- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Bonitas MedGap Supreme Plan

Overall, the Bonitas MedGap Supreme Plan is a trustworthy short-term insurance product designed to provide extra protection for those with medical aid. The Bonitas MedGap Supreme Gap Cover Plan starts from R279 ZAR. Bonitas MedGap has a trust score of 4.5.

| 🔎 Provider | 🥇 Bonitas MedGap Supreme Plan |

| 🟥 Years in Operation | 41 years |

| 🟧 Underwriters | Centriq Insurance Company Limited |

| 🟨 Market Share in South Africa | 5%> |

| 🟩 Gap Cover Waiting Period | 3 – 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Monthly Premium | R279 – R695 |

| 🟥 Oncology Benefit | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

Bonitas MedGap Supreme Plan – 7 Key Point Quick Overview

- ✅ Bonitas MedGap Supreme Plan Overview

- ✅ Bonitas MedGap Supreme Plan Premiums

- ✅ Bonitas MedGap Supreme Plan Benefits and Cover Breakdown

- ✅ Bonitas MedGap Supreme Plan Exclusions and Waiting Periods

- ✅ Bonitas MedGap Supreme Plan vs Other Gap Cover Plans

- ✅ Our Verdict on Bonitas MedGap Supreme Plan

- ✅ Bonitas MedGap Supreme Plan Frequently Asked Questions

Bonitas MedGap Supreme Plan Overview

The Bonitas MedGap Supreme Plan is one of three plans that starts from R279 per month. The Bonitas MedGap Supreme Plan has benefits for allied professionals, oncology, co-payment, casualties, accidental death/permanent disability, premium waiver, maternity, and more.

Bonitas MedGap offers 24/7 medical emergency assistance and has a trust rating of 4.5, according to the Trust Index.

Bonitas MedGap Gap Cover has the following plans to choose from:

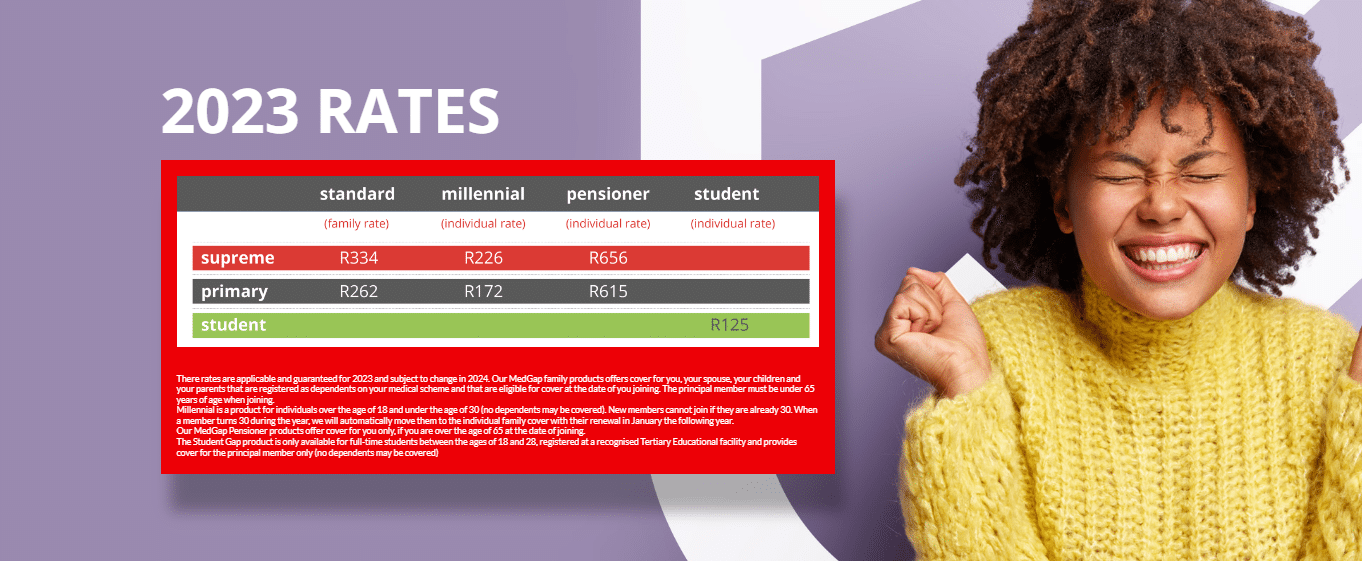

Bonitas MedGap Supreme Plan Premiums

| 🅰️ Plan | 🥇 Standard | 🥈 Millennial | 🥉 Pensioner |

| 🅱️ Premium | R499 | R279 | R695 |

Read more about the 5 Best Hospital Plans for Immigrants

Bonitas MedGap Supreme Plan Benefits and Cover Breakdown

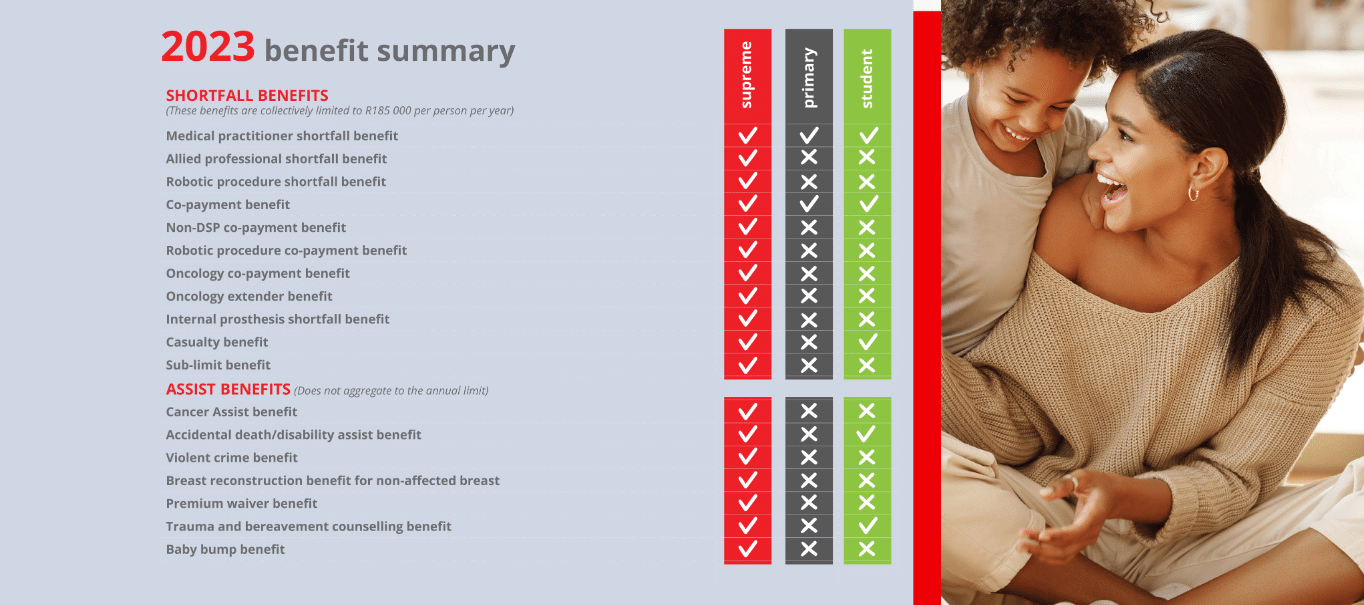

Bonitas MedGap Supreme Shortfall Benefits

| 🟥 Medical Practitioner Shortfall Benefit | Covers the gap between what the medical scheme has paid, and the actual cost incurred for the medical practitioner who treated you in the hospital of up to 300%. |

| 🟧 Allied Professional Shortfall Benefit | Covers up to 300% of the shortfall for services provided by allied health professionals. |

| 🟨 Robotic Procedure Shortfall Benefit | Covers the shortfall for robotic-assisted procedures by up to 300%. |

| 🟩 Co-payment Benefit | Covers the co-payment required by your medical scheme for certain procedures or treatments. |

| 🟦 Non-DSP Co-Payment Benefit | Covers the co-payment for using non-designated service providers. |

| 🟪 Robotic Procedure Co-Payment Benefit | Covers the co-payment for robotic-assisted procedures up to R12,000. |

| 🟥 Oncology Co-Payment Benefit | Covers the co-payment for oncology treatments by up to 20%. |

| 🟧 Oncology Extender Benefit | Provides additional cover for oncology treatments up to 20%. |

| 🟨 Internal Prostheses Shortfall Benefit | The shortfall cover for internal prostheses is up to R35,000 per family per year, while stents are covered up to R8,000, subject to the overall annual limit. |

| 🟩 Casualty Benefit | Provides cover for treatments received in a casualty ward up to R23,000. |

| 🟦 Sub-limit Benefit | Provides additional cover of up to R14,000 when the medical scheme’s sub-limits are reached. |

Bonitas MedGap Supreme Assist Benefits

| 🟥 Cancer Assist Benefit | Provides additional support for cancer treatments of up to 8,000 for minimum state 2 local and malignant cancers initially. Alternatively, it pays up to R20,000 for a first-time diagnosis and an additional R15,000 if the medical aid oncology benefit is reached within the same year. |

| 🟧 Accidental Death or Disability Assist Benefit | Provides a lump sum payment of R55,000 for accidental death or disability. |

| 🟨 Violent Crime Benefit | Provides a lump sum payment in the event of violent crime. |

| 🟩 Breast Reconstruction Benefit (for non-affected breast) | Covers the cost of reconstructive surgery of up to R15,000 for the non-affected breast after a mastectomy. |

| 🟦 Premium Waiver Benefit | Waives the premium in the event of certain circumstances for up to R36,000. |

| 🟪 Trauma and Bereavement Counselling Benefit | Provides cover for trauma and grief counseling of up to R30,000. |

| 🟥 Baby Bump Benefit | Provides a lump sum payment of R2,500 for the birth or adoption of a child. |

READ more about the 5 Best Thorough Covered Medical Aid Plans in South Africa

Bonitas MedGap Supreme Plan Exclusions and Waiting Periods

Bonitas MedGap Supreme Exclusions

Bonitas MedGap excludes cover for:

- ✅ Participation in war, invasion, terrorist activity, rebellion, active military duty, police duty, police reservist duty, civil commotion, labor disturbances, riots, strikes, or the activities of locked-out workers.

- ✅ Nuclear weapons, nuclear material, ionizing radiation, or contamination by radioactivity from any nuclear fuel or any nuclear waste from burning nuclear fuel, including any self-sustaining process of nuclear fission (splitting an atomic nucleus into small parts).

- ✅ Taking any legal drug unless it has been prescribed by a registered medical practitioner (other than you) and you are following the medical practitioner’s instructions in taking the drug.

- ✅ Taking any illegal drug.

and many more. A full list of exclusions will be provided by Bonitas.

Bonitas MedGap Supreme Waiting Periods

Bonitas MedGap has the following waiting periods:

- ✅ A General 3-Month Expiration Period

- ✅ A pre-existing condition waiting period of 9 months

Finally, a 12-Month waiting period for birth, cancer, or anything pregnancy-related.

Bonitas MedGap Supreme Plan vs Other Medical Aid Gap Cover Plans

| 🔎 Provider | 🥇 Bonitas MedGap Supreme Plan | 🥈 Cura Administrators Gap Advanced | 🥉 NetcarePlus GapCare 500+ |

| 🟥 Years in Operation | 41 years | 26 years | 27 years |

| 🟧 Underwriters | Centriq Insurance Company Limited | GENRIC Insurance Company Limited | The Hollard Insurance Company Limited |

| 🟨 Market Share in South Africa | 5%> | <5% | <5% |

| 🟩 Gap Cover Waiting Period | 3 – 12 months | 3 – 12 months | 3 – 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Monthly Premium | R279 – R695 | R397 – R625 | R355 |

| 🟥 Oncology Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | None | ✅ Yes |

| 🟩 Maternity Benefit | ✅ Yes | None | ✅ Yes |

| 🟦 Scopes and Scans | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Co-payment Cover | ✅ Yes | None | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Accidental Cover | ✅ Yes | None | ✅ Yes |

| 🟨 Trauma Counseling | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟩 Premium Waiver | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Non-DSP Co-Payment | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Prostheses | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Travel Cover Extender | None | ✅ Yes | None |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | None | ✅ Yes |

Our Verdict on Bonitas MedGap Supreme Plan

According to our research, the Bonitas MedGap Supreme Plan offers a comprehensive range of benefits and covers medical expenses, making it an attractive option for individuals seeking additional cover.

The plan benefits various services, including oncology, in-hospital and out-of-hospital treatments, co-payments, emergency room visits, and more.

Frequently Asked Questions

What is the monthly premium for Bonitas MedGap Supreme Plan in 2024?

The Bonitas MedGap Supreme Plan premiums in 2024 are as follows: Standard – R499, Millennial – R279, Pensioner – R695.

What are the benefits covered by Bonitas MedGap Supreme Plan?

Bonitas MedGap Supreme Plan covers a wide range of benefits, including allied professionals, oncology, co-payment, casualties, accidental death/permanent disability, premium waiver, and maternity, among others.

How does Bonitas MedGap Supreme Plan compare to other gap cover plans?

Bonitas MedGap Supreme Plan offers comparable benefits to other gap cover plans, especially those of notable short- and long-term insurance market competitors.

What are the waiting periods for Bonitas MedGap Supreme Plan?

Bonitas MedGap Supreme Plan has a general 3-month waiting period for those not signing up through an employer. Additionally, there is a 9-month waiting period for pre-existing conditions and a 12-month waiting period for birth, cancer, or anything pregnancy-related.

Does the Bonitas MedGap Supreme Plan provide 24/7 medical emergency assistance?

Yes, the plan offers 24/7 medical emergency assistance, ensuring you have access to support and guidance during emergencies, day or night.

How does the Bonitas MedGap Supreme Plan compare to other gap cover plans?

The Bonitas MedGap Supreme Plan distinguishes itself through its comprehensive coverage, including benefits for oncology treatments, in-hospital and out-of-hospital care, co-payments, emergency room visits, and more.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans