- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Kaelo Gap

Overall, Kaelo Gap – Gap Cover is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The Kaelo Gap – Gap Cover Plan start from R364 ZAR. Kaelo has a trust score of 4.2.

| 🔎 Provider | 🥇 Kaelo Gap |

| 🟥 Years in Operation | 19 years |

| 🟧 Underwriters | Centriq Insurance Company Limited |

| 🟨 Market Share in South Africa | <1% |

| 🟩 Gap Cover Waiting Period | 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | R364 |

| 🟥 Oncology Benefit | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

Kaelo Gap – Gap Cover – 7 Key Point Quick Overview

- ✅ Kaelo Gap Overview

- ✅ Kaelo Gap Premiums

- ✅ Kaelo Gap Benefits and Cover Breakdown

- ✅ Kaelo Gap Exclusions and Waiting Periods

- ✅ Kaelo Gap vs Other Gap Cover Plans

- ✅ Our Verdict on Kaelo Gap

- ✅ Kaelo Gap Frequently Asked Questions

Kaelo Gap Overview

The Kaelo Gap is one of two plans that starts from R364 per month. The Kaelo Gap Plan has benefits for oncology, tariff shortfalls, sub-limits, penalties from using non-DSP hospitals, innovative oncology medicine, dental reconstruction, child casualty illness, and more.

Kaelo Gap Cover has two plans to choose from:

Kaelo Gap Premiums

| 🟥 Individuals <60 years | R364 |

| 🟧 Individuals 60 years> | R519 |

| 🟨 Family <60 years | R659 |

| 🟩 Family 60 years> | R941 |

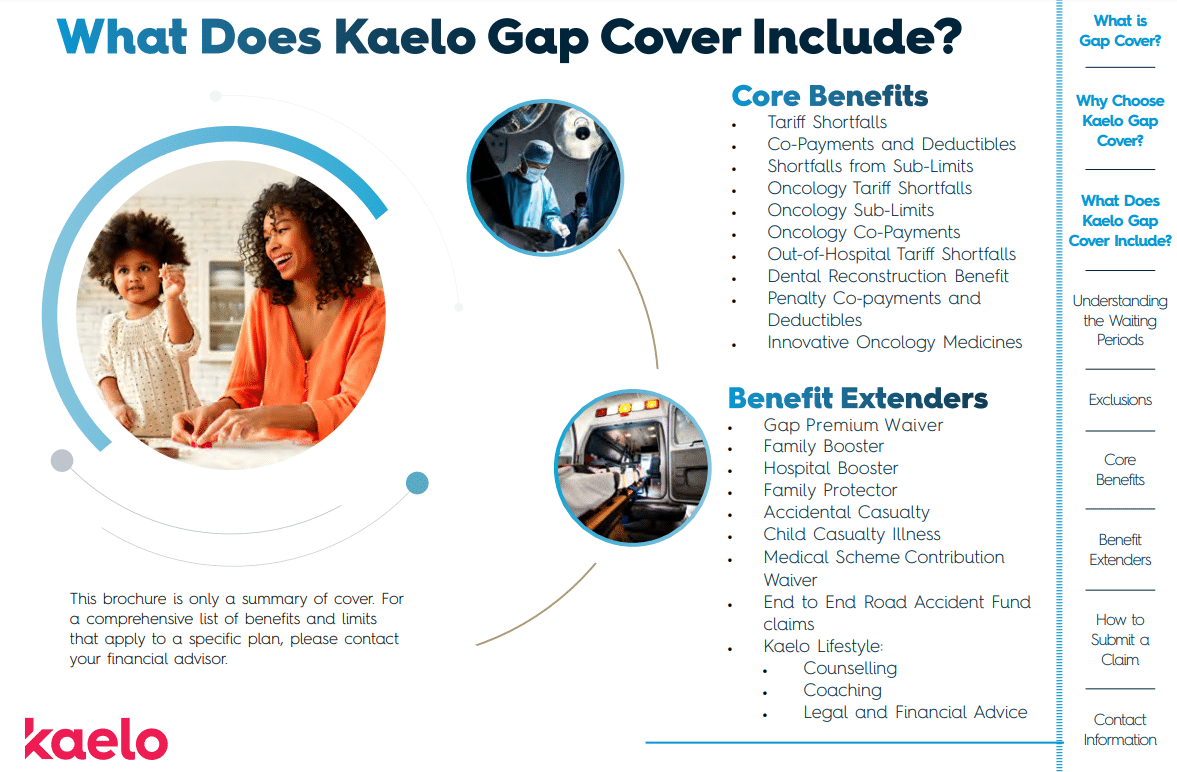

Kaelo Gap Benefits and Cover Breakdown

Kaelo Gap Cover Benefits

| 🟥 Overall Annual Limit | There is an overall annual limit of R185,537 per insured per year. |

| 🟧 Tariff Shortfalls | Subject to the overall annual limit of R185,537 per insured per year. |

| 🟨 Co-Payments and Deductibles | Covers diagnostic and medical procedure cover during hospitalization. |

| 🟩 Shortfalls from Sub-limits | Limited to R60,900. |

| 🟦 Oncology Tariff Shortfalls | The Oncology Shortfall Benefit covers up to 500% of the Medical Scheme rate to cover oncology treatment shortfalls. |

| 🟪 Oncology Sub-Limits | Benefits are payable for oncology and related Treatment approved by the Insured Party’s Medical Scheme for treating cancer (malignant neoplasm) during an Insured Event. The Benefit payable is equal to the charged amount less the amount paid by the Medical Scheme of the Insured Party. |

| 🟥 Oncology Co-Payments | The Oncology Co-payment Benefit pays the 20% Oncology-Related Co-Payment imposed by the Medical Scheme. |

| 🟧 Out-of-Hospital Tariff Shortfalls | Limited to an additional 500% of the medical scheme tariff. |

| 🟨 Penalty Co-payment | Limited to per Family per year, with a maximum of R17,500 per event. Cover for penalty Co-payments or Deductibles that do not exceed 30% for the voluntary use of a non-Network Hospital by an Insured Party. |

| 🟩 Innovative Oncology Medicines | As it relates to Innovative Oncology Medicines, a value equal to the lesser of 25% of the total drug cost, or R13,000, is covered. Cover for shortfalls in Innovative Oncology Medicines as defined by the Medical Scheme of the Insured Party. |

| 🟦 Dental Reconstruction Benefit | Limited to two events per family per year. Limited to R49,900 per year. |

Kaelo Gap Benefit Extenders

| 🟥 Family Booster | Limited to R15,900. |

| 🟧 Child Casualty Illness | Subject to 2 events per year and R2,700 per event. |

| 🟨 Accidental Casualty | Limited to R17,400 per event. |

| 🟩 Hospital Booster | Day 1 to 13 – R480 per day. Day 14 – 20 – R860 per day. Day 21 – Day 30 – R1,700 per day. Maximum benefit of R29,300 per insured per year. |

| 🟦 Family Protector | Limited to R20,000 for children <6 years. Limited to R30,000 for all other insured persons. |

| 🟪 Medical Scheme Contribution Waiver | Contributions will be covered for six months, up to R35,500. This benefit is only available once during the policy’s lifetime. |

| 🟥 Gap Cover Premium Waiver | The Kaelo Health Gap Cover premium will be waived six months after the event. This benefit is only available once during the policy’s lifetime. |

| 🟧 Road Accident Fund Claims | Covered by the policy. |

Kaelo Gap Exclusions and Waiting Periods

Kaelo Gap Exclusions

The Kaelo Gap Cover has certain exclusions, including:

- ✅ The Gap Cover Policy does not cover claims not paid by the policyholder’s medical aid.

- ✅ Claims that the medical aid paid on an ex-gratia basis are not included.

- ✅ Charges by healthcare providers for Split Billing are not covered, but Balance Billing is.

- ✅ The policy does not cover infertility treatment.

- ✅ Treatments that occur outside the period of an Insured Event are not covered.

- ✅ The policy does not cover external prostheses, appliances, and convalescing equipment.

- ✅ Specialized dental procedures such as crowns, bridges, and implants are not included.

- ✅ The policy does not cover the harvesting or preserving of human tissues such as stem cells.

- ✅ Therapeutic massage therapists are not included on the cover.

- ✅ The policy does not cover rehabilitation, frail care, and hospice services.

- ✅ Step-Down Facilities are not included in the cover.

- ✅ Medicines To-Take-Out (TTO) are not covered.

Procedures like breast augmentation, gastroplasty, lipectomy, and gender reversal are not covered.

Kaelo Gap Waiting Periods

Kaelo applies the following waiting periods to its policies:

- ✅ Exclusions specific to certain conditions will apply for 12 months.

- ✅ Concessions on waiting periods are arranged with Kaelo by your broker.

- ✅ Your broker will notify you when a concession period has been set.

These concessions apply only to employer groups.

Kaelo Gap vs Other Gap Cover Plans

| 🔎 Provider | 🥇 Kaelo Gap | 🥈 Stratum Benefits Elite | 🥉 Sirago Gap Assist |

| 🟥 Years in Operation | 19 years | 24 years | 30 years |

| 🟧 Underwriters | Centriq Insurance Company Limited | Guardrisk Insurance Company Limited (FSP 75) | GENRIC Insurance Company Limited (FSP: 43638) |

| 🟨 Market Share in South Africa | <1% | >5% | >10% |

| 🟩 Gap Cover Waiting Period | 12 months | 3 Months | From 3 months (up to 12) |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | R364 | R404 | R342 |

| 🟥 Oncology Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟩 Maternity Benefit | None | ✅ Yes | ✅ Yes |

| 🟦 Scopes and Scans | None | ✅ Yes | None |

| 🟪 Co-payment Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Accidental Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Trauma Counseling | None | ✅ Yes | None |

| 🟩 Premium Waiver | ✅ Yes | None | ✅ Yes |

| 🟦 Non-DSP Co-Payment | ✅ Yes | None | ✅ Yes |

| 🟪 Prostheses | None | ✅ Yes | ✅ Yes |

| 🟥 Travel Cover Extender | None | ✅ Yes | None |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | ✅ Yes | None |

Our Verdict on Kaelo Gap

According to our research, the Kaelo Gap plan is a comprehensive policy to supplement medical aid coverage and protect against shortfalls.

It offers many benefits and extenders, including cover for tariff shortfalls, co-payments, deductibles, oncology-related expenses, out-of-hospital care, dental reconstruction, and innovative oncology medicines.

We also found that it provides additional benefits in the event of premature birth, hospital stays, accidental harm, and child illness.

The policy is flexible, extending your coverage regardless of the medical aid or plan option you have selected, and offers affordable premiums regardless of your family size.

Kaelo Gap Frequently Asked Questions

What is the Kaelo Gap plan?

The Kaelo Gap plan is designed to supplement your medical aid coverage and protect against shortfalls, such as when your healthcare provider charges higher rates than your medical aid will pay.

What are the main benefits of the Kaelo Gap plan?

The plan covers tariff shortfalls, co-payments, deductibles, oncology-related expenses, out-of-hospital care, dental reconstruction, and innovative oncology medicines.

Are there any exclusions in the Kaelo Gap plan?

Yes, the policy does not cover prostheses, travel, trauma counseling, maternity, and co-payments.

How does the claim process work?

You have 6 months from the end of the insured event to submit your claim, and once all required documents have been received, your claim will be processed and paid within 7 to 14 working days.

Is the Kaelo Gap plan flexible?

Yes, the plan extends your coverage regardless of the medical aid or plan option you have selected and offers affordable premiums regardless of your family size.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans