- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Platinum Health Medical Aid

Overall, Platinum Health offers 3 medical aid plans (PlatCap, PlatComprehensive, and PlatFreedom) starting from R1,298 per month. Additionally, Platinum Health offers 24/7 emergency support but does not offer comprehensive gap cover on any policy.

| 🔎 Medical Aid | 🥇 Platinum Health |

| 💙 Average Customer Rating | 3/5 |

| 📈 Average Number of Reviews | 3,000+ |

| 📉 Market Share | <5% |

| 3️⃣ Number of plan | 3 |

| 🚑 Number of Hospitals in Network | <50 |

| 🏠 Home care provided | No |

| ➡️ Sponsorships | None |

| 📱 Mobile App | No |

| 💻 Social Media Platforms and Links | YouTube |

Platinum Health Review – Analysis of Medical Aids’ Main Features

- ☑️ Platinum Health at a Glance

- ☑️ Platinum Health Regulation

- ☑️ Platinum Health – Advantages over Competitors

- ☑️ Platinum Health Plan Overview

- ☑️ How to apply for Medical Aid with Platinum Health

- ☑️ How to Submit a Claim with Platinum Health

- ☑️ How to Submit a Compliment or Complaint with Platinum Health

- ☑️ How to Switch my Medical Aid to Platinum Health

- ☑️ Platinum Health Customer Support

- ☑️ Platinum Health vs GEMS vs Medshield – A Comparison

- ☑️ Platinum Health Member Reviews

- ☑️ Platinum Health – Our Verdict

- ☑️ Platinum Health Pros and Cons

- ☑️ Platinum Health Frequently Asked Questions

Medical Aid Platinum Health at a Glance

| 📌 Date Established | 2001 |

| 📍 Headquartered | Northwest, South Africa |

| ✔️ Registration Number | 29/4/2/1583 |

| 👥 The average number of members | <55,000 |

| ✒️ Number of Markets | South Africa |

| 👤 Number of Employees | 100+ |

| 📈 GCR Rating | A+ |

| 📉 Listed on the JSE | ❎ No |

| 📊 JSE Stock Symbol | None |

| ➡️ The most recent Market Cap reported | None |

| 💙 Average Customer Rating | 3/5 |

| 💯 Average Number of Reviews | 3,000+ |

| 📌 Market Share | <5% |

| 3️⃣ Number of plan | 3 |

| 🚑 Number of Hospitals in Network | <50 |

| 🏠 Home care provided | ❎ No |

| ❤️ Sponsorships | None |

| 📱 Mobile App | No |

| 📌 Social Media Platforms and Links | YouTube |

| 📖 Platinum Health Magazine for clients | ❎ No |

| 💻 Medical Claims Portal | ✅ Yes |

| 😷 Information Hub for COVID-19 | ✅ Yes |

| ⚕️Chronic Illness Benefits | ✅ Yes |

| ⚙️ Number of PMB Diagnoses | 270 |

| 📈 Number of PMB Chronic Conditions | 27 |

| 📉 Screening and Prevention offered | ✅ Yes |

| 👶 Maternity Benefit | ✅ Yes |

| 💵 Medical Aid Contribution Range (ZAR) | 1,298 – 5,016 ZAR |

| ⛔ Average Waiting Period | 12 months |

| 💶 Late-joiner penalties charged | ✅ Yes |

| 🌎 Is International Medical Cover offered | ❎ No |

You might consider adding Gap Cover. Here is the 5 Best Gap Cover Options for Under R1 000

Platinum Health Regulation

The Council for Medical Schemes regulates Platinum Health Medical Scheme. The Council governs South Africa’s medical plan business for Medical Schemes (CMS), a regulating body set up under the Medical Schemes Act, No. 131 of 1998 (the Act). The CMS is responsible for a range of tasks related to the oversight of medical insurance plans, such as:

- Responsible for registering medical insurance plans and ensuring they comply with the law and other laws.

- Making sure healthcare plans have the money to pay claims.

- Examining and authorizing proposed price hikes for medical plans.

- Accepting and examining member complaints and initiating disciplinary action against medical plans that violate the Act or other applicable rules.

- Helping medical insurance plans follow the law and other laws.

Furthermore, if a medical scheme is found to violate the law, the CMS has the authority to issue administrative fines and penalties.

Platinum Health – Advantages over Competitors

- Platinum Health Care offers an extensive range of medications to treat acute and chronic diseases and illnesses.

- No limitations are imposed on the doses of medications required for acute treatment.

- Up to 80 different medications are available for chronic medical conditions.

- Platinum Health is a one-stop solution, managing internal management duties such as authorization, hospital placement, transportation, and member accounts.

- Fast services are available even for basic members.

- Proper treatment protocols are followed for all members receiving treatment at registered hospitals.

- Platinum Health offers a generous medical scheme with a moderate increase in members’ contributions, making it one of the cheapest providers in South Africa.

- Monthly contributions are typically 60% lower than the regular market price.

- Most DSP medical facilities are easily accessible across South Africa, and transportation arrangements can be made for members who have difficulty reaching their appointments.

Read more about the 5 Best GP Network Plans on Medical Aid

Platinum Health Plan Overview

| 🔎 Plan | 💴 Contributions (Main) | 💵 Contributions (+ Adult) | 💶 Contributions (+ Child) | 📈 PMB Diagnosis | 📊 Chronic Conditions |

| 1️⃣ PlatCap | 1,298 – 2,965 ZAR | 1,298 – 2,965 ZAR | 530 – 1,030 ZAR | 270 | 27 |

| 2️⃣ PlatFreedom | 2,449 – 5,016 ZAR | 1,992 – 3,984 ZAR | 657 – 1,179 ZAR | 270 | 27 |

| 3️⃣ PlatComprehensive | 1,729 – 2,965 ZAR | 1,729 – 2,965 ZAR | 585 – 1,030 ZAR | 270 | 27 |

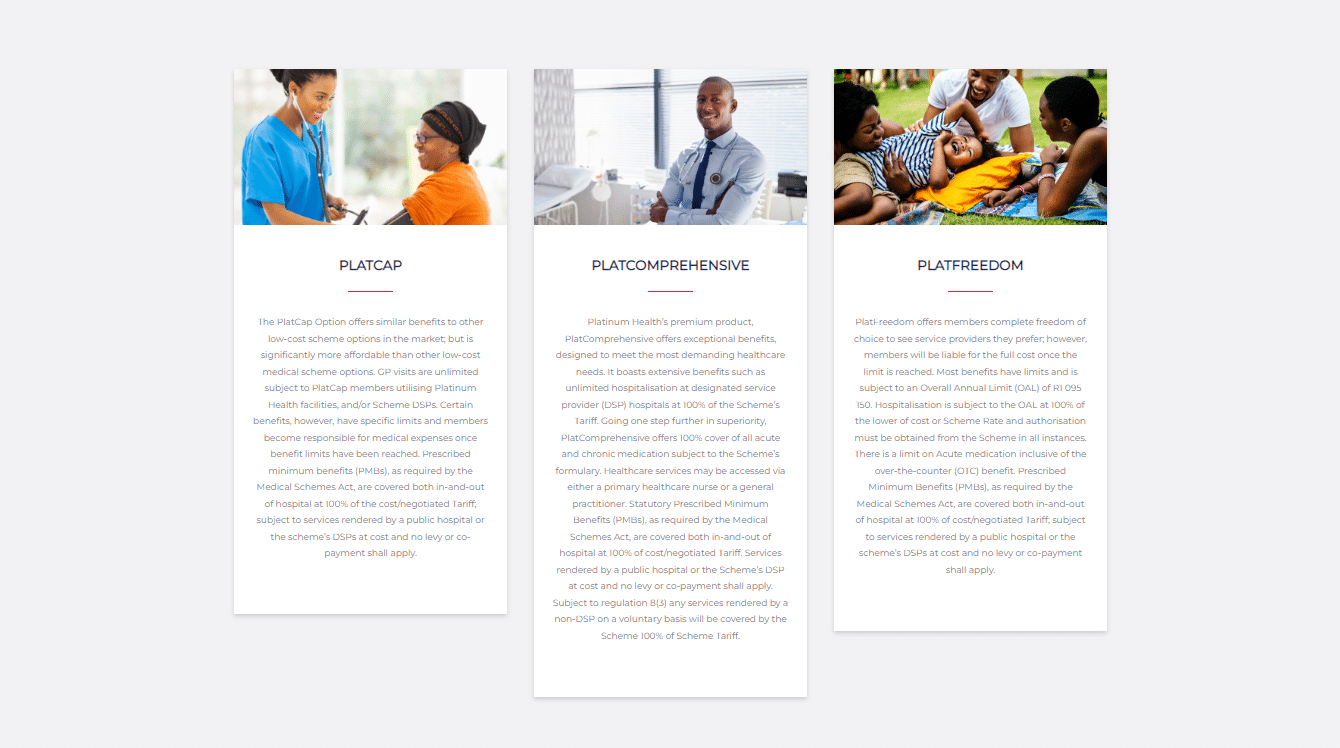

PlatCap

The PlatCap Option is a low-cost medical scheme that provides similar benefits to other options in the market while being more affordable. Unlimited GP visits are available to PlatCap members who utilize Platinum Health facilities or designated service providers (DSPs). However, certain benefits have specific limits, and members become responsible for medical expenses once those limits have been reached. Prescribed minimum benefits (PMBs), as required by the Medical Schemes Act, are covered at 100% of the cost or negotiated tariff, both in- and out-of-hospital, for services rendered by public hospitals or the scheme’s DSPs.

Prospective members and members must ensure that they read their plan brochure to familiarize themselves with the remarks and conditions that apply to each benefit.

PlatFreedom

The PlatFreedom option gives members complete freedom to see their preferred service providers. However, members will be liable for the full cost once the limit is reached. Most benefits have limits and are subject to an overall annual limit (OAL) of R1,157,574. Hospitalization is subject to the OAL at 100% of the lower cost or Scheme rate, and authorization must be obtained from the Scheme. In addition, there is a limit on acute medication, including over-the-counter (OTC) benefits. As required by the Medical Schemes Act, PMBs are covered at 100% of the cost or negotiated tariff, both in- and out-of-hospital, for services rendered by public hospitals or the scheme’s DSPs.

Prospective members and members must ensure that they read their plan brochure to familiarize themselves with the remarks and conditions that apply to each of the benefits.

PlatComprehensive

The PlatComprehensive option, Platinum Health’s premium product, offers extensive benefits to meet demanding healthcare needs. It includes unlimited hospitalization at DSP hospitals at 100% of the Scheme’s Tariff, 100% cover of all acute and chronic medication subject to the Scheme’s formulary, and healthcare services that can be accessed through a primary healthcare nurse or general practitioner. As required by the Medical Schemes Act, PMBs are covered at 100% of the cost or negotiated tariff, both in- and out-of-hospital, for services rendered by public hospitals or the scheme’s DSPs.

Prospective members and members must ensure that they read their plan brochure to familiarize themselves with the remarks and conditions that apply to each of the benefits.

How to apply for Medical Aid with Platinum Health

Medical Aid Quote Platinum Health Medical Scheme process explained

To apply for Medical Aid through Platinum Health, you must:

- Go to the Platinum Health website and hover over “Member Tools.”

- Click on “Membership” from the options, and a new page will load.

- From here, scroll down to “Membership Application” and download the PDF application form.

- Print the form and complete it in print using black ink.

The following documents must accompany the application for membership to Platinum Health:

- The main member’s copy of their South African ID book or card.

- A copy of each dependent’s South African ID Document (16>) or Birth Certificate for those younger than 16.

- Copy of marriage certificate for husband/wife.

- Proof of income or proof of student registration for dependents who are 21 and older.

- Proof of income for the main member.

All completed applications and supporting documents must be emailed to the Membership Department of Platinum Health.

How to Submit a Claim with Platinum Health

Platinum Health has established an agreement with designated service providers (DSPs) to streamline the payment of claims by submitting them directly to the Scheme. Suppose a member receives a tax invoice or account from a medical service provider. In that case, they are advised to contact Platinum Health Client Liaison to confirm whether the invoice has been submitted to the Scheme. If the invoice has not been submitted, the member must do so within four months of the date of services or supplies to prevent it from becoming invalid and resulting in non-payment.

Discover the 5 Best Medical Aids under R500

How to Submit a Compliment or Complaint with Platinum Health

Compliments can be submitted directly to Platinum Health. Furthermore, in the case of a complaint, members must contact Platinum Health directly to submit their issue. Members can contact the Council for Medical Schemes to escalate the issue if the issue is not resolved.

How to Switch my Medical Aid to Platinum Health

To switch your medical aid to Platinum Health, follow these steps:

- Compare the different plans offered by Platinum Health to determine which one best suits your needs and budget.

- Gather all relevant personal and medical information of all family members covered under the new plan. This includes ID numbers, medical history, and current medication details.

- Contact Platinum Health and inform them that you want to switch your medical aid to them. Provide them with the required information.

- Review and sign the necessary forms and agreements to initiate the switch.

- Notify your current medical aid provider of your intention to switch and give them the required notice period, usually one month.

- Provide Platinum Health with proof of termination from your previous medical aid provider.

- Start using your Platinum Health medical aid and make sure all relevant claims are submitted to them.

- Always remember that switching medical aid providers may change benefits, premiums, and waiting periods for pre-existing conditions. Therefore, it is essential to fully understand the terms and conditions of the new plan before making the switch.

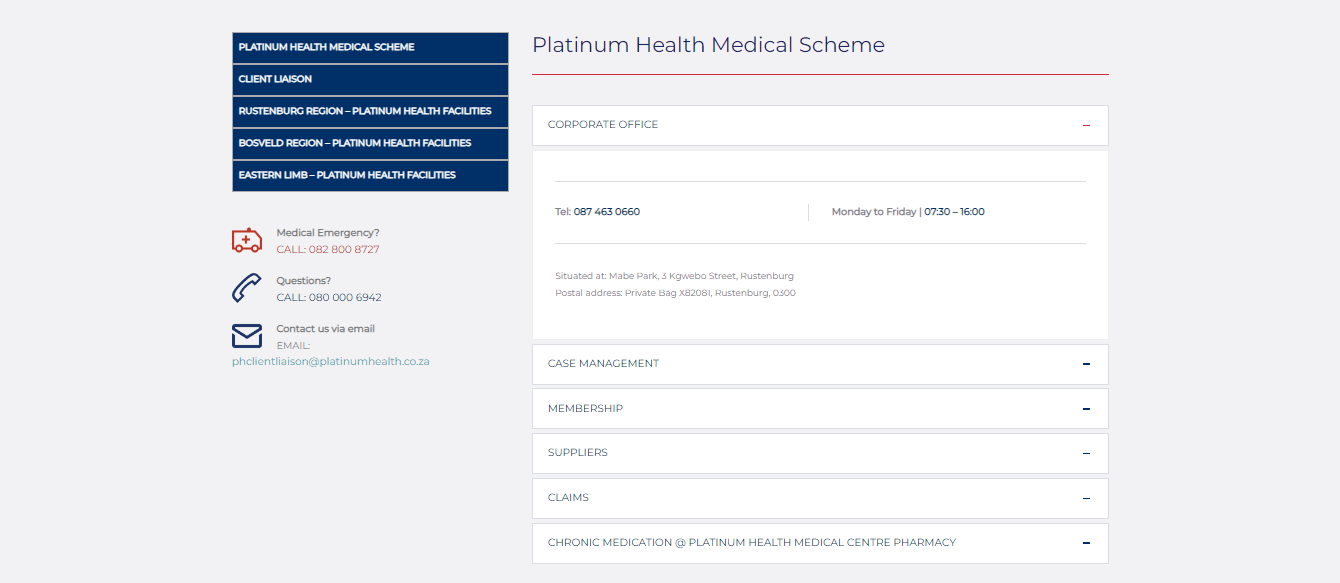

Platinum Health Customer Support

You can contact Platinum Health Medical Aid in South Africa through the following methods:

- Phone: You can call their customer support line.

- Email: You can send an email to their customer support email address.

- Website: You can visit their website and fill out a contact form. Furthermore, you will find the contact details of different departments under the “Contact Us” section of the website.

Platinum Health vs GEMS vs Medshield – A Comparison

| 🔎 Medical Aid | 🥇 Platinum Health | 🥈 GEMS | 🥉 Medshield |

| 📌 Years in Operation | 22 Years | 18 Years | 55 Years |

| 📍 Average # Members | <55,000 | 1.8 million+ | 250,000+ |

| ✔️ GCR Rating | A+ | AA | AA- |

| 👥 Number of Employees | 100+ | 500+ | 500 – 1,000 |

| 📈 Market Share | <5% | >10% | <5% |

| 📉 Market Coverage | South Africa | South Africa | South Africa |

| 📊 Customer Rating | 3/5 | 3 | 3.5 |

| 💙 Number of reviews | 3,000+ | 1,700+ | 900+ |

| 📱 Mobile App | No | Yes | Yes |

| 💶 Contribution Range (ZAR) | 1,298 – 5,016 ZAR | 1,363 – 6,162 ZAR | 1,584 – 7,842 ZAR |

Platinum Health Member Reviews

Exceptional Service.

I would like to express my gratitude for the exceptional service provided by Platinum Health. On two separate occasions, I encountered financial difficulties and could not make my premiums. However, the employees at Platinum Health went beyond to offer me a reduced premium. They even paid my arrears so that I could retain my benefits. Their efforts to assist me and retain my business are appreciated. – Yousef Guzman

Happy Member.

I had a conversation with a warm, efficient consultant, and they helped me make the best decision for my health. This was particularly difficult for me as I had recently lost my job. However, the consultant provided the necessary guidance and support. – Gary Calhoun

Highly Recommended.

I recently contacted Platinum Health with a query about an increase in my Cancer Policy. As a pensioner, this increase was a significant concern for me. However, the consultant I spoke to listened to my concerns with professionalism, empathy, and kindness and promptly assisted me with my request. Their assistance was invaluable, and I am grateful that I was offered a reasonable and affordable package instead of canceling my policy. – Noel Eaton

Platinum Health – Our Verdict.

Platinum Health is a reputable medical aid scheme in South Africa offering quality healthcare services to its members. Everyone has access to Platinum Health’s extensive benefits and medical services. Members, for instance, have access to several unlimited benefits and services, and the conditions for these benefits are reasonable. However, while Platinum Health offers comprehensive options, some areas require improvement, especially in terms of live chat options on the site, its presence on social media, the lack of a medical savings account, and the lack of a mobile app for iOS and Android devices.

Platinum Health Pros and Cons

| ✅ Pros | ❎ Cons |

| Platinum Health offers quality healthcare benefits and services to all members | Several stringent conditions apply across plans |

| There is comprehensive in- and out-of-hospital cover | There is an exceptionally long list of exclusions |

| Unlimited emergency medical transport | There is no medical savings account |

| High annual limits for procedures, oncology, and other conditions | There is limited geographic cover for some medical facilities |

| Reliable and efficient customer support via flexible channels | Waiting times for medical services can apply |

Platinum Health Frequently Asked Questions

Who can join Platinum Health in South Africa?

Anyone in South Africa can join Platinum Health.

Is Platinum Health a good medical aid?

Platinum Health is a good medical aid in South Africa. Platinum = offers extensive benefits, including unlimited hospitalization at designated service provider (DSP) hospitals with cover of 100% of the Scheme’s Tariff. Additionally, Platinum Health provides 100% coverage for all acute and chronic medication within the scheme’s rules and annual limits.

What is the waiting period for Platinum Health?

There may be a three-month mandatory waiting period in addition to any condition-specific requirements of up to a year. Suppose a member agrees to pay three months’ worth of medical scheme contributions up front in addition to their regular monthly contributions. In that case, they can avoid the waiting period altogether.

How do I claim from Platinum Health?

You can submit your medical claims to Platinum Health via mail, email, or fax.

Where can I view the Platinum Health medical aid Doctors List?

You can view the DSP list on the Platinum Health website under “Service Providers” and by downloading the Designated Service Providers list.

Where do I find out who the Platinum Health Service Providers are for my area?

You can view this information on the DSP list on the Platinum Health website. You can also view the facilities closest to you on the website.

How long do Platinum Health claims take?

There is no precise timeframe in terms of the claims process. Furthermore, Platinum Health indicates that all claims and refunds are processed according to the Medical Scheme Rules, Rates, and Tariffs.

What are the Platinum Health Authorization contact details?

For authorizations, members can contact Platinum Health at 080 000 6942.

What is the Platinum Health medical aid email address?

For general queries, non-members and members can contact Platinum Health via email at [email protected].

How do I Downgrade my Plan with Platinum Health?

Each year in November, members can switch to a different medical plan or scheme. This modification will go into effect on January 1 of the following year. You can contact Platinum Health’s customer service team via phone, email, or online chat to initiate the downgrading of your plan.

How do I add a Beneficiary to Platinum Health?

If you want to add a child or adult dependent, you can log into your Platinum Health profile and complete any necessary paperwork.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans