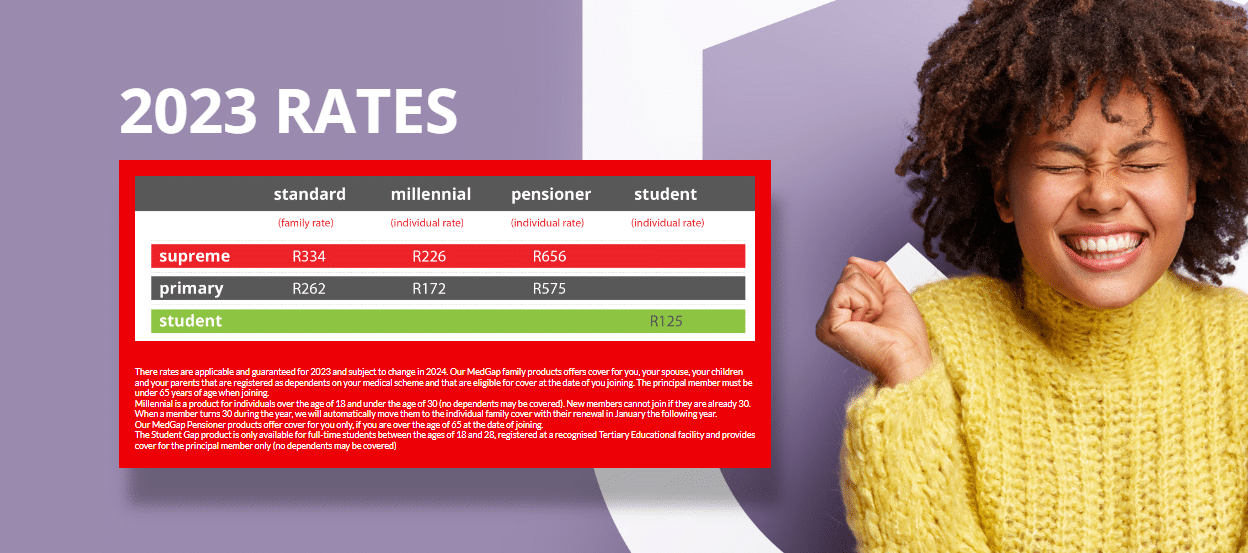

Monthly Premium

From R240

Waiting Period

3 - 12 months

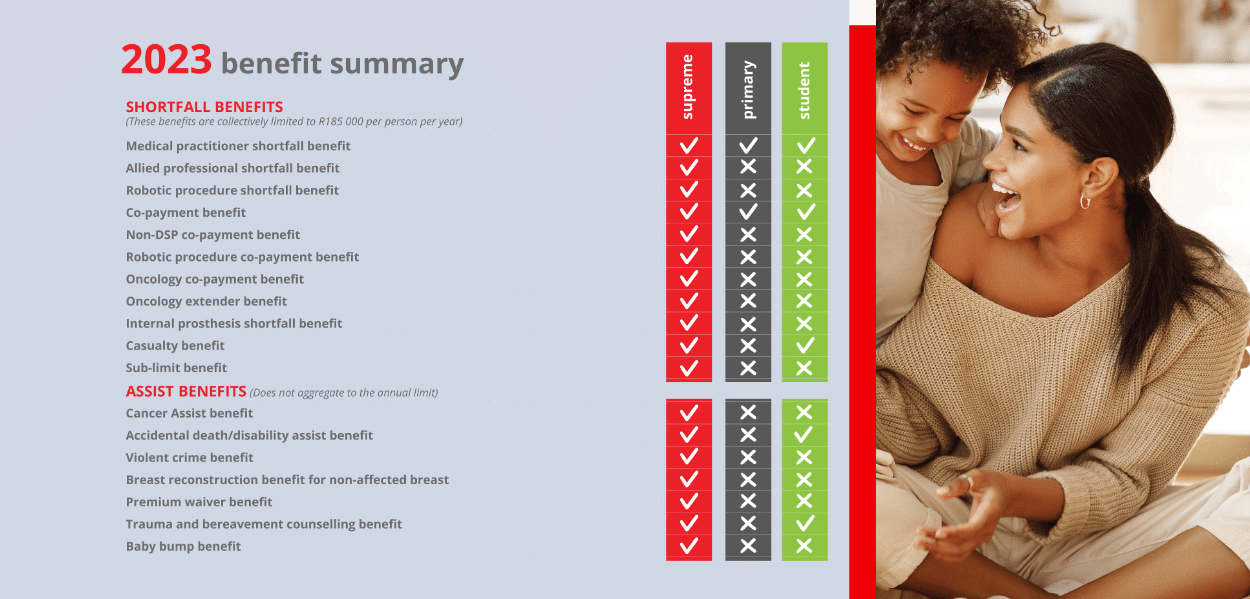

MedGap Primary

The Primary Plan offers benefits for medical practitioner shortfalls and co-payments.

★★★★★ 4.5/5

Oncology Benefits:

Scopes and Scans:

Accidental Cover:

Trauma Counseling:

Co-Payment Cover:

Maternity Benefits:

The Primary Plan offers benefits for medical practitioner shortfalls and co-payments.

In Hospital Benefits:

Out of Hospital Cover

Tax Deductible:

Prostheses:

MedGap Primary

The Primary Plan offers benefits for medical practitioner shortfalls and co-payments.

★★★★★ 4/5

Monthly Premium

From R240

Waiting Period

3 - 12 months

The Primary Plan offers benefits for medical practitioner shortfalls and co-payments.

In Hospital Benefits:

Out of Hospital Cover

Tax Deductible:

Prostheses: