- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Liberty Universal Gap Cover

Overall, Liberty Universal Gap Cover is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The Liberty Universal Gap Cover Plan starts from R506 ZAR. Liberty has a trust score of 4.1.

| 🔎 Provider | 🥇 Liberty Universal Gap Cover |

| 🟥 Years in Operation | 66 years |

| 🟧 Underwriters | Guardrisk Life Limited (FSP 76) |

| 🟨 Market Share in South Africa | >25% |

| 🟩 Gap Cover Waiting Period | 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | R506 |

| 🟥 Oncology Benefit | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

Liberty Universal Gap Cover – 7 Key Point Quick Overview

- ✅ Liberty Universal Gap Cover Overview

- ✅ Liberty Universal Gap Cover Premiums

- ✅ Liberty Universal Gap Cover Benefits and Cover Comprehensive Breakdown

- ✅ Liberty Universal Gap Cover Exclusions and Waiting Periods

- ✅ Liberty Universal Gap Cover vs Other Gap Cover Plans

- ✅ Our Verdict on Liberty Universal Gap Cover

- ✅ Liberty Universal Gap Cover Frequently Asked Questions

Liberty Universal Gap Cover Overview

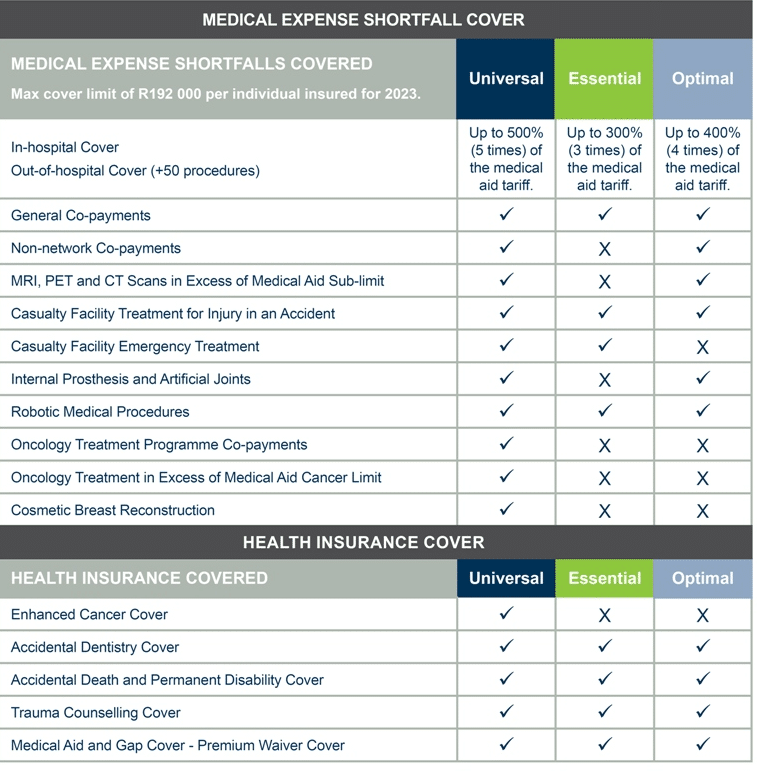

The Liberty Universal Gap Cover is one of three plans that starts from R506 per month. Liberty’s Universal Gap Cover has benefits for non-network co-payments, oncology, internal prostheses, casualties, robotic medical procedures, and more.

Liberty Gap Cover has three plans to choose from:

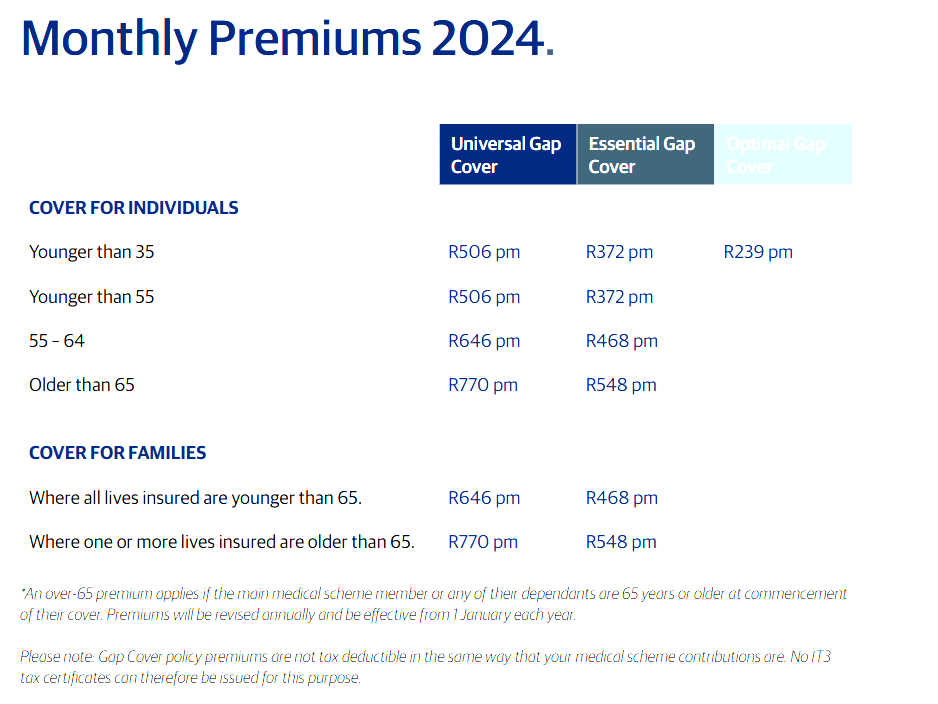

Liberty Universal Gap Cover Premiums

| 🟥 Individual Cover | 🟥 Premiums |

| 🟧 <55 Years | R506 monthly |

| 🟨 55 – 64 Years | R646 monthly |

| 🟩 >65 Years | R770 monthly |

| 🟦 Family Cover | 🟦 Premiums |

| 🟪 Where all insured are <65 years | R646 monthly |

| 🟥 Where one or more insured are >65 Years | R770 monthly |

Liberty Universal Gap Cover Benefits and Cover Comprehensive Breakdown

| 🟥 Shortfall Cover | Cover Information |

| 🟧 Overall Annual Cover Limit – R192,000 per insured per year | Overall Annual Cover Limit – R192,000 per insured per year |

| 🟨 In-hospital cover for shortfalls in terms of doctors and specialist charges exceeding medical aid tariff | Covers up to 500% of the medical aid tariff. |

| 🟩 Shortfalls on ±50 out-patient procedures (includes PET, MRI, and PET scans) | Covers up to 500% of the medical aid tariff. |

| 🟦 General Co-payments imposed by the medical aid for hospital admission, CT, PET, and MRI scans, and certain medical aid procedures | General Co-payments imposed by the medical aid for hospital admission, CT, PET, and MRI scans, and certain medical aid procedures |

| 🟪 Non-network Co-payments | Covers up to R11,600 for one claim per policy per year. |

| 🟥 MRI, PET, and CT scans exceeding medical aid sub-limits | Covers up to R3,200 per insured per policy per year. |

| 🟧 Casualty Facility Treatment for the treatment of casualties in-hospital after 48 hours of accidental injury | Covers up to R22,100 per policy per year. |

| 🟨 Covers after-hours emergency treatment in a casualty facility for children under 11 | Covers up to R2,500 per policy per year. |

| 🟩 Internal Prostheses | Covers up to R38,500 per policy per year. |

| 🟦 Stents | Covers up to R3,200 per insured per policy per year. |

| 🟪 Robotic Medical Procedures – covers shortfalls from using robotic machines for in-hospital treatment. | Covers up to R33,000 per policy per year. |

| 🟥 Oncology Program Cop-payments | Covers general and specialized treatment and biological drugs. There is a 25% co-payment on the cost of treatment. |

| 🟧 Oncology Program Exceeding the Medical Aid Cancer Limit | The benefit can be used for general and specialized treatment and biological drugs. Covers 20% of the affected insured person’s continued treatment cost. |

| 🟨 Cosmetic Breast Reconstruction of the non-affected breast after a single mastectomy caused by breast cancer. | Covers up to R24,000 for each individual insured. |

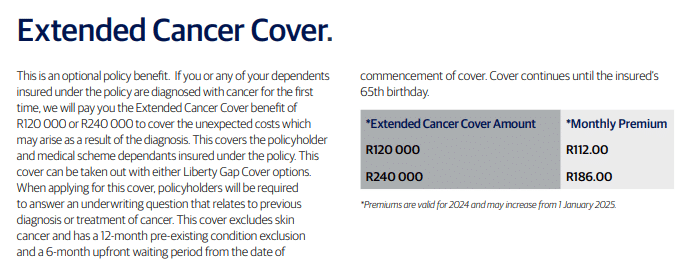

| 🟩 Enhanced Cancer Cover | Provides R30,000 for any unexpected costs associated with a first-time cancer diagnosis. |

| 🟦 Accidental Dentistry | Covers up to R22,500 for accidental tooth fractures and up to R3,200 per fractured tooth. |

| 🟪 Accidental Death and Permanent Disability Cover | Covers up to R50,000 for unexpected costs if the main policyholder accidentally dies or is completely and permanently disabled. |

| 🟥 Trauma Counselling Cover | Covers up to R26,500 per policy per year or R800 per session within 6 months of the traumatic event. |

| 🟧 Medical Aid and Gap Cover Waiver | Covers up to R110,000 after the policyholder accidentally dies or is permanently disabled. |

Discover more about Health Insurance for Globetrotting

Liberty Universal Gap Cover Exclusions and Waiting Periods

Liberty Universal Gap Cover Exclusions

Exclusions on the Essential Gap Cover plan include, but are not limited to, the following, with the full list available here:

- ✅ Nuclear weapons, as well as ionizing and nuclear radiation

- ✅ Suicide, attempted suicide, or intentional self-injury

- ✅ Any illness or injury caused by the consumption of alcohol

- ✅ Illegal behavior or violations of the Republic of South Africa laws

- ✅ Medical practitioners’ daily expenses

- ✅ Breast and dental implants.

- ✅ Medical emergency transportation

Dental procedures performed as an out-patient

Liberty Universal Gap Cover Waiting Periods

- ✅ Cover begins immediately on the policy’s start date, with no waiting periods.

- ✅ Medical conditions within 12 months before the policy’s start date are not eligible for benefits.

- ✅ Pregnancy before the policy’s start date is considered a pre-existing condition, with a 12-month exclusion period for pregnancy or birth-related claims.

If the policyholder had previous cover under a similar policy, the pre-existing condition waiting period applies only to the unexpired part of the previous policy period. However, the full 12-month exclusion period applies to benefits not provided under the previous policy.

Discover the Best Medical Aids in South Africa Cover IVF

Liberty Universal Gap Cover vs Other Gap Cover Plans

| 🔎 Provider | 🥇 Liberty Universal Gap Cover | 🥈 Stratum Benefits Elite Gap Cover | 🥉 Sirago Plus Gap |

| 🟥 Years in Operation | 66 years | 24 years | 30 years |

| 🟧 Underwriters | Guardrisk Life Limited (FSP 76) | Guardrisk Insurance Company Limited (FSP 75) | GENRIC Insurance Company Limited (FSP: 43638) |

| 🟨 Market Share in South Africa | >25% | >5% | >10% |

| 🟩 Gap Cover Waiting Period | 12 months | 3 Months | 3 months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | R506 | R404 | R426 |

| 🟥 Oncology Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟩 Maternity Benefit | None | ✅ Yes | ✅ Yes |

| 🟦 Scopes and Scans | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Co-payment Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Accidental Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Trauma Counseling | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟩 Premium Waiver | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Non-DSP Co-Payment | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Prostheses | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Travel Cover Extender | None | ✅ Yes | None |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | ✅ Yes | ✅ Yes |

POLL: 5 Best Gap Cover Alternatives for Under R200

Our Verdict on Liberty Universal Gap Cover

Our verdict on Liberty Universal Gap Cover is that it offers comprehensive coverage for various healthcare needs and can be a valuable addition to your overall healthcare plan.

With benefits that include cover for in-hospital and out-of-hospital procedures, non-network co-payments, diagnostic scans, casualty facility treatment, and more, policyholders can know they are protected against medical expense shortfalls.

While the plan does not provide maternity benefits and excludes a travel cover extender, the overall cover and competitive premiums make Liberty Universal Gap Cover a favorable choice.

Liberty Universal Gap Cover Frequently Asked Questions

What is the annual cover limit for Liberty Universal Gap Cover?

Liberty Universal Gap Cover’s overall annual cover limit is R192,000 per insured per year. This limit ensures that policyholders have substantial financial protection against medical expense shortfalls.

Does Liberty Universal Gap Cover provide cover for non-network co-payments?

Yes, Liberty Universal Gap Cover includes cover for non-network co-payments. It provides up to R11,600 for one claim per policy per year, ensuring that policyholders have financial support when receiving treatment from non-network healthcare providers.

Are MRI, PET, and CT scans exceeding medical aid sub-limits covered by Liberty Universal Gap Cover?

Liberty Universal Gap Cover covers MRI, PET, and CT scans that exceed medical aid sub-limits. Policyholders can receive a cover of up to R3,200 per insured per policy per year for these essential diagnostic procedures.

Does Liberty Universal Gap Cover include benefits for casualty facility treatment?

Yes, Liberty Universal Gap Cover covers casualty facility treatment for the in-hospital treatment of casualties following accidental injury. Policyholders can receive a cover of up to R22,100 per policy per year, providing financial support in case of emergencies.

What additional benefits does Liberty Universal Gap Cover provide?

Liberty Universal Gap Cover offers a range of additional benefits, including cover for internal prostheses, robotic medical procedures, trauma counseling, accidental dentistry, enhanced cancer cover, and cover for accidental death or permanent disability.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans