- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Makoti Medical Aid Primary Option

Overall, the Makoti Medical Aid Primary Option is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and basic cover to up to 3 Family Members. The Makoti Medical Aid Primary Option starts from R355 ZAR.

| 👤 Main Member Contribution | R355 – R1,034 |

| 👥 Adult Dependent Contribution | R355 – R805 |

| 🍼 Child Dependent Contribution | R230 – R370 |

| 📉 Annual Limit | Unlimited hospital cover |

| ➡️ Hospital Cover | Unlimited |

| ↪️ Gap Cover | None |

| 💶 Prescribed Minimum Benefits | ☑️ Yes |

| 🟦 Screening and Prevention | ☑️ Yes |

| 🔵 Medical Savings Account | None |

| 💙 Maternity Benefits | ☑️ Yes |

Makoti Medical Scheme Primary Option – 7 Key Point Quick Overview

- ☑️ Makoti Medical Scheme Primary Option Overview

- ☑️ Makoti Medical Scheme Primary Option Contributions

- ☑️ Makoti Medical Scheme Primary Option Benefits and Cover Comprehensive Breakdown

- ☑️ Makoti Medical Scheme Primary Option Exclusions and Waiting Periods

- ☑️ Makoti Medical Scheme Primary Option vs Similar Plans from other Medical Schemes

- ☑️ Our Verdict on the Makoti Medical Scheme Primary Option

- ☑️ Makoti Medical Scheme Primary Option Frequently Asked Questions

Makoti Medical Scheme Primary Option Overview

The Makoti Medical Scheme Primary Option medical aid plan is one of 2, starting from R355, and includes basic cover for GPs, medicines, specialists, radiology, pathology, and more. Gap Cover is not available on the Makoti Medical Scheme Primary Option. However, Makoti offers 24/7 medical emergency assistance. According to the Trust Index, Makoti Medical Scheme has a trust rating of 2.7.

Makoti Medical Aid Scheme has two options namely Makoti Comprehensive Option and Makoti Primary Option

Makoti Medical Scheme Primary Option Contributions

| 💶 Income Bracket | 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| 💵 R0 – R3,240 | R355 | R355 | R230 |

| 💴 R3,241 – R6,966 | R376 | R376 | R253 |

| 💷 R6,967 – R9,720 | R837 | R689 | R308 |

| 💶 R9,271 – R12,960 | R897 | R725 | R331 |

| 💵 R12,961 – R17,280 | R964 | R771 | R350 |

| 💴 R17,281+ | R1,034 | R805 | R370 |

Makoti Medical Scheme Primary Option Benefits and Cover Comprehensive Breakdown

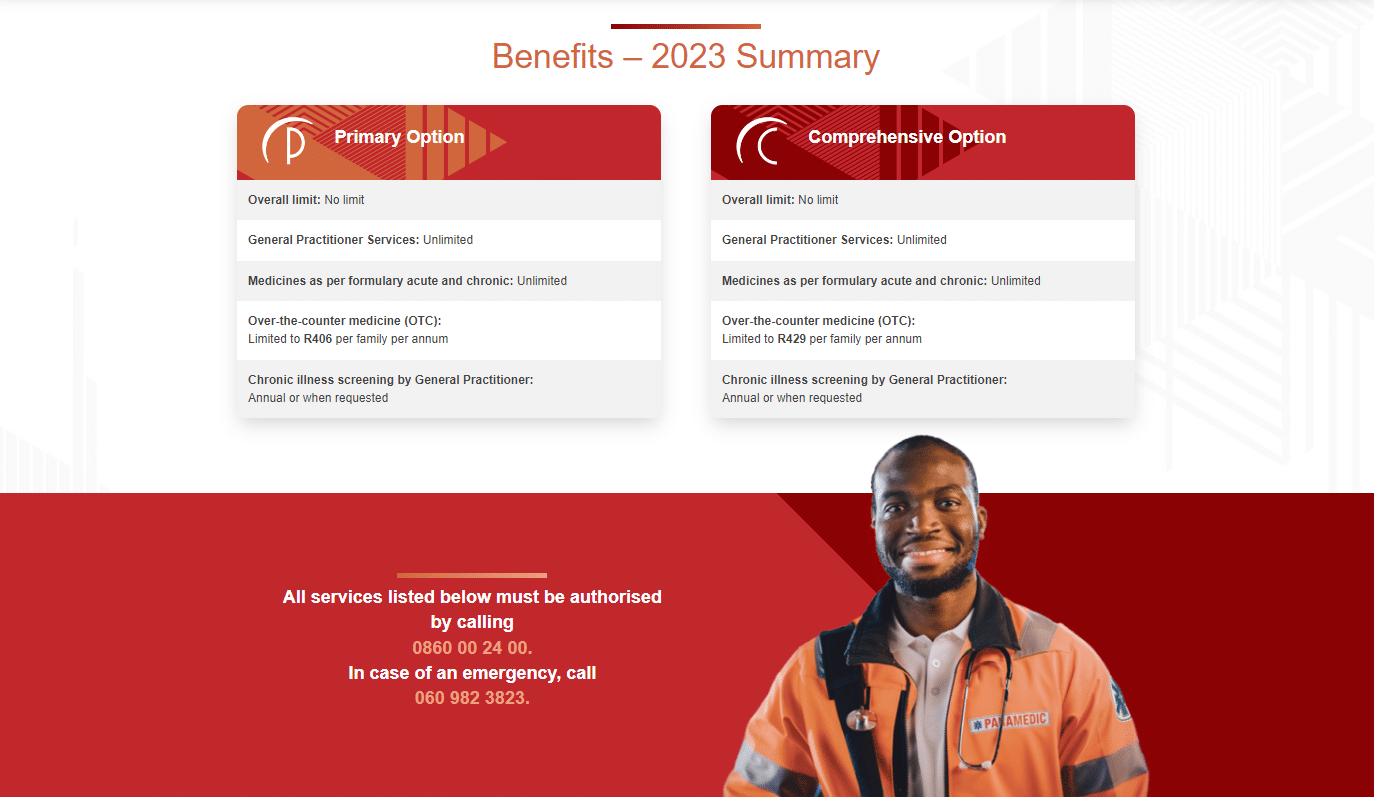

Primary Option Day-to-Day Benefits

| 🟥 General Practitioner Consultations | Unlimited primary healthcare from a chosen GP. Covered according to the Makoti Scheme tariff. |

| 🟧 Acute Medicine | Unlimited coverage according to the medication formulary. |

| 🟨 Chronic Medicine | Unlimited coverage according to the medication formulary. |

| 🟩 Over-the-Counter Medicine | Limited to R406 per family per year for generic medication. |

| 🟦 Specialist Consultations | Only PMBs are covered. Members must use State Hospitals. |

| 🟪 Pathology | The following tests are covered: Liquid base cytology (first) Vaginal or cervical smears (Pathology Anatomical Exfoliative cytology) Glucose Glycosylated Haemoglobin Haemoglobin Estimation Platelet count Quantitative Kahn, VDRL, or other flocculation Grouping A, B, and O antigens Grouping: Rh antigens Leucocytes |

| 🟥 Ambulance Services | Available only for emergencies. Makoti Medical Scheme uses Lifemed as the preferred provider. Transport is not offered for non-life-threatening situations. |

| 🟧 Optometry | Limited to R1,009 per beneficiary every 2 years. This will include the eye test, frames, and lenses. Pre-authorization is required. The cover is only provided where needed for correcting significant visual impairment. Replacement of lost glasses is not covered. |

| 🟨 Dentistry | Covers consultations, fillings, extractions, and preventative care according to managed care protocols. A registered and accredited dentist or dental therapist must provide dentistry services. Pre-authorization from the Dental Information Systems (Pty) Ltd is required. |

Primary Option In-hospital Benefits

| 🔴 In-hospital Benefits | Benefits are covered up to 100% of the Makoti tariff. Pre-authorization is required before admission. Risk managers review all admissions to optimize care. |

| 🟠 Services in State Hospitals | PMBs are covered up to 100% as authorized. |

| 🟡 Maternity | Confinement in a private hospital is covered up to R26,500. Pre-authorization is required in the second trimester of pregnancy. |

| 🟢 Internal Prostheses | Limited to R55,462 per family per year. |

Read more about Health Insurance

Makoti Medical Scheme Primary Option Exclusions and Waiting Periods

Makoti Medical Scheme Primary Option Exclusions

Makoti Medical Scheme will NOT cover the following costs unless it forms part of the Prescribed Minimum Benefits (PMBs):

- The treatment of obesity and its direct complications

- Items or treatments that are not medically indicated

- Willfully self-inflicted injuries

- Injuries arising from professional sports and speed contests

- The hire of medical, surgical, and other appliances

- The cost of surgical stockings

- Medical services provided by any person not registered with the Health Professions Council of South Africa, the South African Nursing Council, or the South African Pharmacy Council

- Recuperative holidays

- Dental extractions for non-medical purposes

- Gold inlays

- Unproven or experimental treatment

- Cosmetic and reconstructive surgery, treatment, or appliances

- Frail care and convalescence

- Employee medical examinations initiated by an employer

- Injuries where another party is responsible for the costs (e.g., Road Accident Fund or Workmen’s Compensation claims)

- Roaccutane and Retin A for the treatment of skin conditions

- Contraceptives and contraceptive devices

- Member-related traveling expenses

and many more.

Discover the 5 Best Comprehensive Medical Aid Plans

Makoti Medical Scheme Primary Option Waiting Periods

Makoti Medical Scheme may apply waiting periods to individuals applying for membership or as a dependent and who were not part of a medical scheme for at least 90 days before the date of application. This includes a general waiting period of up to three months and a condition-specific waiting period of up to 12 months.

Medical Aid Comparisons : Makoti Medical Scheme Primary Option vs Similar Plans from other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 Makoti Medical Scheme Primary Option | 🥈 Momentum Ingwe Plan | 🥉 Fedhealth myFed |

| 👤 Main Member Contribution | R355 – R1,034 | R541 | R1,590 – R4,676 |

| 👥 Adult Dependent Contribution | R355 – R805 | R541 | R1,590 – R4,260 |

| 🍼 Child Dependent Contribution | R230 – R370 | R466 | R677 – R1,782 |

| 📉 Annual Limit | Unlimited hospital cover | None | Unlimited Hospital Cover |

Our Verdict on the Makoti Medical Scheme Primary Option

The Makoti Medical Scheme Primary Option is a hospital plan that offers comprehensive cover for hospitalization and related medical expenses. The plan is designed for individuals who require affordable healthcare coverage for unexpected medical events. The Primary Option offers benefits such as in-hospital treatment for various conditions, including chronic conditions and emergency medical care. Members are also covered for prescribed minimum benefits and day-to-day medical expenses, subject to certain terms and conditions. One of the drawbacks of the Primary Option is that it may not provide adequate cover for individuals with pre-existing conditions or those who require regular medical care. Additionally, the plan may not cover all medical expenses and may have certain exclusions and restrictions.

You might also like: Makoti Medical Aid

You might also like: Makoti Comprehensive Option

Makoti Medical Scheme Primary Option Frequently Asked Questions

What is the Makoti Medical Scheme Primary Option?

The Primary Option is a hospital plan offered by Makoti Medical Scheme that provides affordable cover for hospitalization and related medical expenses.

What medical expenses are covered by the Makoti Medical Scheme Primary Option?

The Primary Option covers in-hospital treatment for various conditions, including chronic conditions, emergency medical care, and prescribed minimum benefits.

Does the Makoti Medical Scheme Primary Option cover pre-existing conditions?

The Primary Option, subject to certain terms and conditions, may cover pre-existing conditions.

How much must I pay for the Makoti Medical Scheme Primary Option?

The contribution rates for the Primary Option vary depending on your membership level and the income bracket of the main member.

How long does it take for claims to be processed by Makoti Medical Scheme?

Makoti Medical Scheme is known for speedy claims processing, with most claims processed within 5 working days.

Can I choose my doctor with the Makoti Medical Scheme Primary Option?

The Primary Option allows members to choose their healthcare providers, subject to certain terms and conditions.

What geographic areas does Makoti Medical Scheme operate in?

Makoti Medical Scheme operates in specific provinces within South Africa, including Gauteng, Limpopo, Northwest, and Mpumalanga.

Does the Makoti Medical Scheme Primary Option cover emergency medical care?

Yes, the Primary Option covers emergency medical care, subject to certain terms and conditions.

What are the benefits of the Makoti Medical Scheme Primary Option?

The Primary Option offers affordable healthcare coverage for unexpected medical events, in-hospital treatment for various conditions, and coverage for prescribed minimum benefits.

How can I contact customer support at Makoti Medical Scheme?

You can contact Makoti Medical Scheme customer support by telephone, email, online chat, contact form, or postal address.

What are the drawbacks of the Makoti Medical Scheme Primary Option?

The Primary Option may not cover individuals with pre-existing conditions or requiring frequent medical care. Additionally, the plan may have certain exclusions and restrictions.

What is the claims process for the Makoti Medical Scheme Primary Option?

Members can complete the claim form and submit it along with supporting documentation to Makoti Medical Scheme to submit a claim. Claims are processed within a few working days.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans