- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Total Risk Administrators Absolute Cover Plus

Overall, Total Risk Administrators Absolute Cover Plus is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The Total Risk Administrators Absolute Cover Plus Plan starts from R300 ZAR. Total Risk Administrators has a trust score of 4.2.

| 🔎 Provider | 🥇 Total Risk Administrators Absolute Cover Plus |

| 🟥 Years in Operation | 24 years |

| 🟧 Underwriters | Auto & General Insurance Company Limited |

| 🟨 Market Share in South Africa | <5% |

| 🟩 Gap Cover Waiting Period | 3 – 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | R300 |

| 🟥 Oncology Benefit | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

Total Risk Administrators Absolute Cover Plus – 7 Key Point Quick Overview

- ✅ Total Risk Administrators Absolute Cover Plus Overview

- ✅ Total Risk Administrators Absolute Cover Plus Premiums

- ✅ Total Risk Administrators Absolute Cover Plus Benefits and Cover Breakdown

- ✅ Total Risk Administrators Absolute Cover Plus Exclusions and Waiting Periods

- ✅ Total Risk Administrators Absolute Cover Plus vs Other Gap Cover Plans

- ✅ Our Verdict on Total Risk Administrators Absolute Cover Plus

- ✅ Total Risk Administrators Absolute Cover Plus Frequently Asked Questions

Total Risk Administrators Absolute Cover Plus Overview

The Total Risk Administrators Absolute Cover Plus is one of four plans that starts from R300 per month. Total Risk Administrators’ Absolute Cover Plus has benefits for co-payments for non-DSP scopes and scans, sub-limits for scopes, internal prostheses, cancer boosters, and more.

Total Risk Administrators (TRA) Gap Cover has four plans to choose from:

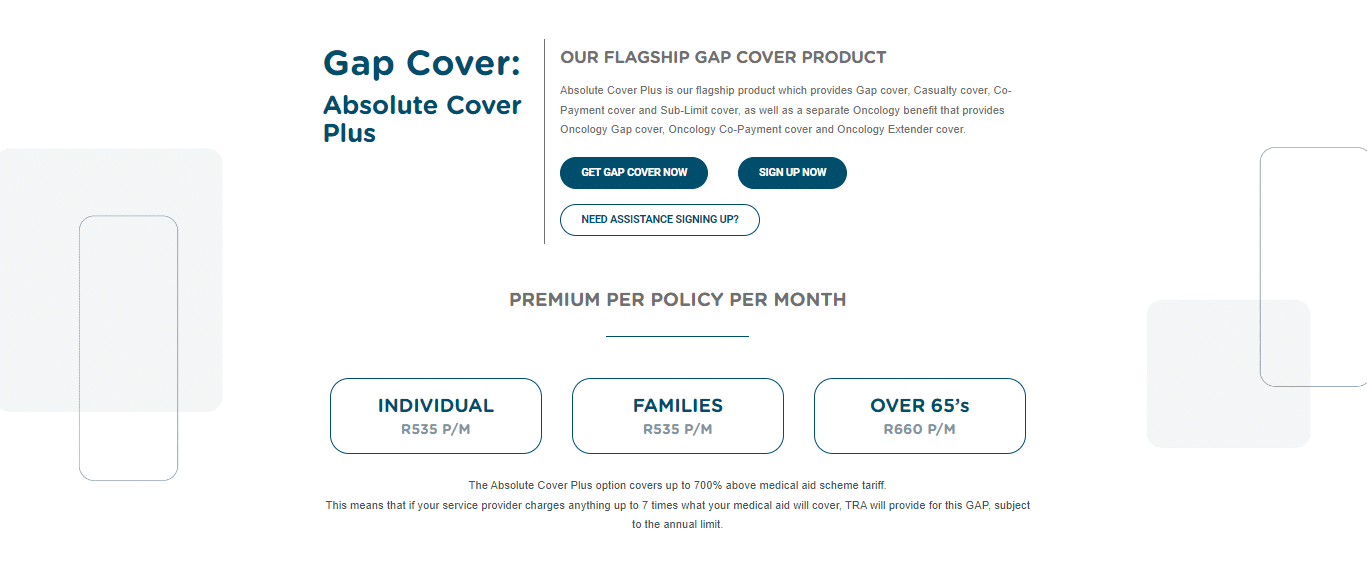

Total Risk Administrators Absolute Cover Plus Premiums

| 🟥 Policyholder/Family Criteria | Absolute Cover Plus |

| 🟧 All members <65 years | R300 |

| 🟨 Premium per individual policy monthly | N/A |

| 🟩 Premium per family policy monthly | N/A |

| 🟦 For families with one or more members 65 years> | R435 |

Total Risk Administrators Absolute Cover Plus Benefits and Cover Breakdown

| 🟥 Gap Cover | Up to 700% cover. |

| 🟧 Prescribed Minimum Benefits | Covered but subject to medical aid review. |

| 🟨 Casualty Unit Benefit | Limited to R20,000 per policy per year. |

| 🟩 Co-payment Benefit (In the network) | Unlimited cover provided. Subject to the aggregate annual limit per insured person per year. |

| 🟦 Co-payment Benefit (Out of the network) | Limited to 2 payments per policy per year up to a combined limit of R15,000. |

| 🟪 Co-payment Benefit (Out-of-hospital) for MRIs, CTs, and PET scans | Limited to 2 scans per policy per year. Unlimited cover subject to the aggregate annual limit insured person per year. |

| 🟥 Sub-limit Benefit – Internal Prostheses | Unlimited cover provided. Subject to the aggregate annual limit per insured person per year. Limited to R30,000 per event. |

| 🟧 Sub-limit Benefits for MRI, CT, and PET scans | Limited to 2 MRI, CT, or PET scans per policy per year. Limited to R5,500 per scan. |

| 🟨 Sub-limit Benefits for Colonoscopies and Gastroscopies | Limited to R20,000 per policy per year and R5,500 per event. |

| 🟩 Dental Benefit | Unlimited cover provided. Subject to the aggregate annual limit per insured person per year. |

| 🟦 Global Fee Benefit | Limited to R22,000 per policy per year. |

| 🟪 Oncology Gap Benefit | Unlimited cover provided. Subject to the aggregate annual limit per insured person per year. |

| 🟥 Oncology Co-payment Benefit (in the network) | Unlimited cover provided. Subject to the aggregate annual limit per insured person per year. |

| 🟧 Oncology Co-payment Benefit (out of the network) | Limited to two co-payments per policy per year and a combined limit of R15,000. |

| 🟨 Oncology Extender Benefit | Unlimited cover provided. Subject to the aggregate annual limit per insured person per year. |

| 🟩 Oncology “New-Tech” Benefit | Limited to R15,000 per policy per year. |

| 🟦 Oncology Gap Benefit for Breast Reconstruction Surgery | Limited to R33,000 per beneficiary per life of the policy. |

| 🟪 Maternity Private Ward Benefit | Limited to R1,000 per day for three consecutive days. |

| 🟥 Accidental Death Cover | Limited to R30,000 per insured or spouse. Limited to R9,000 per dependent. |

| 🟧 Policy Extender | The cover is valid for 12 months. |

| 🟨 Medical Aid Contribution Waiver | Limited to 6 months. Limited to a maximum of R6,000 per month. |

| 🟩 TRA Assist | – |

| 🟦 Home Drive | A designated driver service may include “Own Vehicle” or “Uber” services. Limited to 6 trips per year per policy. The radius is set at 50 kilometers. |

| 🟪 Panic Button | You will have 24-hour access to a crisis manager who will walk you through an emergency. |

| 🟥 Medical Health and Trauma Counselling Line | Access to qualified nurses is unrestricted, 24 hours a day, 7 days a week, for telephonic emergency medical advice, symptom assessment, medical terminology explanation, etc. Insured persons have access to a COVID-19 care line. |

| 🟧 Claim Submission | Insured members can use the mobile app to submit their claim documents. |

| 🟨 Travel Benefit | Emergency Medical and Related expenses: up to R600,000 with an excess of R500. COVID-19 Extension covers emergency inpatient or outpatient treatment due to COVID-19 up to R600,000 with an excess of R500. Medical evacuation, repatriation, or transportation to a medical center: the full cost is covered when arranged by Hepstar Financial Services. Hospital Cash benefit provides R500 per day (maximum of R3,000) if you are hospitalized. Inconvenience Cover includes Baggage Cover up to R5,000 for theft, damage, or loss by the travel supplier. |

Total Risk Administrators Absolute Cover Plus Exclusions and Waiting Periods

Total Risk Administrators Absolute Cover Plus Exclusions

Total Risk Administrators does not mention exclusions in its policy documents. However, we have found some general exclusions that could apply to gap cover in South Africa. However, we urge potential policyholders to contact TRA to verify exclusions before they apply.

- ✅ Certain treatments are generally not covered, including cosmetic surgery, obesity treatment, laser eye surgery, dental implants, and fertility treatment.

- ✅ Treatments for self-inflicted wounds, alcohol or drug addiction, or suicide attempts are not covered unless taken according to a medical practitioner’s prescription, resulting in a bad reaction.

- ✅ Expenses related to psychiatric treatment, depression, emotional or mental illness, or stress-related illness are generally not covered.

- ✅ Gap cover does not pay for medical expenses incurred outside South Africa’s borders unless specified in the policy.

- ✅ Services provided by allied health professionals are generally not included in gap cover, except for in-hospital physiotherapy.

- ✅ Injuries from certain adventure sports like skiing, mountain climbing, or scuba diving are not covered.

Gap cover excludes consultations before or after in-hospital treatment, medicine and disposable items, crutches, and wheelchairs unless specified in the policy.

Total Risk Administrators Absolute Cover Plus Waiting Periods

There is no general three (3) month waiting period. Instead, the waiting periods commence from the Join Date of the Gap Cover Policy. There is a 10-month condition-specific waiting period. No claims may be submitted within the first 10 months of membership for any Gap Cover policy if they relate to any of the following conditions:

- ✅ Head, neck, and spinal procedures (e.g., Laminectomy)

- ✅ All types of hernia procedures

- ✅ Endoscopic procedures (e.g., Colonoscopy, Gastroscopy)

- ✅ Pregnancy and childbirth (including cesarean delivery)

- ✅ Gynecological conditions (e.g., Hysterectomy)

- ✅ Joint replacement (excluding treatment due to accidental trauma)

- ✅ Inability to walk/move without pain, and more.

Any policyholder diagnosed with cancer before membership:

- ✅ Related claims have a 9-month waiting period.

Policyholder previously diagnosed with cancer and in remission:

- ✅ Must provide medical evidence of 2+ consecutive years of remission.

There will not be any coverage for pre-existing conditions (excluding cancer) leading to hospitalization for the first 6 months of membership. Furthermore, TRA reserves the right to request clinical information if a claim in this period indicates a pre-existing condition.

Discover more about Precautionary Care

Total Risk Administrators Absolute Cover Plus vs Other Gap Cover Plans

| 🔎 Provider | 🥇 Total Risk Administrators Absolute Cover Plus | 🥈 Elixi Gap Single | 🥉 Auto & General Comprehensive Gap Cover |

| 🟥 Years in Operation | 24 years | 6 years | 38 years |

| 🟧 Underwriters | Auto & General Insurance Company Limited | Unity Health | 1Life Insurance Limited |

| 🟨 Market Share in South Africa | <5% | <5% | <5% |

| 🟩 Gap Cover Waiting Period | 3 – 12 months | 3 – 12 months | 10 months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | R300 | R242 | R280 |

| 🟥 Oncology Benefit | ✅ Yes | None | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | None | ✅ Yes |

| 🟩 Maternity Benefit | ✅ Yes | None | None |

| 🟦 Scopes and Scans | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Co-payment Cover | ✅ Yes | None | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Accidental Cover | None | None | ✅ Yes |

| 🟨 Trauma Counseling | ✅ Yes | None | None |

| 🟩 Premium Waiver | ✅ Yes | None | ✅ Yes |

| 🟦 Non-DSP Co-Payment | ✅ Yes | None | ✅ Yes |

| 🟪 Prostheses | ✅ Yes | None | ✅ Yes |

| 🟥 Travel Cover Extender | ✅ Yes | None | None |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | None | None |

POLL: 5 Best Gap Cover Options for Under R1500

Our Verdict on Total Risk Administrators Absolute Cover Plus

According to our findings, the Absolute Cover Plus plan offers a wide range of benefits and covers a significant portion of medical costs that a standard medical aid scheme may not cover. However, it is not a substitute for a medical aid scheme membership and has an aggregate annual limit.

Therefore, it is important to consider these factors and your healthcare needs when deciding on a plan.

Total Risk Administrators Absolute Cover Plus Frequently Asked Questions

Can TRA Absolute Cover Plus replace a medical aid scheme membership?

No, Absolute Cover Plus is not a substitute for a medical aid scheme membership. Instead, it is designed to provide additional cover for gaps in your existing medical aid benefits.

What is the aggregate annual limit for TRA Absolute Cover Plus?

The benefits of Absolute Cover Plus are subject to an aggregate annual limit of R185,837 per insured person.

Does TRA Absolute Cover Plus include travel insurance?

Yes, Absolute Cover Plus provides a comprehensive travel insurance benefit for all TRA Gap Cover policyholders under 71.

What is the Co-payment Benefit of TRA Absolute Cover Plus?

The Co-payment Benefit in Absolute Cover Plus offers unlimited co-payment benefits but is subject to the aggregate annual limit per insured person per annum. This covers the co-payment or deductible your medical aid charges you for certain in-hospital procedures.

What is the Sub-limit Benefit of TRA Absolute Cover Plus?

The Sub-limit Benefit covers the shortfall on a service provider account that is not covered because you have reached the sub-limit for Internal Prostheses and MRI / CT / PET scans imposed by your medical aid.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans