- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Medshield Late Joiner Fee

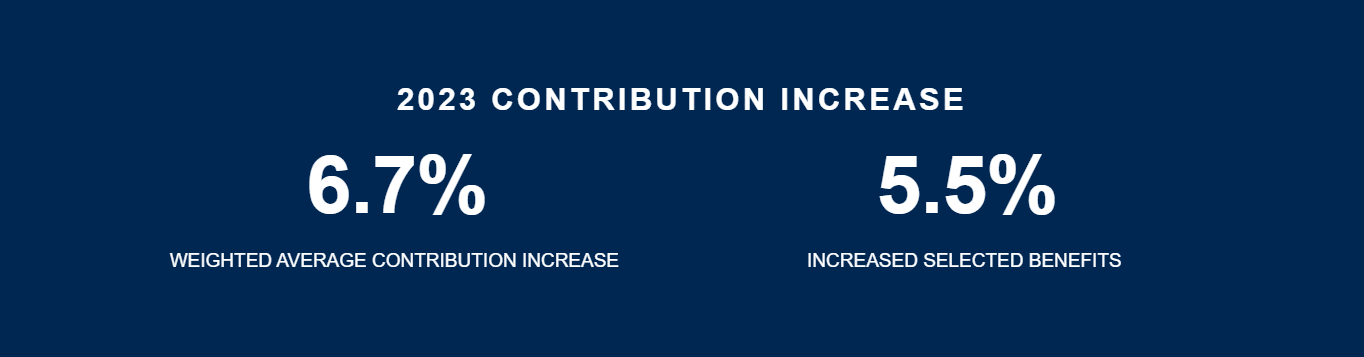

Overall, Medshield is a trustworthy and comprehensive medical aid provider. New Members may be subject to late-joiner penalties or a waiting period for pre-existing conditions. The Medshield Medical Aid Plans start from R1584 ZAR per month. Medshield has a trust rating of 4.1.

| 🟥 Medical Aid | 🔎 Medshield |

| 🟧 Waiting Period | Possible |

| 🟨 Late Joiner Fee | Possible |

| 🟩 Plans (from) | R1584 ZAR |

| 🟦 Trust Rating | 4.1 |

Medshield Late Joiner Fees – 9 Key Point Quick Overview

- ✅ Medshield Late Joiner Fees – What to know before Joining

- ✅ Medshield Waiting Periods

- ✅ Medshield Exclusions

- ✅ Medshield and Pre-existing Conditions

- ✅ Late Joiner Fees vs. Waiting Periods – What is the Difference

- ✅ What Happens if You Do Not Pay Late Joiner Fees

- ✅ National Health Insurance (NHI) Bill South Africa

- ✅ Our Verdict on Medshield Late Joiner Fees

- ✅ Medshield Late Joiner Fees Frequently Asked Questions

Medshield Late Joiner Fees – What to know before Joining

When registering with Medshield, new members must disclose details of their previous medical aid and prove such membership and that of their dependents. This information and documents must show the joining and end dates and accompany the Medshield member application.

Furthermore, this will determine whether Medshield will apply waiting periods or late joiner penalties. However, where late joiner penalties have already been imposed, and credible evidence of cover is subsequently provided, the penalty shall be recalculated.

The revised penalty shall be applied beginning the following month.

Medshield Waiting Periods

Often, there is a waiting period for pre-existing conditions. This is to prevent new members from abusing medical insurance for a brief period to finance pricey procedures and cancel their membership shortly after.

According to the Medical Schemes Act No. 131 of 1998, the following waiting periods could apply when joining Medshield:

- ✅ A 3 (three) month general waiting time for all benefits.

- ✅ A maximum 12 (twelve) month exclusion for a previous ailment.

Finally, a late joiner contribution penalty may apply.

Medshield Exclusions

Medshield does not cover some of the following, with a full list available on the official Medshield website:

- ✅ Cosmetic crown and bridge procedures, as well as the accompanying laboratory fees

- ✅ Crown and bridge procedures with minimal tooth structural loss and accompanying laboratory costs

- ✅ Rehabilitation of the occlusion and the related laboratory expenditures

- ✅ Provisional crowns, as well as the accompanying laboratory fees

- ✅ Emergency crowns that are not inserted immediately to safeguard a tooth after an injury, as well as the related laboratory expenditures

- ✅ Gold, precious metal, semi-precious metal, and platinum foil prices

- ✅ Fees for laboratory delivery

- ✅ Unless expressly authorized and unless PMB level of care, orthopedic shoes, and boots

- ✅ TENS and APS pain relief machines

- ✅ Stethoscopes

and many more. A full list of exclusions will be provided by Medshield.

Medshield and Pre-existing Conditions

When joining a medical aid scheme, it is essential to note that there is usually a waiting period of 12 months before any pre-existing conditions are covered. Therefore, joining a medical aid scheme earlier in life is advisable, rather than waiting until old age when the risk of developing chronic health conditions is higher.

Additionally, it is important to note that some medical aid schemes, such as Medshield, have specific policies regarding pre-existing conditions.

Therefore, it is important to research and understands the policies of a medical aid scheme before joining to ensure that you are fully aware of any waiting periods or limitations regarding pre-existing conditions.

Late Joiner Fees vs. Waiting Periods – What is the Difference

Late Joiner Fees are a one-time penalty fee charged by medical aid if you join after a certain age or have never been a member of a medical aid program. Waiting periods, on the other hand, are periods during which you are not covered for certain medical aid benefits.

These waiting periods apply to all new members, regardless of whether they are charged Late Joiner Fees. Depending on the benefit, waiting periods can range from three to twelve months.

What Happens if You Do Not Pay Late Joiner Fees

Your medical aid membership may be suspended or terminated if you fail to pay the Late Joiner Fees. The scheme may also pursue legal action to collect overdue fees. If your membership is suspended, you cannot access medical aid benefits until you have paid any outstanding fees.

If your membership is terminated, you must reapply for membership and may be subject to even higher Late Joiner Fees. Therefore, paying your Late Joiner Fees on time is crucial to prevent interruptions in your medical aid coverage.

National Health Insurance (NHI) Bill South Africa

In South Africa, the NHI is a proposed universal health coverage system. It is still in the planning stages, but it could affect Late Joiner Fees and other facets of medical aid.

Our Verdict on Medshield Late Joiner Fees

Overall, Medshield implements late joiner penalties to ensure members do not wait until they need medical assistance to join the scheme. The late joiner penalties are designed to encourage individuals to join the scheme when they are younger and healthier, thus balancing the risk pool and maintaining affordable contributions for all members.

Members subject to late joiner penalties must complete the MDS Member Record Amendment and Dependent Registration Form and submit it to Medshield. Medshield will then apply a late joiner penalty based on the information provided, ranging from 5% to 75% of the member’s contribution.

Prospective members must understand that late joiner penalties can significantly impact their contributions, particularly if they have pre-existing conditions or a history of gaps in medical scheme cover.

Members subject to a late joiner penalty might also have to serve waiting periods for certain benefits, such as hospitalization, maternity care, and chronic medication.

Medshield Late Joiner Fees Frequently Asked Questions

Can a calculator help me determine my Medshield late joiner penalty?

To help members estimate the cost of their penalty, Medshield provides a late joiner penalty calculator on their website. The calculator considers the member’s age, length of membership in the medical plan, and any coverage gaps. However, Medshield reserves the right to determine the exact penalty and tailor it to each individual’s circumstances.

How do pre-existing conditions affect Medshield late joiner fees?

Medshield’s late joiner fees can rise if you have a pre-existing condition. In addition, a risk-based penalty may increase the member’s contribution to Medshield.

What is the waiting period for benefits after paying a Medshield late joiner fee?

After paying a Medshield late joiner fee, you must wait for benefits for a different amount of time for each benefit. For example, typical waiting periods for medical care include three months for primary care visits and twelve months for hospital stays.

Is it possible to appeal a Medshield late joiner penalty?

Penalties for late enrollment in Medshield can be challenged. Members who disagree with a Medshield decision may submit a written request for reconsideration and any relevant supporting materials.

What are people saying about their experiences with Medshield late joiner fees?

Members of Medshield have differing views on the topic of late joiner fees. Some contributors defend the fees, saying they must cover costs and ensure everyone pays their fair share. Some people argue that the prices are too high, especially for those with health problems. Some members have also reported problems with the late-joiner penalty and benefit waiting periods.

How does the Medshield late joiner penalty compare to the late joiner fees of other medical schemes like Discovery?

The specific fees and penalties may vary from medical scheme to medical scheme and are often based on the risk pool and the cost of providing benefits.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans