- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Total Risk Administrators Vital Cover Plus

Overall, Total Risk Administrators Vital Cover Plus is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The Total Risk Administrators Vital Cover Plus Plan starts from R275 ZAR. Total Risk Administrators has a trust score of 4.2.

| 🔎 Provider | 🥇 Total Risk Administrators Vital Cover Plus |

| 🟥 Years in Operation | 24 years |

| 🟧 Underwriters | Auto & General Insurance Company Limited |

| 🟨 Market Share in South Africa | <5% |

| 🟩 Gap Cover Waiting Period | 3 – 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | R275 |

| 🟥 Oncology Benefit | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

Total Risk Administrators Vital Cover Plus – 7 Key Point Quick Overview

- ✅ Total Risk Administrators Vital Cover Plus Overview

- ✅ Total Risk Administrators Vital Cover Plus Premiums

- ✅ Total Risk Administrators Vital Cover Plus Benefits and Cover Breakdown

- ✅ Total Risk Administrators Vital Cover Plus Exclusions and Waiting Periods

- ✅ Total Risk Administrators Vital Cover Plus vs Other Gap Cover Plans

- ✅ Our Verdict on Total Risk Administrators Vital Cover Plus

- ✅ Total Risk Administrators Vital Cover Plus Frequently Asked Questions

Total Risk Administrators Vital Cover Plus Overview

The Total Risk Administrators Vital Cover Plus is one of four plans that starts from R275 per month. Total Risk Administrators’ Vital Cover Plus has benefits for TRA Assist, medical aid contribution waiver, accidental death, travel, oncology co-payments, and more.

Total Risk Administrators (TRA) Gap Cover has four plans to choose from:

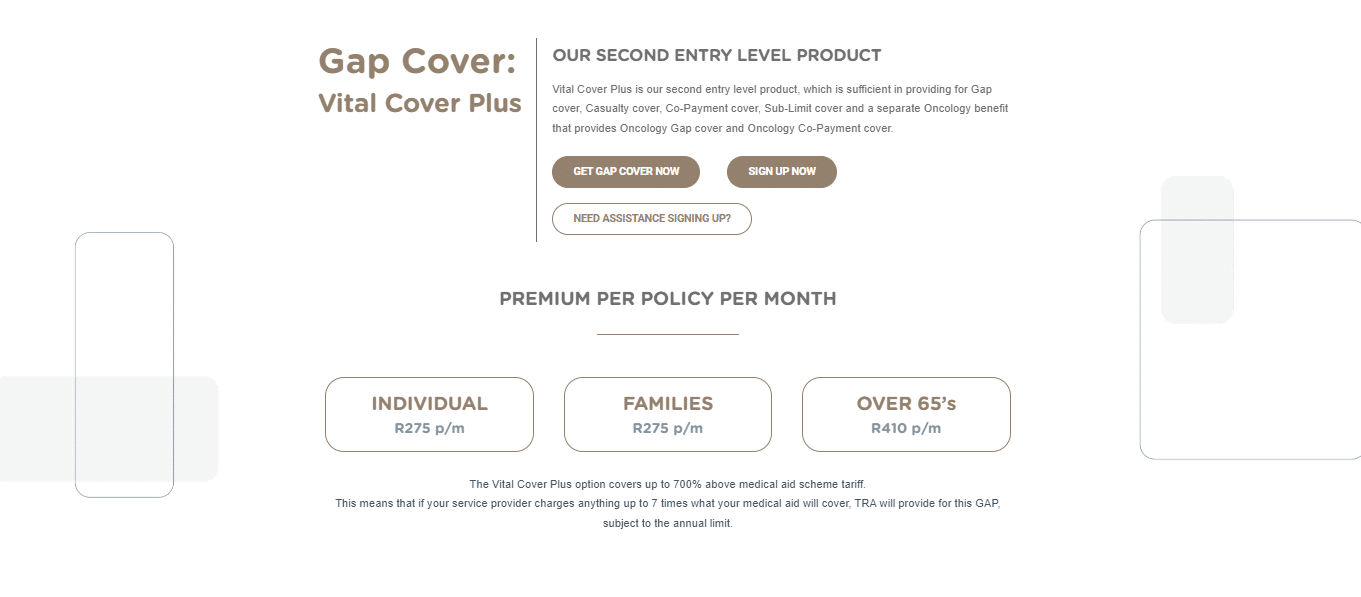

Total Risk Administrators Vital Cover Plus Premiums

| 🟥 Policyholder/Family Criteria | Vital Cover Plus |

| 🟧 All members <65 years | R275 |

| 🟨 Premium per individual policy monthly | N/A |

| 🟩 Premium per family policy monthly | N/A |

| 🟦 For families with one or more members 65 years> | R410 |

Total Risk Administrators Vital Cover Plus Benefits and Cover Breakdown

| 🟥 Gap Cover | Up to 700% cover. |

| 🟧 Prescribed Minimum Benefits | Covered but subject to medical aid review. |

| 🟨 Casualty Unit Benefit | Limited to R8,000 per policy per year. |

| 🟩 Co-payment Benefit (In the network) | Limited to R12,000 per policy per year. |

| 🟦 Sub-limit benefit – Internal Prostheses | Limited to R5,000 per policy per year. |

| 🟪 Dental Benefit | Unlimited cover provided. Subject to the aggregate annual limit per insured person per year. |

| 🟥 Oncology Gap Benefit | Unlimited cover provided. Subject to the aggregate annual limit per insured person per year. |

| 🟧 Oncology Co-payment Benefit (in the network) | Limited to R12,000 per policy per year. |

| 🟨 Accidental Death Cover | Limited to R9,000 per insured or spouse. Limited to R4,500 per dependent. |

| 🟩 Policy Extender | The cover is valid for 12 months. |

| 🟦 Medical Aid Contribution Waiver | Limited to 6 months. Limited to a maximum of R4,000 per month. |

| 🟪 TRA Assist | – |

| 🟥 Home Drive | A designated driver service may include “Own Vehicle” or “Uber” services. Limited to 6 trips per year per policy. The radius is set at 50 kilometers. |

| 🟧 Panic Button | You will have 24-hour access to a crisis manager who will walk you through an emergency. |

| 🟨 Medical Health and Trauma Counselling Line | Access to qualified nurses is unrestricted 24 hours a day, 7 days a week, for telephonic emergency medical advice, symptom assessment, medical terminology explanation, etc. Insured persons have access to a COVID-19 care line. |

| 🟩 Claim Submission | Insured members can use the mobile app to submit their claim documents. |

| 🟦 Travel Benefit | Emergency Medical and Related expenses: up to R600,000 with an excess of R500. COVID-19 Extension covers emergency inpatient or outpatient treatment due to COVID-19 up to R600,000 with an excess of R500. Medical evacuation, repatriation, or transportation to a medical center: the full cost is covered when arranged by Hepstar Financial Services. Hospital Cash benefit provides R500 per day (maximum of R3,000) if you are hospitalized. Inconvenience Cover includes Baggage Cover up to R5,000 for theft, damage, or loss by the travel supplier. |

Total Risk Administrators Vital Cover Plus Exclusions and Waiting Periods

Vital Cover Plus Exclusions

Total Risk Administrators does not mention exclusions in its policy documents. However, we have found some general exclusions that could apply to gap cover in South Africa. However, we urge potential policyholders to contact TRA to verify exclusions before they apply.

- ✅ Certain treatments are generally not covered, including cosmetic surgery, obesity treatment, laser eye surgery, dental implants, and fertility treatment.

- ✅ Expenses related to psychiatric treatment, depression, emotional or mental illness, or stress-related illness are generally not covered.

- ✅ Gap cover does not pay for medical expenses incurred outside South Africa’s borders unless specified in the policy.

- ✅ Services provided by allied health professionals are generally not included in gap cover, except for in-hospital physiotherapy.

- ✅ Injuries from certain adventure sports like skiing, mountain climbing, or scuba diving are not covered.

Gap cover excludes consultations before or after in-hospital treatment, medicine and disposable items, crutches, and wheelchairs unless specified in the policy.

Vital Cover Plus Waiting Periods

There is no general three (3) month waiting period. Instead, the waiting periods commence from the Join Date of the Gap Cover Policy. There is a 10-month condition-specific waiting period. No claims may be submitted within the first 10 months of membership for any Gap Cover policy if they relate to any of the following conditions:

- ✅ Head, neck, and spinal procedures (e.g., Laminectomy)

- ✅ All types of hernia procedures

- ✅ Endoscopic procedures (e.g., Colonoscopy, Gastroscopy)

- ✅ Pregnancy and childbirth (including cesarean delivery)

- ✅ Gynecological conditions (e.g., Hysterectomy)

- ✅ Joint replacement (excluding treatment due to accidental trauma)

- ✅ Inability to walk/move without pain, and more.

Any policyholder diagnosed with cancer before membership:

- ✅ Related claims have a 9-month waiting period.

Policyholder previously diagnosed with cancer and in remission:

- ✅ Must provide medical evidence of 2+ consecutive years of remission.

There will not be any coverage for pre-existing conditions (excluding cancer) leading to hospitalization for the first 6 months of membership. Furthermore, TRA reserves the right to request clinical information if a claim in this period indicates a pre-existing condition.

Total Risk Administrators Vital Cover Plus vs Other Gap Cover Plans

| 🔎 Provider | 🥇 Total Risk Administrators Vital Cover Plus | 🥈 Elixi Gap Single | 🥉 Auto & General Comprehensive Gap Cover |

| 🟥 Years in Operation | 24 years | 6 years | 38 years |

| 🟧 Underwriters | Auto & General Insurance Company Limited | Unity Health | 1Life Insurance Limited |

| 🟨 Market Share in South Africa | <5% | <5% | <5% |

| 🟩 Gap Cover Waiting Period | 3 – 12 months | 3 – 12 months | 10 months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | R275 | R242 | R280 |

| 🟥 Oncology Benefit | ✅ Yes | None | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | None | ✅ Yes |

| 🟩 Maternity Benefit | None | None | None |

| 🟦 Scopes and Scans | None | ✅ Yes | ✅ Yes |

| 🟪 Co-payment Cover | ✅ Yes | None | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Accidental Cover | None | None | ✅ Yes |

| 🟨 Trauma Counseling | ✅ Yes | None | None |

| 🟩 Premium Waiver | ✅ Yes | None | ✅ Yes |

| 🟦 Non-DSP Co-Payment | None | None | ✅ Yes |

| 🟪 Prostheses | ✅ Yes | None | ✅ Yes |

| 🟥 Travel Cover Extender | ✅ Yes | None | None |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | None | None |

Our Verdict on Total Risk Administrators Vital Cover Plus

According to our findings, the Vital Cover Plus plan offers comprehensive coverage for various medical procedures and benefits, including gap cover, casualty unit benefit, co-payment benefit, and sub-limit benefit.

However, it lacks cover in some areas, such as co-payments for out-of-network services and sub-limits for MRI/CT/PET scans. It also imposes waiting periods for certain conditions and procedures. Therefore, it is crucial to consider these factors and your specific needs when evaluating this plan.

Total Risk Administrators Vital Cover Plus Frequently Asked Questions

What is the premium for TRA Vital Cover Plus in 2023?

TRA Vital Cover Plus premium starts from R275 per month for all members under 65 years.

What benefits does TRA Vital Cover Plus offer?

TRA Vital Cover Plus provides benefits such as gap cover, in-hospital and out-of-hospital cover, trauma counseling, emergency room cover, and more.

How does TRA Vital Cover Plus compare to other gap cover plans?

TRA Vital Cover Plus offers competitive benefits compared to other gap cover plans, including oncology benefits, in-hospital benefits, co-payment cover, and cover for accidental death and permanent disability.

What are the waiting periods for TRA Vital Cover Plus?

TRA Vital Cover Plus has waiting periods depending on the condition or procedure. Therefore, it is best to refer to the comprehensive list provided by Total Risk Administrators for specific waiting period details.

Are there any exclusions with TRA Vital Cover Plus?

While TRA does not mention exclusions in its policy documents, general exclusions could apply to gap cover in South Africa. Therefore, we recommended contacting Total Risk Administrators to verify exclusions before applying.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans