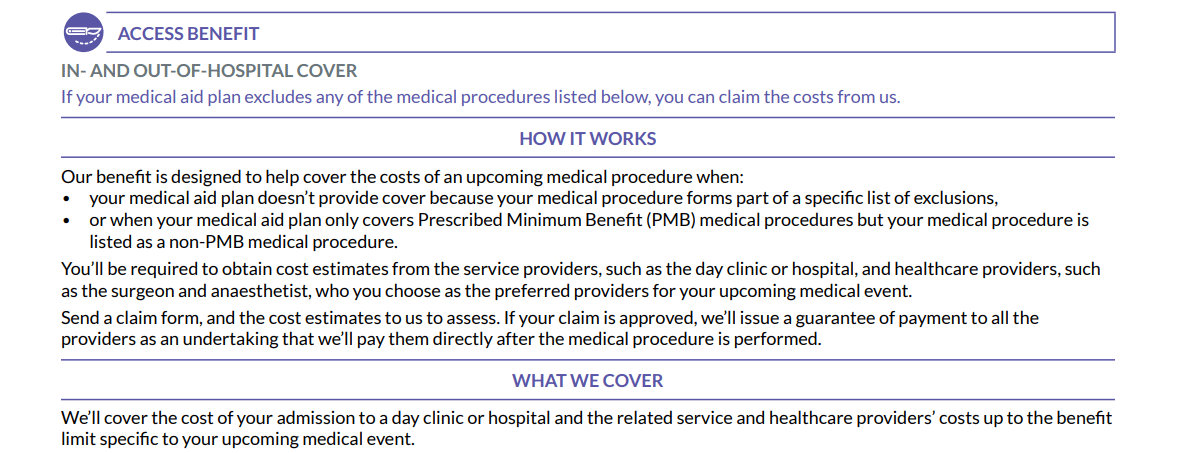

This plan serves as an enhanced alternative, specifically designed to encompass specific medical procedures not included in the policyholder’s existing medical cover. It applies to individuals aged 65 and above and families with at least one member aged 65 or above, who will be subjected to the premium associated with a family or individuals over 65.

Under this plan, the benefits offered are contingent upon an annual Out-of-Pocket Limit (OPL) of R 177,835 per policy, regardless of whether the policyholder is covered as an individual or as part of a family. Consequently, any approved claim amounts will be deducted from the OPL.

Access Optimiser Access Cover

This provides cover for procedures that are not typically covered by medical aid.

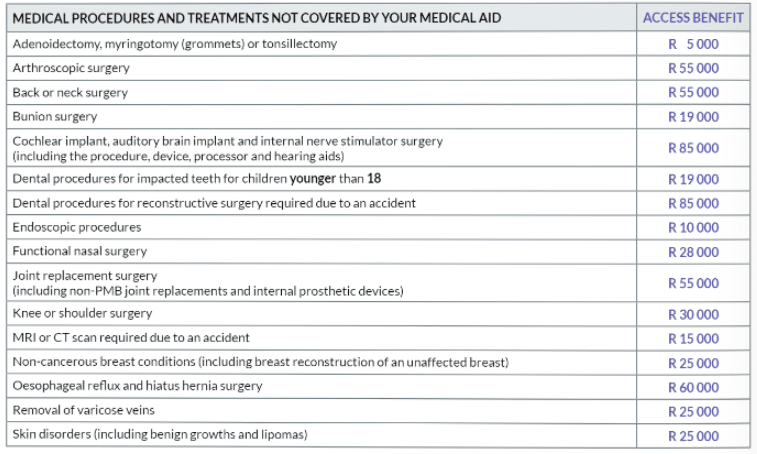

| 🟥 The procedure not covered by Medical Aid | Access Cover Amount Provided |

| 🟧 Arthroscopic Surgery | R50,000 |

| 🟨 Back / Neck Surgery | R50,000 |

| 🟩 Bunion Surgery | R14,000 |

| 🟦 A cochlear implant, auditory brain implant, and internal nerve stimulator surgery (Including the procedure, device, processor, and hearing aids) | R80,000 |

| 🟪 Dental Procedures for impacted teeth (children <18 years) | R14,000 |

| 🟥 Dental procedures – reconstructive surgery because of an accident | R80,000 |

| 🟧 Endoscopic Procedures | R5,000 |

| 🟨 Functional Nasal Surgery | R23,000 |

| 🟩 Joint replacement surgery (Including non-PMB joint replacements and internal prosthetic devices) | R50,000 |

| 🟦 Knee or shoulder surgery | R25,000 |

| 🟪 MRI or CT scan is required due to an accidental event | R10,000 |

| 🟥 Non-cancerous breast conditions (including breast reconstruction of a breast not affected by cancer) | R20,000 |

| 🟧 Esophageal reflux and hiatus hernia surgery | R55,000 |

| 🟨 Removal of varicose veins | R20,000 |

| 🟩 Skin disorders (including benign growths or lipomas) | R20,000 |

Access Optimiser Benefits

| 🅰️ Cover Type | 🅱️ Summary |

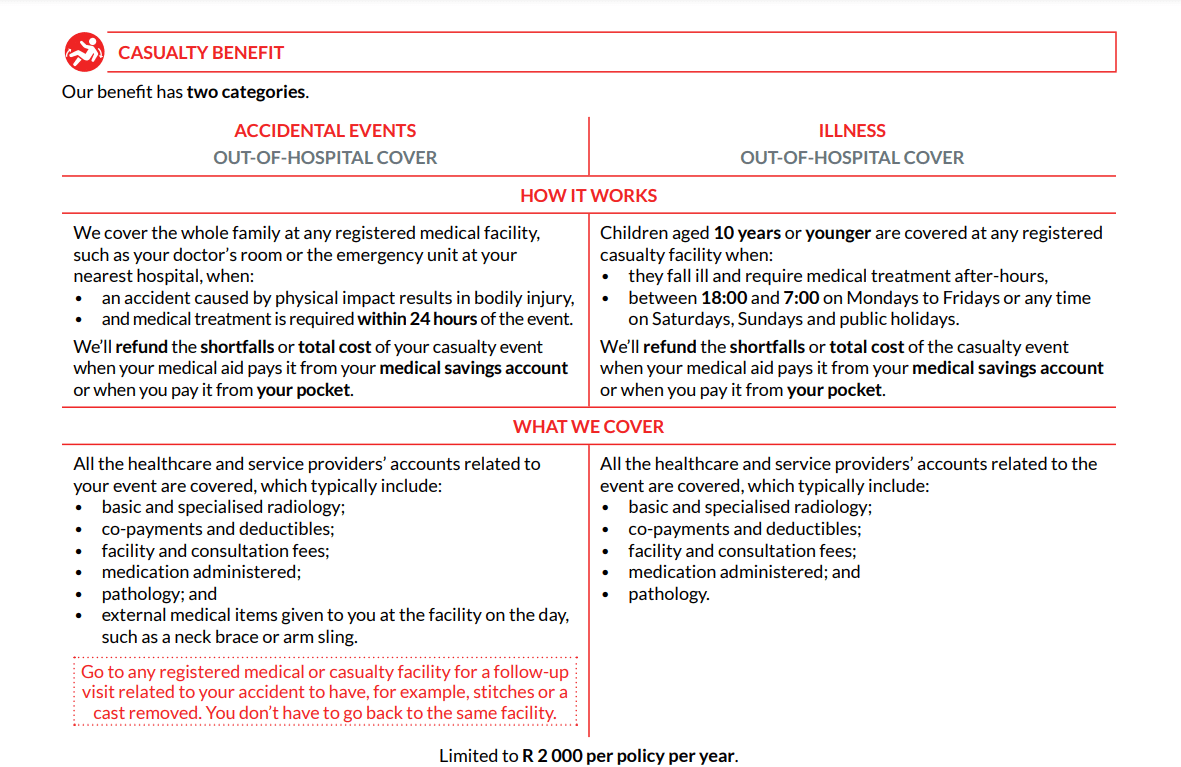

| 🟧 Casualty Cover | Covers all accident-related expenses, including facility and doctor consultation fees, co-payments and deductibles, radiology services, pathology, medication during the accident, and external medical items provided by the facility. |

| 🟨 Illness Cover | Specifically for children under 10 years. Covers the cost of visits to a casualty facility and associated healthcare provider bills for illness outside normal business hours. Reimbursement is provided for out-of-pocket expenses. |

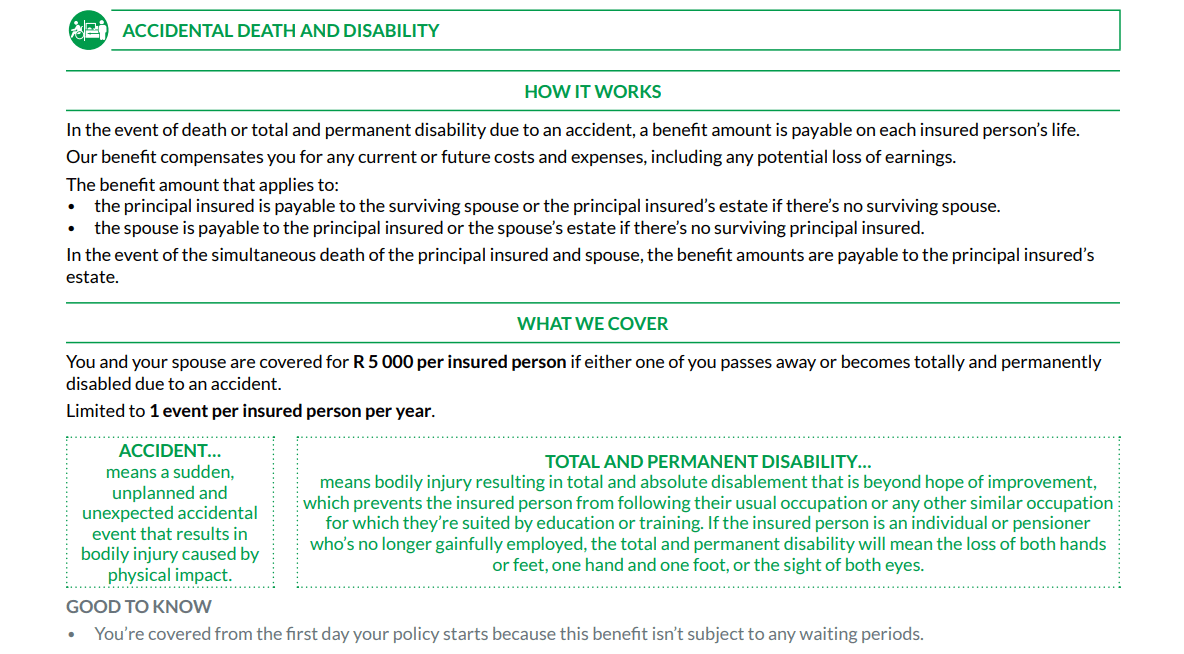

| 🟩 Accidental Disability and Death | Provides a benefit of R5,000 each for total and permanent disability or death resulting from an accident. Limited to one event per person per year. |

| 🟦 Lifestyle Benefit | Offers immediate access to educational content based on the CAPS curriculum for 8th to 12th-grade students. Designed to support studying, increase knowledge, and improve grades. |

Stratum Benefits Access Optimiser Exclusions and Waiting Periods

Access Optimiser Exclusions

Suppose you claim within the first 10 months of cover for certain medical events/procedures (such as adenoidectomy, cardiovascular procedures, cataract removal, dentistry, etc.). In that case, Stratum Benefits will only cover 20% of the claim amount.

Access Optimiser Waiting Periods

Waiting periods apply from the policy start date, policy option upgrades, and for new members added after the initial policy start date. There is a three-month general waiting period for all claims except accidental events.

Additionally, there is a 12-month waiting period for pre-existing conditions, including investigations, procedures, surgeries, and treatments related to illnesses or medical conditions diagnosed within 12 months of starting the policy with Stratum Benefits.

Read more about Health Insurance for the Youth

Stratum Benefits Access Optimiser vs Other Gap Cover Plans

| 🔎 Provider | 🥇 Stratum Benefits Access Optimiser | 🥈 Sirago Exact Cover | 🥉 Kaelo Gap Core |

| 🟥 Years in Operation | 24 years | 30 years | 19 years |

| 🟧 Underwriters | Guardrisk Insurance Company Limited (FSP 75) | GENRIC Insurance Company Limited (FSP: 43638) | Centriq Insurance Company Limited |

| 🟨 Market Share in South Africa | >5% | >10% | <1% |

| 🟩 Gap Cover Waiting Period | 3 Months | From 3 months (up to 12) | 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | R167 | R195 | R255 |

| 🟥 Oncology Benefit | None | None | None |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | None | None | None |

| 🟩 Maternity Benefit | None | None | None |

| 🟦 Scopes and Scans | ✅ Yes | ✅ Yes | None |

| 🟪 Co-payment Cover | None | None | None |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | None |

| 🟧 Accidental Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Trauma Counseling | None | None | None |

| 🟩 Premium Waiver | None | None | ✅ Yes |

| 🟦 Non-DSP Co-Payment | None | None | None |

| 🟪 Prostheses | ✅ Yes | ✅ Yes | None |

| 🟥 Travel Cover Extender | None | None | None |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | None | ✅ Yes |

READ more about the 5 Best Gap Cover Options for Under R200

Our Verdict on Stratum Benefits Access Optimiser

According to our research, it offers a range of benefits, including casualty cover, illness cover for children under 10 years, accidental disability and death benefits, and a lifestyle benefit with educational content.

Furthermore, it also provides cover for specific medical procedures that may not be covered by regular medical aid. One of the notable advantages of the Stratum Benefits Access Optimiser plan is its affordability, with monthly premiums starting from R155. It also offers 24/7 medical emergency assistance, providing peace of mind during unexpected situations.

Stratum Benefits Access Optimiser Frequently Asked Questions

How much are the monthly premiums for Stratum Benefits Access Optimiser?

The monthly premiums for Stratum Benefits Access Optimiser start from R155 for individuals or families below 64 years and R207 for individuals or families above 65 years.

Does Stratum Benefits Access Optimiser cover pre-existing conditions?

There is a 12-month waiting period for pre-existing conditions, including investigations, procedures, surgeries, and treatments related to illnesses or medical conditions diagnosed within 12 months of starting the policy with Stratum Benefits.

Are there any exclusions under the Stratum Benefits Access Optimiser plan?

Yes, within the first 10 months, Stratum Benefits Access Optimiser covers only 20% of the claim amount for certain medical events/procedures such as adenoidectomy, cardiovascular procedures, cataract removal, dentistry, etc.

Does Stratum Benefits Access Optimiser provide cover for specialized medical procedures?

Yes, Stratum Benefits Access Optimiser covers specific medical procedures not typically covered by regular medical aid, such as arthroscopic surgery, back/neck surgery, cochlear implant surgery, dental procedures, and more.

Is emergency assistance available with Stratum Benefits Access Optimiser?

Yes, Stratum Benefits Access Optimiser offers 24/7 medical emergency assistance to ensure support during unforeseen medical situations.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans