- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

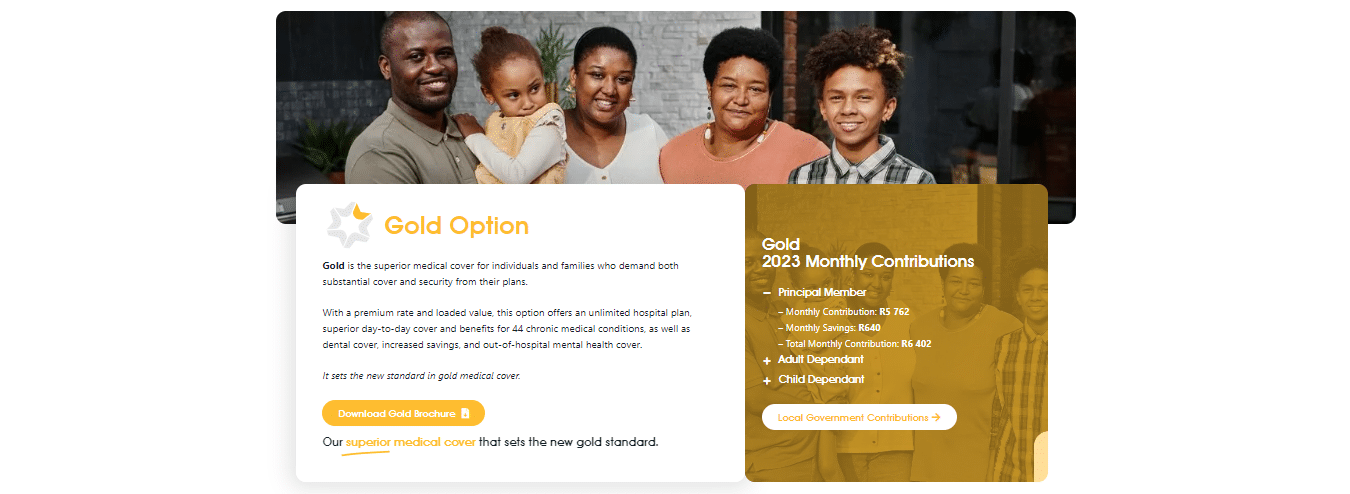

KeyHealth Gold Medical Aid Plan

Overall, the KeyHealth Gold Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and covers 44 chronic medical conditions for up to 3 Family Members. The KeyHealth Gold Medical Aid Plan starts from R7,036 ZAR.

| 👤 Main Member Contribution | R7,036 |

| 👥 Adult Dependent Contribution | R4,758 |

| 🍼 Child Dependent Contribution | R1,382 |

| 🌎 International Cover | ☑️ Yes |

| 🔁 Gap Cover | ☑️ Yes |

| 💶 Prescribed Minimum Benefits | ☑️ Yes |

| 📉 Screening and Prevention | ☑️ Yes |

| 💙 Medical Savings Account | ☑️ Yes |

| 👶 Maternity Benefits | ☑️ Yes |

| ⚕️ Hospital Cover | Unlimited |

KeyHealth Gold Plan – 9 Key Point Quick Overview

- ☑️ KeyHealth Gold Plan Overview

- ☑️ KeyHealth Gold Plan Contributions and Medical Savings

- ☑️ Gold Plan Benefits and Cover Comprehensive Breakdown

- ☑️ KeyHealth Health Booster

- ☑️ KeyHealth Smart Baby Program

- ☑️ Gold Plan Exclusions and Waiting Periods

- ☑️ KeyHealth Gold Plan vs. Similar Plans from other Medical Schemes

- ☑️ Our Verdict on The Gold Plan

- ☑️ Gold Plan Frequently Asked Questions

KeyHealth Gold Plan Overview

The KeyHealth Gold medical aid plan is one of 6, starting from R7,036 and includes a medical savings account, cover for 44 chronic medical conditions, out-of-hospital mental health cover, higher day-to-day limits, and more. Gap Cover is available on the KeyHealth Gold Plan, along with 24/7 medical emergency assistance. According to the Trust Index, KeyHealth has a trust rating of 4.1.

KeyHealth offers 6 medical aid plans:

- ✅ KeyHealth Essence Medical Aid Plan

- ✅ KeyHealth Origin Medical Aid Plan

- ✅ Keyhealth Equilibrium Medical Aid Plan

- ✅ Keyhealth Silver Medical Aid Plan

- ✅ Keyhealth Gold Medical Aid Plan

- ✅ Keyhealth Platinum Medical Aid Plan

KeyHealth Gold Plan Contributions and Medical Savings

Contributions

| 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| R7,036 | R4,758 | R1,382 |

Medical Savings

| 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| R703 per month | R475 per month | R138 per month |

| R8,436 per year | R5,700 per year | R1,656 per year |

POLL: 5 Best Medical Aids under R500

Gold Plan Benefits and Cover Comprehensive Breakdown

Gold Plan Major Medical Benefits

| 📌 Hospitalization Varicose vein surgery Facet joint injections Hysterectomy Rhizotomy Reflux surgery Back and Neck Surgery (including spinal fusion) Joint Replacement | Unlimited cover up to 100% of the agreed tariff. |

| 🏥 Private Hospital Admissions | Unlimited cover. Covered up to 100% of the agreed tariff. Subject to using DSP hospitals. A 30% co-payment will apply when using a non-DSP hospital. |

| 🚑 State Hospital Admissions | Unlimited covers up to 100% of the agreed tariff. |

| 👨⚕️ Specialist and Anesthetist Services | Covered up to 100% of the medical scheme tariff. Unlimited cover, subject to using a DSP. |

| 💊 Medication upon discharge | Limited to R575 per admission. Covered up to 100% of the medical scheme tariff. |

| 💖 Maternity | Covered up to 100% of the medical scheme tariff. Private ward access for three days for natural birth. |

| ⚕️ Major Medical Occurrences Sub-acute facilities and wound care Hospice Private Nursing Rehabilitation Step-down Facilities Wound Care | Limited to R43,600 per family per year. Covered up to 100% of the medical scheme tariff. Pre-approval is needed. Subject to case management and scheme protocols. Wound care is included up to R14,300 as a combined in and out-of-hospital benefit. Only PMBs are covered. |

| ❤️ Organ Transplants (Solid Organs, Tissue, and Corneas) Hospitalization Harvesting Drugs for Immuno-Suppressive Therapy | Covered up to 100% of the medical scheme tariff. Pre-approval is needed. Subject to case management. Only PMBs are covered in DSP hospitals. |

| ☑️ Renal Dialysis | Covered up to 100% of the medical scheme tariff. Pre-approval is needed. Subject to case management and scheme protocols. Only PMBs are covered. |

| ✅ Oncology | Covered up to 100% of the medical scheme tariff. Covered up to R433,500 per family per year. Pre-approval is needed. Subject to case management and scheme protocols. Must use a DSP for treatment. |

| 🅰️ Palliative Care | Covered up to 100% of the medical scheme tariff. Available instead of hospitalization. Pre-approval is needed. Subject to case management and scheme protocols. |

| 🅱️ Radiology | Covered up to 100% of the medical scheme tariff. Pre-approval is needed for specialized radiology (MRI, CT) Hospitalization is not covered if hospitalization admission is for investigative purposes. Day-to-day benefits cover investigative admissions. |

| 🩺 MRI and CT scans | Limited to R17,800 per family per year. Combined in and out-of-hospital cover. |

| ❎ X-Rays | Unlimited cover. |

| ➡️ PET scans | Two scans per beneficiary per year. Limited to R25,200 per scan. |

| 📊 Pathology | Covered up to 100% of the medical scheme tariff. Unlimited cover. |

Gold Plan Out-of-Hospital Benefits

| 📌 Routine Medical Expenses GP and Specialist Consultations Radiology Prescribed and OTC medicine Optical and Auxiliary services | Covered up to 100% of the medical scheme tariff. Annual Medical Savings available: Main Member – R7,164 Adult Dependent – R4,848 per year Child Dependent – R1,404 per year Additional day-to-day benefits: Main Member – R5,380 per year Adult Dependent – R4,010 per year Child Dependent – R1,290 per year |

| 💊 Over-the-counter medicine | Limited to R2,200 per family per year. Covered up to 100% of the medical scheme tariff. Paid from Medical Savings Account (MSA). Subject to the day-to-day benefit and limit. |

| 👓 Over-the-counter reading glasses | Limited to R200 per family per year. Limited to one pair per year. Paid from Medical Savings Account (MSA). Subject to the day-to-day benefit and limit. |

| 📈 Pathology | Covered up to 100% of the medical scheme tariff. Paid from Medical Savings Account (MSA). Subject to the day-to-day benefit and limit. |

| 🤓 Optical Services | Limited to R3,380 per family every two years. Subject to the MSA and day-to-day benefits. Covered up to 100% of the medical scheme tariff. Optical management will apply. Confirmation of benefit is required. |

| ☑️ Frames | Limited to R1,070 per frame. Limited to one frame per beneficiary every 2 years. Covered up to 100% of the medical scheme tariff. Subject to the overall optical benefit. |

| ✅ Lenses | Limited to one pair per beneficiary every two years. Covered up to 100% of the medical scheme tariff. Subject to the overall optical benefit. |

| ✳️ Contact Lenses | Limited to R1,600 per beneficiary per year. Covered up to 100% of the medical scheme tariff. Subject to the overall optical benefit. |

| 👁️ Refractive Surgery | Subject to pre-approval and the overall optical benefit. |

| 🦷 Conservative Dentistry | Subject to DENIS protocols. Managed care interventions and Scheme rules apply. Scheme Exclusions will apply. |

| 👨⚕️ Consultations | Covered up to 100% of the medical scheme tariff. Two check-ups per beneficiary per year. Three specific (emergency) consultations per beneficiary per year. |

| ❎ Intra-oral X-Rays | Four intra-oral radiographs per beneficiary per year. Covered up to 100% of the medical scheme tariff. |

| ❎ Extra-oral X-Rays | One extra-oral x-ray per beneficiary per year. Covered up to 100% of the medical scheme tariff. |

| 😷 Preventative Care | Two scale and polish treatments per beneficiary per year. Covered up to 100% of the medical scheme tariff. |

| 🦷 Fillings | One per tooth every 720 days. Covered up to 100% of the medical scheme tariff. Multiple fillings require a treatment plan and X-rays. Retreatment is subject to clinical protocols. |

| 🪥 Tooth Extractions and root canal treatment | Root canal therapy on primary (milk) teeth, wisdom teeth (third molars), and direct or indirect pulp capping is excluded from treatment on this benefit. Covered up to 100% of the medical scheme tariff. |

| 📌 Plastic Dentures | One set per beneficiary per year. DENIS pre-approval is required. |

| 📍 Partial Chrome Cobalt Frame Dentures | Limited to 1 partial metal frame per beneficiary every 5 years. DENIS pre-approval is required. Covered up to 100% of the medical scheme tariff. |

| 👑 Crowns and Bridges | Limited to 1 tooth per beneficiary every 5 years. DENIS pre-approval is required. Covered up to 100% of the medical scheme tariff. |

| ➡️ Implants | Paid from funds available in the MSA. |

| 📊 Orthodontics (non-cosmetic and only treatment) | Covered up to 100% of the medical scheme tariff. DENIS approval is required. Cases are assessed using orthodontic indices where the function is impaired. Only one beneficiary per family can receive treatment once a year. Limited to beneficiaries between 9 and 18. |

| 😊 Maxillo-Facial and Oral Surgery | Covered up to 100% of the medical scheme tariff. DENIS protocols and Scheme rules apply. Exclusions will apply according to scheme rules. |

| ⬇️ Surgery in Dental Chair | Covered up to 100% of the medical scheme tariff. DENIS pre-authorization is required. Only covers the removal of impacted teeth. |

| 💤 Surgery in-hospital with general anesthesia | DENIS pre-authorization is required. |

| 😴 Hospitalization and Anaesthesia | DENIS protocols and Scheme rules apply. Subject to managed care interventions. Certain exclusions will apply according to scheme rules. |

| 💉 Hospitalization and general anesthesia | Covered up to 100% of the medical scheme tariff. DENIS pre-authorization is required. Only covers the removal of impacted teeth. Limited to extensive dental treatment for children <5. |

| ☑️ Inhalation sedation in dental rooms | Covered up to 100% of the medical scheme tariff. DENIS pre-authorization is not required. |

| ✅ Moderate/deep sedation in dental rooms | Covered up to 100% of the medical scheme tariff. DENIS pre-authorization is required. Limited to extensive dental treatment. |

Discover the 5 Best Hospital Plans for Domestic Workers

KeyHealth Gold Chronic Benefits

| 🅰️ Category A CDL | Covered up to 100% of the medical scheme tariff. Unlimited cover. Subject to reference pricing and protocols. Beneficiaries must register on the Disease Risk Program. |

| 🅱️ Category B (Other) | Covered up to 100% of the medical scheme tariff. Limited to R9,200 per family per year. Subject to the chronic benefit. |

Gold Plan falls within Category A of the CDL of KeyHealth and covers a selection of conditions including:

- ✅ Addison’s Disease

- ✅ Ulcerative colitis

- ✅ Asthma

- ✅ Bipolar Mood Disorder

- ✅ Bronchiectasis

- ✅ Cardiac Failure

- ✅ Cardiomyopathy Disease

- ✅ Chronic Renal Disease

- ✅ Coronary Artery Disease

- ✅ Crohn’s Disease

- ✅ Chronic Obstructive Pulmonary Disorder

Gold Plan covers additional non-PMB/CDL conditions including:

- 👍🏽Acne

- 👍🏽 Allergic Rhinitis

- 👍🏽 Benign Prostatic Hypertrophy

- 👍🏽 Diverticulitis and Irritable Bowel Syndrome

- 👍🏽 Gastroesophageal Reflux Disease

- 👍🏽 Hypoparathyroidism

- 👍🏽 Hyperkinesis (attention deficit disorder)

- 👍🏽 Hyperthyroidism

- 👍🏽 Iron deficiency anemia

- 👍🏽 Major Depression

Gold Plan Supplementary Benefits

| 📌 Psychiatric Treatment | Limited to R43,600 per family per year. Covered up to 100% of the medical scheme tariff. Pre-approval is required. Subject to case management. Out-of-hospital is only covered up to R17,800. |

| 🩸 Blood Transfusions | Unlimited cover. Covered up to 100% of the medical scheme tariff. Pre-approval required. |

| 🦾 Prostheses Internal External Fixation Devices Implanted Devices | Limited to R50,500 per family per year. Covered up to 100% of the medical scheme tariff. Pre-approval is required, and it is subject to case management. Covered according to reference pricing. Scheme protocols will apply, and beneficiaries must use a preferred provider. |

| ⚕️ Document-Based Care (DBC) for back and neck | Covers conservative back and neck treatment instead of surgery. Covered up to 100% of the medical scheme tariff. Requires pre-authorization and will be subject to case management and scheme protocols. Only approved DBC facilities can be used. Only PMBs are covered. |

| ➡️ HIV/AIDS | Unlimited cover. Covered up to 100% of the medical scheme tariff. Must be registered with the Chronic Disease Risk Program (LifeSense) |

| 🚑 Ambulance Services | Subject to protocols. Covered up to 100% of the medical scheme tariff. |

| 👩🏻🦼 Medical Appliances Wheelchairs Orthopaedic Appliances Incontinence Equipment | Limited to R9,700 per family per year. Covered up to 100% of the medical scheme tariff. Combined benefits for in and out-of-hospital. Subject to quantities and protocols. |

| 🫁 Oxygen Nebulizers Glucometer Blood Pressure Monitor | Pre-approval is required and will be subject to approval. |

| 🦻 Hearing Aids | Limited to R17,250 per beneficiary every 5 years. Covered up to R8,650 maximum per ear. Covered up to 100% of the medical scheme tariff. |

| 💛 Hearing Aid Maintenance | Covered up to 100% of the medical scheme tariff. |

| ⬇️ Endoscopic Procedures (Scopes) | Covered up to R1,085 per beneficiary per year. Covered up to 100% of the medical scheme tariff. |

| ☑️ Colonoscopy or gastroscopy | Pre-approval is required. Co-payments do not apply when using a DSP hospital and specialist for out-of-hospital services for PMB. |

| ✅ All other procedures | Pre-approval is required. Co-payments do not apply when using a DSP hospital and specialist for out-of-hospital services for PMB. |

You might like Best Medical Aids in South Africa Covering Braces

KeyHealth Health Booster

The KeyHealth health booster provides members additional benefits for preventative treatment. This includes free screening tests, among several other features, as seen in the benefits table below.

| 🍼 Baby Immunisation | Child dependents <6 years. According to the Department of Health schedule. |

| 💉 Flu Vaccination | All beneficiaries are covered. |

| 😷 COVID-19 Vaccination | All beneficiaries are covered. |

| 📌 Tetanus-Diphtheria Injection | All beneficiaries are covered when needed. |

| Pneumococcal Vaccination | All beneficiaries are covered. |

| 📍 Malaria Medication | All beneficiaries are covered. Limited to R440 per year. |

| ☑️ HPV vaccination | Two doses per lifetime for female beneficiaries between 9 and 14. |

| 👶 Baby Growth Assessment | Three yearly assessments at a pharmacy or baby clinic for babies <35 months. |

| 🩹 Contraceptive Medication – Tablets and Patches | Limited to R175 every 20 days. Female beneficiaries 16> |

| 💉 Contraceptive Medication – Injectables | Limited to R270 every 20 days. Female beneficiaries 16> |

| 🅰️ Pap Smear (Pathology) | Once per year. Female beneficiaries 15> |

| 🅱️ Pap Smear Consultation Pelvic Organs Ultrasound | Once per year. Female beneficiaries 15> |

| 📈 Mammogram | Once per year. Female beneficiaries 40> |

| Prostate Specific Antigen (PSA) | Once per year. Male beneficiaries 40> |

| 📉 HIV/AID Tests | Once per year. All beneficiaries are covered. |

| 📊 Health Assessment Body Mass Index (BMI) Blood Pressure Measurement Cholesterol Test (Finger prick) Blood Sugar Test (Finger prick) PSA (Finger Prick) | Once per year. All beneficiaries are covered. |

| 💛 Weight Loss Program | Beneficiaries with a BM of 30> will receive the following: Three dietician consultations (one per week) One biokinetics consultation. Three additional dietician consultations per week if a weight loss chart was received, proving weight loss after the first three weeks. One follow-up with biokinetics. |

| 👨⚕️ Antenatal Visits to a GP, Gynaecologist, or midwife and a Urine Test | Pre-notification and pre-approval are needed. Twelve visits are covered. |

| 🎀 Ultrasounds – one before the 24th week and one after | Pre-notification and pre-approval are needed. Limited to two scans per pregnancy. |

| 💶 Short Payments / Co-payments for services rendered and birthing fees | Covered up to 1,290 per pregnancy. |

| 🚼 Paediatrician Visits | The baby must be registered on the scheme. Limited to 2 visits within the baby’s first year and one in the second year. |

| 🩺 Antenatal Vitamins | Limited to R2,180 per pregnancy. |

| 🧡 Antenatal Classes | Limited to R2,180 for the first pregnancy. |

You might consider

KeyHealth Smart Baby Program

The Smart Baby Programme by KeyHealth provides expecting mothers and fathers with general guidance and support on health and well-being throughout the pregnancy while ensuring peace of mind.

Smart Baby Program Features

- ✅ Coverage under Health Booster for antenatal visits (GP, gynecologist, or midwife), scans, and birthing fees that require short/co-payments.

- ✅ Provision of KeyHealth’s maternity benefits and instructions on how to access them.

- ✅ The New Baby and Childcare Handbook, authored by Marina Petropulos, is specifically for first-time parents.

- ✅ Information on the initial year of the baby’s life, including vaccinations, Easy-ER, and other details.

- ✅ Availability of Netcare 911’s 24-hour Health-on-Line service at 082 911 for medical advice and insights from a registered nurse.

Smart Baby Program Benefits

The Smart Baby Programme benefits accessible to women (and babies) are distinct from day-to-day benefits and medical savings accounts.

| 🍼 Antenatal visits | Twelve visits, one of which is after the birth. |

| 🚼 Ultrasounds | Limited to two pregnancy ultrasounds. |

| 👶 Paediatrician Visits (after the baby is a registered beneficiary) | Limited to two visits in the baby’s first year. |

| 🧡 Antenatal vitamins | Limited to R2,320 per pregnancy. |

| ➡️ Antenatal classes | Limited to R2,320 per pregnancy. |

Gold Plan Exclusions and Waiting Periods

Exclusions

The KeyHealth Gold Plan has specific exclusions, including:

- 📌 Acupuncture

- 📌 Bio-stress assessments

- 📌 Colonic irrigation

- 📌 Conservative back/neck treatment in the hospital

- 📌 Cosmetic / non-functional procedures

- 📌 DNA testing

- 📌 Gender reassignment

- 📌 Industrial and educational psychologists

- 📌 IQ tests and learning or educational problems

- 📌 Music and water therapy

- 📌 Obesity and weight loss surgery (excluding benefits available on the Health Booster)

- 📌 Polysomnogram and titration (sleep study)

- 📌 Reversal of sterilization

Waiting Periods

If a Principal Member or their dependent is diagnosed with a specific illness, the Scheme reserves the right to exclude benefits for this condition for 12 months. Subject to the regulations, KeyHealth can impose waiting periods on an individual who applies for membership or admission as a dependent and has not been a beneficiary of a medical scheme for a minimum of 90 days before the application date. Such waiting periods may include the following:

- 📌 A general waiting period of up to 3 months also encompasses PMB conditions.

- 📌 A condition-specific waiting period of up to 12 months, including PMB conditions.

Discover more about Late Joiner Penalties

If an individual who applies for membership or admission as a dependent was previously a beneficiary of a medical scheme for a continuous period of up to 24 months, which ended less than 90 days before the application date, Keyhealth could impose the following:

- 📌 A condition-specific waiting period of up to 12 months, except for any treatment or diagnostic procedures covered within PMB conditions.

If the previous medical scheme had imposed a general or condition-specific waiting period on such an individual, and the waiting period had not expired at the time of termination, Keyhealth could impose a waiting period for the remaining duration as imposed by the previous medical scheme. However, any child born into the Scheme during membership will not be subject to waiting periods. Furthermore, Keyhealth can impose the following:

- ⚠️ A general waiting period of up to 3 months, except for any treatment or diagnostic procedures covered within PMB conditions, on any person who applies for membership or admission as a dependent and was previously a beneficiary of a medical scheme for a continuous period of more than 24 months, which ended less than 90 days before the application date.

Medical Aid Comparisons : KeyHealth Gold Plan vs. Similar Plans from other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 KeyHealth Gold | 🥈 Momentum Extender | 🥉 Sasolmed Comprehensive |

| 👤 Main Member Contribution | R7,036 | R | R |

| 👥 Adult Dependent Contribution | R4,758 | R | R |

| 🍼 Child Dependent Contribution | R1,382 | R | R |

| 🔁 Gap Cover | ☑️ Yes | ☑️ Yes | ☑️ Yes |

| ⚕️ Hospital Cover | Unlimited | Unlimited | Unlimited |

| 📉 Prescribed Minimum Benefits | ✅ Yes | ✅ Yes | ✅ Yes |

| 💳 Medical Savings Account | ☑️ Yes | ☑️ Yes | ☑️ Yes |

| 👶 Maternity Benefits | ✅ Yes | ✅ Yes | ✅ Yes |

| 🩺 Oncology Cover | R169,000 | R500,000 | R2577,025 |

Our Verdict on The Gold Plan

KeyHealth Gold is a comprehensive medical insurance plan offered by KeyHealth Medical Scheme in South Africa. The plan provides extensive coverage for both in-hospital and out-of-hospital medical expenses, including chronic medication and wellness benefits. One of the main advantages of KeyHealth Gold is its high level of benefits, which includes unlimited hospital coverage and generous day-to-day benefits for consultations, medication, and pathology tests. The plan also offers a range of additional benefits, such as maternity benefits, preventative care, and emergency medical evacuation. Another advantage of KeyHealth Gold is its flexibility. Members can choose from various optional benefits and tailor their cover to suit their needs. Members also have access to a network of healthcare providers, which can help to reduce out-of-pocket expenses.

However, one notable drawback of KeyHealth Gold is its cost, as it is one of the more expensive medical insurance plans offered by KeyHealth. Additionally, some members may find the plan’s high level of benefits unnecessary for their needs and may prefer a more affordable plan with lower benefits. In conclusion, KeyHealth Gold offers comprehensive medical insurance coverage with a wide range of benefits and the flexibility to tailor coverage to individual needs.

You might also 🩷 : KeyHealth Equilibrium

You might also 🩷 : KeyHealth Essence

You might also 🩷 : KeyHealth Origin

You might also 🩷 : KeyHealth Platinum

You might also 🩷 : KeyHealth Silver

Gold Plan Frequently Asked Questions

What is KeyHealth Gold?

KeyHealth Gold is a comprehensive medical insurance plan offered by KeyHealth Medical Scheme in South Africa. It covers in-hospital and out-of-hospital medical expenses, chronic medication, and wellness benefits.

What are the benefits of KeyHealth Gold?

The benefits of KeyHealth Gold include unlimited hospital cover, generous day-to-day benefits for consultations, medication, and pathology tests, as well as maternity benefits, preventative care, and emergency medical evacuation. Members can also choose from various optional benefits and tailor their cover to suit their needs.

What is the cost for the KeyHealth Gold plan?

The contribution rates (2023) for the KeyHealth Gold Medical Aid Plan are as follows: The plan starts at R7,036 ZAR, with an adult dependent contribution of R4,758 and a child dependent contribution of R1,382.

Is KeyHealth Gold worth the cost?

KeyHealth Gold may be worth the cost for those who require extensive medical insurance coverage, including chronic medication and wellness benefits. However, those not requiring such comprehensive cover may find it more cost-effective to choose a lower level of cover.

Are there any drawbacks to KeyHealth Gold?

One notable drawback of KeyHealth Gold is its cost, as it is one of the more expensive medical insurance plans offered by KeyHealth. Additionally, some members may find the plan’s high level of benefits unnecessary for their needs and may prefer a more affordable plan with lower benefits.

Does KeyHealth Gold plan have medical emergency assistance?

Yes, KeyHealth Gold plan offers 24/7 medical emergency assitance.

Does KeyHealth Gold plan cover chronic medication?

Yes, KeyHealth Gold plan covers 44 chronic medical conditions for up to 3 family members.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans