- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Medimed Late Joiner Fee

Overall, Medimed is a trustworthy and comprehensive medical aid provider. New Members 35 years or older may be subject to late-joiner penalties on Medimed Medical Aid Plans. The Medimed Medical Aid Plans start from R1500 ZAR per month. Medimed has a trust rating of 3.0.

| 🟥 Number of Years Since Age 35 | 🪙 Penalty |

| 🟧 1 – 4 years | 0.5% x contribution |

| 🟨 5 – 14 years | 0.25% x contribution |

| 🟩 15 – 24 years | 0.50% x contribution |

| 🟦 25+ years | 0.75% x contribution |

Medimed Late Joiner Fees – Key Point Quick Overview

- ✅ Medimed Late Joiner Fees – What to know before Joining

- ✅ Medimed Waiting Periods

- ✅ Medimed Exclusions

- ✅ Medimed and Pre-existing Conditions

- ✅ Late Joiner Fees vs. Waiting Periods – What is the Difference

- ✅ What Happens if You Do Not Pay Late Joiner Fees

- ✅ National Health Insurance (NHI) Bill South Africa

- ✅ Our Verdict on Medimed Late Joiner Fees

- ✅ Medimed Late Joiner Fees Frequently Asked Questions

Medimed Late Joiner Fees – What to know before Joining

In terms of late joiner fees for Medimed, an applicant or adult dependent of an applicant who is 35 years of age or older at the time of application for membership or admission as a dependent may be subject to late joiner fees.

However, beneficiaries who have had continuous medical scheme cover since 1 April 2001 without any breaks exceeding 3 consecutive months are exempt from these fees. Furthermore, Medimed applies these fees according to the following table:

| 🟥 Number of Years Since Age 35 | 🪙 Penalty |

| 🟧 1 – 4 years | 0.5% x contribution |

| 🟨 5 – 14 years | 0.25% x contribution |

| 🟩 15 – 24 years | 0.50% x contribution |

| 🟦 25+ years | 0.75% x contribution |

Medimed Waiting Periods

Below are the typical waiting periods that Medimed could impose.

General waiting periods include the following:

- ✅ Medimed may impose a waiting period on a person who applied for membership or admission as a dependent and was not a beneficiary of a medical scheme for at least 90 days before the application date.

- ✅ The waiting period could be up to three months for general services and 12 months for condition-specific services.

Condition-specific waiting periods include the following:

- ✅ Medimed may impose a waiting period on a person who applied for membership or admission as a dependent and was previously a beneficiary of a medical scheme for a continuous period of up to 24 months, terminating less than 90 days immediately before the date of application.

- ✅ The waiting period for condition-specific services may be up to 12 months, except for any treatment or diagnostic procedures covered within the Prescribed Minimum Benefits.

- ✅ Suppose the previous medical scheme had imposed a waiting period that had not expired at termination. In that case, the Scheme might impose a waiting period for the unexpired duration of such a waiting period.

Furthermore, waiting periods are waived in the following:

- ✅ If a person previously had medical scheme cover and terminated it less than 90 days before applying for membership or admission as a dependent due to a change of employment or an employer changing or terminating the medical scheme, no waiting period will be imposed. However, the transfer must occur at the beginning of the financial year, or reasonable notice must be given to the new scheme.

- ✅ If a waiting period was imposed by the former medical scheme and had not expired at the time of termination, the Scheme may impose such a waiting period for the unexpired duration.

- ✅ No waiting periods may be imposed on a beneficiary who changes from one benefit option to another within the Scheme, except if the beneficiary is subject to a waiting period on the current benefit option, in which case the remaining period may be applied.

No waiting periods may be imposed on a child dependent born during the membership period.

Medimed Exclusions

Medimed has some of the following exclusions, with the full list available on the scheme’s official website:

- ☑️ All costs incurred for treating sickness conditions or injuries sustained by a member or a Dependent, for which any other party is liable, can be recovered by that party.

- ☑️ Costs for treatment of self-inflicted sickness or injuries, excessive use of intoxicating substances or drugs, or material violation of the law are not covered unless according to the Prescribed Minimum Benefits.

- ☑️ Costs for injuries arising from professional sports, speed contests, and speed trials are not covered unless according to the Prescribed Minimum Benefits.

- ☑️ Costs for cosmetic procedures, treatment of obesity and its direct implications, and holidays for recuperative purposes are not covered unless according to the Prescribed Minimum Benefits.

- ☑️ Accommodation or treatment in headache and stress-relief clinics, spas, and resorts for health, slimming, recuperative, or other similar purposes, and traveling expenses incurred by practitioners, are not covered.

- ☑️ Any benefits not available under the Prescribed Minimum Benefits and not included in Annexure B are not covered.

- ☑️ Treatment of sexually transmitted diseases is not covered unless according to the Prescribed Minimum Benefits.

and many more. A full list of exclusions will be provided by Medimed.

Medimed and Pre-existing Conditions

When joining a medical aid scheme, it is essential to note that there is usually a waiting period of 12 months before any pre-existing conditions are covered. Therefore, joining a medical aid scheme earlier in life is advisable, rather than waiting until old age when the risk of developing chronic health conditions is higher.

Additionally, it is important to note that some medical aid schemes, such as Medimed, have specific policies regarding pre-existing conditions.

Therefore, it is important to research and understands the policies of a medical aid scheme before joining to ensure that you are fully aware of any waiting periods or limitations regarding pre-existing conditions.

Late Joiner Fees vs. Waiting Periods – What is the Difference

Late Joiner Fees are a one-time penalty fee charged by medical aid if you join after a certain age or have never been a member of a medical aid program. Waiting periods, on the other hand, are periods during which you are not covered for certain medical aid benefits.

These waiting periods apply to all new members, regardless of whether they are charged Late Joiner Fees. Depending on the benefit, waiting periods can range from three to twelve months.

What Happens if You Do Not Pay Late Joiner Fees

Your medical aid membership may be suspended or terminated if you fail to pay the Late Joiner Fees. The scheme may also pursue legal action to collect overdue fees. If your membership is suspended, you cannot access medical aid benefits until you have paid any outstanding fees.

If your membership is terminated, you must reapply for membership and may be subject to even higher Late Joiner Fees. Therefore, paying your Late Joiner Fees on time is crucial to prevent interruptions in your medical aid coverage.

National Health Insurance (NHI) Bill South Africa

In South Africa, the NHI is a proposed universal health coverage system. It is still in the planning stages, but it could affect Late Joiner Fees and other facets of medical aid.

Our Verdict on Medimed Late Joiner Fees

Overall, Medimed is a medical scheme providing its members with comprehensive healthcare coverage. As a result, late joiner fees may apply to members 35 years and older who join the scheme without previous continuous medical scheme cover. These fees are calculated based on the years the member has been without cover since 21.

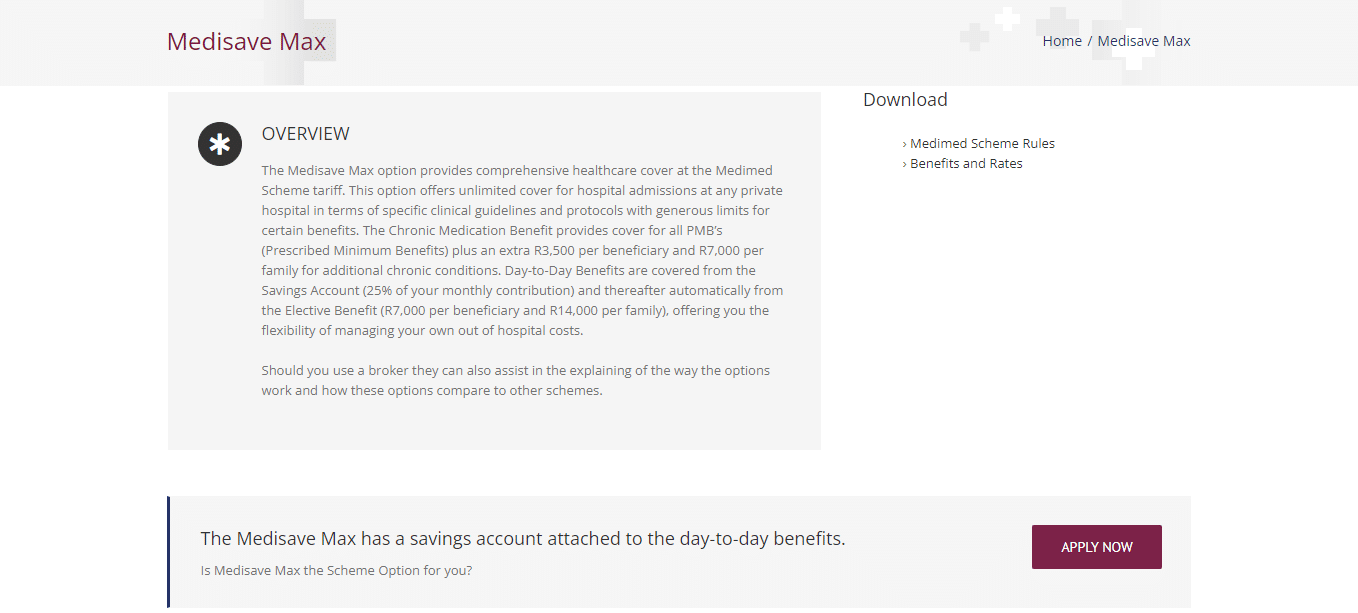

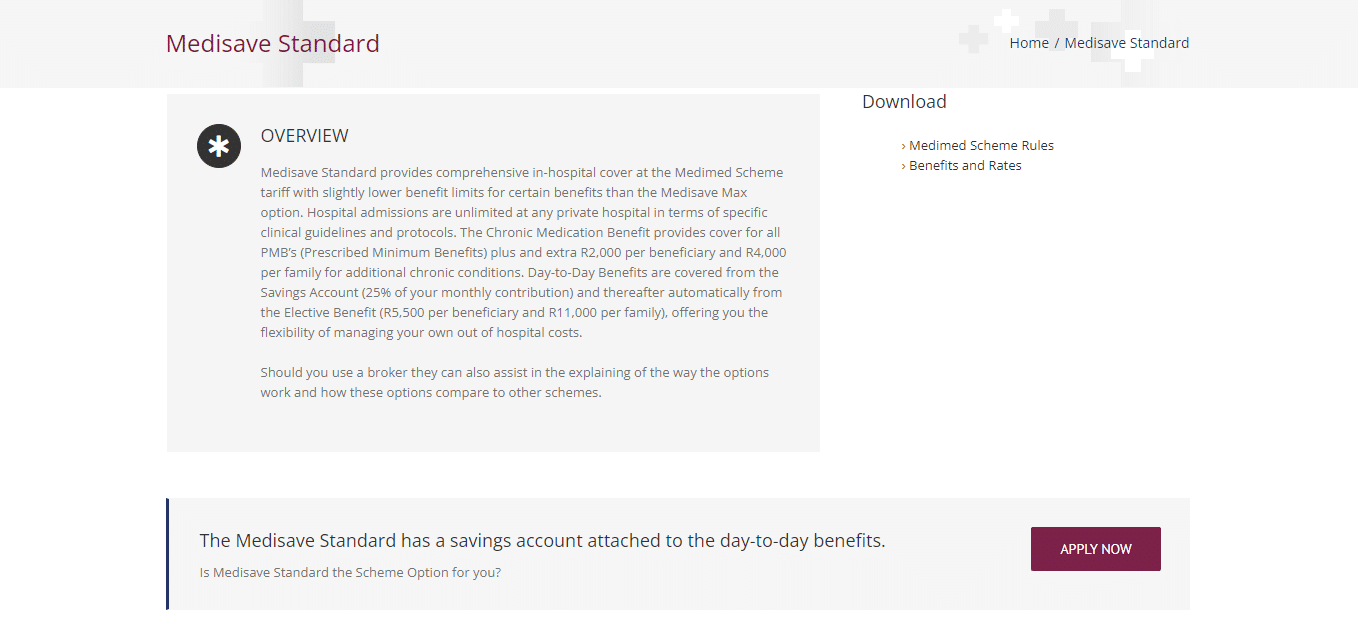

The scheme also imposes waiting periods on certain medical conditions, including pre-existing conditions, chronic conditions, maternity benefits, and elective procedures. In addition, some exclusions may apply, and contributions are based on the plan chosen by the member.

Furthermore, because of certain penalties, conditions, and other restrictions, prospective members must carefully consider the plan options and the waiting periods before choosing a Medimed plan.

Medimed Late Joiner Fees Frequently Asked Questions

What are Late Joiner Fees for Medimed?

Members who join Medimed at age 35 or later without having had continuous medical scheme cover in the past are subject to late joiner fees. Overall, these penalties encourage people to enroll in health plans before they have an urgent medical need rather than waiting until an incident occurs, or they can least afford it.

Why does Medimed Charge Late Joiner Fees?

To keep the program viable and continue providing its members with high-quality healthcare coverage, Medimed implements late joiner fees. People are incentivized to join the scheme earlier in life and keep their medical scheme covered uninterrupted by late joiner fees.

How does Medimed calculate Late Joiner Fees?

Medimed’s late-joiner fees determine how long a member has gone without health insurance after turning 21. Each year that a person goes without health insurance, the percentage rises.

Who is Affected by Late Joiner Fees at Medimed?

Members who join Medimed at age 35 or later without having been a part of another medical insurance plan continuously for the previous six months are subject to late joiner fees.

Can You Waive Late Joiner Fees for Medimed?

Yes, members who can prove another medical scheme already covered them or who face extenuating circumstances (such as financial hardship) may be eligible to have their Medimed late joiner fees waived.

When is the Best Time to Join Medimed?

To avoid late joiner fees and waiting periods and guarantee uninterrupted medical scheme cover, you should sign up for Medimed as soon as possible.

What Are the Alternatives to Joining a Medical Aid Scheme Like Medimed?

Private medical insurance or out-of-pocket payment for medical care are viable alternatives to enrolling in a medical aid program like Medimed. These options, however, can be more costly in the long run and may not offer adequate protection.

How Do Late Joiner Fees Affect Your Medical Aid Benefits at Medimed?

Medimed’s late-joiner fees can increase the total cost of contributions and reduce access to some benefits. For example, pre-existing conditions, chronic conditions, maternity benefits, and certain elective procedures may all be subject to waiting periods for members.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans