- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Genesis Late Joiner Fee

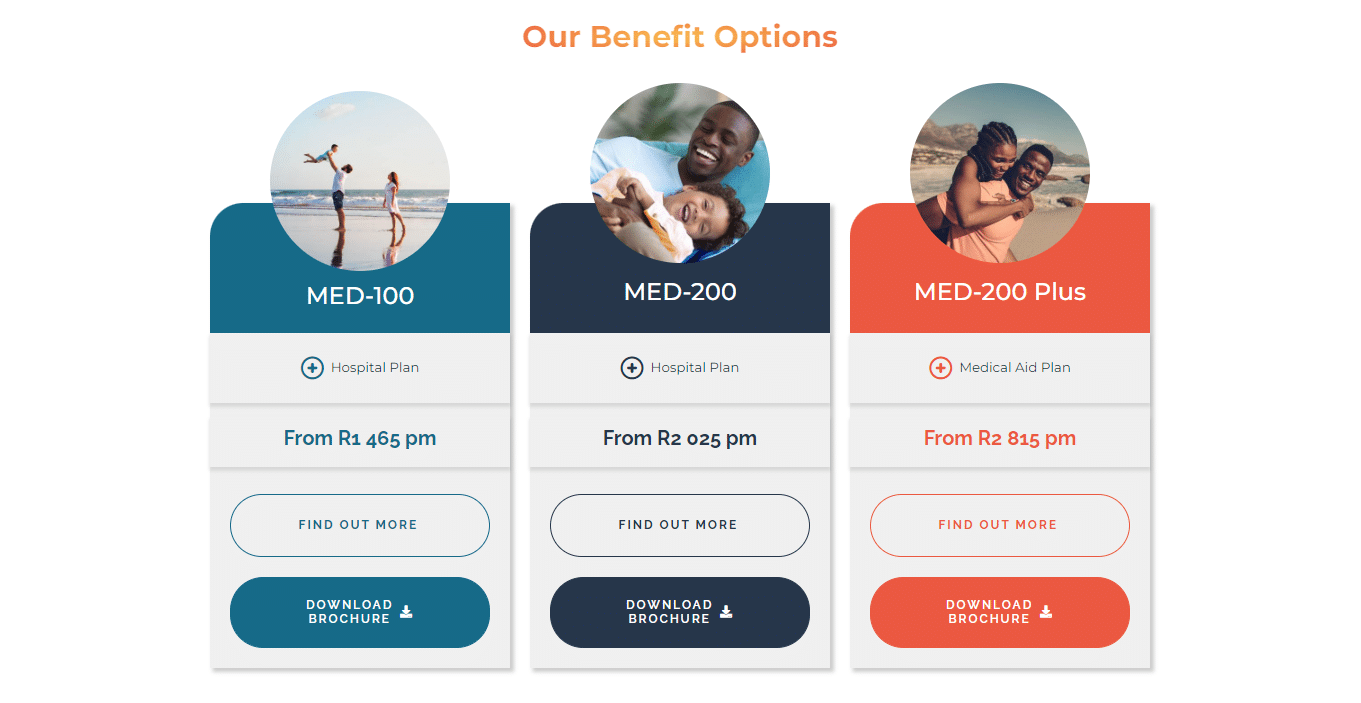

Overall, Genesis is a trustworthy and comprehensive medical aid provider. New Members 35 years or older may be subject to late-joiner penalties on Genesis Medical Aid Plans. The Genesis Medical Aid Plans start from R1465 ZAR per month. Genesis Medical Scheme has a trust rating of 4.2.

| ➡️ Penalty Bands (number of years without cover after age 35) | 💶 Maximum Penalty |

| 🟥 1 – 4 years | 0.05 x monthly contribution |

| 🟧 5 – 14 years | 0.25 x monthly contribution |

| 🟨 15 – 24 years | 0.50 x monthly contribution |

| 🟩 25+ years | 0.75 x monthly contribution |

Genesis Late Joiner Fees – 9 Key Point Quick Overview

- ✅ Genesis Late Joiner Fees – What to know before Joining

- ✅ Genesis Waiting Periods

- ✅ Genesis Exclusions

- ✅ Genesis and Pre-existing Conditions

- ✅ Late Joiner Fees vs. Waiting Periods – What is the Difference

- ✅ What Happens if You Do Not Pay Late Joiner Fees

- ✅ National Health Insurance (NHI) Bill South Africa

- ✅ Our Verdict on Genesis Late Joiner Fees

- ✅ Genesis Late Joiner Fees Frequently Asked Questions

Genesis Late Joiner Fees – What to know before Joining

Genesis Medical Scheme, per the Medical Schemes Act, may impose a late joiner penalty on applicants who have not been members of a medical scheme for a specific period.

The funding model for medical schemes is based on cross-subsidization, where younger and healthier members contribute for an extended period without making substantial claims, thereby subsidizing the claims of older and more medically fragile members.

As time passes, the younger members become older and can benefit from the contributions of the newer, healthier members. Late joiner penalties are calculated based on the years the applicant did not have medical scheme cover after 35. The penalties imposed by Genesis are as follows:

The purpose of late joiner penalties in Genesis Medical Scheme is to prevent selective abuse, where applicants join a scheme later in life when they require the more extensive cover without having contributed to the scheme’s risk pool. Existing members’ medical savings accounts cannot be used to cover the costs of new members, who expect to receive extensive benefits as soon as they join. As a result, Genesis Medical Scheme imposes late joiner penalties to offset these potential costs.

A late joiner, in the context of Genesis Medical Scheme, is an applicant, or an adult dependent of an applicant, who is 35 years of age or older and who was not a member of a medical scheme before 1 April 2001 without a break in cover exceeding 3 consecutive months since that date.

| ➡️ Penalty Bands (number of years without cover after age 35) | 💶 Maximum Penalty |

| 🟥 1 – 4 years | 0.05 x monthly contribution |

| 🟧 5 – 14 years | 0.25 x monthly contribution |

| 🟨 15 – 24 years | 0.50 x monthly contribution |

| 🟩 25+ years | 0.75 x monthly contribution |

Genesis Waiting Periods

Genesis reserves the right to impose waiting periods based on the applicant’s health profile as determined by the Scheme. The two forms of delays are as follows:

- ✅ A general waiting period of up to three months, during which members are required to pay their regular monthly contributions but are not entitled to any benefits, except in specific cases relating to PMBs, in which case treatment can be obtained at any public or state hospital in South Africa, subject to the Uniform Patient Fee Schedule (UPFS) tariff.

- ✅ Secondly, members must continue making regular monthly payments during a condition-specific waiting period of up to 12 months. Therefore, except in limited circumstances involving PMBs, for which care can be obtained at any public or state hospital in South Africa subject to the Uniform Patient Fee Schedule (UPFS) tariff, the member will be responsible for all medical expenses incurred during the first 12 months.

This safeguard is designed to discourage people from enrolling in the Scheme so that they can gain access to healthcare in the near future.

Genesis Exclusions

Some general exclusions include, but are not limited to:

- ☑️ Bandages and aids

- ☑️ Patented foods, including baby foods and milk substitutes

- ☑️ Slimming preparations

- ☑️ Tonics and nutritional supplements

- ☑️ All costs for cosmetic procedures/treatment/medication, except if due to an accident, illness, or disease.

- ☑️ Operations for nasal or breast reconstruction except due to medical reasons.

- ☑️ All costs for operations, medicines, treatment, and procedures for obesity, cosmetic purposes, or of the member’s choosing where this has no connection with any illness, presumed illness, accident, or other medical disability:

- ☑️ Medicines not registered with the Medicines Control Council

- ☑️ Toiletries and beauty preparations

and more. A full list of exclusions will be provided by Genesis.

Genesis and Pre-existing Conditions

When joining a medical aid scheme, it is essential to note that there is usually a waiting period of 12 months before any pre-existing conditions are covered. Therefore, joining a medical aid scheme earlier in life is advisable, rather than waiting until old age when the risk of developing chronic health conditions is higher.

Additionally, it is important to note that some medical aid schemes, such as Genesis, have specific policies regarding pre-existing conditions.

Therefore, it is important to research and understands the policies of a medical aid scheme before joining to ensure that you are fully aware of any waiting periods or limitations regarding pre-existing conditions.

Late Joiner Fees vs. Waiting Periods – What is the Difference

Late Joiner Fees are a one-time penalty fee charged by medical aid if you join after a certain age or have never been a member of a medical aid program. Waiting periods, on the other hand, are periods during which you are not covered for certain medical aid benefits.

These waiting periods apply to all new members, regardless of whether they are charged Late Joiner Fees. Depending on the benefit, waiting periods can range from three to twelve months.

What Happens if You Do Not Pay Late Joiner Fees

Your medical aid membership may be suspended or terminated if you fail to pay the Late Joiner Fees. The scheme may also pursue legal action to collect overdue fees. If your membership is suspended, you cannot access medical aid benefits until you have paid any outstanding fees.

If your membership is terminated, you must reapply for membership and may be subject to even higher Late Joiner Fees. Therefore, paying your Late Joiner Fees on time is crucial to prevent interruptions in your medical aid coverage.

National Health Insurance (NHI) Bill South Africa

In South Africa, the NHI is a proposed universal health coverage system. It is still in the planning stages, but it could affect Late Joiner Fees and other facets of medical aid.

Our Verdict on Genesis Late Joiner Fees

Overall, Genesis Medical Scheme imposes late joiner fees on applicants who have not been members of a medical scheme for a specific time to prevent selective abuse and offset potential costs.

Furthermore, Genesis’ late joiner penalties are calculated based on the years an applicant did not have medical scheme cover after 35. The maximum penalty is 0.75 times the monthly contribution. Therefore, individuals must join Genesis Medical Scheme promptly to avoid late joiner fees.

Genesis Late Joiner Fees Frequently Asked Questions

What are the late joiner penalties for Genesis?

Late joiner penalties are additional fees charged to individuals who join Genesis Medical Scheme after the age of 35 or after a certain period has passed since they first became eligible to join.

What is a late joiner loading for Genesis Medical Scheme?

A late joiner loading is an additional fee added to the monthly contributions of individuals who join Genesis Medical Scheme after the age of 35 or after a certain period has passed since they first became eligible to join.

Can I join Genesis Medical Scheme after the age of 35?

Yes, you can join Genesis Medical Scheme after 35 but may be subject to late joiner penalties or loadings.

How much are late joiner fees for Genesis?

The amount of late joiner fees for Genesis depends on how many years an individual did not have medical scheme cover after age 35. The maximum penalty is 0.75 times the monthly contribution.

What are the late joiner policies of Genesis Medical Scheme?

Genesis Medical Scheme imposes late joiner penalties or loadings on individuals who join the scheme after 35 or after a certain period has passed since they first became eligible to join.

What are the benefits of joining Genesis Medical Scheme as a late joiner?

As a member of Genesis Medical Scheme, you can access a range of benefits, including hospital cover, chronic medication benefits, and wellness programs. However, you may have to pay late joiner penalties or loadings.

What is the compulsory waiting period for Genesis Medical Scheme?

The compulsory waiting period for Genesis Medical Scheme is when you must wait before you can start using the medical aid scheme’s benefits.

The waiting period for Genesis Medical Scheme is usually three months. However, it may be longer for certain benefits, such as maternity benefits.

How can I avoid late joiner fees with Genesis Medical Scheme?

You can avoid late joiner fees with Genesis Medical Scheme by joining the medical aid scheme before 35 or before the end of the waiting period. You could also avoid late joiner fees if you prove that you were covered by another medical aid scheme or employer’s medical scheme during the period you were eligible to join Genesis.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans