- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

CompliMed Gap Cover

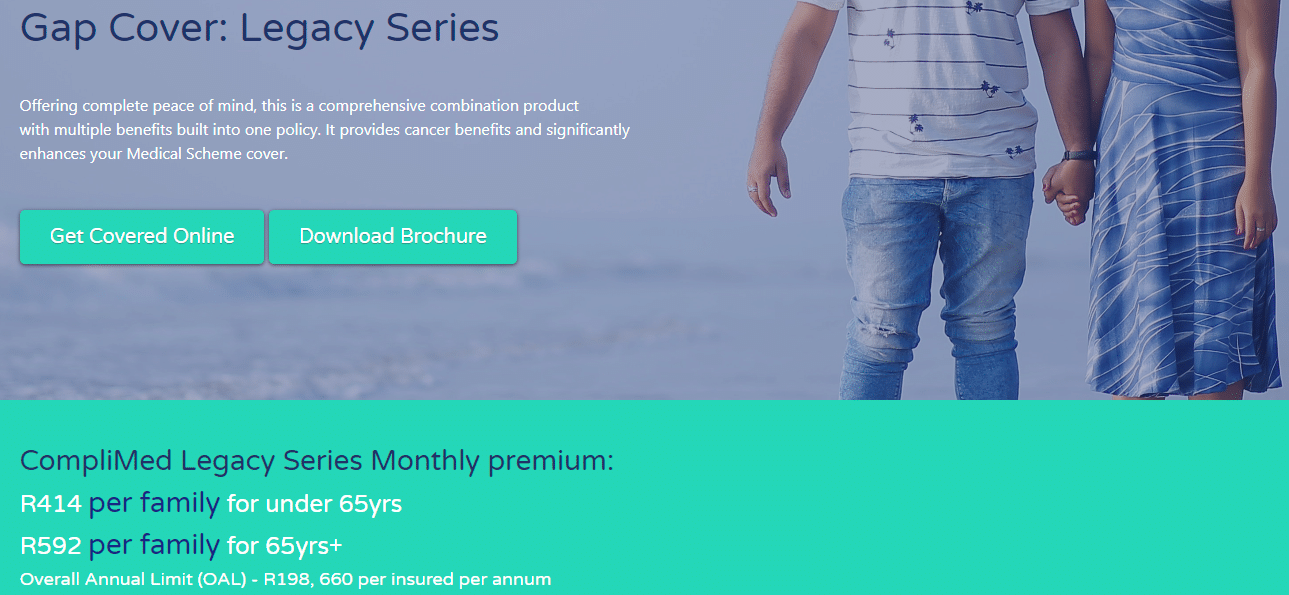

Overall, CompliMed Gap Cover is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. CompliMed Gap Cover starts from R414 ZAR. CompliMed has a trust score of 4.3.

| 🟥 Date Established | 2003 |

| 🟧 Underwriters | Turnberry Management Risk Solutions (Pty) Ltd |

| 🟨 Headquartered | South Africa |

| 🟩 The average number of members | 5,000+ |

| 🟦 Number of Markets | 1 |

| 🟪 Market Share | <5% |

| 🟥 Number of plans offered | 1 |

| 🟧 Is a Mobile App offered | None |

| 🟨 Waiting Period | 3 – 12 months |

| 🟩 Exclusions | ✅ Yes |

CompliMed Gap Cover – 10 Key Point Quick Overview

- ✅ CompliMed Gap Cover – Advantages over Competitors

- ✅ CompliMed Gap Cover Features

- ✅ How to apply for Gap Cover with CompliMed

- ✅ How to Submit a Claim for Gap Cover with CompliMed

- ✅ CompliMed Gap Cover Exclusions and Waiting Periods

- ✅ CompliMed Gap Cover vs Other Notable Providers

- ✅ CompliMed Gap Cover Pros and Cons

- ✅ CompliMed User Reviews

- ✅ Our Verdict on CompliMed Gap Cover

- ✅ CompliMed Gap Cover Frequently Asked Questions

CompliMed Gap Cover – Advantages over Competitors

Choosing CompliMed comes with a comprehensive list of advantages. Advantages of choosing CompliMed include:

- ✅ CompliMed Gap Cover provides additional financial protection to cover the shortfall between medical scheme benefits and the actual cost of medical treatment.

- ✅ The product offers a range of plan options, enabling customers to choose a cover that suits their needs and budget.

- ✅ CompliMed Gap Cover covers in-hospital and day-to-day medical expenses, including co-payments, deductibles, and shortfalls.

- ✅ The product covers various medical treatments, including cancer, specialized radiology, pathology, and organ transplants.

- ✅ CompliMed Gap Cover includes a casualty illness benefit that covers the cost of emergency treatment for illnesses or injuries that require urgent medical attention.

- ✅ The product offers additional benefits such as dental cover, international travel cover, and accidental death and disability cover.

- ✅ CompliMed Gap Cover is underwritten by reputable insurers, providing customers with peace of mind knowing financially sound companies back their claims.

- ✅ The product has no general waiting period, meaning customers can claim immediately after their policy start date.

- ✅ CompliMed Gap Cover has no overall limit on claims, providing customers unlimited coverage for eligible medical expenses.

- ✅ The product offers an optional trauma recovery benefit that covers the cost of therapy and treatment following a traumatic event.

- ✅ CompliMed Gap Cover includes various value-added services, such as telephonic legal and tax advice, a medical helpline, and a 24-hour emergency assistance service.

The product provides easy online claims submission and real-time claims tracking via the CompliMed mobile app or online portal.

READ more: 5 Best Gap Cover Options for Under R200

CompliMed Gap Cover Features

CompliMed In-hospital Benefits

| 🟥 Medical Expense Shortfall Cover | Medical Aid Rate increased to 600% for specialists, GPs, Anaesthetists, Radiology, Pathology, Consumables, etc. Subject to the overall limit of R185,837. |

| 🟧 Co-payment Cover | Subject to the overall limit of R185,837. |

| 🟨 Non-DSP Hospital Penalty Cover | Limited to R14,000 per admission. Limited to 2 claims per family per year. Subject to the overall limit of R185,837. |

| 🟩 Sub-Limit Cover | Limited to R38,000 per admission per insured. Subject to the overall limit of R185,837. |

| 🟦 Trauma Recovery Cover | Covers insured persons when the Medical Scheme applies sub-limits on step-down facilities for physical rehabilitation due to an accident that occurred while on the policy. Limited to R3,000 per admission per insured and R10,000 per family. Subject to the overall limit of R185,837. |

CompliMed Out-of-Hospital Benefits

| 🟥 Co-Payments for MRI, CT, and PET scans | Subject to the overall limit of R185,837. |

| 🟧 Co-Payments for Scopes | Limited to R4,000 per event. Limited to 2 claims per insured per year. Subject to the overall limit of R185,837. |

| 🟨 Sub-limit Cover for MRI, CT, and PET scans | Limited to R38,000 per event per insured. Subject to the overall limit of R185,837. |

| 🟩 Casualty Benefits for Accidents | Limited to R15,000 per event per insured. Subject to the overall limit of R185,837. |

| 🟪 Casualty Benefit for Illness | Limited to R3,500 per event. Limited to 3 claims per family per year. Subject to the overall limit of R185,837. Treatment is restricted to Monday to Friday, Weekends, and Public Holidays between 6 pm and 6 am. |

CompliMed In-hospital and Out-of-Hospital Benefits

| 🟥 Traditional Cancer Cover | Pays for cancer treatment in a private facility, including sub-limits, deductibles, and co-payments. Subject to the overall limit of R185,837. |

| 🟧 Biological Cancer Drug Cover | Covers Biological Cancer Drugs when the Medical Scheme has a sub-limit. Subject to the overall limit of R185,837. |

| 🟨 MRI and CT Scan Cover | Covers MRI and CT scans when no benefit is available through your Medical Scheme. Limited to R6,500 per event, with a maximum of two claims per family per year. Subject to the overall limit of R185,837. |

| 🟩 Trauma Care Cover | Covers the cost of trauma counseling consultations with a registered healthcare provider after a member has been diagnosed with a critical illness, has been the victim of a violent crime, or has lost an immediate family member. Limited to R2,000 per consultation and R8,000 per family per year. Subject to the overall limit of R185,837. |

| 🟦 Innovative Cancer Drug Cover | Cover for new and innovative cancer drugs. Each claim is limited to R10,000. Subject to the overall limit of R185,837. |

| 🟪 Breast Cancer Prevention Cover | Increases the Medical Aid rate up to 600% for Prophylactic Mastectomy. Subject to the overall limit of R185,837. |

| 🟥 Breast Cancer Reconstruction Cover | The medical aid rate is increased by up to 600% for breast reconstruction post-mastectomy because of cancer in the affected breast. Reconstructed for the unaffected breast for symmetry, while no benefit exists on the Medical Scheme, there is cover of up to R25,000 per insured per lifetime. Subject to the overall limit of R185,837. |

CompliMed Added benefits

| 🟥 Cancer Diagnosis Benefit | There is a once-off payment for the first diagnosis of cancer according to the stage when the diagnosis is made as follows: Stage 1 – R5,000 Stage 2 – R15,000 Stage 3 – R20,000 Stage 4 – R25,000 |

| 🟧 Medical Scheme Contribution Waiver | Limited to R6,000 per month for 6 months if death or permanent and total disability occurs because of an accident. |

| 🟨 Gap Premium Waiver | Covers the gap cover payment for 12 months if the contribution payer dies or becomes permanently and totally disabled. |

| 🟩 Personal Accident Benefit | Limited to R30,000 per insured on the policy if accidental death or permanent and total disability occurs. |

| 🟦 Critical Illness Benefit | Limited to R10,000 per insured on the policy if death or critical illness occurs, excluding cancer. |

| 🟪 International Cover | Limited to R5 million per insured and requires at least 48 hours before departure. |

CompliMed In-hospital Dental Cover

| 🟥 Medical Expense Shortfall Cover | Increases the medical aid rate by up to 600% for impacted wisdom teeth, orthognathic surgery, reconstructive maxillofacial surgery due to an accident (while on the Policy), and oral cancer (while on the Policy). Subject to the overall limit of R185,837. |

| 🟧 Co-payment Cover | Subject to the overall limit of R185,837. |

| 🟨 Sub-Limit and Co-payment Cover for Dental Implants | Covers the cost of dental implants for reconstructive maxillofacial surgery due to an accident (occurring while the Policy was in effect) and oral cancer (diagnosed while on the Policy). The annual limit is R50,000 per family. Subject to the overall limit of R185,837. |

| 🟩 Sub-limit Cover | R30,000 per admission per insured for impacted wisdom teeth, orthognathic surgery, reconstructive maxillofacial surgery due to an accident (while on the Policy), and oral cancer (diagnosed while on the Policy). Subject to the overall limit of R185,837. |

| 🟦 Basic Dental Medical Expense Shortfall Cover | Increases the Medical Aid rate for children up to and including 12 years old by up to 600%. The annual limit is R4,000 per family. Subject to the overall limit of R185,837. |

How to apply for Gap Cover with CompliMed

To apply for Gap Cover with CompliMed, follow these steps:

- ✅ Visit the CompliMed website

- ✅ Click on the “Gap Cover” tab and select the plan that suits your needs.

- ✅ Click on the “Apply Now” button and fill out the application form with your details, medical scheme information, and other relevant information.

- ✅ Review the terms and conditions of the policy and select any optional benefits you require.

- ✅ Submit your application and wait for confirmation from CompliMed.

- ✅ Once your application is approved, you will receive a policy schedule and membership certificate.

Start enjoying the additional financial protection provided by CompliMed Gap Cover.

How to Submit a Claim for Gap Cover with CompliMed

To submit a claim for Gap Cover with CompliMed, follow these steps:

- ✅ Download and complete the relevant claim form from the CompliMed website.

- ✅ Ensure that you provide all required information, including your personal details, medical scheme information, and treatment details.

- ✅ Attach all relevant supporting documentation, including the invoice or statement from the healthcare provider, the explanation of benefits from your medical scheme, and any other required supporting documents.

- ✅ Submit your claim form and supporting documentation via email or post them to the address on the claim form.

- ✅ You can also submit your claim via the CompliMed mobile app or online portal, allowing easy submission and real-time claims tracking.

- ✅ Once your claim is received, it will be assessed by CompliMed’s claims department, and you will be notified of the outcome of your claim as soon as possible.

- ✅ If your claim is approved, payment will be made directly to you, and you can expect to receive payment within a few days.

Keep a copy of your claim form and all supporting documentation for your records.

Discover more about Medical Aid Plans

CompliMed Gap Cover Exclusions and Waiting Periods

CompliMed does not cover any of the following:

- ✅ Nuclear weapons, nuclear material, ionizing radiation, or contamination by radioactivity are not covered.

- ✅ LASIK, refractive surgery, cosmetic surgery (except for breast reconstruction after cancer treatment), and procedures without objective indications of impairment are not covered.

- ✅ Suicide, intentional self-injury, drug use not prescribed by a medical practitioner, alcohol-related events, and participation in certain activities (military, aviation, racing) are not covered.

- ✅ Treatment for infertility, fraudulent claims, non-pre-authorized treatment, and treatment not covered or declined by the medical scheme are not covered.

- ✅ Benefits are not payable for expenses covered by the medical scheme or transport charges.

- ✅ Additional exceptions include private ward confinement costs, failure to follow medical practitioner instructions, and limited cover for dental procedures.

- ✅ Additional exceptions include psychiatric conditions, co-payments and sub-limits for dentistry, and defined procedures declined by the medical scheme.

Step-down facility costs must be authorized and paid by the medical scheme for trauma recovery cover.

CompliMed Gap Cover Waiting Periods

All benefits are subject to a 3-month general waiting period (except in the event of an accident that occurred while on the Policy).

- ✅ A 10-month pregnancy/childbirth waiting period

- ✅ A 12-month waiting period for hysterectomy, hysteroscopies, endometriosis, ovarian cysts, fibroids (myomectomy), muscular-skeletal (except in the event of an accident that occurred while on the Policy), tonsillectomy, myringotomy, grommets, adenoids, wisdom teeth, hernia, cataracts, gastroscopies, colonoscopies, cancer, nasal and sinus.

If the Policy’s start date coincides with the start date of the Medical Schemes, there will be no 3-month general waiting period for Medical Expense Shortfall Cover (increasing the medical aid rate up to 600%).

CompliMed Gap Cover vs Other Notable Providers

| 🔎 Gap Cover Provider | 🥇 CompliMed | 🥈 Turnberry | 🥉 Old Mutual |

| 🟥 Underwriters | Turnberry Management Risk Solutions (Pty) Ltd | Lombard Insurance Company | Old Mutual Life Assurance Company (South Africa) Limited |

| 🟧 Number of Plans | 1 | 5 | 1 |

| 🟨 Average Price | R414 | R164 | R225 |

| 🟩 Waiting Periods | 3 – 12 months | 3 – 12 months | 3 – 12 months |

| 🟦 Exclusions | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Oncology Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Out-of-Hospital Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Maternity Benefit | None | None | None |

| 🟩 Scopes and Scans | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Co-payment Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Accidental Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Trauma Counseling | ✅ Yes | ✅ Yes | None |

| 🟨 Premium Waiver | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟩 Non-DSP Co-Payment | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Prostheses | None | ✅ Yes | None |

| 🟪 Accidental Death/ Permanent Disability | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Travel Cover Extender | ✅ Yes | None | None |

CompliMed Gap Cover Pros and Cons

| ✅ Pros | ❎ Cons |

| Provides financial protection for medical expenses not covered by medical scheme | May not cover all medical expenses |

| Range of plan options to suit different needs and budgets | May require additional information or documentation |

| Covers both in-hospital and day-to-day medical expenses | Pre-existing conditions may be excluded |

| Additional benefits such as dental cover | Waiting periods may apply |

CompliMed User Reviews

Great Service.

In early 2015, I enrolled in Gap Cover with CompliMed. Since then, my family has encountered three situations requiring hospitalization where our medical aid coverage fell short of meeting the associated expenses. On each occasion, I knew that CompliMed would cover the gap. Their commitment to delivering the best possible service has been consistently demonstrated, and I remain grateful for their assistance. – Kelly White

Professional Provider.

I am pleased to report that my recent claim against my Gap cover policy was handled expeditiously and professionally. I submitted the claim on 28th September, and to my satisfaction, it was settled within two days on 2nd October. This is the second claim I have made this year, and both times the service provided by CompliMed has been exceptional. I would highly recommend them. – Lauren Oliver

Great Support.

I submitted a claim to CompliMed for a CT scan that was not covered by my medical aid on 23rd October 2022. To my delight, the claim was processed and settled remarkably, and I received payment by 25th October 2022. I want to express my gratitude to CompliMed for their excellent service and prompt response. – Blake Coetzee

Our Verdict on CompliMed Gap Cover

CompliMed Gap Cover is a comprehensive insurance product that provides financial protection to cover the shortfall between medical scheme benefits and the actual cost of medical treatment. The product offers a range of plan options to suit customers’ specific needs and budgets and covers both in-hospital and day-to-day medical expenses, including co-payments, deductibles, and shortfalls.

CompliMed Gap Cover includes a range of additional benefits, such as cover for dental expenses, international travel, accidental death and disability, and trauma recovery.

CompliMed Gap Cover Frequently Asked Questions

What is CompliMed Gap Cover?

CompliMed Gap Cover is an insurance product that provides financial protection for medical expenses not covered by your medical scheme.

What medical expenses does CompliMed Gap Cover?

CompliMed Gap Cover covers in-hospital and day-to-day medical expenses, including co-payments, deductibles, and shortfalls.

What additional benefits are included with CompliMed Gap Cover?

CompliMed Gap Cover includes a range of additional benefits such as dental cover, international travel cover, accidental death and disability cover, and trauma recovery benefits.

Are there waiting periods for CompliMed Gap Cover?

CompliMed Gap Cover has no general waiting period, but waiting periods may apply to certain benefits.

Does CompliMed Gap Cover cover pre-existing conditions?

Pre-existing conditions may be excluded from cover under CompliMed Gap Cover.

How do I submit a claim for CompliMed Gap Cover?

Claims can be submitted via email, post, or through the CompliMed mobile app or online portal.

How long does it take to receive payment for a CompliMed Gap Cover claim?

Payment for approved Gap cover claims is typically made within a few days.

Are there any limits on the number of claims I can make under CompliMed Gap Cover?

CompliMed Gap Cover has no overall limit on claims. However, an overall annual limit of R185,837 per insured per year exists.

How do I cancel my CompliMed Gap Cover policy?

You can contact CompliMed’s customer service team to cancel your policy by phone or email. Cancellation may be subject to the terms and conditions of your policy.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans