- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Liberty Essential Gap Cover

Overall, Liberty Essential Gap Cover is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The Liberty Essential Gap Cover Plans start from R372 ZAR. Liberty has a trust score of 4.1.

| 🔎 Provider | 🥇 Liberty Essential Gap Cover |

| 🟥 Years in Operation | 66 years |

| 🟧 Underwriters | Guardrisk Life Limited (FSP 76) |

| 🟨 Market Share in South Africa | >25% |

| 🟩 Gap Cover Waiting Period | 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | R372 |

| 🟥 Oncology Benefit | None |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | None |

Liberty Essential Gap Overview

The Liberty Essential Gap Cover is one of three plans that starts from R372 per month. Liberty’s Essential Gap Cover has benefits for in-hospital shortfalls, scopes and scans, accidental dentistry, and more.

Liberty Gap Cover has three plans to choose from:

Liberty Essential Gap Cover – 7 Key Point Quick Overview

- ✅ Liberty Essential Gap Overview

- ✅ Liberty Essential Gap Cover Premiums

- ✅ Liberty Essential Gap Cover Benefits and Cover Comprehensive Breakdown

- ✅ Liberty Essential Gap Cover Exclusions and Waiting Periods

- ✅ Liberty Essential Gap Cover vs Other Gap Cover Plans

- ✅ Our Verdict on Liberty Essential Gap Cover

- ✅ Liberty Essential Gap Cover Frequently Asked Questions

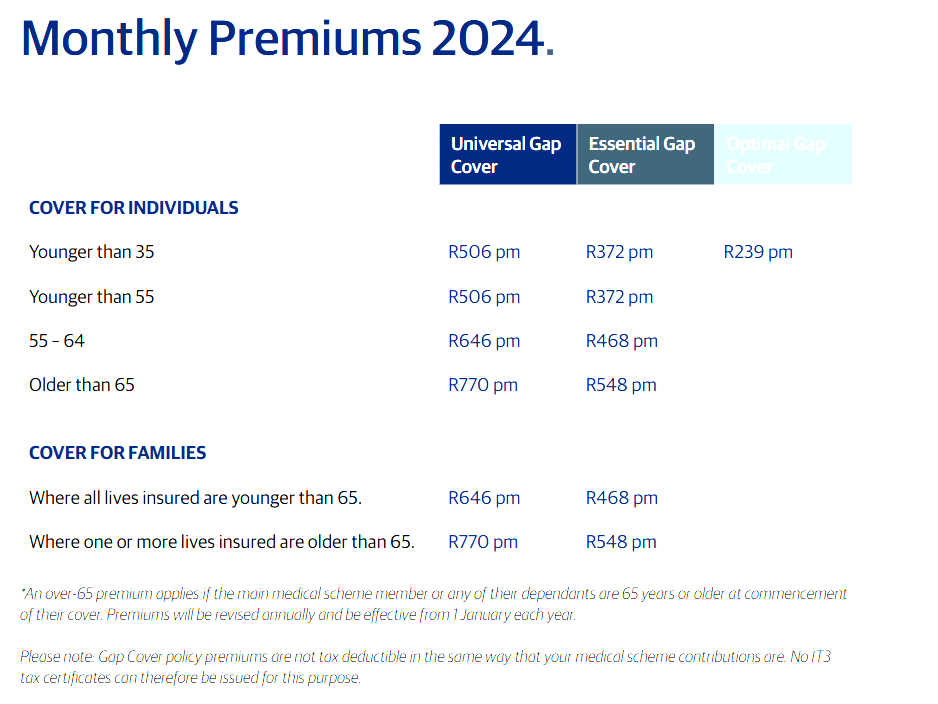

Liberty Essential Gap Cover Premiums

| 🟥 Individual Cover | 🟥 Premium |

| 🟧 <55 Years | R372 monthly |

| 🟨 55 – 64 Years | R468 monthly |

| 🟩 >65 Years | R548 monthly |

| 🟦 Family Cover | 🟦 Premium |

| 🟪 Where all insured are <65 years | R468 monthly |

| 🟥 Where one or more insured are >65 Years | R548 monthly |

Liberty Essential Gap Cover Benefits and Cover Comprehensive Breakdown

Liberty Essential Gap Cover

Liberty Essential Gap Cover affordably addresses the most common coverage gaps and provides additional financial protection against certain health risks.

Liberty Essential Gap Cover Features

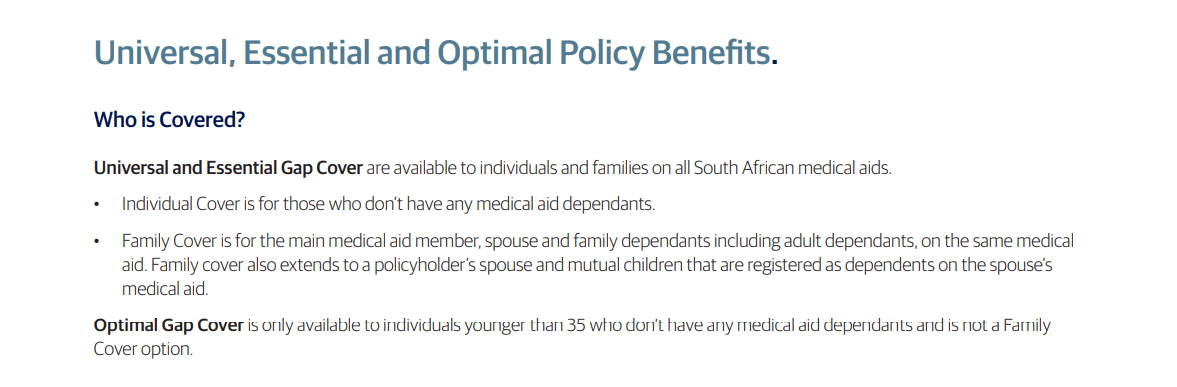

Who will be covered under this plan?

In South Africa, there is no upper age limit for enrolling in a medical insurance plan, so anyone and their family can obtain coverage.

- ✅ Individual Coverage should be considered by those who are self-sufficient in terms of medical coverage.

Family Coverage extends to the spouse and dependent children of the primary member on the primary member’s medical plan. Additionally, spouses who register in the same health insurance plan will be covered.

What do the Liberty Essential Gap Cover Benefits Include?

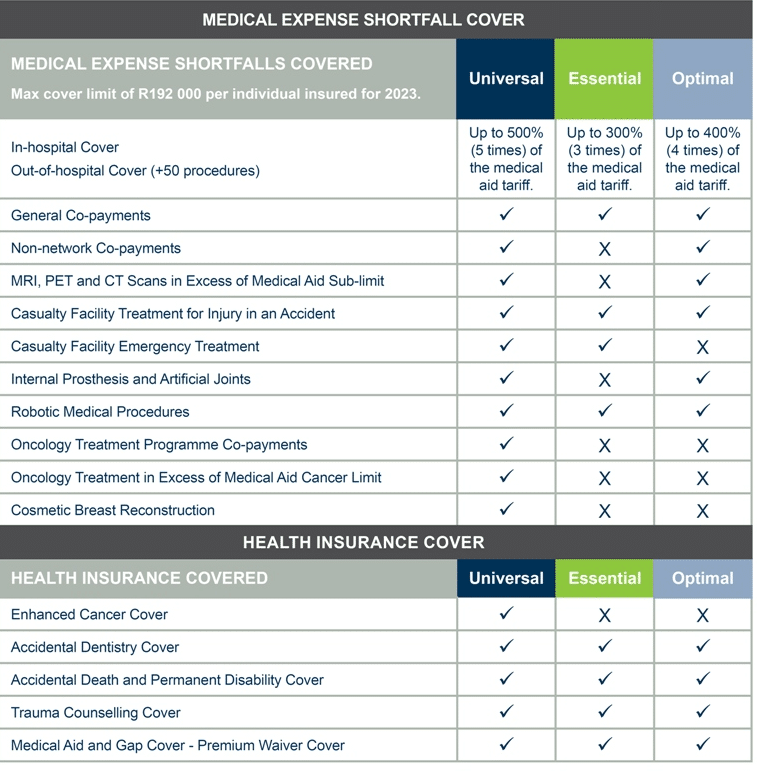

| 🅰️ Shortfall Cover | 🅱️ Cover Information |

| 🟧 Overall Annual Cover Limit – R192,000 per insured per year | Overall Annual Cover Limit – R192,000 per insured per year |

| 🟨 In-hospital cover for shortfalls in terms of doctors and specialist charges exceeding medical aid tariff | Covers up to 300% of the medical aid tariff. |

| 🟩 Shortfalls on ±50 out-patient procedures (includes PET, MRI, and PET scans) | Covers up to 300% of the medical aid tariff. |

| 🟦 General Co-payments imposed by the medical aid for hospital admission, CT, PET, and MRI scans, and certain medical aid procedures | General Co-payments imposed by the medical aid for hospital admission, CT, PET, and MRI scans, and certain medical aid procedures |

| 🟪 Casualty Facility Treatment for the treatment of casualties in-hospital after 48 hours of accidental injury | Covers up to R22,100 per policy per year. |

| 🟥 Covers after-hours emergency treatment in a casualty facility for children under 11 | Covers up to R2,500 per policy per year. |

| 🟧 Robotic Medical Procedures – covers shortfalls from using robotic machines for in-hospital treatment. | Covers up to R33,000 per policy per year. |

| 🟨 Accidental Dentistry | Covers up to R22,500 for accidental tooth fractures and up to R3,200 per fractured tooth. |

| 🟩 Accidental Death and Permanent Disability Cover | Covers up to R50,000 for unexpected costs if the main policyholder accidentally dies or is completely and permanently disabled. |

| 🟦 Trauma Counselling Cover | Covers up to R26,500 per policy per year or R800 per session within 6 months of the traumatic event. |

| 🟪 Medical Aid and Gap Cover Waiver | Covers up to R110,000 after the policyholder accidentally dies or is permanently disabled. |

Women might consider making use of our free Ovulation Calculator

Liberty Essential Gap Cover Exclusions and Waiting Periods

Essential Gap Cover Exclusions

Exclusions on the Essential Gap Cover plan include, but are not limited to, the following, with the full list available here:

- ✅ Nuclear weapons, as well as ionizing and nuclear radiation

- ✅ Suicide, attempted suicide, or intentional self-injury

- ✅ Any illness or injury caused by the consumption of alcohol

- ✅ Illegal behavior or violations of the Republic of South Africa laws

- ✅ Medical practitioners’ daily expenses

- ✅ Breast and dental implants.

- ✅ Medical emergency transportation

Dental procedures performed as an out-patient is excluded.

Essential Gap Cover Waiting Periods

- ✅ Coverage begins immediately on the policy’s start date, with no waiting periods.

- ✅ Medical conditions within 12 months before the policy’s start date are not eligible for benefits.

- ✅ Pregnancy before the policy’s start date is considered a pre-existing condition, with a 12-month exclusion period for pregnancy or birth-related claims.

If the policyholder had previous coverage under a similar policy, the pre-existing condition waiting period applies only to the unexpired part of the previous policy period. However, the full 12-month exclusion period applies to benefits not provided under the previous policy.

Liberty Essential Gap Cover vs Other Gap Cover Plans

| 🔎 Provider | 🥇 Liberty Essential Gap Cover | 🥈 Elixi Gap Single | 🥉 Discovery Health Gap Core |

| 🟥 Years in Operation | 66 years | 6 years | 31 years |

| 🟧 Underwriters | Guardrisk Life Limited (FSP 76) | Unity Health | Discovery Insure Ltd |

| 🟨 Market Share in South Africa | >25% | <5% | >56% |

| 🟩 Gap Cover Waiting Period | 12 months | 3 – 12 months | 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | R372 | R242 | R143 |

| 🟥 Oncology Benefit | None | None | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | None | None | ✅ Yes |

| 🟩 Maternity Benefit | None | None | ✅ Yes |

| 🟦 Scopes and Scans | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Co-payment Cover | None | None | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | None |

| 🟧 Accidental Cover | ✅ Yes | None | None |

| 🟨 Trauma Counseling | ✅ Yes | None | None |

| 🟩 Premium Waiver | ✅ Yes | None | None |

| 🟦 Non-DSP Co-Payment | None | None | None |

| 🟪 Prostheses | None | None | None |

| 🟥 Travel Cover Extender | None | None | None |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | None | ✅ Yes |

Our Verdict on Liberty Essential Medical Aid Gap Cover

According to our research, the Liberty Essential Gap Cover Plan is a suitable entry-level option, effectively covering various shortfalls. However, as a basic plan, it has limitations, and policyholders may encounter out-of-pocket expenses.

Liberty Essential Gap Cover Frequently Asked Questions

What is Liberty Essential Gap Cover?

Liberty Essential Gap Cover is an insurance plan offered by Liberty that helps cover the shortfall between medical scheme rates and actual medical expenses, providing financial protection against unexpected healthcare costs.

What does the Liberty Essential Gap Cover Plan cover?

The Liberty Essential Gap Cover Plan covers various medical shortfalls, including specialist fees, in-hospital costs, and certain outpatient treatments, depending on the specific policy terms and conditions.

Can I choose my healthcare providers with Liberty Essential Gap Cover?

Yes, you can choose your preferred healthcare providers, including specialists and hospitals, as long as they are within the network or meet the policy’s requirements.

Does Liberty Essential Gap Cover include coverage for pre-existing conditions?

Pre-existing conditions are generally not covered by the Liberty Essential Gap Cover plan. However, it is recommended to review the policy details as specific coverage may vary.

What are the waiting periods associated with Liberty Essential Gap Cover?

Liberty Essential Gap Cover may have waiting periods for certain benefits. Common waiting periods include those for pre-existing conditions, maternity-related expenses, and specific procedures.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans