- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Affinity Health Hospital Insurance Plan

Overall, the Affinity Health Hospital Insurance Plan is a trustworthy and comprehensive medical insurance plan that offers 24/7 medical emergency assistance and in-hospital procedures to up to 3 Family Members. The Affinity Health Hospital Insurance Plan starts from R1,258 ZAR.

| 👤 Main Member Contribution | R1,258 |

| 👥 Adult Dependent Contribution | R1,168 |

| 🍼 Child Dependent Contribution | R378 |

| 🔁 Gap Cover | None |

| 🏥 Hospital Cover | Up to R175,000 per policyholder, R275,000 per family |

| 📉 Annual Limit | Up to R175,000 per policyholder, R275,000 per family |

| 💶 Prescribed Minimum Benefits (PMB) | ✅ Yes |

| 😷 Screening and Prevention | ✅ Yes |

| 💵 Medical Savings Account | None |

| 💙 Maternity Benefits | ✅ Yes |

Affinity Health Hospital Plan – 7 Key Point Quick Overview

- ✅ Affinity Health Hospital Plan Overview

- ✅ Affinity Health Hospital Plan Contributions

- ✅ Affinity Health Hospital Plan Benefits and Cover Comprehensive Breakdown

- ✅ Affinity Health Hospital Plan Exclusions and Waiting Periods

- ✅ Affinity Health Hospital Plan vs Similar Plans from Other Medical Schemes

- ✅ Our Verdict on the Affinity Health Hospital Plan

- ✅ Affinity Health Hospital Plan Frequently Asked Questions

Affinity Health Hospital Plan Overview

The Affinity Health Hospital plan is one of 3, starting from R1,258, and includes hospital cover up to R175,000 per policyholder, serious illness benefits, maternity, day clinic procedures, and more. Gap Cover is available on the Affinity Health Hospital Plan, along with 24/7 medical emergency assistance. According to the Trust Index, Affinity Health has a trust rating of 9.9.

Affinity Health has the following three options to choose from:

- ✅ Affinity Health Hospital Insurance Plan

- ✅ Affinity Health Day-to-Day Medical Aid Plan

- ✅ Affinity Health Combined Medical Insurance Plan

Affinity Health Hospital Plan Contributions

| 🟥 Category | 🟧 Policyholder | 🟨 Spouse | 🟩 Adult Dependent | 🟥 Child Dependent |

| 🟧 Typical | R1,258 | R1,168 | R1,168 | R378 per child |

| 🟨 Junior | n/a | n/a | n/a | R1,148 first child Additional children – R378 each |

| 🟩 Senior | R1,378 | R1,298 | R1,298 | R378 per child |

You might like the 5 Best Hospital Plans for Foreigners

Affinity Health Hospital Plan Benefits and Cover Comprehensive Breakdown

Hospital Plan Main Benefits

| ⚠️ Accidental Hospital Cover | Limited to R175,000 per individual or R275,000 per family per event. Covers casualties and hospitalization. |

| ☀️ Daily Illness Hospitalisation | This benefit provides covers as follows: Day 1 to 3 – Up to R22,000 or R27,000 when the patient is admitted to the ICU. Day 4 and 5 – Up to R10,000 or R14,000 when the patient is admitted to the ICU. From the 6th day, the benefit pays R3,000 and covers up to 21 days per insured person per illness event. |

| 🟨 Sub-Acute Hospitalisation | Members have access to Affinity Health-affiliated sub-acute care. Limited to R20,000 per member annually. |

| 🟡 Serious Illness Hospital Benefit | The maximum Serious Illness Benefit for the lifetime of the policy is R300,000. The maximum benefit for confirmed Strokes and Cancer is R150,000. |

| 🍼 Maternity | Natural, home, and water birth is limited to R25,000 per birth. Maternity C-Sections are covered up to R35,000. |

| 🅰️ Day Clinic Procedures | Affinity Day Clinics for procedures up to R25,000 per member per year. Procedure-specific sub-limits will apply. |

| 🅱️ Diagnostic Procedures | Affinity Health Diagnostic Formulary procedures covered up to R20,000 per single member or R25,000 per family policy per year. Benefit limits and co-payment apply. |

| 🚗 Motor Vehicle Accident Benefit | This aids Road Accident Fund claims. Affinity Health’s attorney network will assess the accident at no cost to the member and assist with Road Accident Fund reimbursement. |

| 📌 Workmen’s Compensation Benefit | This benefit covers occupational injuries and diseases. Affinity Health advises and assists members with third-party recovery, informing them of claim progress. |

| 📍 Post-Hospital Private Home Nursing | Private nurse assistance is covered up to R11,000 per single member policy or R13,000 per family policy per year. |

| ✅ Hospital Home Care Benefit | In-home and virtual visits with remote monitoring provide patients with timely, hospital-level care at home. |

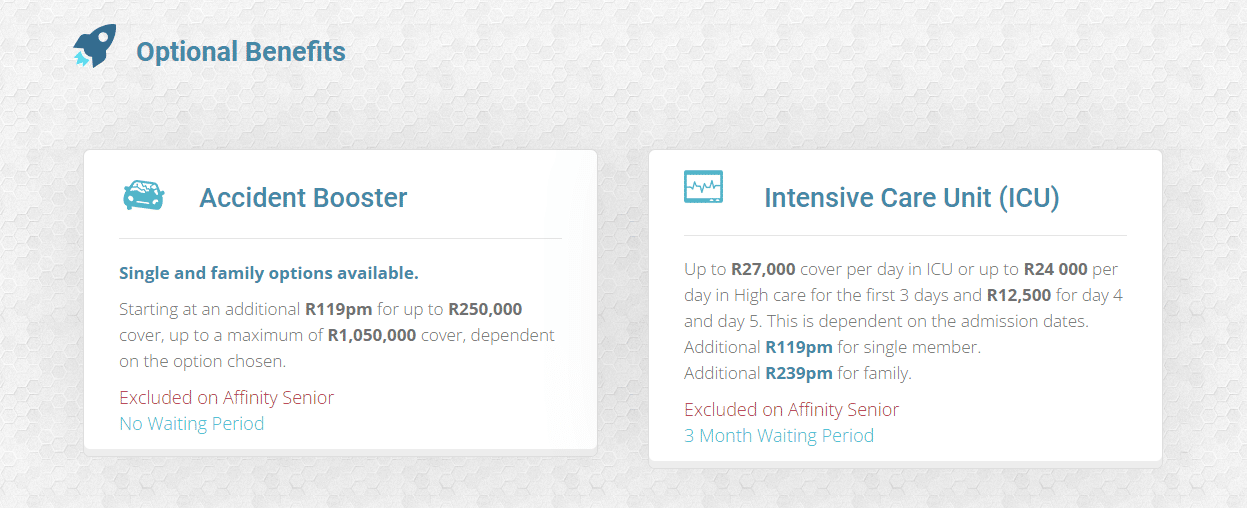

Hospital Plan Optional Benefits

| 🅰️ Intensive Care Benefit | Limited to R27,000 per day in ICU for the first 3 days, R14,000 for the 4th, and R14,000 for the 5th. Single Cover costs an additional R119 per month. Family Cover costs an additional R239 per month. |

| 🅱️ Hospital Accident Booster | This is an optional booster to increase the Accident Hospital Cover benefit. |

Hospital Plan 24/7 Emergency Services

| ⚠️ Trauma Support Services | Telephonic trauma support counseling and mental health wellness support for sexual assault, crime, gender-based violence, death, attempted suicide, and domestic violence by qualified and dedicated professionals. |

| ➡️ 24-Hour Emergency | This includes 24/7 medical advice, ambulance services, inter-hospital transfers, hospital pre-authorization, and treating facility authorization. |

| ✅ Major Trauma | Trauma covers paraplegia, quadriplegia, severe burns, internal and external head injuries, polytrauma, and limb loss. The cover is up to R1,000,000 for the policy’s duration. |

| ☑️ Immediate Emergency Casualty Room Treatment | Limited to 1 ER Accident-related room treatment up to R1,000 per policy. |

| 📊 Casualty Room Treatment | Emergency Room treatment for medical conditions and accidents up to R3,500 per policy per year. |

Discover the 5 Best Gap Cover Options for Under R300

Affinity Health Hospital Plan Exclusions and Waiting Periods

Hospital Plan Exclusions

The Affinity Health Hospital Plan will not cover any of the following:

- If a pre-existing condition causes injury within the first 12 months of cover.

- If an injury is due to suicide, intentional self-injury, or exposure to obvious risk (excluding attempts to save human life).

- If an injury is caused by alcohol, drugs, or narcotics (unless prescribed by a medical professional).

- If an injury is caused by exposure to atomic energy or nuclear reaction.

- If an injury occurs while traveling by air, participating in riots, civil commotion, or war, or during professional sports.

- If an injury results from mountaineering, rock climbing, skydiving, or similar activities unless agreed upon by the Assurer.

- If an injury is caused while committing intentional unlawful acts or driving a vehicle without proper authorization.

- If an injury results from a gradually operating condition known to the Assured Person.

- If an injury is due to congenital abnormalities, chronic diseases, or disorders.

- If an injury is related to regular medical treatments, contraceptive medication, or fertility-related therapies.

- If an injury results from elective cosmetic surgery, corrective optical or laser surgery, or treatment.

- If an injury results from male or female birth control, infertility, or assisted reproduction.

- If an injury is due to a pandemic or epidemic.

- If an unregistered healthcare professional provides the treatment.

- If a superbug or multi-drug-resistant illness causes an injury.

- If the Assured Person(s) is covered by a statutory body for a defined event, the policy will pay only the maximum benefit amount.

- If the Assured Person(s) does not follow a doctor’s medical advice or instructions.

- If fertility treatment leads to multiple births.

Hospital Plan Waiting Periods

Affinity Health applies the following waiting periods to the Hospital Plan:

- Benefits have a waiting period of 3 months from the Commencement Date unless mentioned otherwise.

- Pre-existing Conditions have a waiting period of 12 months from the Commencement Date.

- Each Benefit may have its specific Waiting Period according to the policy.

Affinity Health Hospital Plan vs Similar Plans from Other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 Affinity Health Hospital | 🥈 Bonitas Hospital Standard Plan | 🥉 Sizwe Hosmed Access Core |

| 👤 Main Member Contribution | R1,258 | R2,964 | R2,418 |

| 👥 Adult Dependent Contribution | R1,168 | R2,497 | R2,085 |

| 🍼 Child Dependent Contribution | R378 | R1,127 | R486 |

| 💙 Hospital Cover | Up to R175,000 per policyholder, R275,000 per family | Unlimited | Unlimited for PMBs |

Read more about Cape Medical Plan Medical Aid

Our Verdict on the Affinity Health Hospital Plan

Affinity Health’s Hospital Plan is a comprehensive medical insurance plan offering hospitalization and related expenses coverage. The plan is designed to support individuals and families during an unexpected medical emergency financially. The plan offers many benefits, including hospitalization, surgery, and emergency medical treatment coverage. It also covers the cost of medication prescribed during a hospital stay and includes a 24-hour emergency helpline. One of the key features of Affinity Health’s Hospital Plan is its affordability. The plan is priced competitively and is accessible to individuals and families with different budget levels.

Additionally, the plan is flexible, allowing members to choose from different options to tailor their cover to their specific needs. However, there are some drawbacks to the plan. For example, the cover is limited to hospitalization and does not include cover for outpatient services or preventative care. Additionally, there are waiting periods for some benefits, such as maternity benefits.

You might also like the following:

- Affinity Health Day-to-Day Medical Aid Plan

- Affinity Health Combined Medical Insurance Plan

- Affinity Health Medical Aid

Affinity Health Hospital Plan Frequently Asked Questions

What does the Affinity Health Hospital Plan cover?

The Affinity Health Hospital Plan covers hospitalization, surgery, emergency medical treatment, and medication prescribed during a hospital stay.

Does the Affinity Health Hospital Plan cover outpatient services?

No, the Affinity Health Hospital Plan does not cover outpatient services or preventative care.

Is the Affinity Health Hospital Plan affordable?

Yes, the Affinity Health Hospital Plan is competitively priced and designed to be affordable for individuals and families with different budget levels.

Can I customize my cover with the Affinity Health Hospital Plan?

Yes, the Affinity Health Hospital Plan is flexible. It allows members to choose from different options to tailor their cover to their needs.

Are there waiting periods for benefits with the Affinity Health Hospital Plan?

Yes, there are waiting periods for some benefits, such as maternity benefits.

Is there a 24-hour emergency helpline with the Affinity Health Hospital Plan?

Yes, the Affinity Health Hospital Plan includes a 24-hour emergency helpline.

Can I enroll in the Affinity Health Hospital Plan at any time?

Yes, enrollment is open throughout the year. However, there may be waiting periods for certain benefits.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans