- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Clientèle Health Premium H.E.L.P Plan (2023)

Overall, the Clientèle Health Premium H.E.L.P Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and significant coverage to up to 3 Family Members. The Clientèle Health Premium H.E.L.P Plan starts from R825 ZAR.

| 🔎 Medical Health Plan | 🥇 Clientèle Health Ultimate H.E.L.P |

| 🌎 International Cover | None |

| 👤 Main Member Contribution | R825 |

| 👥 Adult Dependent Contribution | R825 |

| 👶 Child Dependent Contribution | R825 |

| 🔁 Gap Cover | None |

| 💙 Hospital Cover | ✅ Yes |

| 😷 Screening and Prevention | ✅ Yes |

| 💶 Medical Savings Account | None |

| 🍼 Maternity Benefits | ✅ Yes |

Clientèle Health Premium H.E.L.P Plan – 7 Key Point Quick Overview

- ✅ Clientèle Health Premium H.E.L.P Plan Overview

- ✅ Clientèle Health Premium H.E.L.P Plan Monthly Premiums per age 2023

- ✅ Clientèle Health Premium H.E.L.P Plan Benefits and Cover Comprehensive Breakdown

- ✅ Clientèle Health Premium H.E.L.P Plan Exclusions and Waiting Periods

- ✅ Clientèle Health Premium H.E.L.P Plan vs Medical Aid Plans

- ✅ Our Verdict on the Clientèle Health Premium H.E.L.P Plan

- ✅ Clientèle Health Premium H.E.L.P Plan Frequently Asked Questions

Clientèle Health Premium H.E.L.P Plan Overview

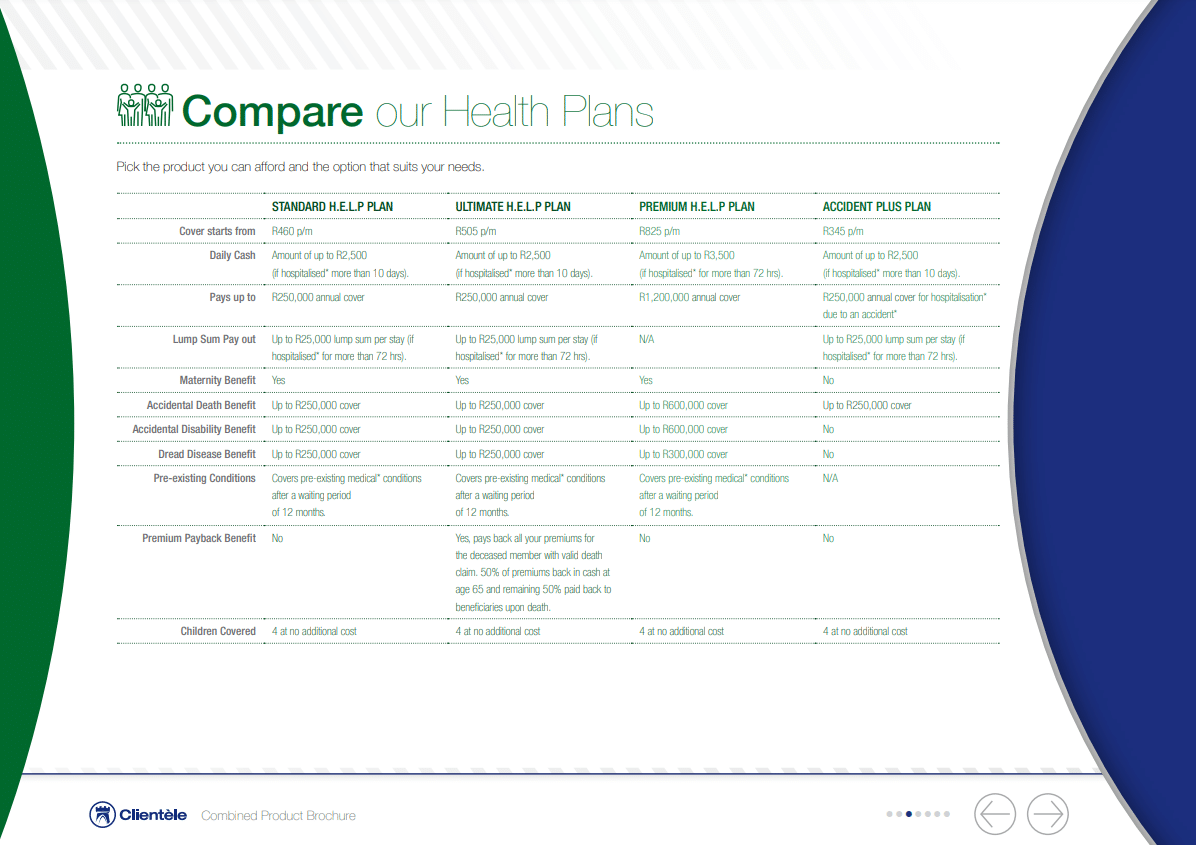

The Clientèle Health Premium H.E.L.P plan is one of 4, starting from R825 monthly. The Clientele Health Premium H.E.L.P plan is a comprehensive health insurance plan that offers significant coverage and financial protection for individuals and families in South Africa. Gap Cover is available on the Clientèle Health Premium H.E.L.P Plan, along with 24/7 medical emergency assistance. According to the Trust Index, Clientèle Health has a trust rating of 8.5.

Clientèle Health has the following four plans:

- Clientèle Health Accident Plus Plan

- Clientèle Health Premium HELP Plan

- Clientèle Health Standard HELP Plan

- Clientèle Health Ultimate HELP Plan

Clientèle Health Premium H.E.L.P Plan Monthly Premiums per age 2023

✅ Up to 61 Years: R825 per month per insured person

Clientèle Health Premium H.E.L.P Plan Benefits and Cover Comprehensive Breakdown

| 🟥 Daily Cash | Up to R3,500 if the member is hospitalized for more than 72 hours. |

| 🟧 Maximum Payment | R1,200,000 per year |

| 🟨 Maternity Benefit | Available |

| 🟩 Accidental Death Benefit | Up to R600,000 |

| 🟦 Accidental Disability Benefit | Up to R600,000 |

| 🟪 Dread Disease Benefit | Up to R300,000 |

| 🟥 Pre-Existing Conditions | Covered after a 12-month waiting period |

| 🟧 Number of Children Covered | 4 – no extra cost |

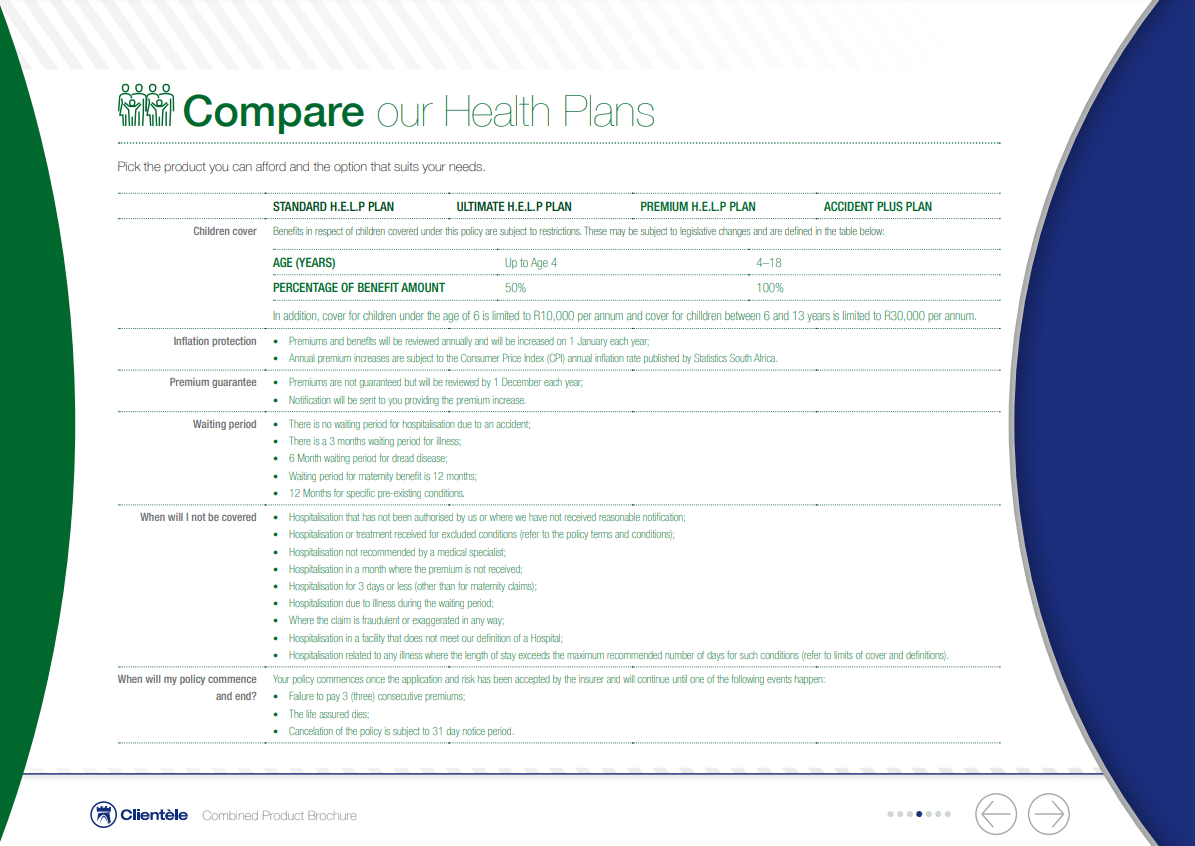

| 🟨 Children Cover | The benefits for children covered by this policy are subject to limitations. In addition, cover for children under six is capped at R10,000 per year, and cover for children between the ages of six and thirteen is capped at R30,000 per year. |

| 🟩 Inflation Protection | Each year, the premiums and benefits will be evaluated and adjusted accordingly, with increases taking effect on January 1st. Statistics South Africa reports that the annual inflation rate will determine the increased amount. |

| 🟦 Premium Guarantee | The premiums may change annually and will be assessed by December 1st of each year. Members will be notified of any premium increases. |

You might consider the 5 Best Medical Aids under R500

Clientèle Health Premium H.E.L.P Plan Exclusions and Waiting Periods

Premium H.E.L.P Plan Exclusions

The exclusions of the Clientele H.E.L.P Standard Plan are as follows:

- Hospitalization that has not been authorized by Clientele or when reasonable notification has not been received.

- Hospitalization or treatment received for conditions excluded as per policy terms and conditions.

- Hospitalization is not recommended by a medical specialist.

- Hospitalization during a month when the premium has not been received.

- Hospitalization lasts for 3 days or less (except for maternity claims).

- Hospitalization due to illness during the waiting period.

- Claims that are fraudulent or exaggerated in any way.

- Hospitalization in a facility that does not meet the Clientele’s definition of a hospital.

Hospitalization is related to an illness where the length of stay exceeds the recommended number of days for such conditions, as per limits of coverage and definitions.

Premium H.E.L.P Plan Waiting Periods

Here are the waiting periods for the Clientele H.E.L.P Standard Plan:

- No waiting period for hospitalization due to an accident.

- A 3-month waiting period for illness.

- A 6-month waiting period for the dread disease.

- A 12-month waiting period for maternity benefits.

A 12-month waiting period for specific pre-existing conditions.

Clientèle Health Premium H.E.L.P Plan vs Medical Aid Plans

| 🔎 Medical Health Plan | 🥇 Clientèle Health Ultimate H.E.L.P | 🥈 Makoti Medical Scheme – Comprehensive Option | 🥉 Sizwe Hosmed Gold Ascend |

| 🌎 International Cover | None | None | Covered up to 100% of the scheme rates |

| 👤 Main Member Contribution | R825 | R2,268 – R3,101 | R3,000 |

| 👥 Adult Dependent Contribution | R825 | R1,954 – R2,657 | R2,880 |

| 👶 Child Dependent Contribution | R825 | R754 – R1,008 | R824 |

| 🔁 Gap Cover | None | None | None |

| 💙 Hospital Cover | ✅ Yes | Unlimited | Unlimited for PMBs |

| 😷 Screening and Prevention | ✅ Yes | ✅ Yes | ✅ Yes |

| 💶 Medical Savings Account | None | None | None |

| 🍼 Maternity Benefits | ✅ Yes | ✅ Yes | ✅ Yes |

READ more about Medshield Medical Scheme

Our Verdict on the Clientèle Health Premium H.E.L.P Plan

The Clientele Health Premium H.E.L.P plan is a comprehensive health insurance policy that offers extensive coverage to individuals and families in South Africa. This plan provides peace of mind and financial security for unanticipated medical expenses by providing a higher annual coverage of R1.2 million. In addition, the plan provides more daily cash, which can be used to cover medical treatment-related expenses such as transportation and lodging. In addition, the Clientele Health Premium H.E.L.P. plan offers enhanced accidental death, disability, and dread disease benefits, which offer enhanced financial protection in the event of unforeseen events.

The accidental death and accidental disability benefits pay up to R600,000. In addition, the dread disease benefit can also pay up to R600,000 if the policyholder diagnoses a covered illness. However, the Clientele Health Premium H.E.L.P. plan has a few disadvantages. This plan’s premiums are higher than other health insurance options, making it difficult for some individuals and families to afford. In addition, the plan does not offer a lump sum payout, which may be a disadvantage for individuals who prefer this type of coverage. Finally, this plan does not include a Premium Waiver, so the policyholder must continue paying premiums even if they cannot work due to illness or injury.

- You might also like: Clientèle Health Accident Plus Plan

- You might also like: Clientèle Health Standard HELP Plan

- You might also like: Clientèle Health Ultimate HELP Plan

- You might also like: Clientèle Health Medical Insurance Review

Clientèle Health Premium H.E.L.P Plan Frequently Asked Questions

What is the Dread Disease Benefit?

The Dread Disease Benefit is a feature of the Clientele Health Premium H.E.L.P. plan that covers critical illnesses such as cancer, heart attack, and stroke. Suppose you are diagnosed with a covered illness. In that case, the benefit can be up to R600,000, which can be used to cover medical expenses and other costs.

How does the Disability Cover work?

The Clientele Health Premium H.E.L.P plan’s Disability Cover can pay up to R600,000 if you become permanently disabled due to an illness or injury. This can help cover medical bills, rehabilitation, and living expenses.

What is the Accidental Death Benefit?

The Accidental Death Benefit is a feature of the Clientele Health Premium H.E.L.P. plan that pays up to R600,000 in the event of an accident-related death. This benefit can financially assist the policyholder’s family during a calamity.

How much Daily Cash Benefit is provided?

Depending on the selected plan, the Daily Cash Benefit provided by the Clientele Health Premium H.E.L.P. plan varies. However, the plan may provide up to R3,500 per day in cash benefits for each day of hospitalization or outpatient treatment.

How much Annual Cover is provided by the plan?

The Clientele Health Premium H.E.L.P plan provides annual coverage of up to R1.2 million, which can help cover unanticipated medical expenses and provide financial security for your family.

What are the Premiums for the plan?

The Clientele Health Premium H.E.L.P plan’s premiums vary based on the level of coverage you select, your age, and other variables. Due to its comprehensive coverage and additional benefits, this plan’s premiums are generally higher than other health insurance policies. However, before deciding if a plan is a good fit for you, it is crucial to examine the plan’s details and premiums thoroughly.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans