- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Makoti Medical Aid Comprehensive Option

Overall, the Makoti Medical Scheme Comprehensive Option is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and auxiliary benefits to up to 3 Family Members. The Makoti Medical Scheme Comprehensive Option starts from R2,449 ZAR.

| 👤 Main Member Contribution | R2,449 – R3,349 |

| 👥 Adult Dependent Contribution | R2,110 – R2,870 |

| 🍼 Child Dependent Contribution | R814 – R1,089 |

| ↪️ Gap Cover | None |

| 📉 Annual Limit | Unlimited hospital cover |

| ☑️ Hospital Cover | Unlimited |

| ➡️ Oncology Cover | PMB Level of Care |

| 💶 Prescribed Minimum Benefits | ☑️ Yes |

| 🔁 Screening and Prevention | ☑️ Yes |

| 🔍 Medical Savings Account | None |

Makoti Medical Scheme Comprehensive Option – 7 Key Point Quick Overview

- ☑️ Makoti Medical Scheme Comprehensive Option Overview

- ☑️ Makoti Medical Scheme Comprehensive Option Contributions

- ☑️ Makoti Medical Scheme Comprehensive Option Benefits and Cover Comprehensive Breakdown

- ☑️ Makoti Medical Scheme Comprehensive Option Exclusions and Waiting Periods

- ☑️ Makoti Medical Scheme Comprehensive Option vs Similar Plans from other Medical Schemes

- ☑️ Our Verdict on the Makoti Medical Scheme Comprehensive Option

- ☑️ Makoti Medical Scheme Comprehensive Option Frequently Asked Questions

Makoti Medical Scheme Comprehensive Option Overview

The Makoti Medical Scheme Comprehensive Option is one of 2, starting from R2,449 and includes cover for clinical psychology, hearing aids, external and internal prostheses, auxiliary benefits, COVID-19, and more. Gap Cover is not available on the Makoti Medical Scheme Comprehensive Option. However, Makoti offers 24/7 medical emergency assistance. According to the Trust Index, Makoti Medical Scheme has a trust rating of 2.7.

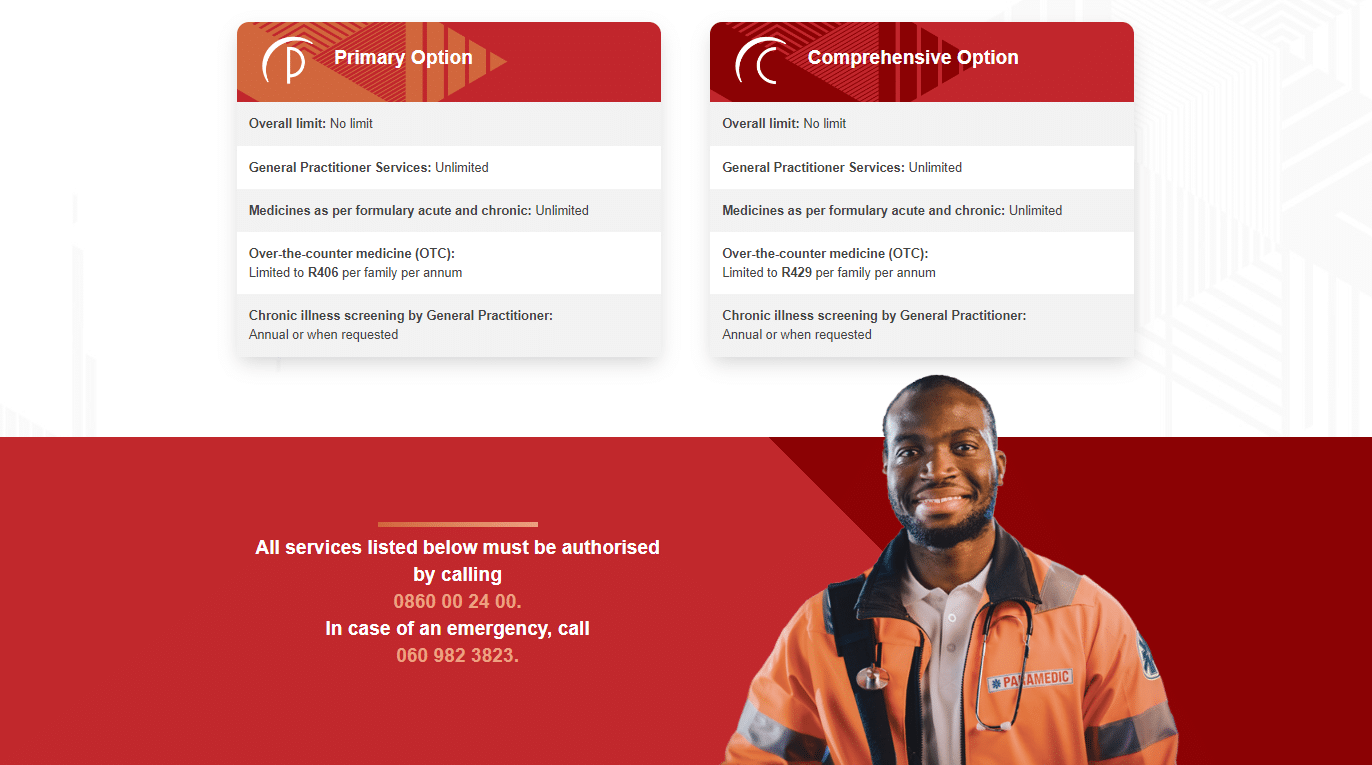

Makoti Medical Aid Scheme has two options namely Makoti Comprehensive Option and Makoti Primary Option

Makoti Medical Scheme Comprehensive Option Contributions

| 💶 Income Bracket | 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| 💴 R0 – R10,082 | R2,449 | R2,110 | R814 |

| 💵 R10,083 – R13,352 | R2,832 | R2,358 | R923 |

| 💷 R13,353 – R17,712 | R3,053 | R2,564 | R991 |

| 💶 R17,713+ | R3,349 | R2,870 | R1,089 |

Makoti Medical Scheme Comprehensive Option Benefits and Cover Comprehensive Breakdown

Comprehensive Option Day-to-Day Benefits

| 👩⚕️ General Practitioner Consultations | Unlimited primary healthcare from a chosen GP. Covered according to the Makoti Scheme tariff. |

| ☑️ Medicines | – |

| 💊 Acute Medicine | Unlimited coverage according to the medication formulary. |

| 💉 Chronic Medicine | Unlimited coverage according to the medication formulary. |

| 📌 Over-the-Counter Medicine | Limited to R429 per family per year for generic medication. |

| 👨⚕️ Specialist Consultations | Subject to pre-authorization. A referral from a GP is required. |

| 🧪 Pathology | Subject to pre-authorization. A referral from a GP is required. |

| 🚑 Ambulance Services | Available only for emergencies. Makoti Medical Scheme uses Lifemed as the preferred provider. Transport is not offered for non-life-threatening situations. |

| 🤓 Optometry | Limited to R2,774 per beneficiary every 2 years. This will include the eye test, frames, and lenses. Pre-authorization is required. The cover is only provided where needed for correcting significant visual impairment. Replacement of lost glasses is not covered. |

| ☑️ Dentistry | – |

| 🦷 Basic Dentistry | Covers consultations, fillings, extractions, and preventative care according to managed care protocols. A registered and accredited dentist or dental therapist must provide dentistry services. Pre-authorization from the Dental Information Systems (Pty) Ltd is required. |

| 📍 Advanced Dentistry | Limited to R3,749 per family per year. Includes root canal treatment and periodontal treatment. A registered and accredited dentist or dental therapist must provide dentistry services. Pre-authorization from the Dental Information Systems (Pty) Ltd is required. |

Comprehensive Option In-hospital Benefits

| 🟥 In-hospital Benefits | Benefits are covered up to 100% of the Makoti tariff. Pre-authorization is required before admission. Risk managers review all admissions to optimize care. |

| 🟧 Private Hospital Benefit | Makoti offers unlimited hospitalization in private hospitals. Step-down benefits are available if medically appropriate. Pre-authorization applies. Clinical protocols apply. The benefit is subject to PMBs. |

| 🟨 Maternity | Confinement is covered in any private hospital. |

Discover more about the Advantages of Hospital Plans

Comprehensive Option Other Services

| 🧠 Clinical Psychology | Limited to eight consultations per family per year. Must be referred by a GP. Pre-authorization is required. |

| 🦻 Hearing Aids | Limited to R3,634 per beneficiary every 4 years. Pre-authorization is required. |

| 🦾 External Prostheses and Appliances | Limited to R3,596 per family per year for the following: Wheelchairs Walking frames Crutches Home Oxygen Glucometers are limited to R390 per member every 2 years. Pre-authorization and clinical protocols apply. |

| 🦿 Internal Prostheses | Limited to R55,462 per family per year. Subject to pre-authorization. Clinical protocols will apply. Cardiac stents are limited to 3 stents (1 per lesion) |

| 🅰️ Back and Neck Program | Subject to clinical protocols. |

Read more about medical aid plans that cover Glaucoma

Comprehensive Option Auxiliary Services

| 📌 Allied Healthcare Services Physiotherapy Occupational Therapy Dieticians Speech Therapy Podiatry | Limited to 20 consultations per family per year. Subject to pre-approval and clinical protocols. |

| 📍 Oncology Chemotherapy Radiotherapy Radiology Related Consultations Pathology | Limited to the PMB level of care. It must be according to an authorized ICON treatment plan. Biologicals and Brachytherapy materials are not covered. |

| 🅰️ COVID-19 Vaccines | Tests and vaccinations are according to Scheme protocol. |

| 🅱️ Immunisation/Vaccinations | One flu vaccine per beneficiary per year. One HPV vaccine for female beneficiaries between 9 and 27. One pneumococcal vaccination for all immune-compromised beneficiaries and those older than 65 years every 5 years. |

| ❤️ Organ Transplants and Kidney Dialysis | Subject to PMBs. Clinical protocols will apply. Pre-approval is required. |

| 🩸 Emergency Room or Casualty visits | Only covers life-threatening emergencies. |

You might like the 10 Best Medical Aids in South Africa

Makoti Medical Scheme Comprehensive Option Exclusions and Waiting Periods

Makoti Medical Scheme Comprehensive Option Exclusions

Makoti Medical Scheme will NOT cover the following costs unless it forms part of the Prescribed Minimum Benefits (PMBs):

- The treatment of obesity and its direct complications

- Items or treatments that are not medically indicated

- Willfully self-inflicted injuries

- Injuries arising from professional sports and speed contests

- The hire of medical, surgical, and other appliances

- The cost of surgical stockings

- Medical services provided by any person not registered with the Health Professions Council of South Africa, the South African Nursing Council, or the South African Pharmacy Council

- Recuperative holidays

- Dental extractions for non-medical purposes

- Gold inlays

- Unproven or experimental treatment

- Cosmetic and reconstructive surgery, treatment, or appliances

- Frail care and convalescence

- Employee medical examinations initiated by an employer

- Injuries where another party is responsible for the costs (e.g., Road Accident Fund or Workmen’s Compensation claims)

- Roaccutane and Retin A for the treatment of skin conditions

- Contraceptives and contraceptive devices

and many more.

Makoti Medical Scheme Comprehensive Option Waiting Periods

Makoti Medical Scheme may apply waiting periods to individuals applying for membership or as a dependent and who were not part of a medical scheme for at least 90 days before the date of application. This includes a general waiting period of up to three months and a condition-specific waiting period of up to 12 months.

POLL: 5 Best Medical Aids under R1500

Makoti Medical Scheme Comprehensive Option vs Similar Plans from other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 Makoti Medical Scheme Comprehensive Option | 🥈 Sizwe Hosmed Gold Ascend | 🥉 CompCare MEDX |

| 👤 Main Member Contribution | R2,449 – R3,349 | R3,418 | R3,428 |

| 👥 Adult Dependent Contribution | R2,110 – R2,870 | R3,282 | R3,172 |

| 🍼 Child Dependent Contribution | R814 – R1,089 | R944 | R1,107 |

| 📉 Annual Limit | Unlimited hospital cover | Unlimited Hospital Cover | Unlimited |

| 💙 Hospital Cover | Unlimited | Unlimited for PMBs | Unlimited |

Our Verdict on the Makoti Medical Scheme Comprehensive Option

The Makoti Medical Scheme Comprehensive Option is a health insurance plan providing policyholders with extensive coverage for various medical expenses. The plan is designed to cater to the needs of individuals and families looking for comprehensive medical insurance that covers a wide range of medical treatments and services. One of the stand-out features of this plan is that it offers unlimited hospital coverage, which means that policyholders can access private hospital care without worrying about hitting a cap. Additionally, the plan covers a wide range of healthcare services, including specialist consultations, diagnostic tests, and surgical procedures, making it a comprehensive option for those seeking a comprehensive medical aid plan.

In terms of benefits, the plan offers several value-added services, including emergency medical assistance, trauma counseling, and chronic medication management. Policyholders will also have access to a network of healthcare providers, which may help them save on healthcare expenses. Furthermore, the scheme provides comprehensive coverage for chronic conditions, such as diabetes and hypertension, making it an attractive option for those with pre-existing medical conditions. However, it is important to note that the plan has certain drawbacks. For example, the scheme has several waiting periods for certain procedures and services, which may limit access to care for some policyholders.

Additionally, the plan may be relatively expensive compared to other medical insurance options, making it less accessible for some individuals and families.

You might also like: Makoti Medical Aid

You might also like: Makoti Primary Option

Makoti Medical Scheme Comprehensive Option Frequently Asked Questions

What is Makoti Medical Scheme?

Makoti Medical Scheme is a South African health insurance provider that offers various healthcare plans to individuals and families.

What is Makoti Comprehensive Option?

Makoti Comprehensive Option is a medical aid plan that provides comprehensive coverage for medical expenses, including hospital coverage, chronic conditions, and a range of healthcare services.

What does the Makoti Comprehensive Option cover?

Makoti Comprehensive Option covers hospital expenses, specialist consultations, diagnostic tests, surgical procedures, chronic conditions, and value-added services such as trauma counseling and emergency medical assistance.

Does Makoti Comprehensive Option have waiting periods?

Yes, Makoti Comprehensive Option has waiting periods for certain procedures and services, which may limit access to care for some policyholders.

Are there network providers available with Makoti Comprehensive Option?

Yes, policyholders will have access to a network of healthcare providers, which may help them save on healthcare expenses.

Does Makoti Comprehensive Option cover chronic conditions?

Yes, the plan provides comprehensive coverage for chronic conditions such as diabetes and hypertension.

Does Makoti Comprehensive Option cover maternity expenses?

Yes, the option covers maternity expenses, including consultations and prenatal care.

Does Makoti Comprehensive Option cover dental expenses?

Yes, Makoti Comprehensive covers conservative and specialized dentistry up to a certain limit.

Does Makoti Comprehensive Option have a deductible?

No, the plan does not have a deductible.

What are the benefits of the Makoti Comprehensive Option?

The benefits of the Makoti Comprehensive Option include unlimited hospital cover, comprehensive coverage for various healthcare services, value-added services such as trauma counseling and emergency medical assistance, and coverage for chronic conditions.

How much does the Makoti Comprehensive Option cost?

The cost of Makoti Comprehensive starts from R2,268. It will depend on the Main Member’s income bracket and the number of people on their medical aid.

Can I customize my coverage with Makoti Comprehensive Option?

Yes, policyholders can customize their coverage by selecting optional benefits and adjusting their level of coverage.

Can I switch to Makoti Comprehensive Option from another health insurance provider?

Yes, policyholders can switch to Makoti Comprehensive Option from another health insurance provider, subject to certain conditions.

How do I claim with Makoti Comprehensive Option?

Policyholders can claim with Makoti Comprehensive Option by submitting a claim form and supporting documents to the scheme.

How do I enroll in Makoti Comprehensive Option?

To enroll in Makoti Comprehensive Option, individuals and families can visit the Makoti Medical Scheme website, complete an application form, and submit it with the required supporting documents.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans