- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Turnberry Synergy

Overall, Turnberry Synergy Gap Cover is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The Turnberry Synergy Gap Cover Plans start from R380 ZAR. Turnberry has a trust score of 4.3.

| 🔎 Provider | 🥇 Turnberry Synergy |

| 🟥 Years in Operation | 22 years |

| 🟧 Underwriters | Lombard Insurance Company |

| 🟨 Market Share in South Africa | <5% |

| 🟩 Gap Cover Waiting Period | 3 – 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | R380 |

| 🟥 Oncology Benefit | None |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

Turnberry Synergy Gap Cover – 7 Key Point Quick Overview

- ✅ Turnberry Synergy Overview

- ✅ Turnberry Synergy Premiums

- ✅ Turnberry Synergy Benefits and Cover Breakdown

- ✅ Turnberry Synergy Exclusions and Waiting Periods

- ✅ Turnberry Synergy vs Other Gap Cover Plans

- ✅ Our Verdict on Turnberry Synergy

- ✅ Turnberry Synergy Frequently Asked Questions

Turnberry Synergy Overview

The Turnberry Synergy is one of five plans that starts from R380 per month. The Turnberry Synergy Plan has benefits for non-DSP hospital penalties, sub-limits, co-payments, reconstructive maxilla-facial surgery, and more.

Turnberry Gap Cover has five plans to choose from

Turnberry Synergy Premiums

| 🅰️ Families under 65 years | 🅱️ Families that have members 65 years> |

| R380 | R532 |

Turnberry Synergy Benefits and Cover Breakdown

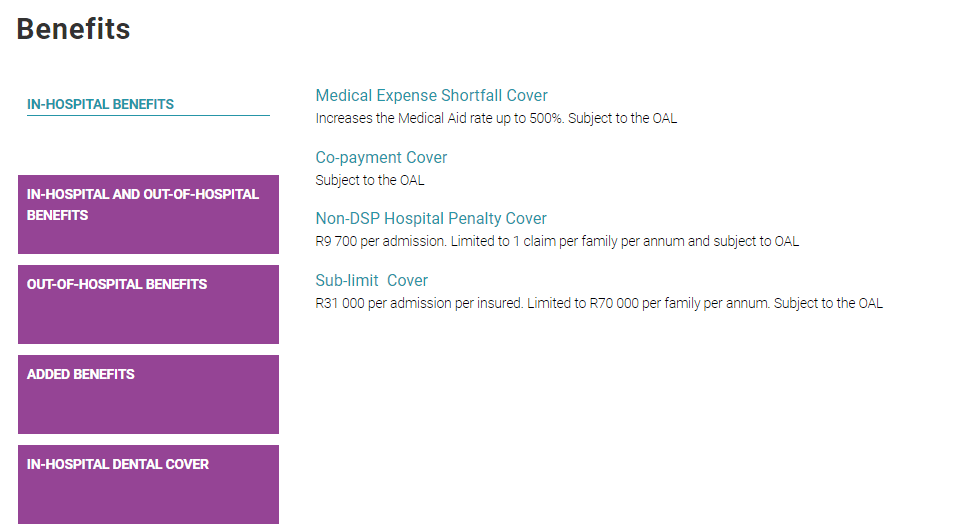

Turnberry Synergy In-Hospital Benefits

| 🟥 Medical Expense Shortfall Cover | Increases medical aid by 500%. Covers costs associated with GPs, Specialists, Anaesthetists, Radiology, Pathology, and Consumables. Subject to the Overall Annual Limit. |

| 🟧 Co-payment cover | Subject to the Overall Annual Limit. |

| 🟨 Non-DSP Hospital Penalty Cover | Limited to R9,000 per admission. Limited to 1 family claim per year. Subject to the Overall Annual Limit. |

| 🟩 Sub-Limit Cover | Limited to R28,000 per admission per insured. Limited to R70,000 per family per year. Subject to the Overall Annual Limit. |

Turnberry Synergy In-Hospital Dental Cover

| 🟥 Medical Expense Shortfall Cover | Increases medical aid by 500% for impacted wisdom teeth, orthognathic surgery, reconstructive maxillofacial surgery after an accident, and oral cancer diagnosed while on the policy. Subject to the Overall Annual Limit. |

| 🟧 Basic Dental Medical Expense Shortfall Cover for Children | Increases Medical Aid by 500% for basic dentistry for children under 12. Limited to R2,000 per family per year. |

| 🟨 Co-payment Cover | Subject to the Overall Annual Limit. |

| 🟩 Sub-limit and Co-payment Cover Dental Implants | Covers oral cancer and reconstructive maxillofacial surgery dental implants (diagnosed while on the policy). Limited to R20,000 per admission, R50,000 per family per year. Subject to the Overall Annual Limit. |

| 🟦 Sub-limit Cover | Limited to R20,000 per admission and R50,000 per family per year for impacted wisdom teeth, orthognathic surgery, reconstructive maxillofacial surgery due to an accident while on the policy, and oral cancer (diagnosed while on the policy). Subject to the Overall Annual Limit. |

Turnberry Synergy Out-of-Hospital Benefits

| 🟥 Co-payments for MRI, CT, and PET scans | Subject to the Overall Annual Limit. |

| 🟧 Co-payments for scopes | Limited to R4,000 per event. Limited to 2 claims per insured yearly. Subject to the Overall Annual Limit. |

| 🟨 Sub-limit cover for MRI, CT, and PET scans | Limited to R28,000 per event per insured. Limited to R70,000 per family per year. Subject to the Overall Annual Limit. |

| 🟩 Casualty Benefits for Accidents | Limited to R9,500 per event per insured. Subject to the Overall Annual Limit. |

| 🟦 Casualty Benefit for Illness | Limited to R3,000 per event. Limited to 2 claims per family yearly. Subject to the Overall Annual Limit. Treatment is limited to 6 pm – 6 am, Mondays–Fridays, Saturdays–Sundays, and Public Holidays |

Read more about the 5 Best Medical Aids for women who is impregnated

Turnberry Synergy In-Hospital and Out-of-Hospital Benefits

| 🅰️ MRI and CT Scan Cover | Covers MRI and CT scans without Medical Scheme cover. R4,500 per event and 1 claim per family per year. |

| 🅱️ Trauma Care Cover | Covers trauma counseling with a registered healthcare provider after a member is diagnosed with a critical illness, is a victim of a violent crime, or loses an immediate family member. Limited to R2,000 per insured and R6,000 per family annually. Subject to the Overall Annual Limit |

Turnberry Synergy Added Benefits

| 🟥 Medical Scheme Contribution Waiver | Limited to R6,000 per month for six months if the Medical Scheme Contribution Payer dies or becomes permanently disabled in an accident. |

| 🟧 Gap Premium Waiver | Pays your Synergy Policy premium for 12 months if the Contribution Payer dies or becomes permanently disabled in an accident. |

| 🟨 Personal Accident Benefit | Limited to R10,000 per insured registered on the policy if there is accidental death or permanent total disability. |

| 🟩 International Travel Cover | R5 million per insured, but a 48-hour travel notice is required. |

Read more about 5 Best Medical Aids for Learners

Turnberry Synergy Exclusions and Waiting Periods

Turnberry Synergy Exclusions

Turnberry Synergy excludes Hospitalization, bodily injury, sickness, or disease caused by:

- ✅ Nuclear weapons, nuclear material, or ionizing radiation.

- ✅ LASIK or other refractive surgery for myopia, hyperopia, and astigmatism.

- ✅ Investigations, treatment, or surgery for obesity or cosmetic purposes.

- ✅ Suicide, attempted suicide, or intentional self-injury.

- ✅ Taking drugs or narcotics not prescribed by a Medical Practitioner.

- ✅ Alcohol-related illness or exceeding the legal alcohol limit.

- ✅ Artificial insemination, hormone treatment, or surgery.

- ✅ Fraudulent claim submissions.

- ✅ Treatment or conditions excluded or paid less by the Insured’s Medical Scheme.

- ✅ Medical or surgical treatment not occurring during hospital confinement.

- ✅ No benefits for transport charges or services during emergency transportation.

- ✅ No ward fee benefits for additional costs during private ward confinement.

- ✅ Treatment for not following doctor’s orders.

and more. A full list of Exclusions will be provided by Turnberry.

Turnberry Synergy Waiting Periods

There is a general waiting period of three months for all benefits except accidents on the policy and a waiting period of 10 months for pregnancy/childbirth. Furthermore, there is a waiting period of 12 months for the following treatments:

- ✅ Investigations

- ✅ Treatment or surgery related to hysterectomy

- ✅ Hysteroscopies

- ✅ Endometriosis

- ✅ Ovarian cysts and fibroids

- ✅ Musculoskeletal conditions

- ✅ Tonsillectomy

- ✅ Myringotomy

- ✅ Grommets

- ✅ Adenoids

and more. A full overview of Synergy waiting periods will be provided by Turnberry.

You might like the 5 Best Medical Aid Schemes for Workers

Turnberry Synergy vs Other Gap Cover Plans

| 🔎 Provider | 🥇 Turnberry Synergy | 🥈 Liberty Essential Gap Cover | 🥉 Cura Administrators Gap Advanced |

| 🟥 Years in Operation | 22 years | 66 years | 26 years |

| 🟧 Underwriters | Lombard Insurance Company | Guardrisk Life Limited (FSP 76) | GENRIC Insurance Company Limited |

| 🟨 Market Share in South Africa | <5% | >25% | <5% |

| 🟩 Gap Cover Waiting Period | 3 – 12 months | 12 months | 3 – 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | R380 | R372 | R397 |

| 🟥 Oncology Benefit | None | None | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | None | None |

| 🟩 Maternity Benefit | None | None | None |

| 🟦 Scopes and Scans | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Co-payment Cover | ✅ Yes | None | None |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Accidental Cover | ✅ Yes | ✅ Yes | None |

| 🟨 Trauma Counseling | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟩 Premium Waiver | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Non-DSP Co-Payment | ✅ Yes | None | ✅ Yes |

| 🟪 Prostheses | None | None | ✅ Yes |

| 🟥 Travel Cover Extender | ✅ Yes | None | ✅ Yes |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | ✅ Yes | None |

Our Verdict on Turnberry Synergy

Turnberry Synergy is an insurance plan that offers comprehensive cover for both in-hospital and out-of-hospital medical expenses.

Furthermore, it provides benefits such as increased medical aid rates, cover for scopes and scans, co-payment cover, emergency room visits, accidental cover, trauma counseling, premium waiver, and non-DSP co-payment.

However, there are limitations to consider including oncology benefits, maternity benefits, or prostheses.

Turnberry Synergy Frequently Asked Questions

What is the premium for Turnberry Synergy?

The average monthly premium for Turnberry Synergy is R380. However, it is important to note that premiums may vary based on age and family size.

Are there any waiting periods for Turnberry Synergy?

While the exact waiting periods may vary, there is typically a 3 to 12-month waiting period for gap cover under Turnberry Synergy.

Does Turnberry Synergy cover maternity expenses?

No, Turnberry Synergy does not provide cover for maternity benefits. However, it is important to consider this if you require maternity cover.

What is the overall annual limit with Turnberry Synergy?

The overall annual limit with Turnberry Synergy is R185,837.63 per insured per year, which applies to various benefits and services.

Does Turnberry Synergy include cover for accidental death or disability?

Yes, Turnberry Synergy provides cover for accidental death or permanent disability, offering financial protection in case of such unfortunate events.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans